Blockware Intelligence Newsletter: Week 41

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/3/22-6/10/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Know someone who would benefit from concierge service and world class expertise when buying Bitcoin? Give them one year of free membership in Swan Private Client Services ($3000 value) -- email blockwareHNW@swan.com and we’ll hook it up! (And yes, you can give it to yourself 🤣)

FTX US - Buy Bitcoin, crypto, and now US stocks with lower fees on FTX. Use our referral code (Blockware1) and get 5% off trading fees.

Blockware Solutions (Mining) - It is difficult to buy ASICs, build large mining facilities, and source cheap scalable electricity all on your own. Work with a trusted partner like Blockware to deploy capital into Bitcoin mining.

Blockware Solutions (Staking) - Ethereum 2.0 is almost here, now is the time to stake your ETH with Blockware Solutions Staking as a Service to take advantage of 10-15% APR when the Ethereum network switches over to Proof of Stake.

Summary

Headline CPI came in hotter than expected at 8.6%, 30 basis points over median expectations.

Crude oil prices are back on the rise, pushing the US’ average gasoline price just shy of $5.00, the highest value in history.

Outstanding consumer revolving debt levels have also reached new highs in the midst of a rising interest rate environment.

Higher initial jobless claims numbers support the thesis that the US is entering its second stagflationary recession in history. The 1970’s tells us that solving the issue of high inflation and unemployment is not so easy.

New York’s Mining Ban Bill doesn’t look like it will be signed or vetoed by the governor anytime soon. The governor and her team will be looking at the bill very closely “over the next 6 months.”

Hash ribbons experienced a mild cross, indicating that some old gen machines have turned off/capitulated. Miner capitulations historically occur in late-stage bear markets.

General Market Update

We saw a fairly boring start to the week from a price structure standpoint. There was a compression of volatility in the stock market indexes which broke to the downside on Thursday. This came alongside a build-up of inflationary pressures on the macro side of things.

Early in the week, the market seemed to be waiting on the release of several data points. May’s CPI numbers were released this morning and the Fed Open Market Committee meets for two days next week starting on Wednesday, June 15th.

Friday morning, headline CPI came in at 8.6%. This was 30 basis points higher than the median consensus estimate of 8.3%. In the short-term, the market operates heavily on estimates. 8.3% CPI was largely priced into the market so it would be likely that any number <8.3 would cause a bounce and any number >8.3 would cause selling.

Core CPI, which measures CPI excluding food and energy, was down for the month of May, to 6.0%. This isn’t really surprising as increasing oil and energy prices are driving a fairly significant portion of the current expanding inflation.

CPI Urban Consumers YoY (Bloomberg)

As I usually mention, CPI is a fairly flawed metric, in which the basket of goods whose prices are measured is often adjusted in order to keep the number lower. This generally comes from political pressures as the approval of those in office rides heavily on voter perception of economic health.

Furthermore, inflation is a vector, meaning that one size does not fit all. The inflation rate is different for different types of goods. For example, the inflation rate for the price of a Big Mac is much different than for the price of gasoline.

That being said, CPI is the most widely used and accepted measure of inflation and therefore, has a massive impact on the markets.

With higher CPI values comes more pressure on the Fed to raise the Fed Funds Rate at a greater rate in order to slow down spending, thus decreasing prices. The Fed has lost a lot of credibility recently due to the fact that the majority of the CPI increase can be chalked up to the overly aggressive expansionary monetary policy of 2020-21.

It would not be crazy to think that the Fed will abandon their current plan of 50bps rate hikes in favor of larger increases in the FFR. While it may help to bring down CPI, this could create a new, and much more dangerous, set of problems. You can read more about this in last week’s newsletter.

Moving on, crude prices continued to climb this week and are now at 14 year highs to above $120 per barrel.

WTI Crude Oil (Bloomberg)

The Biden administration is attempting to help cool down these prices by depleting the US’ strategic oil reserves but so far, this has been unsuccessful in bringing down prices.

Obviously, with rising oil prices comes higher gas prices, which are now the highest they’ve been in US history. As of Friday morning, the US National Average Gas Price is only $0.01 away from reaching $5.00, over 20% higher than the previous peak in 2008.

US National Average Gasoline Price (Bloomberg)

With higher prices for crude not only comes higher gas prices, but also higher prices for all goods that require oil in their production. You would be shocked by just how many goods require petroleum to produce: fertilizer, ink, tires, soap, clothing, tooth paste, the list goes on. Essentially name any product and it's almost guaranteed that oil is required to produce it in one way or another.

This is why oil prices and inflation levels are so correlated.

WTI Crude Oil and CPI (Bloomberg)

A commodity bull market is generally not a good thing for consumers as the prices of capital goods rise. This creates increased prices of energy and food and therefore, a drop in discretionary spending.

If the average American needs to spend more at the gas pump and grocery store, they will be less likely to spend money on unnecessary things like traveling, eating at restaurants, buying a new car, shopping at the mall, etc.

This hurts the bottom line of many companies and if the decrease in spending is deep enough, it can cause businesses to lay off employees. This combination of decreased spending and layoffs usually results in a recession.

