Blockware Intelligence Newsletter: Week 59

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/8/22-10/14/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by adding blocks to the blockchain. Your mining rigs, your keys, your Bitcoin.

Have fun and learn more about our Bitcoin future at Pacific Bitcoin, the largest Bitcoin conference on the West Coast. Nov 10-11 in Los Angeles. Get 30% OFF tickets with code BLOCK.

Summary

On Thursday, September’s CPI inflation came in hotter than expected at 8.2% YoY headline and 6.6% YoY core.

The market is now pricing in a near 100% probability of a 75bps FFR hike in November and participants are now also expecting to see 75bps in December.

The US Average 30-Year Fixed Mortgage rate is nearing 7% for the first time since 2022.

The “buy the news” upside reversal we saw on Thursday led to a significant bounce in the Treasury, equity, and bitcoin markets.

Realized Price metrics indicate that Bitcoin is still extremely underpriced.

Coin Days Destroyed signals strong hodling is occurring from long term market participants.

Adjusted Supply in Profit has reached nearly the same level as the 2018 bear market.

ETH/BTC down 22% a month after the merge.

High leverage and low volatility is likely coiling BTC up for a sharp move.

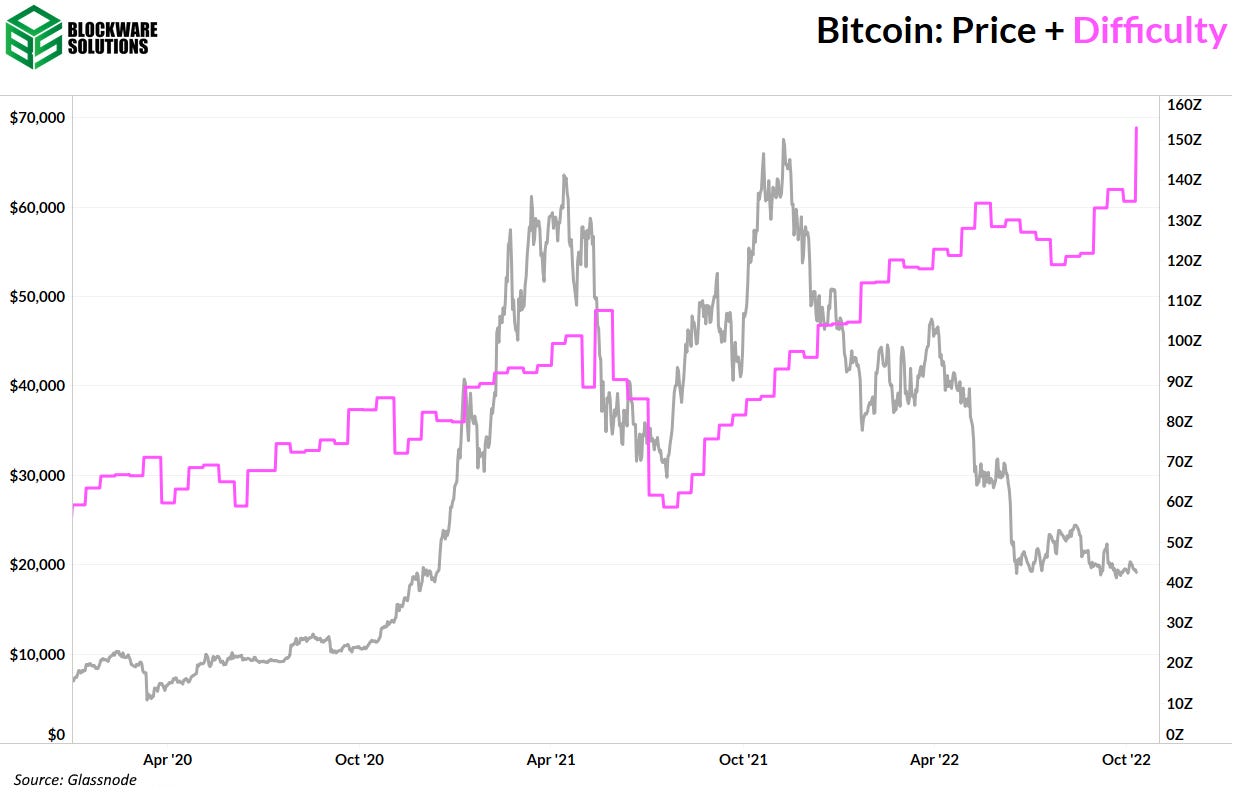

Mining Difficulty has hit an all-time high.

