Blockware Intelligence Newsletter: Week 128

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 4/6/24 - 4/12/24

🚨Buy The Latest-Generation of Bitcoin Mining Hardware🚨

Blockware has partnered with a world-class immersion mining facility to bring you the opportunity to mine using the Whatsminer M66s.

288 TH/s (up to 330 EH/s when in “high performance mode”)

19.5 W/Th

Immersion has a few notable advantages over air-cooled mining:

Heat Resistance

Greater Up-Time

Longer Machine Lifespan

Superior Hashrate & Efficiency

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

The Conservative Case for Bitcoin: Hard Money & The Restoration of Traditional American Values

Blockware Head Analyst, Mitchell Askew, has published his first book on Amazon.

Mitchell explores the tremendous overlap between Bitcoin and Traditional, American Values:

- Property Rights

- Limited Government

- Free Markets

- Freedom of Speech

- Personal Responsibility

- Strong Family Units

- Energy Production

In 10 short chapters, Mitchell articulates the case for why Bitcoin is more American/Patriotic than the US Dollar.

You can purchase here for the low price of $17.76

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Bitcoin Consolidation

Since eclipsing its previous all-time high in early March, BTC/USD has traded range bound in the upper $60,000s / lower $70,000s range. Local lows have been higher as BTC pushes up on resistance at ~$72,000. There’s been no structural change to the bullish catalysts that propelled BTC in Q1; increasing dollar liquidity, rising institutional demand, and illiquid supply. The sideways price action may persist for a little while longer, but the next major move is almost assuredly to the upside.

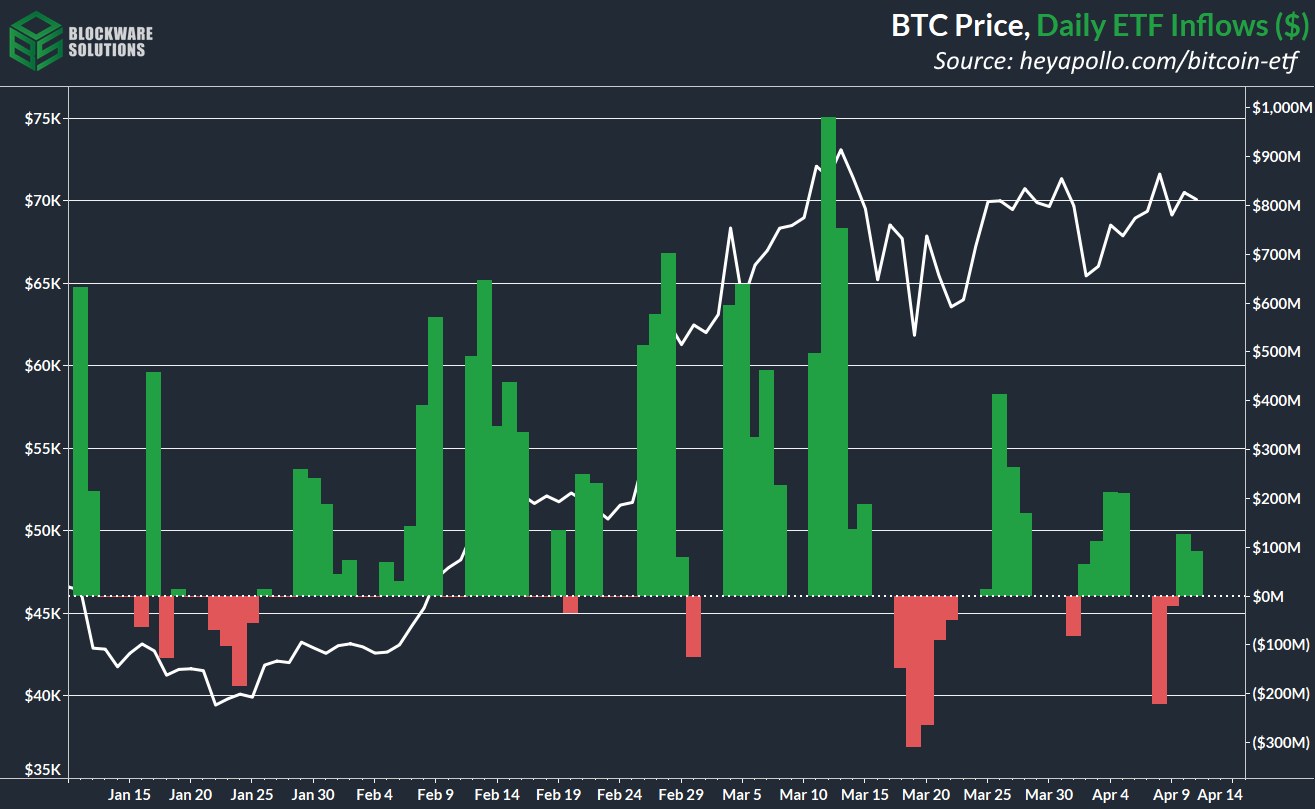

2. Bitcoin ETF Flows:

The Spot Bitcoin ETFs had their third lightest week of inflows since inception, denoted by ~$200 million in net outflows on Monday. However, inflows have been positive throughout the latter half of the week.

