Blockware Intelligence Newsletter: Week 102

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/26/23-9/1/23

Blockware Solutions Labor Day Special

If you purchase ASIC(s) before 11:59pm EST on Tuesday, September 5th, you will secure a 7¢ per kWh hosting rate. This will lower your monthly operating costs by 12.5% compared to an 8¢ rate; factor that across a few dozen machines and you’ll save thousands of dollars each month.

Contact sales@blockwaresolutions.com to bulk order machines at a discounted rate.

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Joe Burnett is joined by Caitlin Long, Founder & CEO of Custodia Bank, to discuss Grayscale v. SEC and the regulatory environment surrounding Bitcoin.

General Market Update

2. Unemployment Rate. The unemployment rate rose to 3.8% in August, a sharp increase from 3.5% in July. The level of unemployment in the US is now at its highest level since February 2022, however, we are still on the low end relative to history.

3. Challenger Cuts. According to the Challenger Report, US employers cut 75,151 jobs in August. This is a 217% increase from July’s print of 20,485 cuts. Throughout 2023, a staggering 557,000 cuts have been recorded, marking one of the bleakest January to August periods in the past 15 years, with only 2020 and 2009 surpassing it in terms of job cuts.

4. Core PCE Ex-Housing. PCE inflation, released yesterday, came in at 4.2% YoY for the core reading. This was just above June’s 4.1% reading. Core PCE excluding housing remains stubbornly high at 4.7% YoY. This is a key metric that the Fed will be watching to determine whether or not its regime of restrictive monetary policy is having its intended effects.

Chart Source: Zero Hedge

5. Russell 2000. Stocks have largely seen a rebound this week after the tough month that was August. The Russell 2000 small-cap index has, at the time of writing, passed back above its 50-day SMA for the first time in almost 3 weeks. The Russell is an important measure of breadth in this market, as we need small-cap participation to fuel a sustained bull market.

Bitcoin-Exposed Equities

6. Valkyrie Bitcoin Miners ETF. It’s been a wild ride for Bitcoin exposed equities this week. With the Grayscale news fueling a Bitcoin buying frenzy, Tuesday was a monster name for public miners. Now, as BTC price action has cooled off to close out the week, we’ve seen a swift pullback from these names. There are plenty of ETF decisions on the horizon, so don’t take your eyes off this group.

7. Bitcoin-Exposed Equity Table. The table below compares the Monday-Thursday price action of many Bitcoin equities, in contrast to that of spot Bitcoin and WGMI. The average name was still up 6.75% as of yesterday’s close, despite Bitcoin being down across the 4-day period. The clear outlier here is Mawson Infrastructure Group (MIGI), which was up over 51.5% on the week.

Bitcoin Technical Analysis

8. Bitcoin / USD. As we’re sure you know, Bitcoin had a strong 6% day on Tuesday following the court ruling supporting Grayscale’s ETF bid. Price has since pulled back to around $26,000. Interestingly, price has respected the YTD AVWAP this newsletter pointed out last week. While algos and funds clearly are watching this indicator, a break below this level (~$25,300) could quickly lead to BTC in the $21-23,000 range.

