Blockware Intelligence Newsletter: Week 107

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/7/23 - 10/13/23

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Mitch Askew interviews Adam Sullivan, CEO of Core Scientific ($CORZQ) Mitch & Adam discuss the Core Scientific Bankruptcy, Adam's plans for leading the company, expectations for the Bitcoin mining industry, and more!

General Market Update

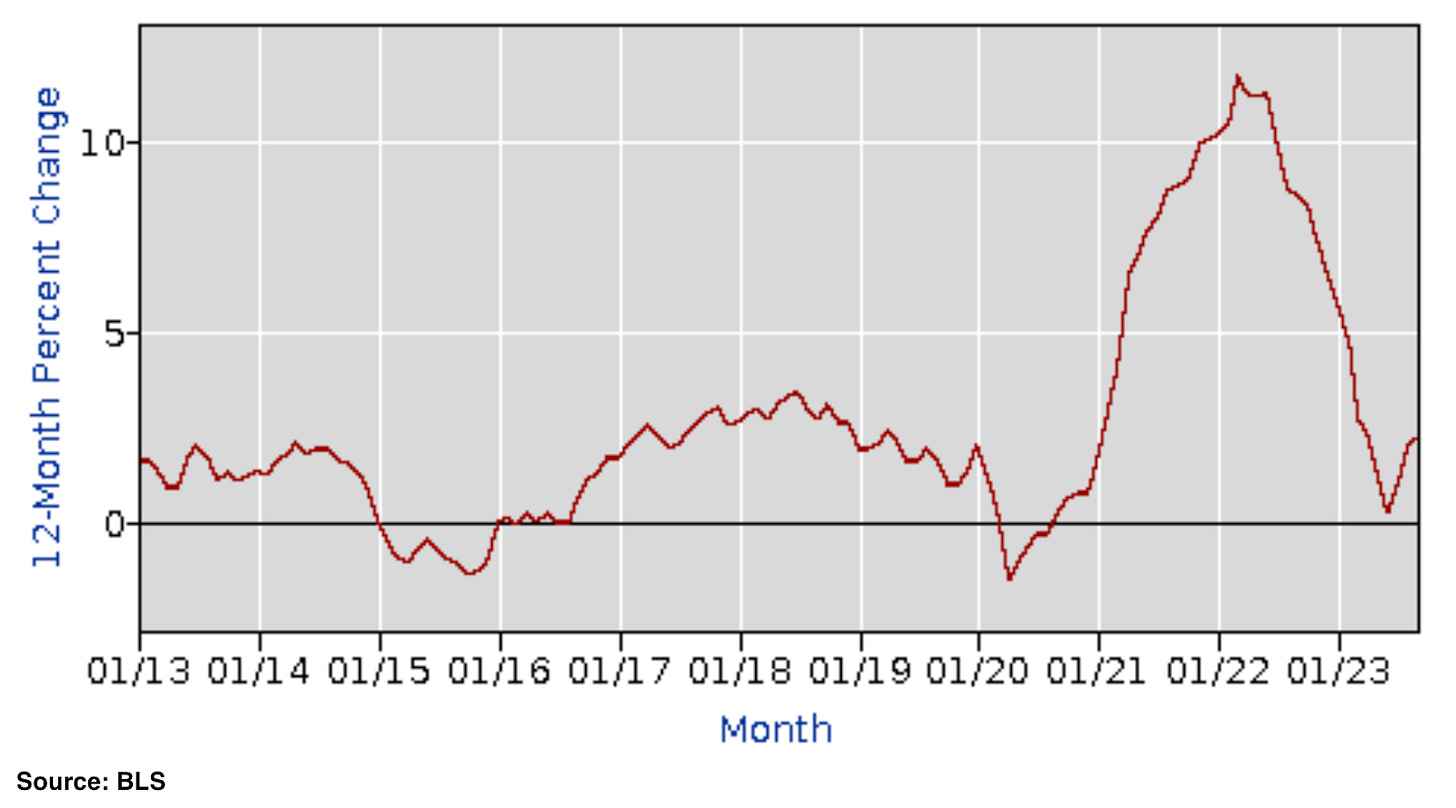

2. CPI. September’s CPI data was released yesterday, and showed 3.7% YoY growth for the headline, compared to 3.6% estimates. This came in above expectations for the MoM number, at 0.4% vs. 0.3% estimates. Core CPI came in-line with expectations of 0.3% MoM and 4.1% YoY. The key factors that led to the elevated numbers were shelter, food and oil, which rose 7.2%, 3.7% and 8.5% YoY respectively. The question now becomes whether the Fed can balance the fact that sticky inflation must be attacked with rising rates, however significant concerns from the credit and housing markets may call for lower rates.

