Blockware Intelligence Newsletter: Week 116

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 1/6/23 - 1/12/23

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

Bitcoin ETFs (Finally) Approved🎉

After years of failed attempts and a comically poor announcement from the SEC, multiple spot Bitcoin ETFs are now officially trading on public markets in the United States.

Over $4.6 billion worth of trading volume took place across the 11 spot Bitcoin ETFs.

Here is the day 1 trading volume for each Bitcoin ETF:

Grayscale Bitcoin Trust ($GBTC): $2,093,800,000

Invesco Galaxy Bitcoin ETF ($BTCO): $44,600,000

Fidelity Wise Origin Bitcoin Trust ($FBTC): $673,700,000

Hashdex Bitcoin ETF ($DEFI): $4,200,000

WisdomTree Bitcoin Fund ($BTCW): $6,400,000

BlackRock’s iShares Bitcoin Trust ($IBIT): $1,009,200,000

ARK 21Shares Bitcoin ETF ($ARKB): $275,600,000

Bitwise Bitcoin ETF ($BITB): $120,300,000

Valkyrie Bitcoin Fund ($BRRR): $9,000,000

Franklin Bitcoin ETF ($EZBC): $65,200,000

VanEck Bitcoin Trust ($HODL): $24,800,000

Unsurprisingly, Grayscale is leading the way in terms of volume, however, much of that is likely outflows as some investors flee from into other ETFs that have lower annual fees than GBTC’s 1.5% Other investors currently in GBTC may elect to stay, and eat the 1.5% fee, in order to avoid capital gains taxes from exiting that position.

Bitcoin On-Chain / Derivatives

Short-Term Holder Volume in Profit to Exchanges: An all time high of ~$2.2 billion worth of “in the money” Bitcoin was sent from short-term holders to exchanges. Those who looked to make the “buy the news, sell the event” trade appear to have done so successfully. However, the Bitcoin price has remained resilient despite this increase in sell pressure.

H/T: @jimmyvs24

HODL Waves: The reaction from long-term Bitcoin holders has been nil; it remains that 70+% of the supply has not moved in over a year. Speculators will move the price in the short-term but the medium and long-term outlook will remain bullish so long as long-term holders continue to sit on a large percentage of the total supply.

General Market Update

2. December CPI. Headline CPI came in slightly higher than expected on Thursday at 3.4% YoY and 0.3% MoM, in comparison to estimates of 3.2% and 0.2% respectively. The YoY change in Core CPI was 3.9%, slightly above estimates of 3.8%. While inflation has continuously come down for the last ~18 months, it’s possible that we’re now seeing some signs of resistance here at about 3-3.5%, although unlikely to be sustained.

3. Jobless Claims. With all the talk of recession for 2024, it’s probably surprising to many to see how well the labor market has generally held up. This week’s print for Initial Jobless Claims was its lowest since October, showing just how tight this market is (for now). While there is a strong argument to be made that this will change later in the year, simply not many people simply are filling for unemployment at the moment.

4. 2 Year Treasury Yield. Despite the slightly higher than expected CPI numbers, Treasury yields have continued lower this week as investors look ahead to lower rates. Treasury auctions also appear to be recovering demand from last quarter, also pointing towards renewed confidence in the future of rates.

5. Nasdaq Composite Index. The market stands at a short-term inflection point here today, as the bears scream about double-tops, and bulls look for a breakout. We will not attempt to choose sides, other than noting that either is apparently equally as likely. The downward trajectory of Treasury yields does make us bullish on equities in the intermediate-term, however we could see a short-term move lower as the market digests recent gains.