Source: https://heyapollo.com/bitcoin-etf

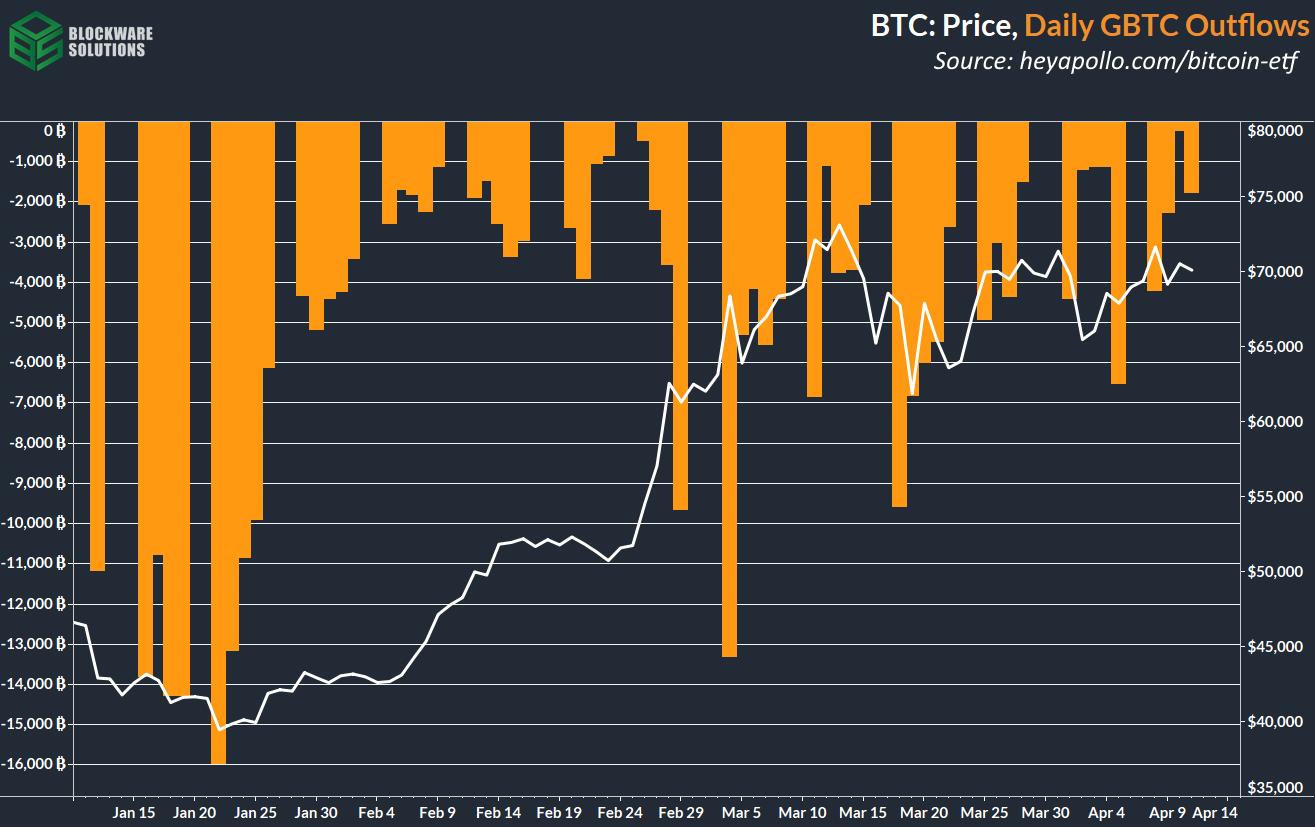

3. Grayscale Bitcoin Outflows:

While inflows into the new spot ETFs were down this week, outflows from GBTC were also down (probably some causation there). GBTC outflows may be slowing down, but they are still occurring. At some point Grayscale may need to change course on their fee strategy as consistent loss of Bitcoin under management is not favorable for them long-term when it comes to profiting from this financial product.

