Blockware Intelligence Newsletter: Week 120

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 2/3/23 - 2/9/23

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Fidelity Canada “All-In-One Conservative ETF” Allocates to Bitcoin:

Fidelity Canada has taken a 1% Bitcoin position inside their “All-In-One Conservative ETF”. This is a sign of shifting conventional wisdom about asset allocation and the role Bitcoin should play in a traditional portfolio.

1% may not seem like much, but there’s north of $500 trillion within equities and treasuries. 1% of that capital rebalancing into BTC will cause the market to rip by orders of magnitude. That’s not to say that the ride will be smooth, but it’s coming.

“60/40” —> “59/40/1”

Source: fidelity.ca

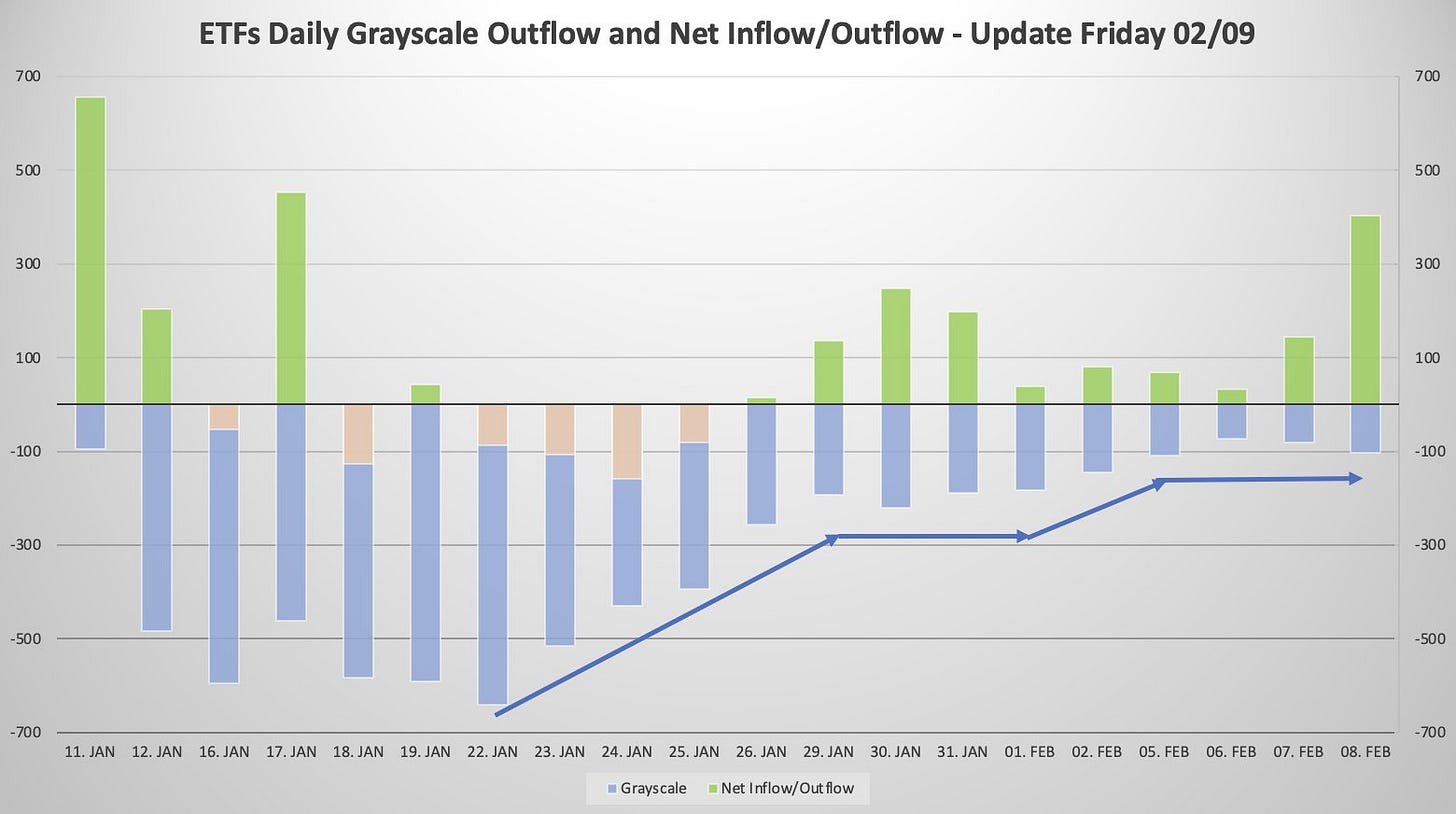

2. Bitcoin ETF Flows: Outflows from GBTC have slowed down significantly over the past few weeks; with daily outflows this week around $100m. The end of the GBTC sell pressure is one of the primary reasons for the strong BTC price action this week.

While initial price action post-ETF approval left much to be desired, the medium-to-long-term impact of the ETFs is undeniably bullish. Passive flows will continue to find their way into these easily accessible Bitcoin vehicles.

Source: @AlexOttaBTC

General Market Update

3. Powell on 60 Minutes. Fed Chair Jerome Powell gave a 60 Minutes interview this week. What was most interesting here was that Powell deviated from his usual well-rehearsed, careful speeches. Powell seemed relaxed and spoke candidly, hinting towards rate cuts coming later than the market expects; “We want to see more evidence that inflation is moving sustainably down to 2%...”.

The Fed Chair clearly sees that the time for cuts is approaching, but was surprised that the hikes hadn’t caused “some pain”. Chair Powell also made comments regarding US fiscal policy, stating that he believes we’re on an unsustainable path in the long term.

4. 10 Year Treasury Auction. On Wednesday, the US Treasury held its quarterly 10-year auction, which saw a record-setting level of buying. $42 billion worth of 10-year notes were auctioned at 4.093%, which broke the previous record by $1 billion. If you recall back in Q4, we were seeing auctions go “no bid.” Now we’re seeing demand surprise sharply to the upside, with international buyers comprising ~71% of demand. However, yields have moved higher in the days since.

