Blockware Intelligence Newsletter: Week 85

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 4/22/23-4/28/23

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through May 2023.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin.

No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

Get yours today at:

https://foundationdevices.com/?mtm_campaign=Blockware

Use code: BLOCKWARE for $10 off!

If you’ve thrown your hands up trying to run a lightning node, relax, you’re not an idiot, It’s not intuitive and manual management means you won’t survive.

These guys are friends of the newsletter and have a limited private beta for readers to trial automated LND operations like rebalancing and channel fee management.

Email paul@encryptedenergy.com and mention us for personalized onboarding.

Blockware Intelligence Podcast

On this week’s episode of the BWI podcast, Luke Broyles joined us for round 2. Luke’s first appearance on the BWI podcast made waves throughout the Bitcoin community and has been dubbed by some as one of the most bullish podcasts of all time. To nobody’s surprise Luke is just as bullish this time around.

Luke and Joe discuss fractional reserve banking, Bitcoin adoption, Luke’s bullishness, artificial intelligence, and more!

Check in at 3pm EST for the live premier!

Bitcoin Venture Capital Industry Research

Our friends at Trammel Venture Partners just published their research analysis on the Bitcoin focused venture capital space. Despite the 2022 bear market, Bitcoin focused companies are growing and raising money at a record rate.

The research brief contains great insights including that $343 million in total capital was raised for Bitcoin-native companies in 2022. If you want to learn more about the status of this industry take a look at the report below.

Summary:

