Blockware Intelligence Newsletter: Week 130

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 4/29/24 - 5/3/24

🚨Buy The Latest-Generation of Bitcoin Mining Hardware🚨

Blockware has partnered with a world-class immersion mining facility to bring you the opportunity to mine using the Whatsminer M66s.

288 TH/s (up to 330 EH/s when in “high performance mode”)

19.5 W/Th

Immersion has a few notable advantages over air-cooled mining:

Heat Resistance

Greater Up-Time

Longer Machine Lifespan

Superior Hashrate & Efficiency

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

Bitcoin: News, ETFs, On-Chain, etc.

1. Bitcoin Drops Below $60,000

After seven consecutive months of up-only price action, BTC closed April with a red candle. In the grand scheme of things, this pull back is nothing short of a typical bull market correction. Risk assets across the board have been down during the same period. Moreover, considering the plethora of seemingly negative headlines that have surfaced over the past couple of weeks, bitcoin has held up well; far better than what the bearish sentiment online might lead one to believe.

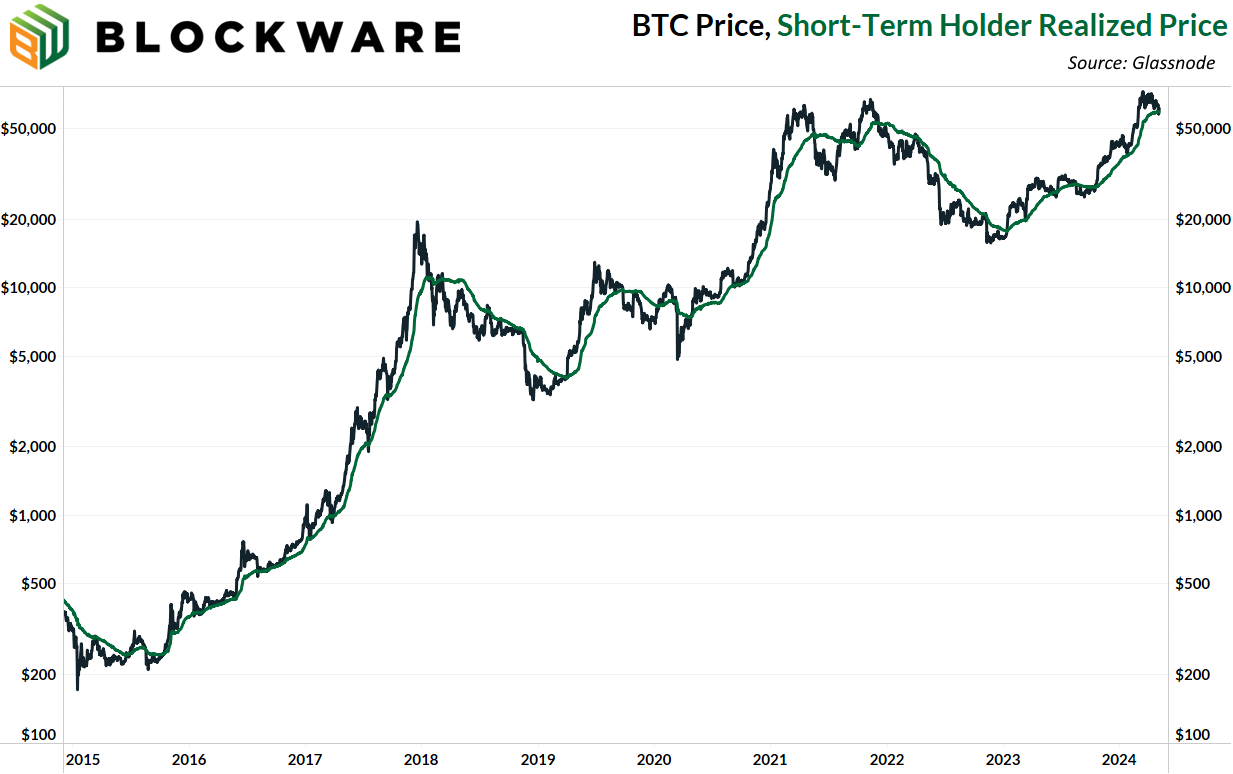

2. Short-Term Holder Cost Basis

BTC has found support at ~$58,000; which happens to be the aggregate cost-basis of short-term holders. Short-term holders being those that have moved their bitcoin within the past 155 days. This has been a key support level in past bull markets, and it’s already provided support three times in the past 18 months. Even if you view the market on a short time frame, as long as this level holds, there’s no reason to turn into a bear. However, it’s best to approach bitcoin with a long time frame; four years at the minimum.

3. Spot ETF Net Outflow

Notably, the spot ETFs have posted two consecutive weeks of net-outflows. As it turns out, many of the so-called “institutional investors” that are getting their bitcoin exposure through the ETF suffer from the same emotional reflexivity that is stereotypical of retail investors; fearfully exiting their position during short-term price dips.