5. Russell 2000 ETF. We’ve seen a fairly strong week of price action across the small-cap equities that comprise the Russell 2000. With a strong Treasury auction providing tailwinds for risk assets. Seeing the Russell pick up above this trendline today is a very encouraging sight. This will be a very important daily candle for the Russell, a close above $197 would be a strong signal of breadth expansion.

Bitcoin Exposed Equities

6. Cleanspark Earnings. Cleanspark (Nasdaq: $CLSK) released its Q1 FY2024 earnings after market close yesterday. Note that $CLSK’s fiscal year starts when Q4 starts in a traditional FY. The company had a great quarter, especially when looking at YoY numbers in the aftermath of FTX collapsing. Revenues grew 165% YoY with hashprice up ~70% YoY, showing the broad expansion of their operational capacity. The street clearly likes what Zach Bradford and the team have been cooking up, as $CLSK gapped up 24% at the open today.

7. BEE Comparison Sheet. With BTC up 6.41% from Monday-Thursday and WGMI up nearly 16%, 21/25 (84%) of Bitcoin Exposed Equities tracked here outperformed spot BTC.

Bitcoin Technical Analysis

8. Bitcoin/USD. In case you somehow missed it, this has (so far) been the best week for Bitcoin price action since the October breakout above $30k. Last week this section pointed out that the key level to watch would be $42.3-43.9k. Now that we’ve cleared this level, $47.7-50k is likely to be a tougher level to crack. Obviously, this all depends on the demand side of the equation. If ETF inflows can outpace the profit-taking and short selling that these prices will attract, the next stop after $50k is likely somewhere around $53k.

Bitcoin On-Chain / Derivatives

9. Short-Term Holder Cost Basis (Realized Price): BTC has recovered all of the losses after the post-ETF approval dip. With continual inflows into ETFs, the 2024 halving right around the corner, and still record levels of illiquid supply, BTC price action looks incredibly bullish on all time frames: short, medium, and long-term.