General Market Update

4. March Consumer Price Index

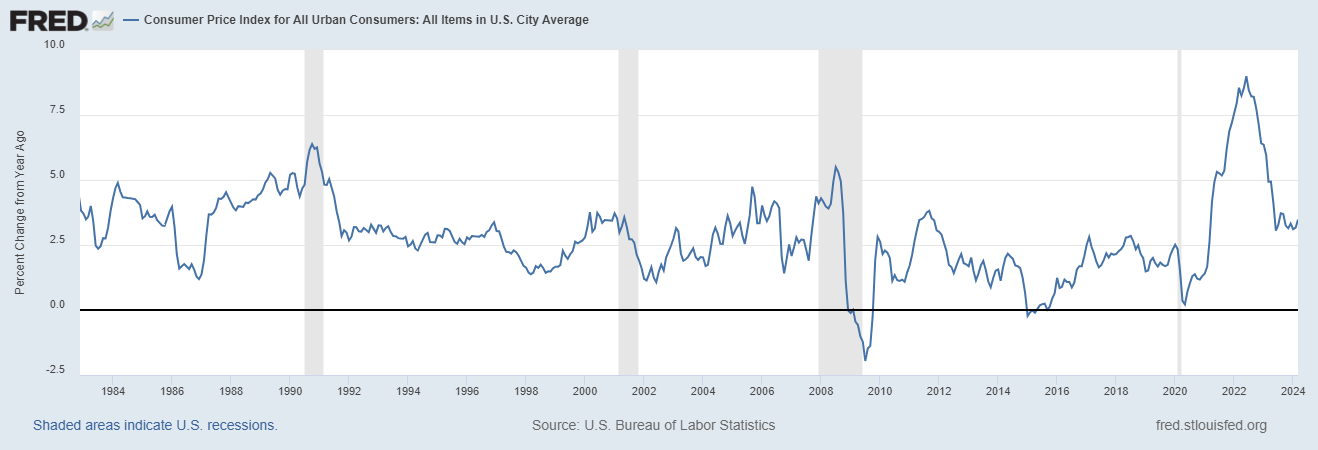

Before we analyze what the latest CPI print means for the market, let’s reiterate a few key points on CPI.

CPI is not inflation

To quote Michael Saylor: “inflation is a vector.” Just as you cannot measure the aerodynamics of a rocket ship with a linear formula, you cannot measure changing prices in an economy with a single data point. The prices of different goods/assets change at different rates, and the effect that changes in monetary policy have on prices are not equal across all goods. CPI is a basket of many goods, some of which you may or may not consume personally. The actual inflation rate for you as a consumer is likely much higher than what is presented with CPI.

CPI is directionally accurate

While CPI may not fully encapsulate the magnitude of changing prices in an economy, it is a useful tool for measuring the overall direction of prices in an economy. Ie: Inflation, disinflation (price increases but at a slower rate), or deflation.

CPI is a key variable that the Fed looks at when determining monetary policy

Despite its flaws, the year-over-year % change in CPI is one of the core data points that the Fed uses when setting monetary policy. Putting yourself into the shoes of the Federal Reserve is a great way to generate alpha in markets; and keeping track of CPI is one way you can do that.

With that out of the way, let’s dig into this CPI data and the market’s response.

Year-over-year CPI change came in at ~3.47%. This was the second consecutive month of accelerating inflation, and the highest print since September of last year. The Fed should not hold its breath waiting for CPI to hit their (arbitrary) target rate of 2%.

5. Average Interest Rate on U.S. Treasuries

The blended average of interest rates on outstanding U.S. Treasury Securities is ~3.22%.

With outstanding debt at ~$34.6 trillion, 3.2% interest rates equates to ~$1.1 trillion in annual interest payments on the debt. For reference, this is ~25% higher than the annual military budget which is ~$874 billion.

So long as treasury rates remain elevated, interest payments on the debt as well as the Federal budget deficit will continue to grow.