3. PPI. The Producer Price Index, often viewed as a leading indicator of CPI, came in well above expectations for September at 2.2% YoY compared to estimates of 1.6%. Month-over-month, PPI grew by 0.5% compared to 0.3% estimates. As rising energy prices have begun to raise the prices producers charge for goods, we may see a resurgence of core CPI numbers. Alongside the risk of a widening conflict in the middle east causing increases to oil prices, investors would be wise to stay vigilant.

4. 30-Year Treasury Yield. Despite a short bounce in Treasury prices, yields have generally trended higher this week as a storm of negative factors impact bond investors. The Treasury increased the size of their auctions in recent weeks, causing more supply to enter the market. Furthermore, the Treasury auction this week, where the US Treasury raises debt, was a disaster. They saw very little demand for 3, 10 and 30-year bonds, which added fuel to the market sell off. This comes alongside higher than expected inflation numbers and a flood of geopolitical risk with the onset of a very deadly and growing conflict in the middle east.

5. CFDs on Gold. As the recent news has shown that the war between Israel and Hamas is unlikely to end anytime soon, investors seem to be seeking safety from exposure to the largest geopolitical tensions in decades and the prospect of higher rates in the US. As a result, gold prices have seen their strongest week since March’s regional banking crisis. The US Government debt spiral is beginning to become a common discussion, and holding Treasuries is clearly not the life boat it once was.

6. Russell 2000 Growth ETF (IWO). After all this newsletter has shown in the prior 5 charts, it shouldn’t be much of a shock to see that stocks have had a poor week of price action. The riskiest names, such as tech growth stocks and small-caps, have specifically seen high levels of selling as investors seek shelter. IWO, iShares’ Russell 2000 Growth ETF, has been hit proportionally hard, and is at its lowest price since March. This ETF is now ~15.8% off it’s YTD highs, at the time of writing.

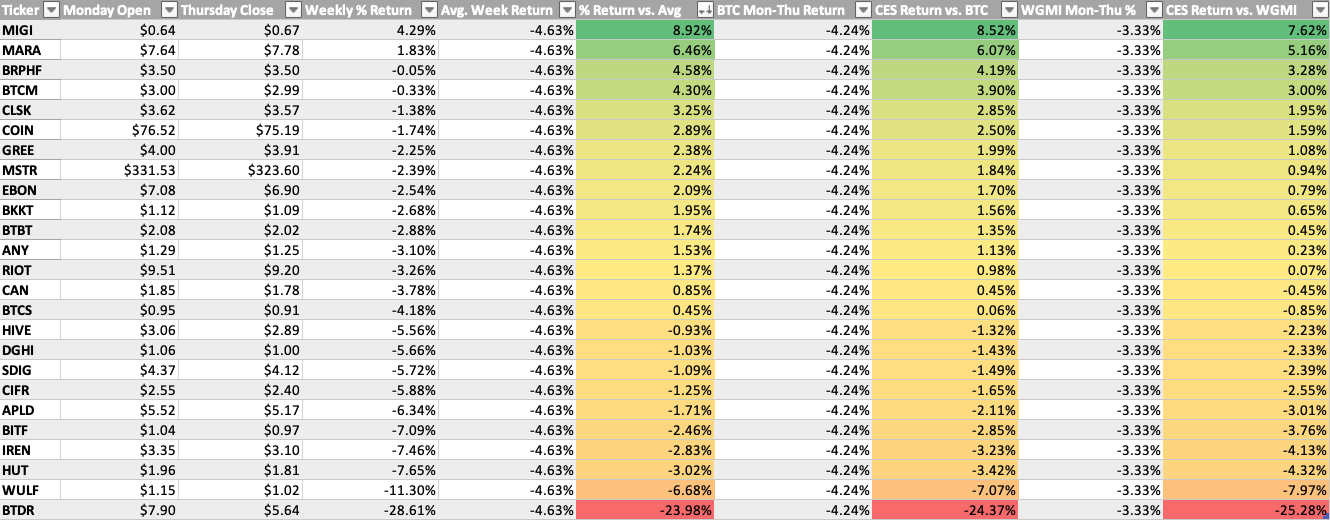

Bitcoin Exposed Equities

7. JPMC Public Miner Report. In case you missed it, JP Morgan Chase initiated coverage on 4 public Bitcoin miners this week, RIOT, MARA, CLSK and CIFR. This is an update to this industry group that cannot be ignored. As JPMC’s analysts continue to produce reports highlighting players in this industry and forming buy/sell determinations and price targets, it opens the floodgates of institutional capital into these names. This move by JPMC, combined with potential approval of spot BTC ETFs, could create serious tailwinds for public mining stocks and BTC price action alike.