10. % of Supply Last Active 1+ Year(s) Ago: Speaking of supply illiquidity, the % of Bitcoin's supply that hasn't moved in a year or longer remains at record-high levels, despite a slight downtick following the approval of spot ETFs.

Supply illiquidity

+ Demand Shock (ETFs)

+ Supply Shock (Halving)

...get ready🚀

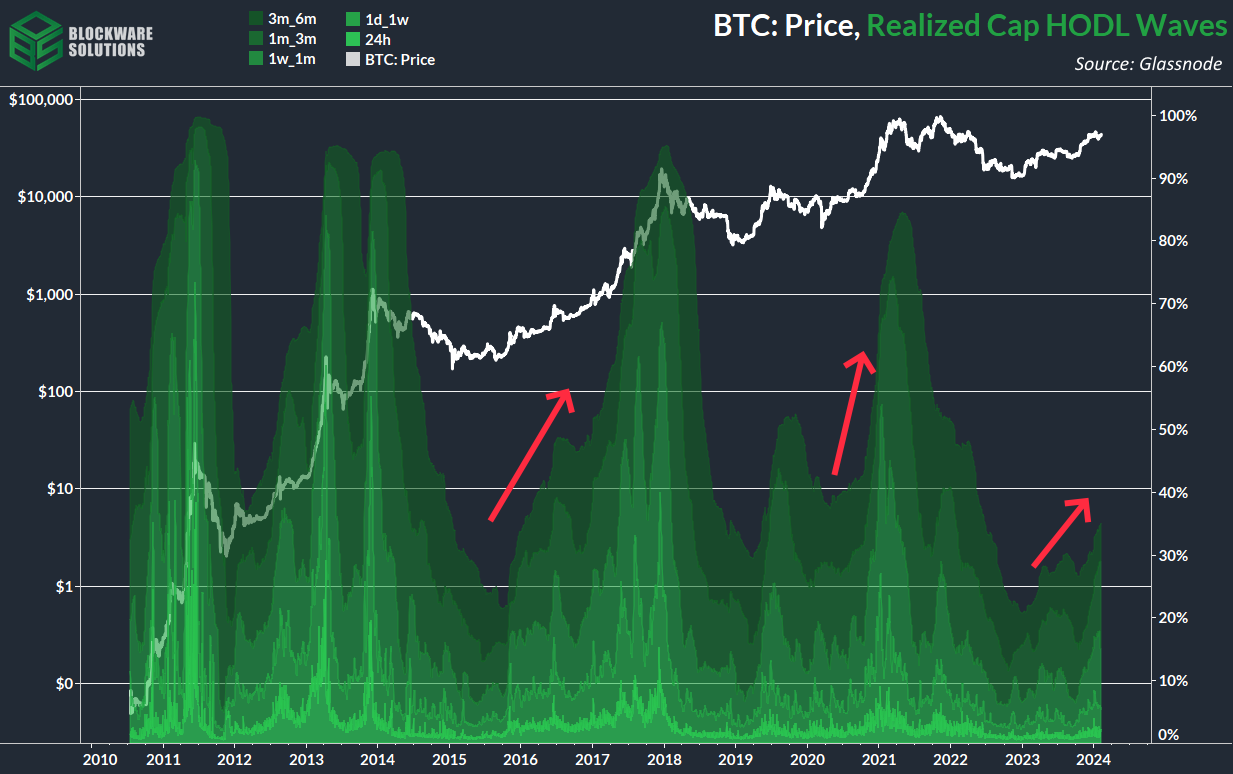

11. Realized Cap HODL Waves: Essentially this is a measure of how long since each coin last moved, weighted by the cost-basis of each coin. High % of supply within age cohort + high-cost basis = Larger RP HODL wave.

There’s been a noticeable up-trend from younger coins (last moved <6 months prior). Increased % of total supply within said age bands and with higher cost-basis.

Similar behavior occurred in the earlier stages of previous bull markets.

Bitcoin Mining

12. Hut 8 Appoints New CEO: Asher Genot, President and Board Member ($HUT), has replaced former CEO Jamie Leverton, effective immediately. This comes a few months after Hut 8’s merger with US Bitcoin Corp. The Hut 8 board cited the merger with US Bitcoin Corp as a “pivotal inflection point”, and felt that a change in leadership was in order.

