Blockware Intelligence Newsletter: Week 105

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/16/23 - 9/22/23

S19 XP and 12 Months of Free Hosting Giveaway

In order to enter the giveaway (~ $7,000 value today), you must complete the following three steps. With just around 50 sign up entries received so far, your odds of winning are looking exceptionally favorable.

1. Sign up for the Blockware Marketplace

2. Complete the 2 onboarding steps

3. Like & RT this tweet

Additionally, purchasing an ASIC on the marketplace gives you 10 additional entries. The deadline for entries is EOD Friday, September 22nd, 2023.

Blockware Intelligence Sponsors

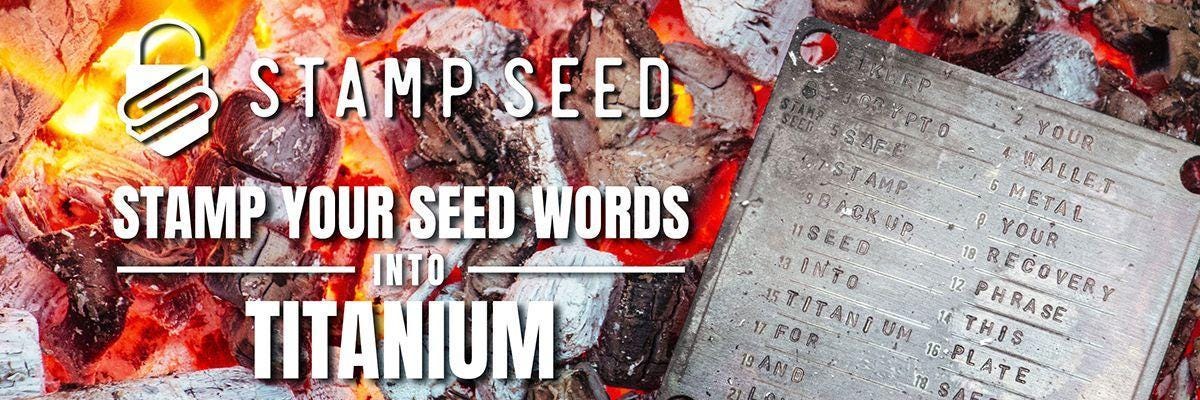

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Mitch Askew interviews Joe Consorti, Market Analyst at the Bitcoin Layer, to discuss the future of Fed policy, why the Fed always resorts to QE, Bitcoin's role in world, why a "soft-landing" isn't going to happen, and more!

General Market Update

2. FOMC Dot Plot. The Fed elected to hold the FFR at 5.25-5.50% on Wednesday. The quarterly dot plot was also released, which showed that the majority of FOMC participants see one more rate hike in the cards for 2023. We also saw a shift in the perceived cut schedule. FOMC now sees the Fed cutting rates in September 2024, in comparison to the previous July 2024 estimate.

3. 10-Year Treasury Yield. After the FOMC hinted towards higher rates for longer, the Treasury market has seen a bit of a sell off. This morning the 10-Year cracked above 4.50% for the first time since the Great Financial Crisis.

4. Russell 2000 Small-Cap Index. With rising yields and future rates, stocks have generally had a very poor week. The Russell 2000 is an important index to watch to gauge market breadth and sentiment. This index was never able to crack resistance at ~$2,000, and has now turned down sharply towards this support channel. Keep an eye on $1,750 for this index heading into next week.

Bitcoin Exposed Equities

5. Valkyrie Bitcoin Miners ETF. Despite Bitcoin holding up fairly well, publicly traded Bitcoin miners have largely had a rough week of price action. The miner ETF, WGMI, is currently down about 7% on the week, and lies near a key support level at ~$9.60.

6. Bitcoin Exposed Equity Comparison. Despite the largely negative week for these names, a few charts stand out. BTDR, BTCM, and APLD are all positive on the week (Monday-Thursday) despite BTC being flat, and WGMI being down over 11% in the same period.

Bitcoin Technical Analysis

7. Bitcoin / USD. As we predicted here last week, the 50-day SMA has turned into resistance this week for Bitcoin price action. That said, the YTD AVWAP has continuously attracted buyers here for the last several weeks. Price will likely continue in this $25-27.5k range until buyers or sellers can steal control.

Bitcoin On-Chain / Derivatives

8. Realized Price: The aggregate cost-basis of the market (realized price) sits at ~$20,200. An MVRV ratio (market value to realized value) of 1.32 means that the average coin is up 32% in fiat terms; not too shabby for a bear market. However, the MVRV ratio is still at extremely low historical levels. Stacking sats when MVRV has been at or below its current level has led to great returns.