8. BEE Comparison Table. As always, the table below compares the Monday-Thursday price action of many Bitcoin Exposed Equities to that of spot BTC and the mining ETF WGMI. Despite the average name being down 4.63%, this is skewed by Bitdeer’s -24% week. The overwhelming majority of these names has actually outperformed both BTC and WGMI as of yesterday’s close.

Bitcoin Technical Analysis

9. Bitcoin / USD. Despite the move the equity markets have seen this week, Bitcoin price has managed to hold up remarkably well. Whether this is due to spending spot ETF rulings, Bitcoin’s labeling as digital-gold in a world of fear and uncertainty, growing illiquid supply, etc. is up for debate, what we do know is that sellers are not flooding the asset as of now. Thus far, BTC has managed to attract buyers at its 50-day SMA (~$26.6k). Heading into next week, keep a close eye on the $26,000-26,600 range for signs of institutional buying, or selling.

Bitcoin On-Chain / Derivatives

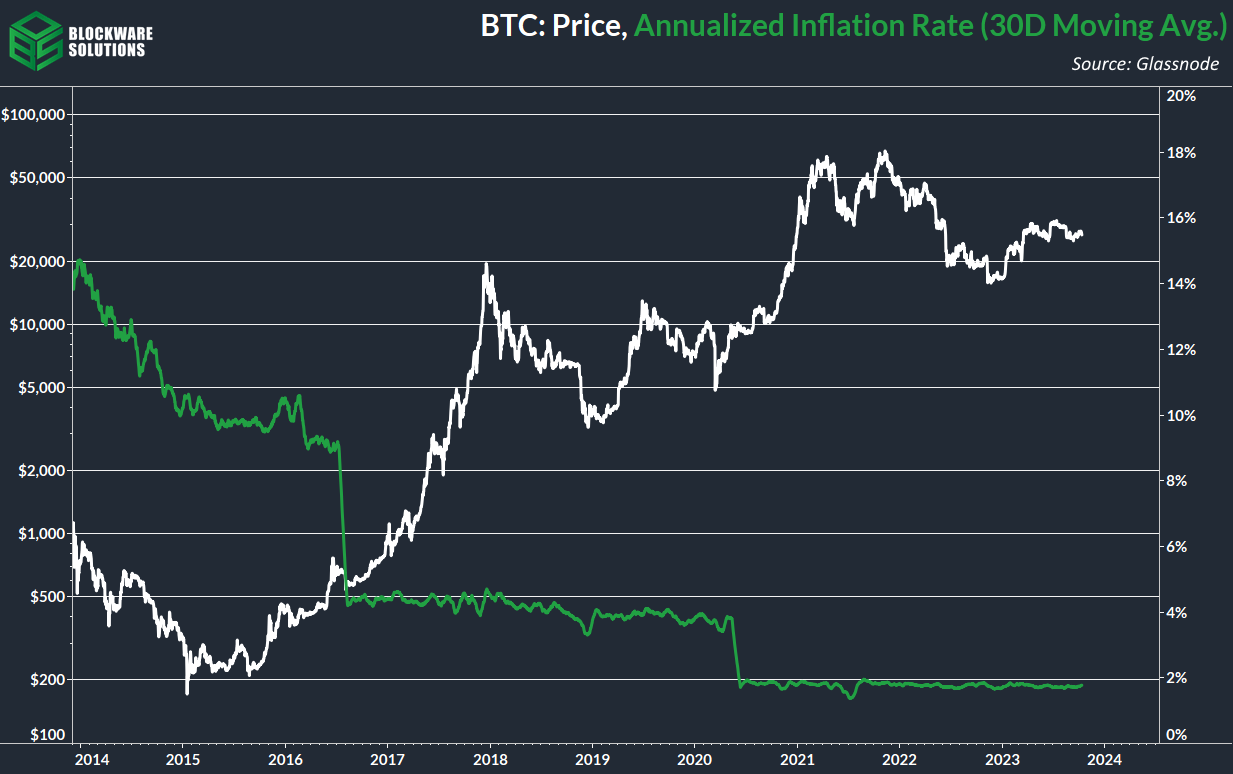

10. Bitcoin Annualized Inflation Rate: Given this was a week in which CPI data was released, it’s a good time to remind everyone that Bitcoin’s inflation rate is predictable, programmatic, and will continue disinflating towards 0% over the next 117 years. The annualized inflation rate has held steady at ~1.7% since May of 2020. This will continue until April 2024 at which point the next halving will occur, and the annual inflation rate will drop below 1%.