Bitcoin On-Chain / Derivatives

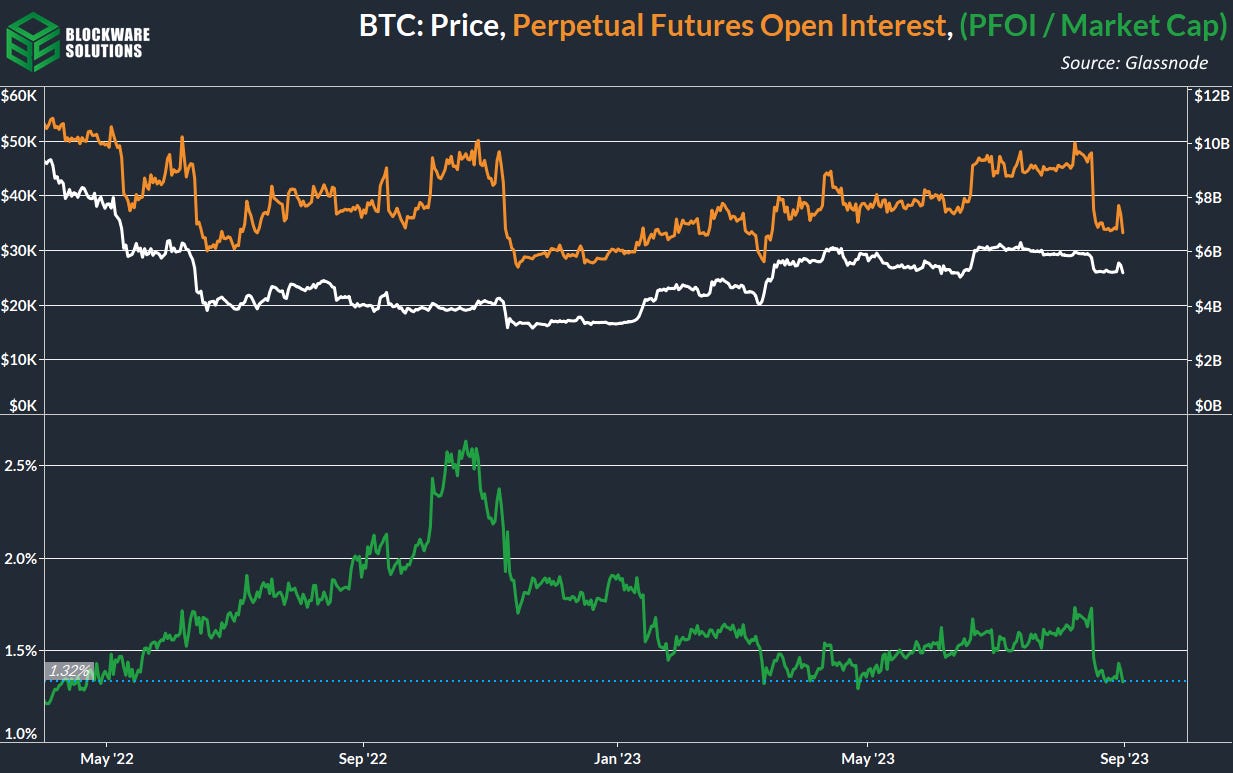

9. Perpetual Futures Open Interest Relative to Market Cap: As volatile as this week has been in terms of BTC price action, all in all, the foundation of the market is now more solid as a result. Open interest as a % of market cap is down to 1.32%. All of the leverage built up over the summer has effectively been wiped out.

10. % of Futures Open Interest Collateralized w/ BTC: Another way to measure the market’s vulnerability to leverage liquidation-induced volatility, is the % of futures open interest that is margined with BTC. Using BTC as collateral for a BTC derivative is effectively a “double whammy". If you’re long BTC with BTC posted as collateral, the price going down brings you to your liquidation point faster because the value of your collateral is declining at the same time. The spike in this metric over the past few months is curious, it may suggest that traders are running out of cash and they are resorting to leveraging against their BTC as the last means of increasing their exposure. Leveraging against your BTC during its monetization phase is extremely risky, you can be correct directionally but volatility can wipe you out regardless.

11. Exchange Balances: In the first paragraph of this section, we mentioned that the market is in a better position now than it was a few months ago because of the leverage wipeout. This is also the case when looking at exchange balances. Over the past 90 days ~111,757 BTC have been taken off of exchanges; this is nearly $3 billion worth. Total exchange balances are now at ~2.26 million, down ~30% from their 2020 high of ~3.2 million.