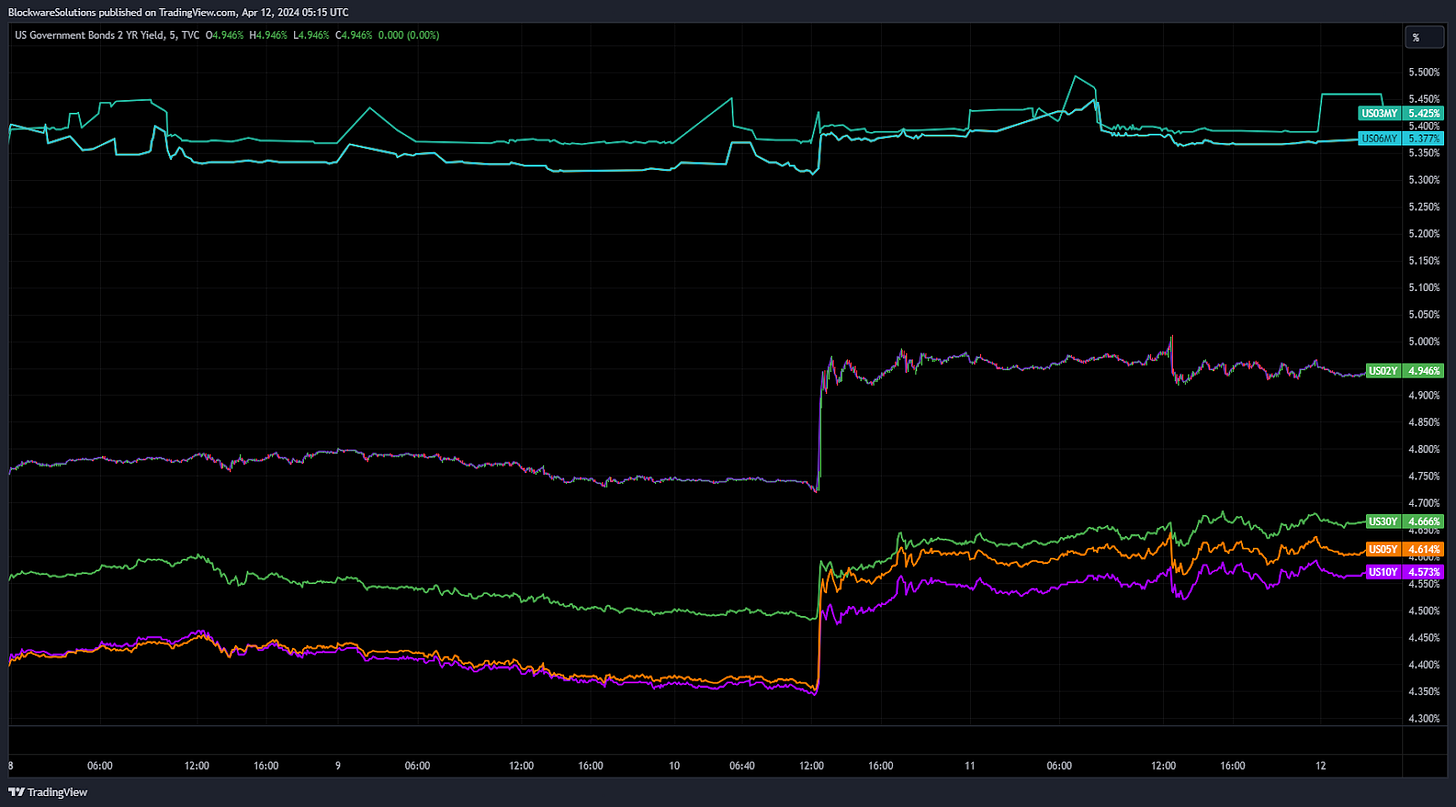

6. Treasury Bonds

Bonds puked on the release of the CPI data; with yields surging across the board. POTUS expects rate cuts this year, but bond investors are not quite as confident. We’ll need to see lower inflation data (unlikely) or direct Fed posturing before we can have a high degree of confidence as to the timeline of rate cuts. The Fed has repeatedly pointed to stubbornly high inflation data this year, and the market has seemingly begun shifting it’s outlook on rate cuts this year.

7. Stock Market Reaction

The US Stock Market opened lower on the high CPI data, but has gained positive territory since, at least at the time of writing. Many forward-looking investors may be unconcerned with elevated inflation and its impact on the economy, or are simply storing their capital in anything but dollars in order to preserve purchasing power. That said, as mentioned previously, the market seems to be shifting towards the realization that inflation is not coming down with the face initially seen. With that, the likelihood for Fed rate cuts in June are quickly falling.

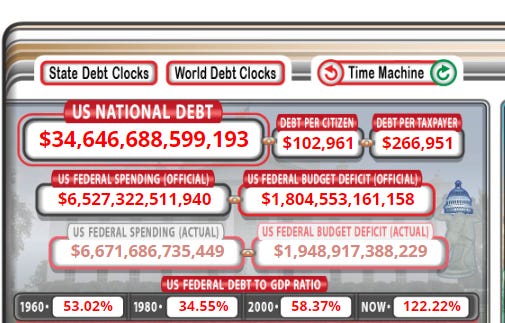

8. US National Debt

The US National Debt has reached a staggering $34.6 trillion, and the annualized budget deficit is at $1.8 trillion. These unfathomably large budget deficits are the obvious culprit for sticky inflation; essentially handcuffing the Fed and nullifying the downward pressure that rate hikes would have otherwise put on prices in the economy.

9. Fiscal Dominance

Fiscal Dominance: “an economic condition that arises when debts and deficits are so high that monetary policy loses traction.”

The economy is most definitely in a state of fiscal dominance at the moment, and the meme below illustrates what that looks like. With mounting fiscal deficits, funded by increased treasury issuance, the Fed’s “higher for longer” policy is having an inverse on their goal to tame inflation.

Jerome Powell is very much stuck between a rock and a hard place:

Keep rates elevated → higher interest payments on the debt, further expansion of $ liquidity, continue combating higher than expected inflation

Lower interest rates → Concede defeat in battle against inflation, quantitative easing, monetary debasement