General Market Update

To probably nobody’s surprise, it's been another volatile week across the markets. The biggest economic event this week came yesterday with the release of September’s Consumer Price Index (CPI) numbers.

For those who missed it, the YoY headline number came in at 8.2%, above the median analyst estimate of 8.1%. Core CPI (CPI excluding food and energy) came in at 6.6%, above the consensus estimate of 6.5%.

Headline was down slightly from August’s 8.26% increase. While this may appear bullish at first, the thing to note is that CPI inflation is not declining nearly as much as many were expecting.

On a month-over-month basis, CPI inflation rose by 0.4%, double analyst estimates of 0.2%.

The current Fed policy to remove liquidity from the markets (quantitative tightening) and to aggressively raise market interest rates SHOULD be lowering demand enough to lower prices significantly. But that would occur in a more textbook macroeconomic environment, 2022 has been anything but textbook.

CPI Component Breakdown (Bureau of Labor Statistics)

Above is a chart from the US BLS that breaks down a few selected components of CPI’s market basket. This helps to explain why we’re seeing continued high headline CPI numbers.

In 2022, energy costs have been the major driver of CPI inflation in the US. Above we can see that while energy costs have made a steep decline in recent months, they’re currently being offset by other components that are on the rise.

Food and shelter costs are among the most watched pieces of CPI and in the month of September, food costs are up 11.2% YoY and shelter costs are up 6.6%.

In response to inflation not declining at the rate expected, markets appear to believe that the Fed will have to be more aggressive than expected in the remainder of 2022.

FedWatch Tool (CME Group)

Based on Fed funds rate futures data, CME Group is now predicting a ~100% probability of the Fed raising market interest rates by 75bps in November. This is up from a ~50% probability one month ago. (Note there is no FOMC meeting in October)

Furthermore, after September’s FOMC meeting, markets were predicting that the Fed would most likely raise by 75bps in November, then 50bps in December. After Thursday’s CPI numbers, estimates are now at a 75bps hike in both meetings.

This would put the upper-limit of the target Fed funds rate at 4.75%, its largest value since September of 2007.

We also saw a larger than expected increase in prices on the production side. On a year-over-year basis, the Producer Price Index (PPI) rose by 8.5% in September, down from 8.7% in August.

MoM PPI (BLS)

But on a month-over-month basis, PPI rose by 0.4%, which was above estimates of 0.2%.

Over the last 2 months, MoM PPI has risen by 0.8% (-0.4 to 0.4), making it the largest 2 month increase of 2022.

PPI tends to be a leading indicator of CPI, as rising costs for producers spills into increased prices for consumers. Keep an eye on rising PPI next month as a sign of potentially higher CPI numbers to come.

This week Allianz, the 9th largest asset managers in the world, released their annual Global Wealth report which showed that household wealth is on track to decline over 2% in 2022.

Allianz wrote that “2022 marks a turning point” as we are likely going to see the first significant destruction of global wealth since the great financial crisis of 2008.

This decline in global household wealth can be seen here in the US as we’re seeing a steep decline in the expected level of spending for 2023 from US households.

Below is a quote from the Survey of Consumer Expectations report released this week from the New York Fed:

“Median household spending growth expectations fell sharply to 6.0% from 7.8% in August, its steepest one month decline since the series’ inception in June 2013, and its lowest reading since January of this year. The decline was broad based across demographic groups.”

Across demographics we’re seeing that Americans are clearly expecting to spend less money in 2023. Likely this stems from expectations of economic recession and a higher-than-usual expectation of potential job loss in 2023.

On the housing front, the US average 30-year fixed mortgage rate is approaching 7% for the first time since 2002.

US Average 30-Year Fixed Mortgage Rate (FRED)

While many news sources are reporting that rates are already above 7%, I personally prefer to use Freddie Mac’s numbers.

For those who might not be aware, the Federal Home Loan Mortgage Corporation (also known as FHLMC or Freddie Mac) is one of three government sponsored entities that provide a secondary market for mortgages by creating mortgage-backed securities.

Because these government sponsored corporations have such a large hand in the mortgage secondary market, it seems likely that their rate estimates are more accurate than any 3rd party.

That being said, whether the 30-year average mortgage rate is at 7.2% or 6.9% is fairly arbitrary because the effect is the same on markets. We’ll see a decline in demand for new mortgage signings and likely lower home prices to come.