We also saw some data released on Wednesday that is tracking consumer revolving debt levels. Revolving credit allows consumers to spend credit and repay portions of their debt while simultaneously taking on more debt. This probably sounds familiar because it’s how your credit card works.

Revolving credit is the most commonly held debt in the US and credit card debt is the most common form of revolving debt.

Under extreme circumstances, prolonged low interest rates foster so much spending and credit creation, alongside the expansion of the monetary base through government spending packages, that the prices of goods rise dramatically.

The issue is that occasionally, American’s will have built up so much debt that once the Fed raises interest rates to lower prices, people can no longer afford their interest payments.

This leads to insolvency, as people default on their debt, and can cause bank runs, foreclosures, and other not so great outcomes.

Consumer Revolving Credit, Fed Funds Rate and Recessions (Bloomberg)

As you can see above, this week, the data point for Total Outstanding Consumer Revolving Debt levels (white line) has hit an all-time high, while interest rates are on the rise.

The chart above is similar to one included last week where you can see the Fed Funds Rate in blue and recessionary months vertically in gray.

This analysis is a continuation of what we discussed in this newsletter last week. If you’d like some more education on the outcome of rising interest rates in an over-indebted populace, go back and read last week’s edition.

Some other news came Thursday from the European Central Bank (ECB) who have become increasingly hawkish and are now raising their key interest rates by 25bps. This is after they’ve also begun to see CPI numbers above 8%.

Initial Jobless Claims (Bloomberg)

We’re also seeing a continued uptick in initial jobless claims, which measures claims for unemployment benefits for the first time following job loss.

While these numbers are not high enough to cause too much concern at the moment, a continued increase could be very dangerous for the economy. Only once before have we seen a stagflationary recession in the US.

The 1970’s were a period in which economic output was receding and Americans were losing their jobs while the prices of goods continued to rise. This is the period where Paul Volcker stepped up to bury inflation by raising the Fed Funds Rate to extremely high levels (up to 20%).

The issue is that Americans are MUCH more indebted today than they were in the 1970’s. Powell has even compared himself to Volcker, but if he were to raise the FFR as aggressively as him, Chairman Powell could put the US in a depression the likes of which the world has never seen.

PPI, a leading indicator of CPI, is set to release its May data point on Tuesday, June 14th. Headline PPI was 15.7% for April, so look out for higher PPI values next week.

In the stock market, we generally saw a low volatility week in the major indexes. This changed on Thursday, as the S&P and NASDAQ broke below key support levels in anticipation of Friday’s CPI announcement.

This was a combination of short’s entering, and investors looking to be out of their stocks before the announcement.

NASDAQ Composite 1D (Tradingview)

The NASDAQ’s 10-day EMA and 21-day EMA were close to intersection on Thursday, which would have been a signal of a short-term uptrend but price fell too far, too fast. A break below the lower trendline shown above is not a good look for the index.

This price action makes a retest of the lows look inevitable. We will likely see high volume selling at the low, if we make it there. Although, I would not be surprised to see the market bounce there, at least in the short-term.

When something looks obvious in the markets, the opposite usually happens.

A deterioration of market breadth earlier in the session preluded the breakdown in stock prices into the close on Thursday.

NASDAQ Advance/Decline Line (Bloomberg)

Above is the Advance/Decline Line for the NASDAQ. This breadth indicator tells us, in aggregate, how many stocks are rising or falling. As you can see, the A/D Line fell fairly dramatically on Thursday as breadth narrowed and more names began declining.

Crypto-Exposed Equities

In general, crypto-exposed equities have had a relatively weak week. We’re seeing the strongest names hold up fairly well while the rest of the pack drifts lower.

There is a wide range of quality in the price action for crypto-equities. Relatively speaking, names like: MSTR, CAN, BTCM and COIN are among the best looking stocks in this group, in my opinion.

It has been interesting to see the decoupling of price action from spot Bitcoin to the NASDAQ as of recent. The cryptoasset is holding up quite well in comparison and appears to be receiving significantly less institutional selling pressure than tech stocks.

Above, as always, is the spreadsheet comparing the weekly performance of several crypto-exposed equities.

Bitcoin On-Chain and Derivatives

To illustrate the significance of this current drawdown, Bitcoin temperature bands tell us how many standard deviations market price is from the 4-year trend. Currently, Bitcoin is approaching its 4-year trend, sitting just above $21K.

This has put pressure on short-term holders, with the percentage of total supply in profit held by STHs retesting historical lows.

This has translated to one of the lowest readings in the short-term holder profit/loss ratio (created by Ark Invest) ever and sitting firmly below the neutral level.

As per traditional bear market behavior, as short-term holders both capitulate and/or age past the 155-day threshold into long-term holders, the STH cost basis declines and the LTH cost basis rises in the bear. With this in mind, long-term holder and short term cost basis continue to converge. Long-term holder CB currently sits at $22,300 (blue) and short-term holder CB at $36,000 (pink). If they are to cross, it is likely they will do so in the upper $20,000s.