Bitcoin On-Chain / Derivatives

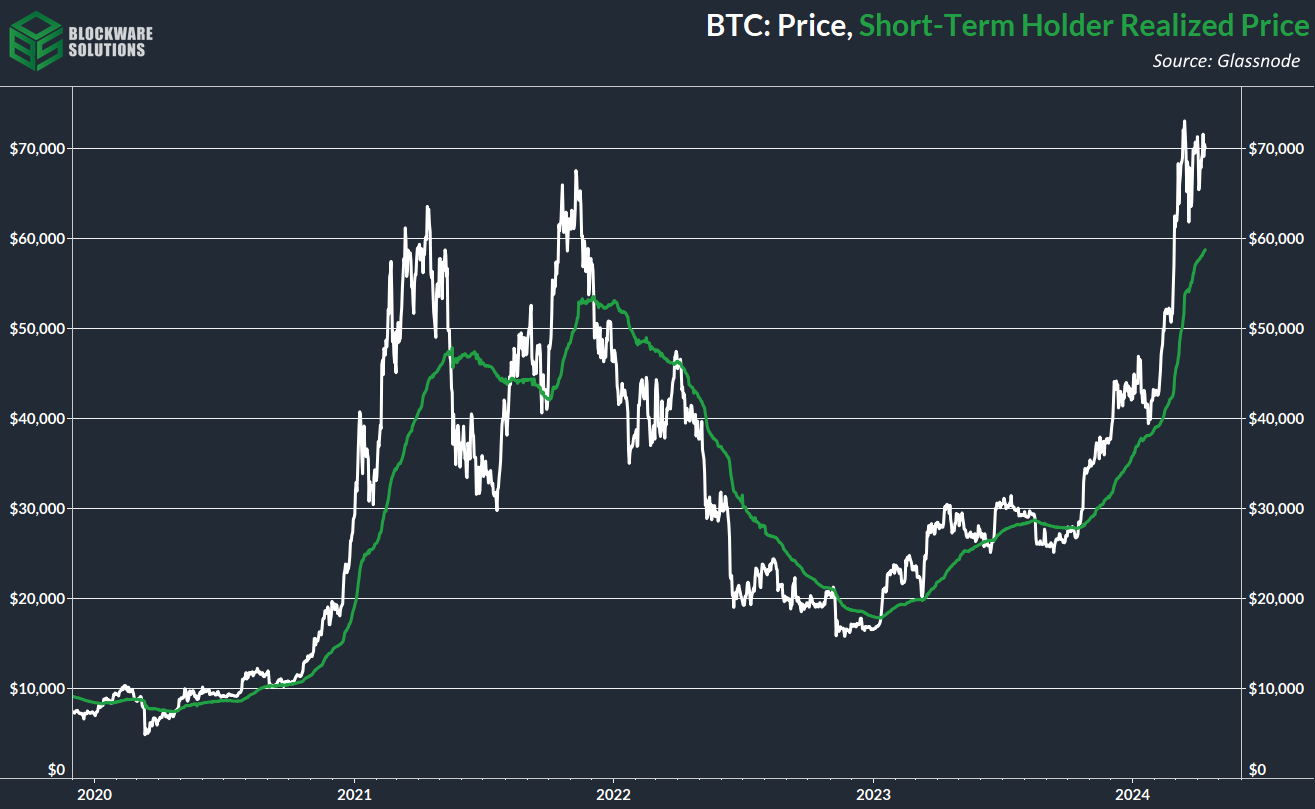

10. Short-Term Holder Realized Price:

Not much change in the cost-basis of short-term holders (coins last moved within 155 days) since last week’s newsletter, it has risen slightly to $58,000. This has been the highest-signal on-chain metric in previous bull markets for identifying points at which BTC may be posting a local bottom. Continuation of this regime of consolidation will push the short-term holder aggregate cost-basis higher, and may tee-up another move up in price.