As a result of all of the data this newsletter has just presented, we’ve mostly seen the sell off continue across the fixed-income and equity markets this week.

US 10-Year Treasury Yield 1D (Tradingview)

Last week and heading into early this week we saw an overall rise in yields. Likely this sell off had to do with fear of a hotter than expected CPI report. Thursday morning, following the report, we saw a spike in yields that pushed the 10Y’s yield above 4% for the first time since April 2010.

4.0% has been a key area where investors have looked to lock in yield on the 10Y. On Thursday it looked like support would break in the form of higher yields.

But as the session played out, yields ultimately reversed which ushered in the huge reversal we saw from the stock indexes. The base case is similar in both markets that fear of high CPI last week may have caused a “sell the rumor, buy the news” type event on Thursday.

As of Friday morning, 10-year yields are just barely back above 4.0%.

Nasdaq Composite 1D (Tradingview)

Thursday morning the Nasdaq gapped down 2.74% to open the session but almost immediately, prices reversed higher to close the gap and close up 2.23% on the day.

High volume upside reversals in large cap stocks such as AAPL, TSLA, MSFT, AMZN, etc. leads me to believe that Thursday likely ushered in a potentially significant countertrend rally.

While it’s still most likely that we’ll see lower prices, it’s worth noting that we’re seeing a large bounce alongside the market's grim outlook on the Fed’s position. As this newsletter has mentioned many times, markets tend to bottom with the worst news.

In general market corrections, it's fairly common to see aggressive green moves from oversold conditions. While Thursday’s price action was certainly constructive, it is much too early to determine if this will result in a multi-week rally, or if the market will ignore it.

Crypto-Exposed Equities

Alongside the equity indexes and Bitcoin, we saw strong reversals across much of the crypto-exposed industry group on Thursday.

From a technical perspective, the most impressive bounces came from HUT, SI, MARA, RIOT, MSTR, BITF and CAN, in my opinion.

It seems likely that much of these bounces is coming from short covering. Shorting crypto-exposed names over the last year has been a relatively foolproof strategy so it’s encouraging to see a potential tide shift.

While, once again, it’s more likely that the bottom still isn’t in, it should be noted that on the off-chance Thursday was the bottom for equities, there will be a ton of overhead supply in these names.

For those who aren’t aware, overhead supply refers to the idea that when stocks have been in a prolonged decline, there will be large groups of people who bought higher and are sitting on losing positions.

As price begins to climb higher again, we tend to see a stream of supply entering the market as those bagholders begin to sell in order to breakeven or decrease their loss. This makes it hard for stocks to just scream higher off the bottom of a base.

Furthermore, it creates tradeable continuation patterns that allow those who missed the bottom (essentially everyone) to find low-risk entry points.

While I’m not giving investment advice, all I’m trying to say is that patience pays.

Above, as always is the table comparing the weekly performance of several crypto-exposed equites.

Bitcoin Technical Analysis

Similar to all other securities discussed here today, Bitcoin also saw a large reversal on Thursday. For BTC, price got down to $18,131, which was its lowest since June 19th (the day after the current bottom).

BTCUSD 1D (Tradingview)

On Thursday morning, price came within 3.2% of the June bottom. While I do still believe that we’re more likely to undercut that low than not, the large volume upside reversal is hard to ignore.

At the end of the day, speculation on short-term price movements is an educated guess, and the market rarely does what you expect.

It’s likely that there were many stop losses placed at the more recent September 21st support level. The undercut and rally is a very common price pattern and it’s what we saw on Thursday.

Price works down to undercut a key support level, then by one or many large fish will scoop up all the sats (shares) that were auto-sold by the stop loss orders to cause an upside reversal in price.

That being said, Friday morning we’re seeing price run into some resistance at the multi week trendline drawn above. Be on the lookout for BTC to break above this line as a signal of a potentially significant rally underway.

On-Chain / Derivatives

Bitcoin has continued to persist in a zone of extreme value. The cost basis of Short Term Holders is less than that of Long Term Holders which is an occurrence that has thus far been unique to bear market bottoms.

There are two factors contributing to the cross of these metrics.

Firstly, STHs are aging into the LTH cohort. This signals that a certain number of the new market participants have recognized Bitcoin’s true long term value proposition and they are hodling as a result.