11. Realized Price: The cost-basis of short term holders (155 days or less) is ~$27.8k and declining. The first test of this resistance level, after losing it as support earlier this year, was rejected. However, the rejection didn’t result in a major move down and a re-test is imminent.

12. HODL Waves (Coins moved within the last 3 months): Speaking of short-term holders, a record low, 10.8% of the circulating supply, has been moved within the past 3 months. A prominent theme throughout 2023 is that the supply of Bitcoin is becoming increasingly illiquid. While demand is clearly illiquid as well, any sort of demand catalyst, whether major or minor, will send price moving upward in very short order.

13. Pleb Accumulation: Users with .01 to 10 BTC have been accumulating aggressively throughout this halving epoch. At the bear market bottom last November they were cumulatively stacking to the tune of 15,000 BTC per day. This cohort has consistently stacked slightly more or less the same amount that is mined each day. It’s unlikely these convicted users will stop stacking anytime soon. So when the issuance rate gets cut in half next April, prepare for the scales to start tipping.

14. Perpetual Futures Open Interest: Our de-facto metric for measuring the state of leverage within the market has risen over the past two weeks. Net-net, the market is less leveraged than it was prior to the leg down in price in August. This increase in leverage is likely due to traders positioning themselves in anticipation of the SEC making an appeal on the ruling in favor of Grayscale; of which they have until midnight tonight to do so.

15. ETH/BTC: The price of ETH as measured in BTC continues its post-merge downtrend; having made another leg down this week. A reclaiming of its 2021 high seems highly unlikely at this point. A re-test of this cycle’s low at ~0.052 will likely occur sometime in the next few months.