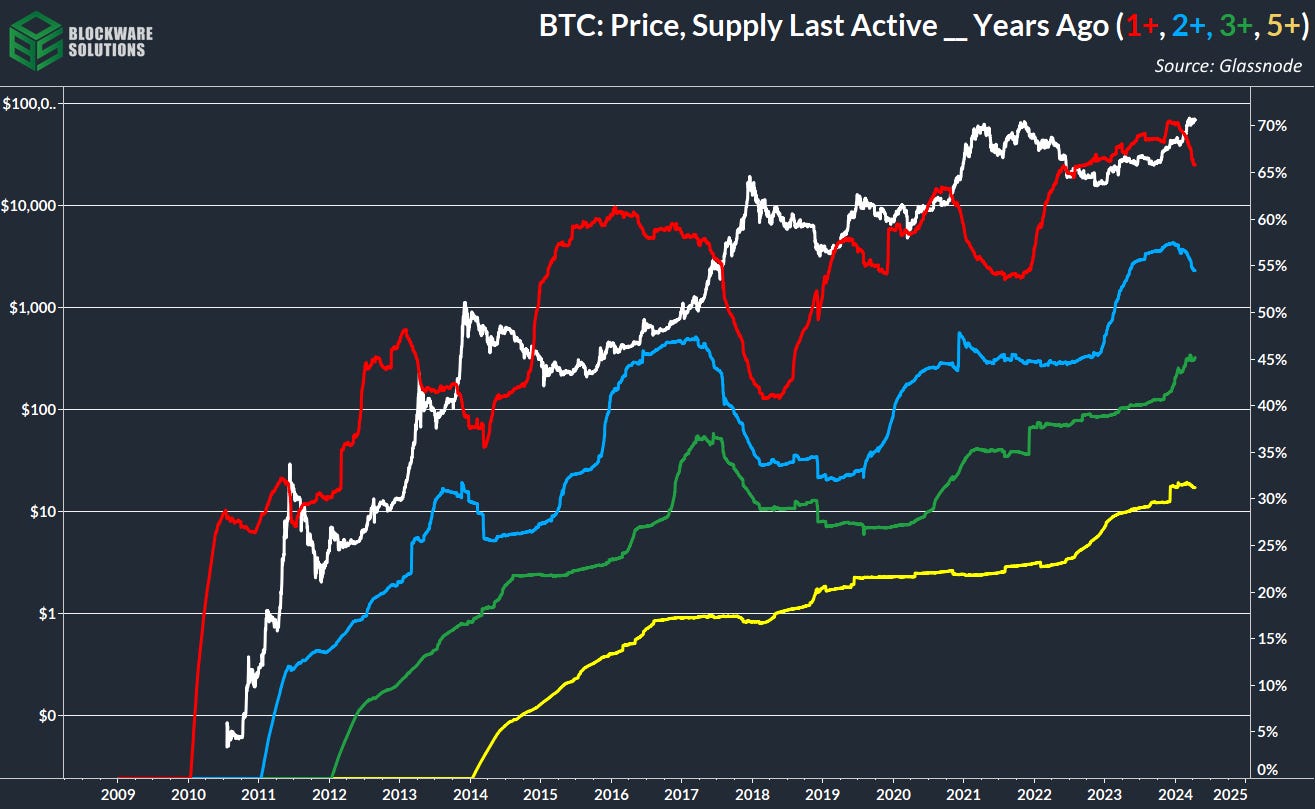

11. Supply Last Active __ Years Ago

We’re seeing interesting activity from coins on-chain; with older coins circulating (presumably to exchanges to be sold) for the first time since the 2021 bull market. This should come as no surprise; higher prices incentivize some long-term holders to distribute supply back into the market.

However, what’s worth noting is that the supply of coins last active 3+ years ago has remained relatively flat while the younger cohorts have begun tapering down. Coins last moved 3-ish years ago were bought close to all-time highs while coins bought within the past 1-2 years were bought at bear market prices, and have more gains to realize. Further price appreciation will be needed to pry the coins bought at last cycle’s top to be parted with.

Despite the volatility of these metrics during each cycle, the border trend is up. Bitcoiners accumulate coins and hold them for long periods of time. If you want to buy them off them, you’ll have to bid the price higher, usually by an order of magnitude. Even then, you will not be able to entice them to part with all of their coins, only some. Few understand absolute scarcity. But those that do are uncompromising in their ability to HODL.

