Blockware Intelligence Newsletter: Week 61

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/22/22-10/28/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by producing blocks. Purchase new S19XPs today!

Have fun and learn more about our Bitcoin future at Pacific Bitcoin, the largest Bitcoin conference on the West Coast. Nov 10-11 in Los Angeles. Get 30% OFF tickets with code BLOCK.

Summary:

Despite GDP growth estimates signaling a 2.6% increase in output in Q3, there are several other data points that signal a weakening economic environment, as we’ll examine below.

The Bank of Canada and the European Central Bank both issued market interest rate increases this week to the tune of 50bps and 75bps, respectively.

Falling US Treasury yields and DXY could potentially relieve the sell pressure hitting the equity indexes on Wednesday/Thursday following big tech earnings.

Bitcoin has seen an overall constructive week of price action after breaking above $20,500 for the first time in over a month.

Bitcoin is still facing Short Term Holder Realized Price and 200-day moving average as key resistance levels.

Reserve Risk, MVRV Z-Score, and Mayer Multiple are showing extreme value, even after the positive price movement of this week.

Miner balances are plummeting as miner margins continue to get crunched by an increasing difficulty

One of the largest publicly traded mining companies, Core Scientific, has defaulted on upcoming debt obligations.

General Market Update

Prior to the release of the US’ Q3 GDP growth estimates, we’ve seen a fairly strong bounce from equities and Treasuries this week. Despite GDP estimates showing an increase in output in Q3, there were several other data points released this week that signal a decline in economic activity to begin the 4th quarter of 2022, as we’ll examine below.

As we’ve just mentioned, on Thursday we received the US’ Q3 GDP estimates. The Bureau of Economic Analysis (BEA) is estimating that in the 3rd quarter, US real GDP grew by 2.6%, which was above market expectations of 2.4%.

This is the first quarter of increasing real GDP since Q4 2021. If you don’t recall, in Q1 GDP shrank by -1.6%, and in Q2 GDP shrank by -0.60%.

According to the BEA, the GDP increase can be attributed to “increases in exports, consumer spending, nonresidential fixed investment, federal government spending, and state and local government spending, that were partly offset by decreases in residential fixed investment and private inventory investment.”

While this is potentially an encouraging sign, it doesn’t mean that the markets are out of the woods. GDP data is backward looking, as it attempts to measure how the economy performed in the past.

Markets look into the future, taking into account all known data sources and pricing assets where the market believes the economy will be in the intermediate-term future. For this reason, GDP numbers don’t tend to have the same effect on the markets that things like interest rates do, for example.

On Tuesday, we saw the appointment of Rishi Sunak as the 57th Prime Minister of the United Kingdom. Sunak previously served as the Finance Minister under Boris Johnson, has a MBA from the Stanford School of Business and was also previously a banker at Goldman Sachs before entering politics in 2015.

Amidst the turbulent economic environment that is the UK, it will be interesting to see how an official with a strong financial and business background will navigate these waters. Following this announcement, the British Pound has rallied against the US Dollar.

In China, we saw the re-election of Xi Jinping as the President of the PRC. Following Xi’s 2018 abolishment of Presidential term limits, he has now become the 1st President to be elected for a 3rd term in the history of the PRC.

Alongside Xi’s re-election, we’ve seen a steep decline for US listed, Chinese owned stocks. The iShares China Large-Cap ETF, FXI, is down about 7% this week, at the time of writing.

On Wednesday, the Bank of Canada (BoC) raised their market interest rate by 50bps, which was below expectations of 75bps.

On Thursday, the European Central Bank (ECB) raised their rates by 75bps for the 3rd time in a row.

Most interesting is that both the BoC and ECB used language in their subsequent press conferences that hinted that they may be nearing a pivot point for the direction of their policy.

While both agencies were sure to make clear that there’s more work to be done, Canada’s 50bps hike was a clear sign that they believe they’re near a market rate that’s conducive to lower inflation.