Bitcoin Exposed Equities

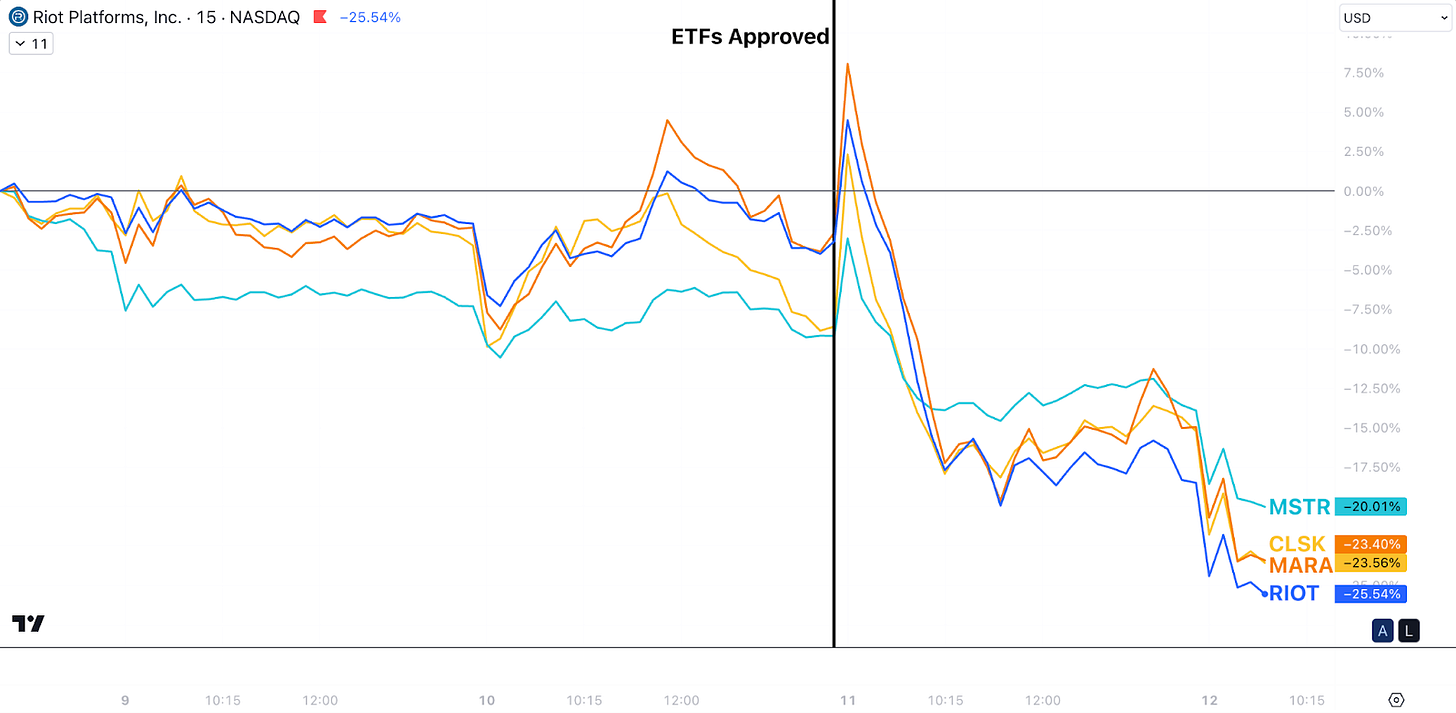

6. BEE Capital Rotation. One short-term theme that was to be expected at the approval of the spot ETFs was a rotation of capital out of many Bitcoin Exposed Equites. Prior to the ETFs, the only way for many funds to have Bitcoin exposure was through the miners or Microstrategy. Now there is a better way, with less counterparty risk. These names aren’t going anywhere, and will likely continue to perform well if BTC does, but for now the market is adjusting to new factors.

7. BEE Comparison Sheet.

Bitcoin Technical Analysis

8. Bitcoin/USD. BTC price appears to be in a similar spot as the Nasdaq. While we’re extremely bullish on BTC for the year of 2024, what happens in the immediate term is up in the air. Watch for a break below the 50-day SMA around ~$42,500 to confirm a correction lower and a break above $49,000 for upside confirmation.