4. Hong Kong Bitcoin ETF

On a more positive note, a suite of Bitcoin ETFs launched in Hong Kong this week, attracting ~$292 million in assets on day 1. The winner of the bunch was the ChinaAMC Bitcoin ETF which garnered ~$123 million in assets on day 1.

5. MicroStrategy: Decentralized Identification

MicroStrategy hosted its fourth annual Bitcoin for corporations events, this time in Las Vegas, Nevada. Michael Saylor, founder and executive chairman, announced “MicroStrategy Orange”, an open source Bitcoin inscription method that allows users to store and manage decentralized indentificiations using UTXOs on-chain. Saylor has spoken extensively about the potential for Bitcoin to reduce online spam and provide verification of identity, in a way that allows one to remain in control of their own data, which may become increasingly necessary in a world in which AI deep fakes are running rampant. MicroStrategy cited a plethora of potential use cases for DIDs, and it will be interesting to see if, when, and how institutions and individuals utilize this.

6. CZ & Roger Ver Sentenced to Prison Time

In what seems like a continuation of a crackdown from US Federal Law Enforcement on Bitcoin and the broader crypto market, CZ, Founder of Binance, was sentenced to 4 months in prison on charges of enabling money laundering. Roger Ver, who is most widely known for being on the wrong side of the Blocksize War, was arrested on far more serious charges of tax evasion. According to the Department of Justice, Ver evaded roughly $48 million in taxes. Ver, who revoked his US Citizenship in 2014, is facing up to 20 years in prison if he is convicted.

7. Block ($SQ) Acquiring Bitcoin

Jack Dorsey announced that Block, formerly known as Square, will be dollar cost-averaging into Bitcoin every month. Along with this announcement they released a blueprint for other corporations to add Bitcoin to their balance sheets as well. With the FASB rule change coming into effect at the end of this year, it’s likely that many more corporations will began building a Bitcoin position on their balance sheets, now that they will no longer be unjustly penalized, from an accounting perspective, for doing so.