European policy makers stated that they’ve “made substantial progress in withdrawing monetary policy accommodation”. Or in other words, they believe they’re nearing having removed all remnants of expansionary monetary policy.

In the US, consumer confidence declined in the month of October as measured by the Consumer Confidence Index.

October’s Consumer Confidence Index, aggregated by The Conference Board from a massive online survey, came in at 102.5. This was below September’s value of 107.8 and Reuter’s estimate of 105.9.

Furthermore, TCB releases another index they call The Expectations Index, which measures the American consumer’s expectations of economic conditions in the near future.

As you can see above in orange, the Expectations Index declined in the month of October to 78.1 from 79.5 in September. According to TCB, readings below 80 tend to be recessionary, meaning that in the US, the degree of consumer expectations and confidence is in-line with previous recessionary periods.

The Present Situations Index, which is a survey of consumer’s evaluations of current business and labor market conditions, declined even more sharply in October. The decline from 150.2 in September to 138.9 in October could signal that we’re seeing a slowdown in economic activity to begin Q4, according to TCB.

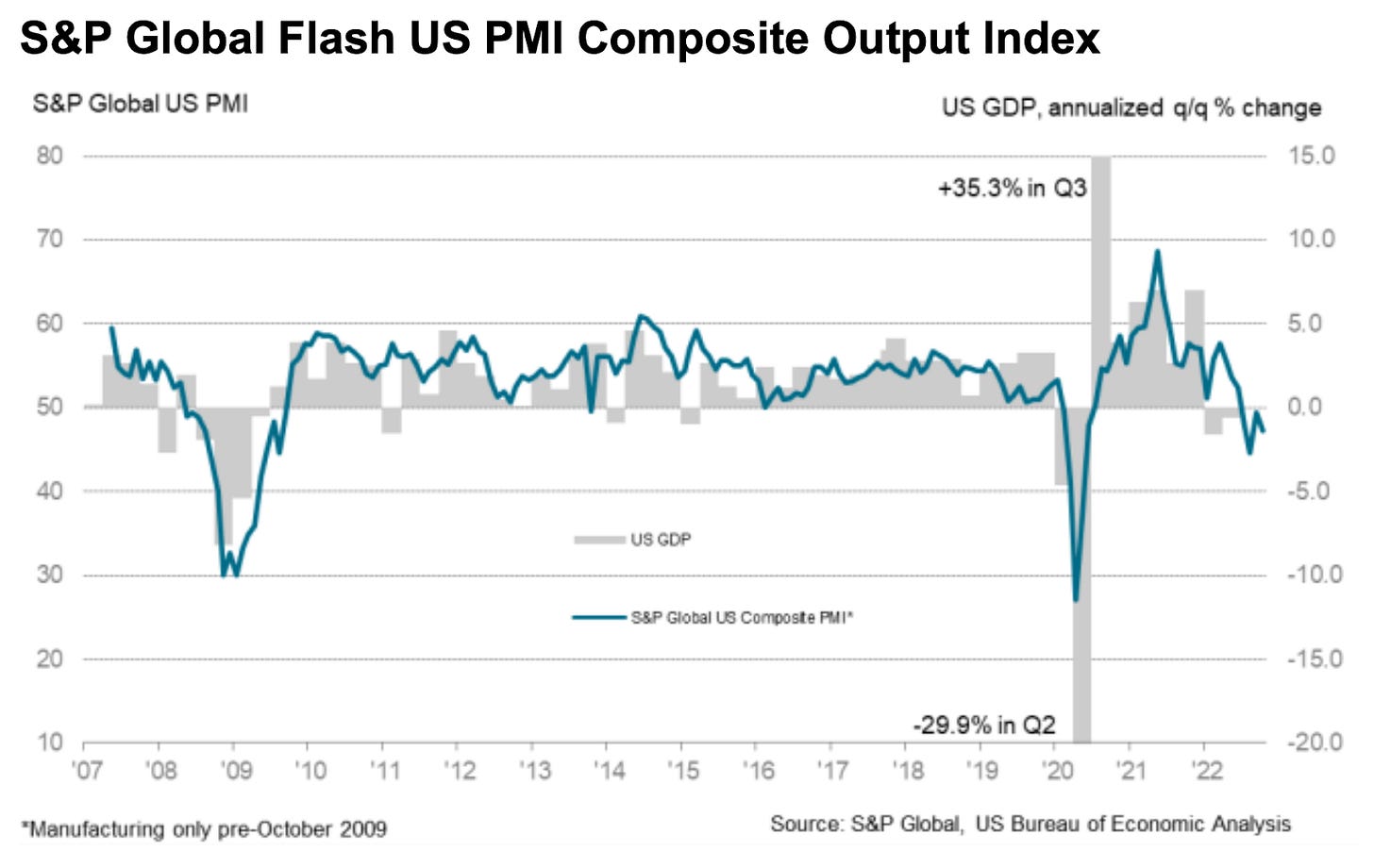

Furthermore, data shows that US business activity also declined in the month of October, as measured by the S&P’s Flash US Composite Purchasing Managers Index.

As shown above, the Flash US PMI declined to 47.3 in October from 49.5 in September (apologies for the low quality image). According to S&P, excluding the short V-shaped bounce in 2020, this was the 2nd largest rate of decrease since 2009.

In conclusion, the 4 data points we’ve just highlighted signal to our team that despite a growth in aggregate economic output (real GDP) in Q3, the US economy is likely not quite as strong as meets the eye.

In the housing market, the US average 30-Year fixed mortgage rate has officially surpassed 7%, according to data from Freddie Mac.

30-Year Fixed Rate Mortgage Average in the United States (Tradingview)

The chart above shows this data point which recessions highlighted in green, and the rate of change at the bottom. In 2022, the rate of change on the US average 30-year mortgage rate has hit its largest value in the history of this metric.