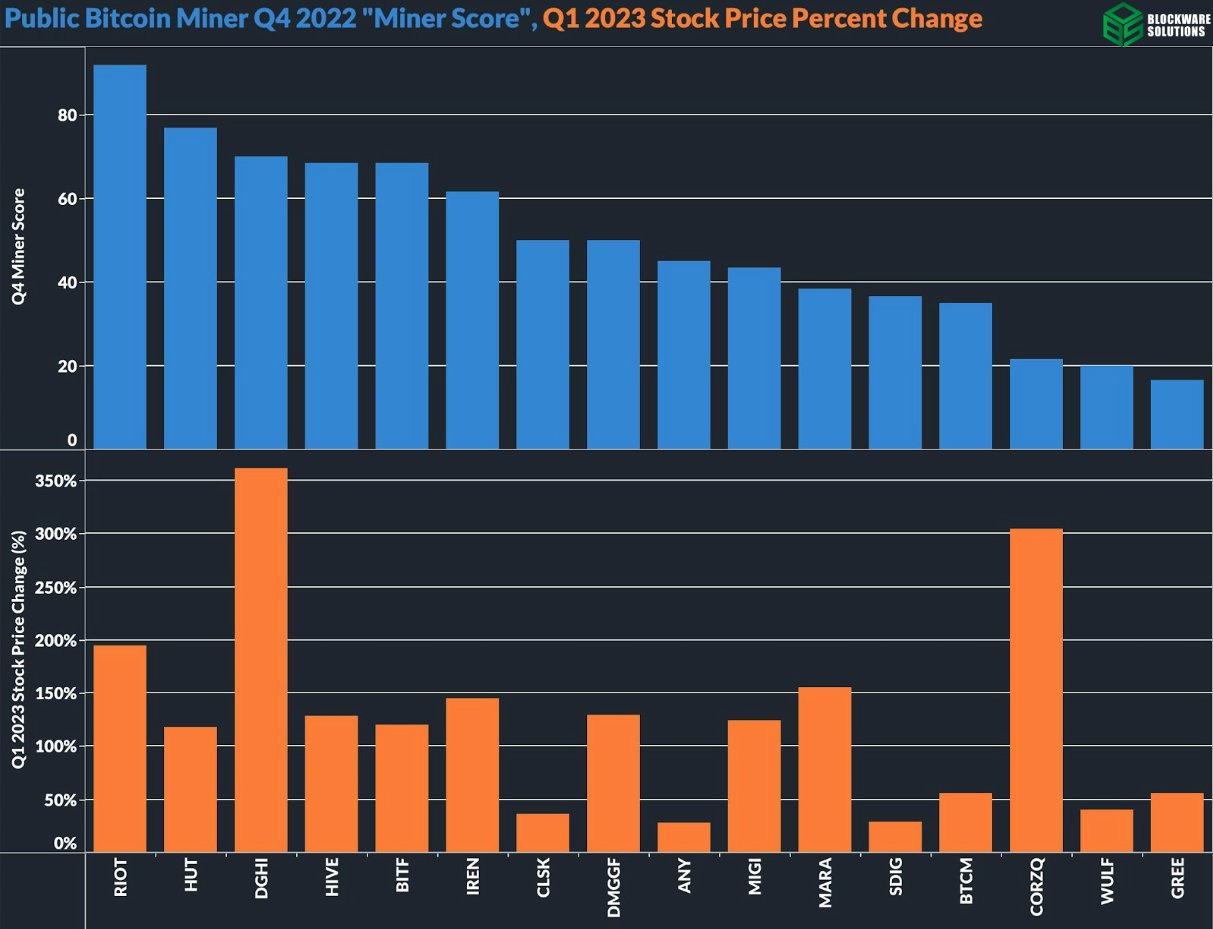

Blockware Intelligence just released an updated version of “Ranking Public Bitcoin Miners” using data from Q4 2022.

Amid a collapse of First Republic’s depositor base, all signs point to an impending credit crunch in the US.

Microsoft, Alphabet, Meta, and Amazon all beat on both earnings and revenue estimates for Q1.

First estimates of Q1 Real GDP came in at 1.1%, down from 2.6% in Q4.

The aggregate cost basis of long term holders declines as FTX-dip buyers age into the long term holder cohort.