General Market Update

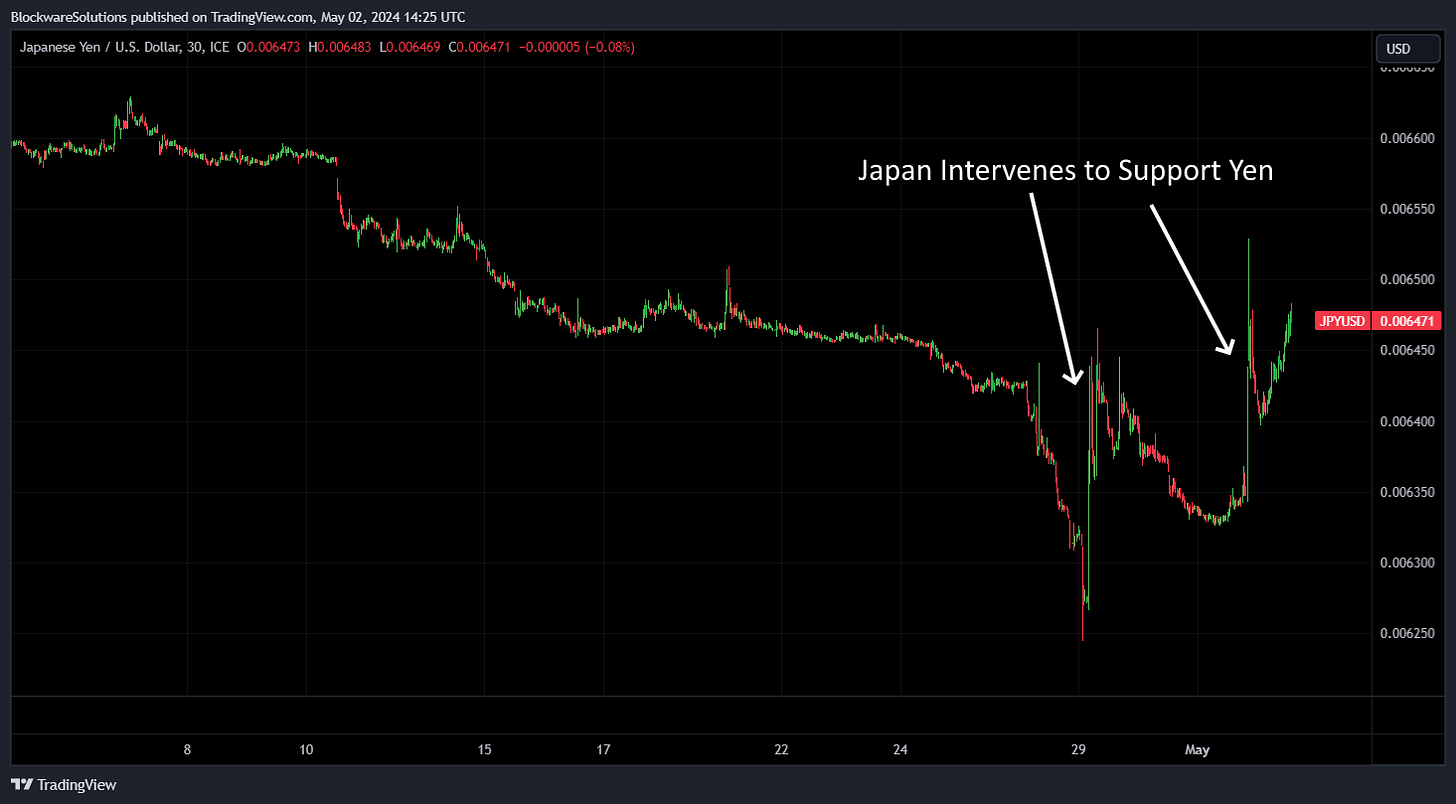

8. Bank of Japan Intervenes in Market

The Japanese Yen, which is down 10% against the US Dollar over the past year, and 27% over the past five years, fell hastily upon market open on Monday, prompting the Bank of Japan to intervene. Twice this week the Yen spiked against the Dollar as the BOJ purchased Yen in an attempt to slow down the bleed. According to reports from Bloomberg and the Financial Times, the BOJ spent nearly $60 billion dollars across the two moments of intervention.

I’m careful to use the phrase “slow the bleed”, rather than “stop the bleed.” With Japan’s debt to gdp ratio north of 200%, inflation has, no doubt, been a policy choice. A devaluing currency makes it easier to pay back their debt as more units of currency circulating through the system allows nominal GDP to rise, ultimately leading to a nominal increase in tax revenue.

Since 2011, the Yen is down 50% against the US Dollar; and during the same period the dollar is down 99.99% against bitcoin. The central bank playbook of “debase the currency to ease the debt burdens” is being executed in the United States just as it has been in Japan. We’re just a few years behind in the process.

9. FOMC Meeting

On Wednesday the Federal Reserve convened and, expectedly, left the federal funds rate unchanged. While the arbitrary level of “2%” is the Fed’s target inflation rate, their eyes, and policy decisions, have clearly shifted towards the employment market; which esoterically concedes that 3% is the new target inflation rate. In his press conference, Jerome Powell essentially declared that he won’t begin cutting rates until unemployment becomes an issue. To quote Powell: “We are prepared to maintain the current target range for the federal funds rate for as long as appropriate. We are also prepared to respond to an unexpected weakening in the labor market.”

10. 3 & 6 Month US Treasury Yield

The treasury market certainly isn’t expecting cuts anytime soon. Both 3-month and 6-month treasuries have yields higher than the effective federal funds rate. If they expected fed funds to go down during the coming months, there would be more demand for those treasuries, buyers would step in, and yields would drop.

11. Treasury Buyback Program

Speaking of treasuries, the US Department of the Treasury announced this week that they will buy $2 billion worth of off-the-run securities each week in order to provide “liquidity support.” For those unfamiliar, “off-the-run” securities are treasuries that were sold at previous auctions, whereas “on-the-run” securities refer to the most newly issued securities. The velocity at which the Fed hiked rates in 2022 caused many long-duration off-the-run securities to go underwater due to on-the-run securities having higher yields. If you recall, the banking crisis of 2023 stemmed from banking institutions being forced to sell off-the-run securities at a loss.

It appears that the treasury is concerned with the state of the bond market. I would be concerned too if I were the US treasury, considering they are already $34 trillion and debt and are having to borrow more, at higher interest rates, in order to finance government spending as well as payments on the outstanding debt.

12. $TLT

Longer duration bonds responded well to both the FOMC meeting and the buyback announcement. $TLT, the 20+ year treasury bond, is up ~1% since the market opened on Wednesday. However, zoomed out, things look far less appetizing for bond investors, with $TLT being down nearly 10% year-to-date, 14.5% year-over-year, and 27% over the past five years.

Bitcoin Mining

13. Hashprice All-Time Low

It’s no secret that right now is a trying time for Bitcoin miners. With the block subsidy now at 3.125 BTC per block, Bitcoin miners are being put to the test. This level of ruthless, free-market competition is not present in any other industry. Miners will survive if they can 1. Source low-cost power, 2. Acquire efficient ASICs. Miners that can’t accomplish this are not operating profitably, and there’s no subsidies or government intervention that can change that.

However, the medium-to-long term outlook is not bleak. The capitulation of the weakest miners on the network will decrease sell pressure on bitcoin, ultimately leading to an increase in price. Miners that have acquired efficient ASICs will be able to hold out until the bull market resumes, and hashprice rips to cycle highs.

14. Cost to Mine 1 BTC

As mentioned, miners with low cost power and efficient ASICs are still operating at a profit. The next projected difficulty adjustment is negative 2.7%. So while it will be dropping, its only marginal which tells us that a majority of miners on the network are still profitable in the current environment. And highly profitable at that, depending on machine type. For example, an S21 mining at Blockware’s facility, with a $0.078/kWh electricity rate, can mine 1 BTC for ~$42,000 worth of electricity.

With Blockware’s turnkey hashrate marketplace, you can purchase an S21 that is online right now. The only thing better than buying the dip, is mining the dip.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.