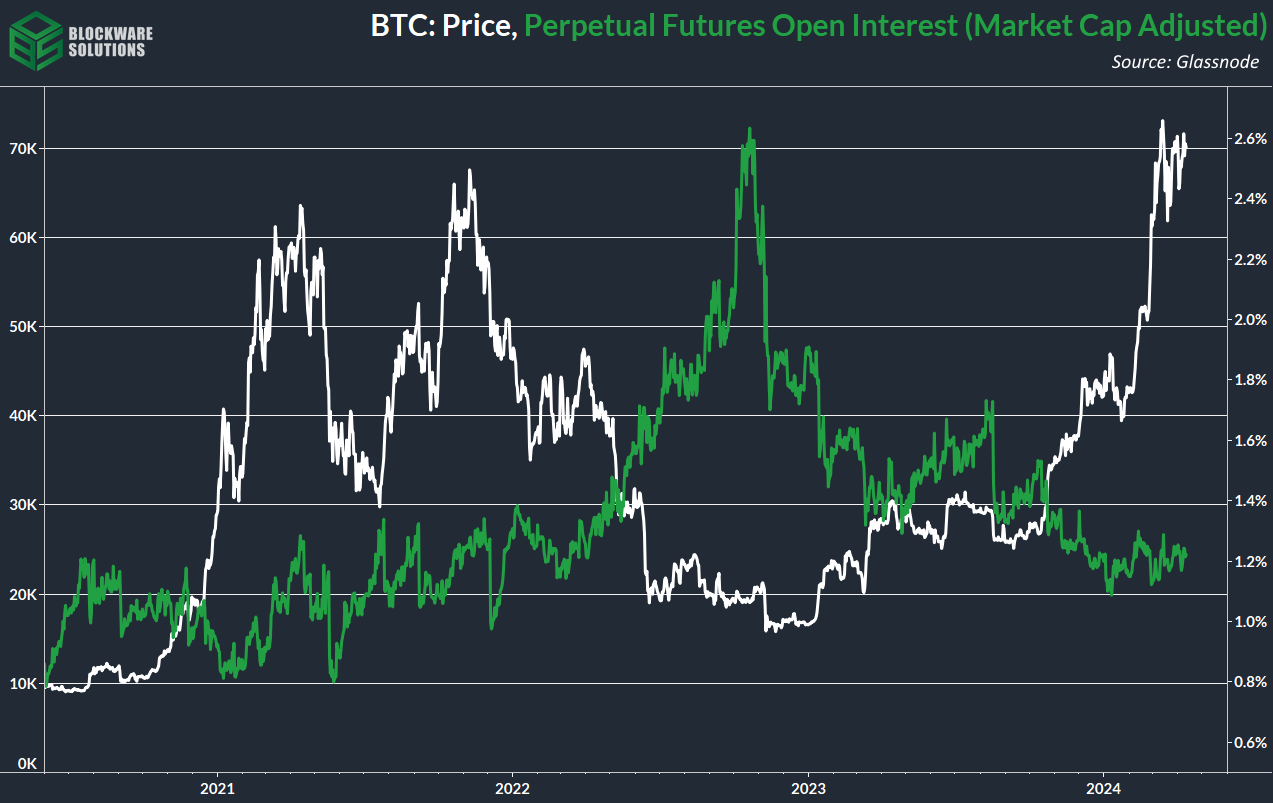

12. Perpetual Futures Open Interest

Things are relatively quiet in the BTC derivatives market. Historically, during periods of prolonged price consolidation, we’ve seen a rise in open-interest relative to market cap. That signals investors opening up newer positions faster than their existing positions can close due to price volatility (perpetual futures have no expiration date). We’re not seeing that during this regime of consolidation. The likely case is that investors are exercising caution as we approach a significant milestone for Bitcoin: the halving. Moreover, this is still the preliminary stages of the bull market, and ansty retail investors are not yet present to the degree they were in 2021 & 2022.

Bitcoin Mining

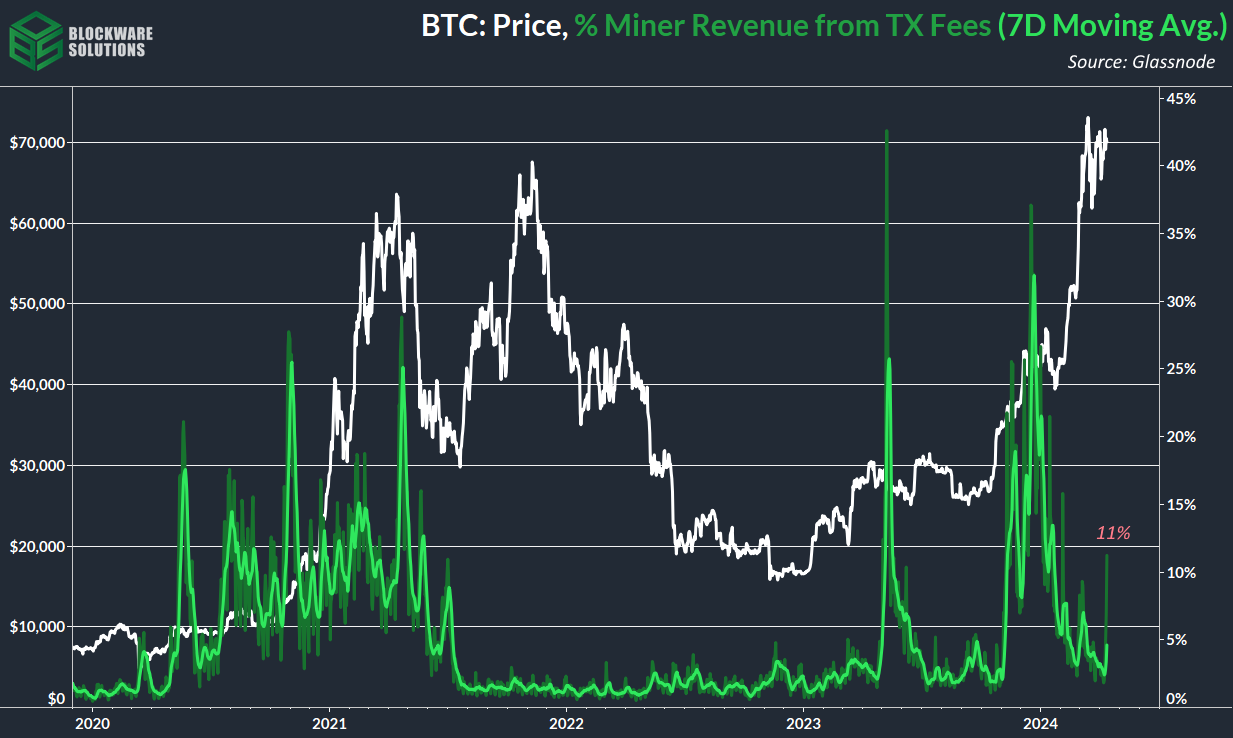

13. Rising Transaction Fees

On-Chain transaction fees are rising as we head towards the 2024 Halving. On Thursday ~11% of Bitcoin mining revenue came from transaction fees. We saw fees rise in a similar fashion in the aftermath of the 2020 halving. This time may be even more potent given the increasing popularity of ordinals and inscriptions, which resulted in elevated on-chain fees throughout much of 2023.

Frequent newsletter readers should be unsurprised by this rise in fees as we have alluded to this likelihood in previous editions. Rising fees will bode well for Bitcoin miners, providing a source of supplemental revenue at an opportune time.