Unsurprisingly, this is causing a decline in demand for home purchases and thus, a decline in housing prices.

S&P/Case-Shiller US Index (FRED)

Above is the Case-Shiller Index, which serves as the benchmark for average single-family home prices in the US. Data was released this week for the month of August, which showed a decline from 307.04 in July to 303.76 in August.

While this decrease may not appear to be much, the index was up 15.6% YoY in July, and ~13% YoY in August. This 2.6% decline between those 2 values was the largest monthly decline in the history of the index.

In other words, it appears that single-family housing prices are declining at an unprecedented rate.

This, combined with data from JP Morgan Chase indicating that US retail investors are down an average of 44% in their personal portfolios this year, is placing significant financial pressure on many average American consumers.

Speaking of investments, we’ve seen a relatively turbulent week of price action from the equity indexes.

Nasdaq Composite 1D (Tradingview)

This week we first saw a continuation of last week’s bounce. On Wednesday, we saw a downside reversal from the index, and Thursday we saw downside continuation stemming from Meta’s missed earnings.

Meta announced their 2nd straight quarter of declining revenue, and a 52% decline in quarterly profits. With this financial data, Meta revised their Q4 outlook lower after stating that the 4th quarter will likely see continued declines in profits.

Meta shares were down nearly 25% as of Thursday’s close, and as the 6th largest holding in the Nasdaq Composite, it wasn’t much of a surprise to see the index down as well.

On Thursday, after the close, we got Q3 earnings numbers from Apple and Amazon, who are the 1st and 3rd largest Nasdaq holdings, respectively.

For Apple, the 3rd quarter was a strong one, with both revenue and net income setting records for the September quarter. As a result, shares initially jumped after-hours.

Amazon didn’t see quite the same reaction after falling short on analyst revenue estimates and providing a weak outlook on Q4. Shares were down 20% after-hours initially.

Despite some weakness being shown later in the week for equities, we’ve generally seen a strong week for Treasury securities.