Bitcoin Mining

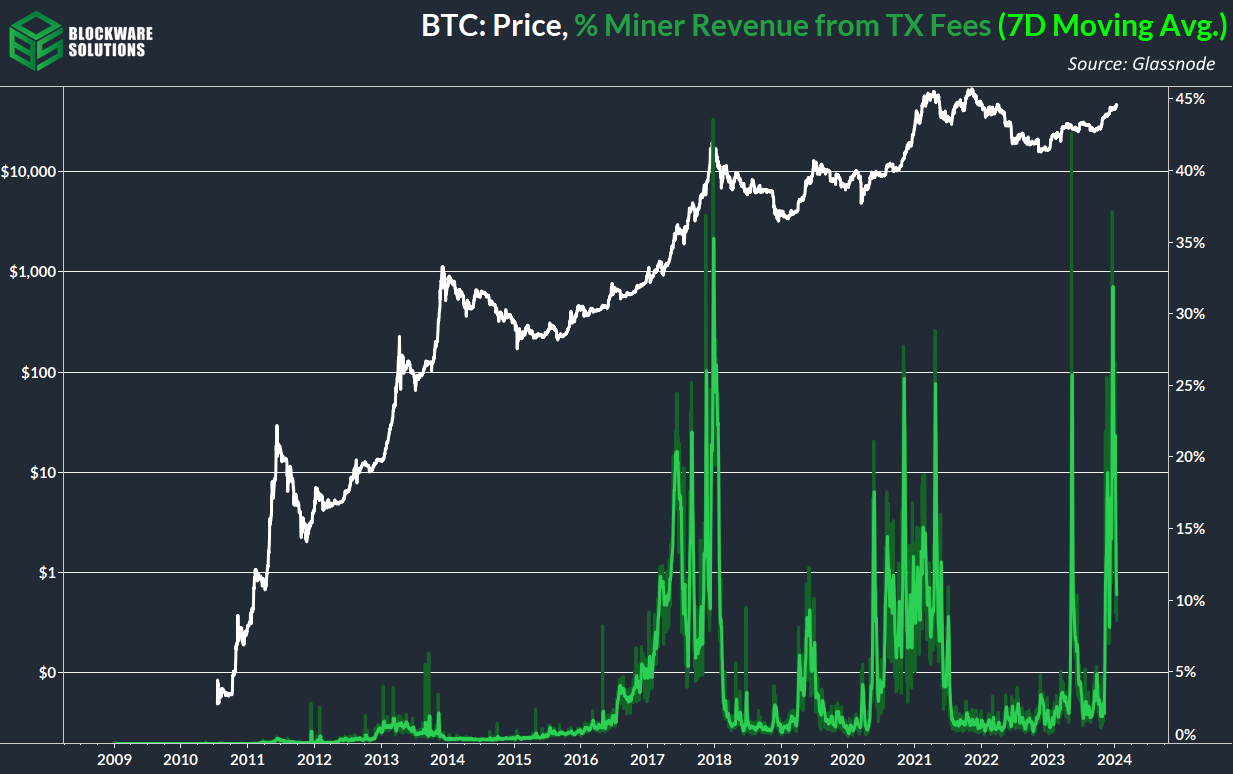

Transaction Fees: On-chain fees have calmed down quite a bit, but they still remain elevated from the bear market lows. While fees in the 20-40 sat/vByte range are now processing, the total amount of transactions in the mempool remains near all-time highs. It may be awhile before we potentially see even lower fees. Furthermore, it possible that extremely low fees never arise pending any new demand catalysts for on-chain settlement.

Mining Difficulty: The latest difficulty adjustment was a positive adjustment of 1.65%. Miners are increasing their capacity in preparation for the 2024 halving. The next adjustment is projected to be down 2%; likely as a result of transaction fees coming back to earth.

Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$22,331 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.