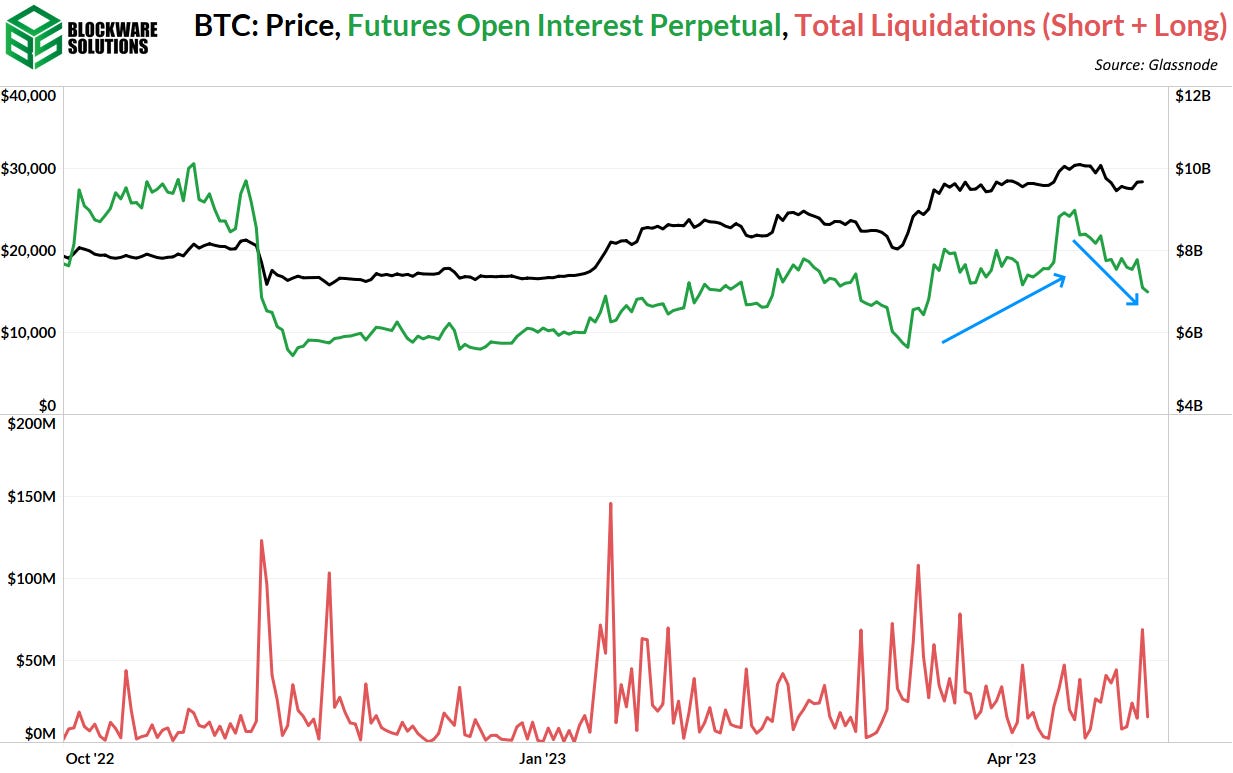

An increase in leverage resulted in a volatile week for BTC price action. This build up of leverage has since been wiped out, continuing the medium term trend of de-leveraging.

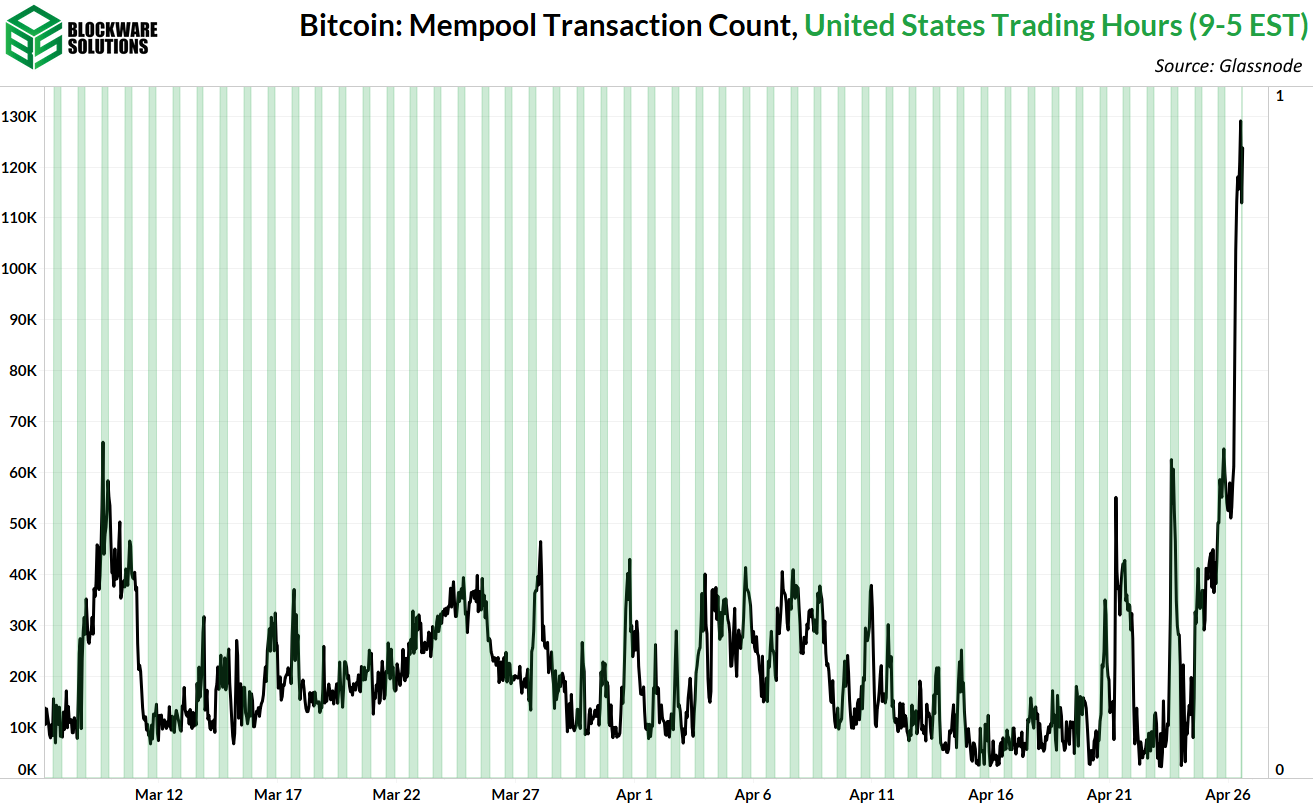

Mempool activity increases during US trading hours (9am - 5pm EST).