Secondly, LTHs are perpetually stacking Bitcoin, especially during dips and bear markets, despite the fact that most of the time (not right now) the price is greater than their cost basis. LTHs also understand the long term value proposition of Bitcoin and recognize that buying it at any price is a good trade; even if it is at a price much higher than what they were stacking at in years past.

The 90 Day Rolling Sum of Coin Days Destroyed (adjusted for circulating supply) has dipped to its lowest point since 2010.

Given that Coin Days Destroyed measures how many coins are moving, weighted by the number of days since each coin was last moved, the metric being this low shows a combination of two behaviors from market participants. First, a relatively low number of on-chain transactions are occurring. Second, the on-chain transactions that are occurring tend to be the movement of young coins. The long term holders are holding on tightly to their Bitcoin.

The Long Term Holders are not just holding but they are accumulating as well. In the last 3 months, Long Term Holders have added half a million BTC (2.3% of the total supply) to their stacks.

Unlike fiat maximalists, who are dumping bonds at historic levels, Bitcoiners are demonstrating an honest conviction in their preferred asset class by literally putting their money where their mouth is.

Shout out to Checkmate, the Lead On-Chain Analyst at Glassnode, for bringing my attention to this metric.

In blue we have the percentage of the BTC supply in profit. While it’s certainly low, at ~54%, it has not quite reached the levels of past bear markets. On the surface that may appear as if there is more capitulation ahead.

However, the green line has adjusted the metric to exclude BTC that was last active 7+ years ago. Coins in that cohort consist of Satoshi’s coins, coins that are lost, and coins that are very unlikely to move again. All of these, having been accumulated at such low prices, are likely to remain in profit forever and that pads the unadjusted percentage of supply in profit. Excluding these coins gives a more accurate depiction of the current profitability status of market participants.

When looking at the adjusted percentage of supply in profit, you can see that we are in an equally disastrous position as during the 2018 bear market.

ETH is down 22% from its pre-merge high when priced in BTC.

In the week 55 newsletter we speculated if the merge would be a “buy the rumor, sell the news” market scenario. One month later that appears to have been the case.

A side effect of the NgU technology of Bull Markets is that it leads to the development and marketing of other blockchain coins. Bear markets result in these alternative coins getting toasted in both USD terms and in BTC terms. After experiencing a bear market, no altcoin has been able to return to its previous BTC-denominated all-time high. (The only exception is dogecoin but this was due to Elon Musk enjoying and promoting the meme.)

“BTC Dominance” is sometimes used to measure Bitcoin’s Market Cap relative to the altcoins. However, this metric is diluted as it contains thousands of coins with misrepresentative market caps due to their illiquidity and lack of real volume.

Measuring BTC against just the top 10 altcoins (excluding stablecoins) provides a better representation of the current state of the BTC vs Alt cycle.

At the bottom of the bear market in 2018, BTC’s market cap comprised 66% of the total market cap of the top 10 coins. Presently, it is at 57%; much closer to its 2018 level than you would be led to believe by looking just at BTC Dominance.

Also, DYOR. Just because a coin is in the “top 10” does not mean that it is decentralized, scarce, and censorship resistant. Luna was in the top 10 this time last year and everyone saw how that ended up.

The amount of leverage in the market has continued to rise dramatically this week. The brief drop below $19k on Thursday did nothing to quell this. Be on the lookout for either a short squeeze or a liquidation cascade very soon.

Parlaying the above chart with the Bitcoin Volatility Index strengthens the thesis that a large volatile move is near. The BVIN is still relatively low but it appears to be gaining upwards momentum.

Bitcoin Mining

As it does every 2,100 blocks, in order to accommodate for the recent increase in Hash Rate, the Bitcoin Network has once again automatically adjusted the difficulty of solving each block’s hash function. This ensures that blocks are found roughly every 10 minutes; keeping the supply schedule on track.

Difficulty jumped a whopping 13.5% this week. This is the largest upwards difficulty adjustment since May 2021; during the heat of the bull market.

Reiterating from last week: there are three main reasons for this increase in hash.

New generation machines coming online

Less power curtailment compared to this summer

In efficient miners selling their rigs and getting them plugged back in by a more efficient miner.

This week we had Bob Burnett (no relation to Joe), CEO of Barefoot Mining, on the Blockware Intelligence Podcast.

Bob discusses his animal thesis and how different sized Bitcoin mining operations are critical when it comes to defending the network against attackers. Make sure to check it out and if you enjoy the episode we would appreciate it if you ‘subscribed’ and hit the like button.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.