12. HODL Waves: Here is an up-to-date chart of “HODL Waves”; a breakdown of Bitcoin’s supply based on the amount of time since each coin was last moved. The broad idea here is that supply illiquidity remains at an all time high; convicted Bitcoin holders have accumulated a high % of the supply and these coins are not moving. As the calendar continues to move forward, we’re going to start shifting our gaze away from the “1-2 year” cohort and pay more attention to the “2-3 year” and “3-5 year” cohorts. It is reasonable to expect that the 1-2y wave will begin to roll over as we approach the 1-year anniversary of the (presumable) market bottom. Coins last active at this point aren’t necessarily held by highly convicted Bitcoiners, although it certainly took ~some~ conviction to step into the market at that point, but may have been acquired by traders seeing a low entry point. That being said, a majority of the coins stacked here were likely accumulated by highly convicted, price-agnostic Bitcoiners. But considering the former category of market participants, the 2-3y cohort provides maximum signal because these coins were acquired during the bull market and held the entire way down. It's reasonable to expect that these coins will not be sold until BTC, at a minimum, reaches the higher prices at which they were acquired. Even then, the majority will likely remain illiquid.

13. Bear Market Recovery: This chart depicts the performance of Bitcoin since its cycle low. Assuming that November 2022 was in fact the bottom for this cycle, which is highly likely, the recovery from the bear market really is in the very early stages. Even the 2021 cycle, which is notorious for being much less explosive than previous cycles, saw price increase by orders of magnitude from the previous cycle's bottom. Accumulating BTC at current prices will likely be looked back upon as a fantastic decision.

14. Issuance + Supply Distribution: There's a paradox in that a good money must be scarce (hard to produce), but also widely distributed. For example, the Mona Lisa, while scarce, would make for poor money because it is not widely distributed, nor is it divisible, nor is it easily portable. Bitcoin has satisfied this seemingly contradictory requirement for a good money through its programmatic supply schedule. Over time, it becomes more difficult to produce because of the halvings and difficulty adjustments. Yet, it's also becoming more widely distributed. Note the supply held by addresses with less than 10 BTC ceaselessly makes new all-time highs.

Bitcoin Mining

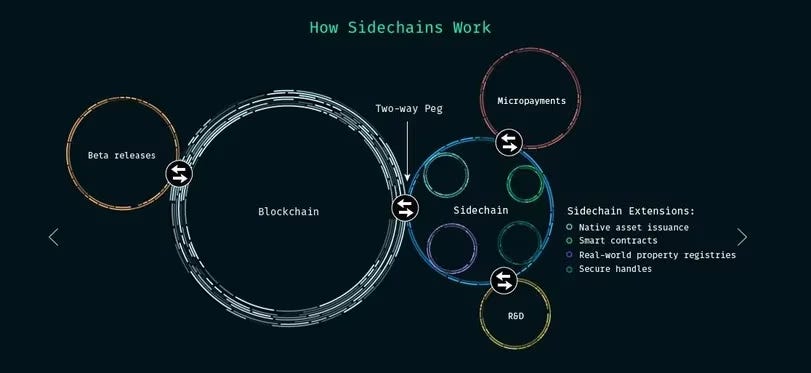

15. Drivechain? A topic of debate in the Bitcoin community recently has been drivechains, a solution to making sidechain two-way pegs potentially more trustless, however it requires a soft fork to be implemented.

16. Drivechain future? Some Bitcoiners question whether implementing BIP 300 and 301 is worth potential risks. It’s only a soft fork, so it would be backwards compatible with old versions of Bitcoin, but it could alter mining incentives in unforeseen ways.

17. Rules without rulers. Just witnessing the BIP 300 soft fork debate should be enough to clearly see how different Bitcoin is from altcoins. Altcoins can change on a whim. However, it's incredibly difficult to even bring a backward-compatible change to Bitcoin. Bitcoiners and drivechain supporters should have patience. Anything rushed is bad for both parties.

18. Incoming Mining Difficulty Decrease. Due to the large previous difficulty increase, block randomness, and miner curtailments, mining difficulty is projected to decrease by about 4% - 5%.

19. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,039 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.