If/when they cross it would mark a high conviction buy opportunity, putting the dark blue oscillator below the green line at the bottom of the chart.

Another bottom signal we continue to watch out for would-be market price pushing below the aggregated realized price. A cross below realized price would mean the market is underwater in aggregate by definition (given it is below their cost basis), and would put the oscillator below in the green buy zone. Don’t want to sound like a broken record these last few weeks, but not much to do but wait.

On the derivatives side, nothing has changed. The spot premium to futures has persisted for months now, one of the longest regimes of which in Bitcoin’s history.

A derivative of premium, aggregated funding rates for perpetual futures remain muted. However, what we really want to see is a clear regime of negative funding rates similar to post covid, October 2020, and summer of last year.

Have been seeing some interesting developments on the mining side. Miners are essentially short hash rate, short difficulty, and long BTC price. With that in mind, miner margins have been getting broadly compressed with hash rising, difficulty rising, and price dropping.

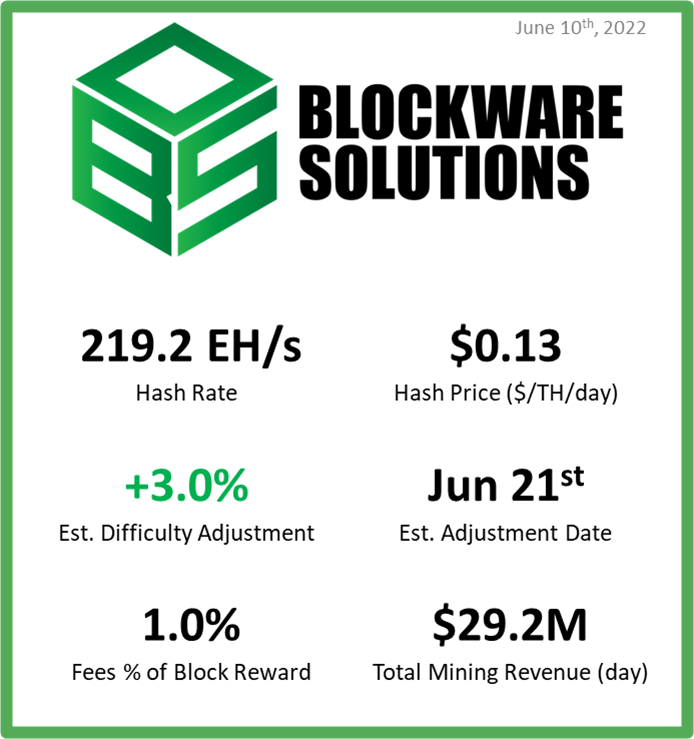

A way to illustrate this is hashprice.

This margin compression has led to some selling of inventory from miners. Something to keep an eye on and will be expanded upon more in the mining section of the letter below.

Remarkably the amount of Bitcoin supply that hasn’t moved in at least a year continues to climb, pushing all-time highs of 65.5%.

And lastly, the Asian trading hour premium we’ve been talking about has come down slightly. Something that has been a good signal over the last 2 years and we will continue to monitor.

Bitcoin Mining

New York Mining Ban Delayed

As reported by CoinTelegraph, Governor Hochul of New York stated, “We’ll be looking at all the bills very, very closely. We have a lot of work to do over the next six months.” There was a lot of confusion last week when the PoW mining ban bill successfully passed the New York Legislature at 3 AM on a Friday morning. Would the governor immediately sign the bill? Would she veto? Now we have a bit more clarity on the next steps. The governor appears to be taking a step back before making a rash devastating decision for the state of New York. She emphasized that while she wants to “protect the environment”, it’s still important to bring in new capital that creates jobs.

Ideally, New York will recognize the mistake they are making and decide to incentivize Bitcoin mining instead of pushing it away. As noted below, according to Cambridge, New York is the 4th largest state in the US for Bitcoin hash rate. 9.8% of the hash rate in the US is located in New York. This ban would obviously be catastrophic for New York, but open opportunities for other states like Kentucky, Texas, and Georgia.

Hash Ribbons Crossed

Hash ribbons crossing indicates a mild miner “capitulation.” This means that miners have been net turning off machines over the previous ~30 days. This is likely due to the sharp drop that Bitcoin experienced down to $30,000 and $25,000. At these prices, it shouldn’t be too surprising to see old-generation rigs (like Bitmain’s S9) turning off.

In the table below from May 13th of this year, it is clear that S9s were on the verge of turning off. As noted in previous Blockware Research, just because a miner becomes unprofitable, doesn’t mean they immediately turn off machines. They have power and hosting contracts that they have signed that may be expensive to break. After that, you also have to sell the machine at an undesirable price (since other miners are capitulating). This is why capitulations take some time to play out, as this minor capitulation has since early May.

*table from May 13th

Historically, miner capitulations do mark Bitcoin bottoms. However, since this appears that it will likely be very minor and short-lived, there are no guarantees that Bitcoin has already made a bear market bottom. With that said, miner capitulations due to price corrections historically only occur during late-stage bull markets. It’s clearly a sign that this price area is a great area for long-term accumulation.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.