Bitcoin Mining

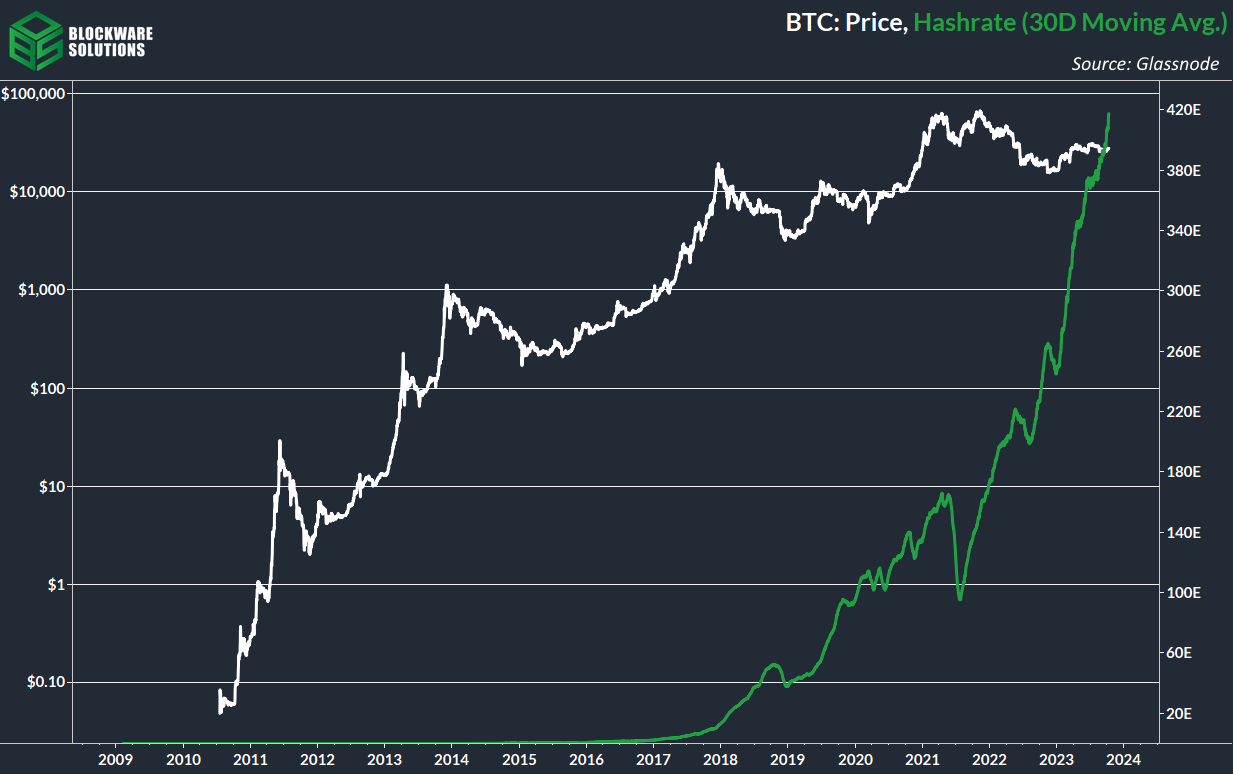

16. Hashrate: Miners are making aggressive moves in preparation for the 2024 halving, the 30-day moving average of hashrate has eclipsed 417 EH/s. While this is certainly going to put increased stress on miner margins, it’s critical to understand that infrastructure is the bottleneck at this moment in time. Even when the S21 & M60 machines hit the market early next year, it’s likely that many S19s (and equivalents) will be unplugged in order to make room for the new-generation machines. Thus, hashrate will not immediately begin going parabolic. This idea was discussed in-depth on our podcast with $CORZQ CEO Adam Sullivan.

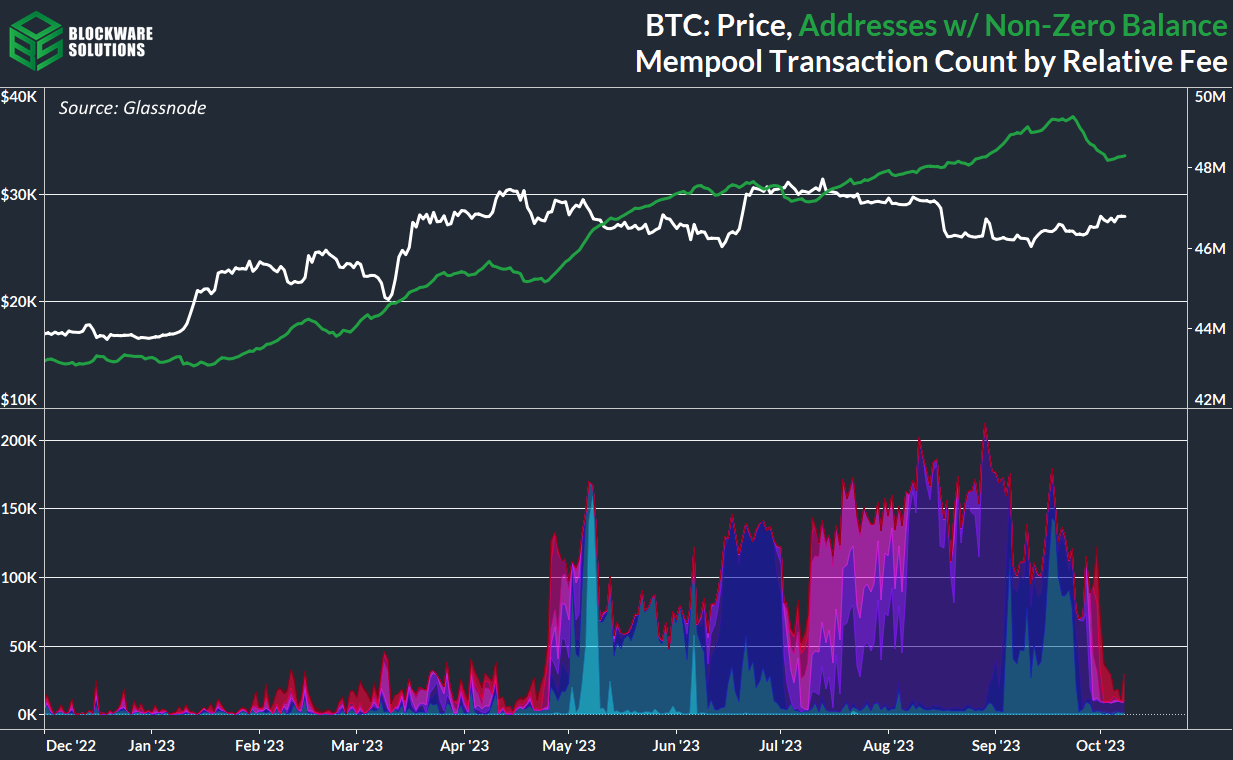

17. Mempool & UTXO Consolidation: In the wake of lower fees, users have begun consolidating UTXOs. As the mempool cleared and lower fee transactions started entering blocks (red/purple on this chart), the number of addresses with a non-zero balance dropped accordingly. This makes sense as users are consolidating funds across multiple addresses into a single UTXO at a new address.

18. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$19,406 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.