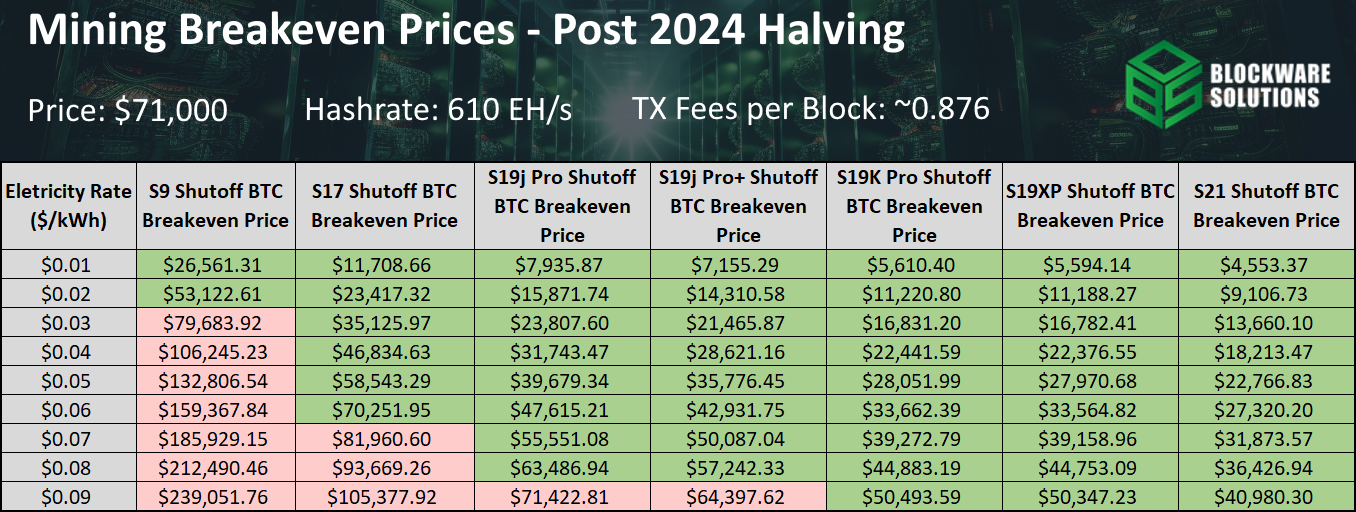

14. Post-Halving Breakeven Prices for Bitcoin Miners

With the halving now just 1 week away, here’s what the landscape looks like for Bitcoin miners based on machine type and electricity rate. It’s not as daunting as you might think, despite the 3.125 block subsidy. The recent upswing in on-chain transaction fees, which is likely to sustain in the short-term post-halving, has provided a nice boost to bottom line mining revenue.

Mid-generation ASICs such as the S19 (or equivalents) have some breathing room that they otherwise wouldn’t have in a low-fee environment. Newer generation ASICs like the S19K Pro and S19 XP will still be producing BTC at a much lower cost than the market price; with breakevens below $45,000.

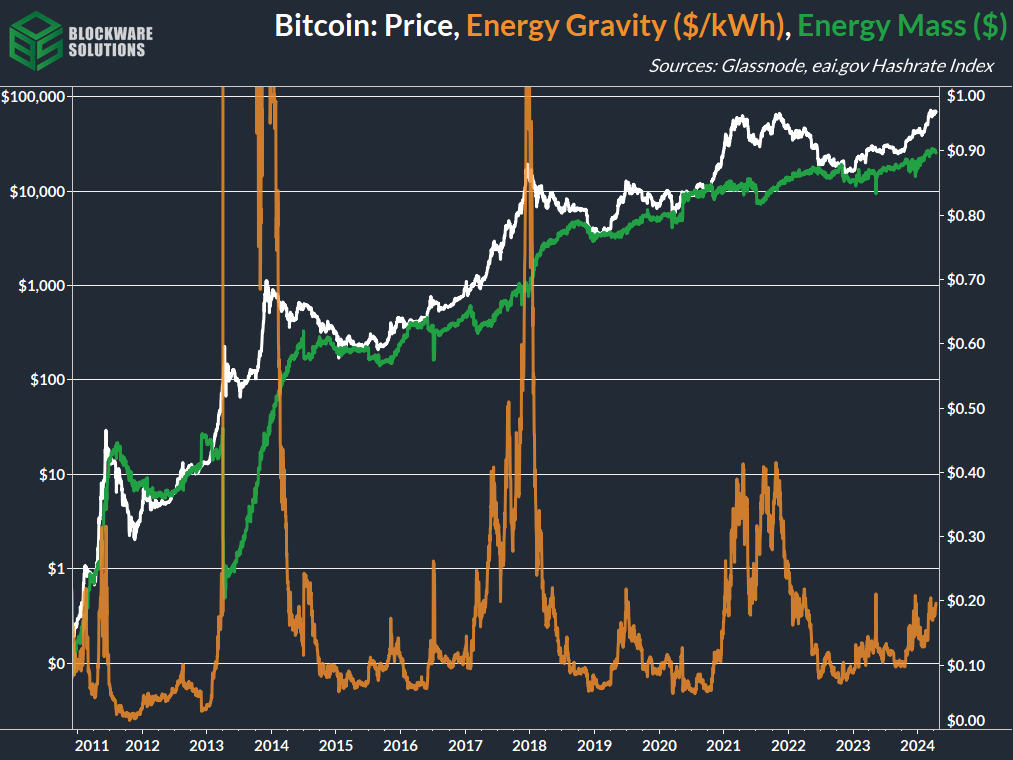

15. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$25,685 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.