The breakeven electricity rate for a modern Bitcoin ASIC is $0.13/kWh.

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$15,900 worth of energy to produce 1 BTC.

General Market Update

We’re now less than a week away from May FOMC and it’s certainly been an interesting one.

The biggest headline this week comes from First Republic Bank, as their earnings report showed they’ve seen a collapse of their deposit base.

Deposits, All Commercial Banks (FRED)

This shouldn’t be too surprising, if you’ve paid attention to the news cycle over the last couple months. The chart above shows that commercial banks have seen their largest decline in deposits since at least the 1970’s (when this data set begins).

This was certainly enough to bring some fear into the market, as yields moved lower earlier in the week. That said, there have been concerns about FRB for weeks now.

Despite a $30 billion “bailout” from other banks, deposits still fell 41% in Q1 of this year. Now, as liquidity has dried up, the bank is in desperate need of another injection.

FRB has been asking for someone to buy their assets for pennies on the dollar, but so far, there’s no bidders.

In other words, FRB is almost certainly beyond saving. Their remaining depositors will be fine, but the institution was likely KIA in the wake of the SVB and Signature collapses.

Alongside overarching fear from depositors, we’ve begun to see recessionary behavior from banks over the last couple months. The credit crunch appears to be underway.

This means that banks have begun to tighten their lending standards, only offering credit to low-risk borrowers. While there still is credit available, we’ll likely see lending activity dry-up as we head into the summer months.

The other big headlines this week came from the plethora of earnings reported by major tech companies. This week we heard from GOOGL, MSFT, META and AMZN.

They all beat estimates for both revenue and earnings.

Despite the large layoffs we’ve seen in this industry, we’re clearly not seeing an earnings recession from the tech giants.

That being said, there are signs indicating that economic growth is slowing, in aggregate.

First estimates of Q1 real GDP were released on Thursday morning, which showed that the economic output grew by 1.1% last quarter. This was down from 2.6% in Q4, and in-line with the Atlanta Fed’s GDPNow estimate.

It is important to note that GDP is a lagging indicator, and generally doesn’t confirm recession until we’re already in it. Many analysts, however, believe that Q2 of 2023 may be a quarter of negative real GDP growth.

As previously mentioned, yields rolled over to begin the week, as a resurgence of banking fears led to investors seeking the safety of Treasuries.

Nasdaq Composite Index, 1D (Tradingview)

Despite yields taking a dip earlier in the week, we also saw some weakness from the equity indexes early in the week. However, the Nasdaq was able to hold its 50-day SMA (red line above)

On Thursday, following the major earnings announcements, stocks had a very strong day.

On Friday, keep an eye out for bullish confirmation with a break above ~$12,200 on the tailwinds of AMZN’s earnings beat.

Heading into next week, keep in mind that FOMC announces their next policy decision on Wednesday. The current market consensus is that the Fed will hike 25bps on Wednesday, and it will mark the last hike of this cycle.

Bitcoin-Exposed Equities

On Wednesday, the Blockware Intelligence team released the 2nd version of “Ranking Public Bitcoin Miners”.

In February we premiered this report, which offered an innovative new framework to quantify the liquidity, solvency and profitability of publicly traded Bitcoin miners. That report used data mostly from Q3 quarterly reports.

This version has been updated to reflect Q4, gathered from the 10-K’s released over the last several weeks.

RIOT and HUT retained their #1 and #2 rankings this time around.

Bitcoin Technical Analysis

After a short pullback last week, we saw BTC run into buyers again right around a very key moving average.

Bitcoin / US Dollar, 1D (Tradingview)

After a breakout (BTC above ~$25,000) it’s important to pay attention to pullbacks to gauge the buy strength remaining. In this case, BTC flashed some pretty bullish signals, as buyers quickly stepped in at the 50-day SMA.

That being said, $30-31,000 has been a strong resistance area. Our base case is more consolidation around this zone.

With FOMC next week, it’s not unreasonable to assume that the policy decision could make or break this current BTC strength.