Check out Hut 8’s press release to learn more.

13. Mining Difficulty: Blocks have been coming in hot during this difficulty epoch, every 9 minutes on average. We’re halfway through the epoch and a +11% difficulty adjustment is projected. Remember, mining difficulty is adjusted every 2,016 blocks based on a targeted moving average of 10 minutes between the discovery of each new block. The actual adjustment will likely change but it almost certainly will be positive.

Higher difficulty will crunch the revenue of Bitcoin miners, reinforcing the importance of mining with the most efficient machines possible. It’s no surprise that difficulty is increasing as miners are deploying new-generation ASICs (S21s and M60s) in preparation for the 2024 Bitcoin halving.

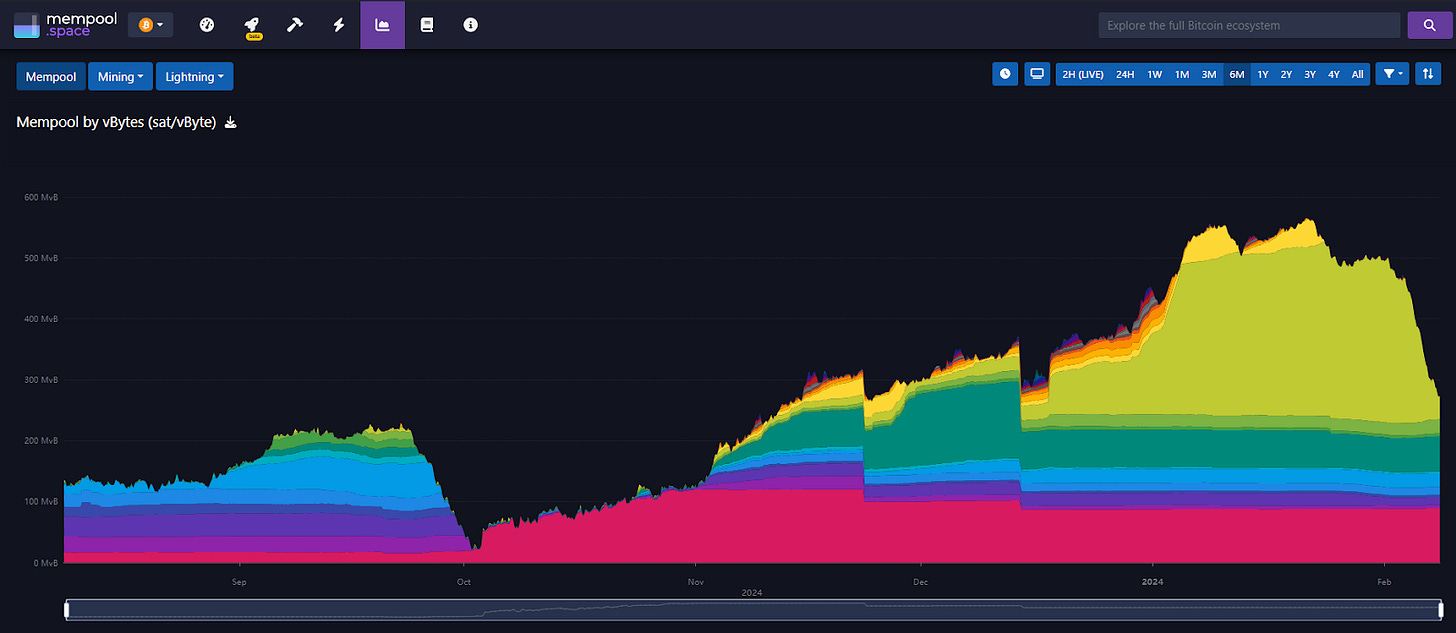

14. Mempool Clearing: With the fast discovery of blocks, miners have been mowing through the backlog of transactions in the mempool. Transactions with a fee rate of >20 sat/vByte have almost entirely cleared, with lower fees likely to clear in the near future.

15. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$24,152 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.