US 10-Year Treasury Yield 1D (Tradingview)

Shown above is the yield-to-maturity for the US 10Y Treasury note. As you can see, yield is down nearly 30bps this week. We’re currently on track to see the first weekly decline in 10Y yields since July.

Therefore, we’re seeing the first significant rally in Treasury prices (remember yield and price are inversely related) in over 3 months.

Generally speaking, yield action tends to be a leading indicator of equity price action. Therefore, the fact that yields are falling alongside equity index prices leads me to believe that equities may still have some strength to show.

That being said, that is simply an educated guess. Downside earnings pressure from mega-cap US companies is also a significant factor for index price action.

DXY 1D (Tradingview)

With rising bond prices, we’re seeing the US Dollar Index (DXY) cool off this week. While we did a bounce on Thursday, DXY is down over 1% this week at the time of writing.

This could also work to alleviate some of the recent sell pressure on US equities, but as always, much is left to be seen.

Crypto-Exposed Equities

Overall, we’ve seen a very strong week for the crypto-exposed group of equities. For example, as of Thursday’s close, EQOS is up 89%, CLSK is up 25%, CIFR is up 37%, and ARBK is up 29% on the week.

This strength has stemmed from the bounces we saw in both the equity indexes and in Bitcoin. One interesting thing was that on Wednesday, as the indexes reversed lower but Bitcoin price chugged higher, the crypto-equities followed BTC.

But more interesting to me was how we saw another case of crypto-equity price action as a leading indicator of Bitcoin price action.

BTCUSD vs. MARA 1D (Tradingview)

Above is an example of this phenomenon using Marathon Digital (MARA). The arrow placed above the candlesticks direct your attention to Monday (Oct. 24) on either chart.

We can see that Monday was a very strong day for MARA, as shares closed up over 10%. This same day was quiet for BTC, with price down -1.24%.

This was a potential signal of institutions front-running their BTC purchases, in my opinion. While some may view this as market manipulation, it provided investors who were paying attention with a potential hint to the bounce that BTC would receive the very next day.

This week we also received news that Core Scientific (CORZ) has paused all debt payments. This is essentially CORZ declaring bankruptcy without actually officially filing. Shares were down over 78% on Thursday.

We will discuss CORZ further in the mining section below.

Above, as always, is the table comparing the weekly price action of several crypto-equities to their average weekly return, BTC, and WGMI.

Bitcoin Technical Analysis

As previously mentioned, it’s been a strong week for Bitcoin price action. At the time of writing, BTC prices are up just over 4% on the week.

In this section last week, we discussed how compressions in volatility lead to explosive movements in price. It’s impossible to predict with certainty that price will move, and despite the fact that the primary trend is still down, it’s certainly been a relief to see some green.

BTCUSD 1D (Tradingview)

Above we can see the resistance range that BTC attempted to break through earlier this week. While BTC was unsuccessful in cleanly breaking this range, the lack of intense sell pressure here is a good sign.

This $20.5-20.8K range has been quite significant recently, for that reason one might expect to see strong sellers around these levels. On Thursday, we saw a bit of selling, but nothing I would label as strong.

$20,800 is the key level our team is watching from a price structure perspective. If BTC is able to crack above this level it may usher in a significant rally.

Also, as you can see above, this week we saw the 10-day EMA (blue) higher than the 50-day SMA (red) for the first time since August. Last time these key moving averages saw a positive crossover was on July 27th, BTC proceeded to rally nearly 10% from the close on 7/27 until topping again on 8/15.

This constructive moving average crossover DOES NOT signal that we are positively going to see a multi-week rally. Instead, it signals a short-term uptrend that COULD lead to a prolonged rally.

On-Chain / Derivatives

Following the positive price action of this week, Bitcoin is approaching Short Term Holder Realized Price (cost basis).

STH RP tends to serve as resistance during bear markets and support during bull markets. The reason for this is psychological. When the price reaches the cost basis of STHs during a bear market, STHs tend to sell in order to exit the market at a break even or near-break even price point. Inversely, during a bull market STHs tend to buy more when the price reaches their cost basis as it’s viewed as a good entry point.