9. Realized Price (3-7 year old coins): This chart looks at the cost-basis for coins that haven’t moved in 3-5 years and 5-7 years. The average cost-basis for both of these cohorts is ~$7,000. This shows that, despite the diminishing returns of the previous bull market, those that have held onto their Bitcoin for at least a cycle or a cycle and a half are up significantly in fiat terms. You’ll often hear no-coiners cherry-pick data points saying “if you bought in 2017 you’re only up a few % points; referencing the $20,000 top which occurred for just a brief moment in time. Those that dollar-cost average into Bitcoin have much lower cost basis than those that only buy at the top. Dollar-cost averaging is the best approach for an asset whose price is as volatile as Bitcoin.

10. Realized Price (Young Coins): Zooming in and observing the cost-basis for younger cohorts can show some potential key price levels in the near-term. The cost-basis for each age cohort is as follows:

1 week to month: $26,120

1 month to 3 months: $29,543

3 months to 6 months: $27,757

6 months to 1 year: $19,432

1 year to 2 years: $37,519

2 years to 3 years: $39,561

The younger coins (those moved within the past six months) are going to be the most reactionary to their cost-basises. BTC may face some headwinds at the $29,500 and $27,700 realized price levels; but if it can push through these levels it will be a positive signal for the short-to-medium term outlook.

11. Hash Ribbon: We discussed this metric in last week's newsletter but I want to dig even deeper. “Hash Ribbons” occur when the 30-day moving average of hashrate crosses below the 60-day moving average, signaling that a large portion of miners have recently turned off their machines. These hash ribbons tend to occur during, or just prior to, local bottoms. Leading up to the hash ribbon the weak miners are selling a majority of their BTC to cover operating costs. They may even be depleting BTC they have in reserves, allowing them to sell more BTC than they are actually mining on a recurring basis. Once these weak miners capitulate, that sell pressure is relieved. Furthermore, difficulty is lowered for the surviving miners which means they now have to sell fewer BTC to cover their operating expenses.

12. Perpetual Futures Open Interest Market Cap Adjusted: Looking at futures open interest adjusted for market cap can give us insight into how vulnerable the market is to massive liquidation events during periods of volatility. After open interest fell off a cliff (leverage traders getting wiped out) during the drop in price a few weeks ago, open interest remained relatively flat. This past week it has begun to trickle back up slowly. Nothing concerning like previous build-ups in open interest but it is worth keeping an eye on. After being spooked by the latest liquidation event, traders may start feeling more comfortable about taking on a new position.

Bitcoin Mining

13. Antminer S21 & S21 Hydro: Bitmain has officially announced the specs for their latest generation of ASICs, the S21 and S21 hydro. These machines are 200T, 17.5 J/T & 335T, 16J/T respectively. This is a major improvement over the XP, however due to the commoditization of ASICs the marginal improvement is much slimmer than it used to be when new generation ASICs hit the market. The S19 series machines will continue to play a pivotal role in the Bitcoin mining ecosystem during the coming epoch; more so than the S9 was able to play during the current epoch.

14. Whatsminer M60: The competition between the two titans of Bitcoin ASIC manufacturing, Bitmain and MicroBT, is unsurprisingly continuing into the next generation of ASICs. Just days before Bitmain announced the full specs of the S21, MicroBT announced the latest in the Whatsminer series: the M60. Like the S21, this machine will have an energy efficiency somewhere in the teens. The machine will be unveiled for the first time on October 24th at ‘Blockchain Life 2023’ in Dubai.

15. Upcoming Difficulty Adjustment: Unfortunately for miners, difficulty rose by 5.48% this week. However the next adjustment is on track to be a negative one, current projection is -4.6%. This will likely change as more blocks are mined (slow early blocks could just be bad luck) but it's good to see the initial trajectory is down. This summer has been filled with back and forth difficulty adjustments, likely due to Texas based miners engaging in demand response programs. This should become more of the case in the future as other grids take advantage of the flexible energy load brought by Bitcoin mining.

Despite the increases in hashrate this year, we are still beneath our projections for the 2024 halving. We expect hashrate to be ~420 EH/s by the time of the halving, we’re currently at 400. For more on the 2024 halving and how you can survive as a Bitcoin miner, check out this report.

16. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,728 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.