Bitcoin On-chain and Derivatives

There is a growing divergence between the cost basis of short-term holders (up) and the cost basis of long-term holders (down). This divergence is an accurate historical signal that the worst of the bear market is behind us.

This divergence can be seen more clearly when we zoom in. The aggregate cost basis of short-term holders has increased to $24,000, while the aggregate cost basis of long-term holders has declined to just under $21,000.

At this point in the Bitcoin cycle, the cost basis of short-term holders tends to serve as support. This level has only been tested once so far during this bear market recovery phase. However, the support level held up without a hitch.

You may be wondering how it is that the long-term holder cost basis can decline while the current price is greater than said cost-basis. The explanation is straightforward. The threshold that determines a short vs long term holder is 155 days. 155 days from today (4/28/23) was November 24th, 2022; roughly two weeks post FTX collapse. Entities that accumulated the initial drop to $16,000 and have held since are now aging into the long-term holder cohort, and they’re bringing the cost basis of those cheaply acquired coins with them.

Leverage was the primary driving force behind the volatility of this week. There was a solid build up in open interest throughout the month of April but it has since come crashing down, and it liquidated both shorts and longs accordingly. Notice the drop in open interest on Tuesday of this week coinciding with a spike in total futures liquidations (short + long).

However, the signal in all of this noise is that following the leverage fueled drop from $30,000 to ~$27,000, open interest continued to decline during the rise back up to ~$30,000 which indicates that the bounce was spot driven.

Looking at the bigger picture, supply continues to tighten as now 54% of the BTC supply has not moved in 2 or more years. At a minimum these entities held from the mania of Spring 2021, down to $30,000 that summer, back up to $69,000, all the way down to $16,000.

Moreover, new addresses are being created at a near historic pace; only being eclipsed by the pearl of the 2017 and 2021 bull markets.

Some of this is to be accredited to a rising popularity in inscriptions and ordinals. However, the fact remains that demand is growing, especially when juxtaposing the 30-day moving average with the 365-day moving average,

Contraction of supply into the hands of long-term holders plus steadily increasing on-chain demand sets the stage for price appreciation in the medium and long term.

The only major obstacle in the short-term is leverage induced volatility as witnessed this week. However, the trend we have been observing is that the overall state of leverage in the market continues to decline, and despite the events of this week, that remains the case.

Open interest relative to market capitalization and the percentage of futures contracts margined with BTC are the two primary metrics we look at to gauge how much leverage is in the market, and what is the markets overall appetite for risk. Both of these metrics continue to decline which means that periods of volatility will be less impactful than they otherwise would be.

Lastly, this is somewhat of a tangent but I thought it would be worth sharing.

The team at Blockware noticed that many of the transactions on our new ASIC Marketplace were confirming on-chain during the middle of the night (US time). Considering many of our clientele are based in the US we thought this was strange.

This observation led to an interesting discovery. Noticeable spikes in mempool congestion tend to occur during US trading hours. It appears that the people in the western hemisphere (most likely the United States) have a higher demand for settling transactions on the Bitcoin network than those in the eastern hemisphere.

Bitcoin Mining

Is the 2024 Halving Priced In?

This week Blockware Intelligence Head Analyst, Joe Burnett discussed why he argues the 2024 halving is NOT priced in.

Watch:

In the video, there are three key reasons why the upcoming halving is not priced in.

1) If the market attempts to bid BTC higher before the halving, a price gap may form between BTC and its production cost through mining. This gap may divert capital inflows from spot BTC to ASICs and mining infrastructure, resulting in reduced capital inflows to spot BTC.

2) Following Bitcoin halvings, weaker miners are compelled to shut down their operations as their mining revenue now exceeds their operating expenses. Now the miners who sell most of their BTC to cover operational expenses are no longer selling, and only the strongest miners remain.

3) Although some believe halvings could have a negative impact by disincentivizing mining and exposing the network to attacks, the successful completion of each halving reinforces the resilience of Bitcoin, leading skeptics to buy more BTC.

Energy Gravity

The presented chart, which is based on a Blockware Intelligence Report, depicts the correlation between Bitcoin's production cost and its market price. The model facilitates the identification of overbought or oversold market conditions for Bitcoin, making it a valuable tool for visualizing price trends.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.