Many people are excited about this recent mini-pump, but we are not out of the woods unless BTC can flip STH RP.

Reserve risk, which measures the confidence of Long Term Holders relative to the price, is continuing to trek downwards to all-time lows. This indicates continued accumulation by Long Term Holders; a key theme of the current bear market as well as past bear markets.

If you are new to Bitcoin, it may be worthwhile to consider the implications of the fact that the people who have been in Bitcoin the longest are not concerned with the price being down ~70% from the all-time high. Rather, they are eagerly accumulating more coins and continuing to hold their existing stashes.

MVRV Z-Score has also remained in the zone of extreme value. As long as valuation metrics such as this, reserve risk, mayer multiple, etc. are in the bottom zone, the bear market is still very much intact and those that are Dollar Cost Averaging at this time will likely benefit tremendously in the future.

Speaking of the Mayer Multiple, here it is.

This metric is an oscillator calculated as the ratio between price, and the 200-day moving average. Similarly to STH RP, the 200-day moving average tends to survive as support or resistance in a bull or bear market respectively.

Bitcoin has been well below the 200-day moving average for a while now. However, months of sideways price action has allowed the 200-day moving average to slowly converge towards price. It currently sits just below $25k and if/when price flips that, we can be confident that the worst of the bear market may be over.

Since the end of this summer’s miner capitulation, hash rate and difficulty have soared. Miner’s have been taking this on the chin and it’s evident by a substantial decrease in miner holdings over the past two months.

Note how during the previous capitulation, miners were able to add BTC to their balance. This highlights the ruthlessly competitive nature of the mining industry. Miners that are able to survive the worst of times are able to benefit at the expense of miners who are forced to capitulate. The same can be said for the Bitcoin market in general. Entities that have remained solvent throughout this bear market have been able to acquire the cheap Satoshis of forced sellers.

To come out of the bear market as a winner, all you have to do is survive.

Despite finally breaking away from $19,000, the built up leverage has yet to be wiped out. Perpetual Futures Open Interest relative to Market Cap remains high and Realized Volatility remains low. Again, this week's price action does not have us out of the woods just yet. As we approach the STH RP resistance it is likely that the volatile move we are waiting for could occur.

The funding rate during this recent build-up in open interest has been positive which indicates a long-bias.

To reiterate from past newsletters: a positive funding rate does not mean more longs exist than shorts. There is always a short for every long. However, it does mean that longs are the “favorite” and shorts are the “underdog.” As such, long positions periodically pay out short positions as an incentive to take that side of the trade.

Mining

As discussed ad nauseam, miner margins are extremely compressed at the moment. Rising energy costs, the drawdown in the price of BTC, and an all-time high in hash rate, have combined for the perfect storm to crush miner margins. Hash price (miner revenue per Terahash per day) is down to its lowest level since the months following the 2020 halving.

The biggest development in mining this week is the announcement by Core Scientific that they will not make interest payments on their upcoming debt obligations. This is not an official declaration of bankruptcy but it is certainly a step in that direction. $CORZ plummeted -78% following the news.

To quote from Core Scientific’s SEC filing:

“As of October 26, 2022, the Company held 24 bitcoins and approximately $26.6 million in cash as compared to 1,051 bitcoins and approximately $29.5 million in cash as of September 30, 2022.”

Seeing as Core Scientific has already depleted the majority of their treasury, there is no reason to expect this specific situation to bleed into the price of BTC.

According to the filing, Core Scientific plans to restructure debt obligations as well as issue additional equity lines of credit. If that does not provide enough liquidity, Core will likely begin to sell ASICs or entire mining sites In order to stay afloat. Purchasing such distressed assets iis an incredible opportunity for competing miners to capitalize on.

Core Scientific has a plethora of mining assets that could be liquidated as they currently possess an estimated ~4.9% of the network’s total hash rate.

Thank You!