Blockware Intelligence Newsletter: Week 24

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 1/28/22-2/04/22

To preface, be sure to check out our YouTube channel for educational videos on all most metrics and data points discussed here in the letter, as well as a series of 20+ interviews with industry leaders including Michael Saylor, Raoul Pal, Preston Pysh, Avi Felman, Sam Trabucco, and more.

Link here: https://www.youtube.com/channel/UC678LSROK47l__G-pMnOMgA

Summary of this week’s letter:

The stock market saw a follow-through day on Monday, signaling the start of a new uptrend.

How much did crypto-exp

Regime of spot premium to derivatives has now surpassed 3 months

Coins spent on-chain continue to trend younger

Whales holdings ticking up

Quarterlies reaching 6%

Diagonal resistance broken, horizontal still the most important around $40.7K locally, and $47K from a HTF momentum perspective

The breakeven operating cost of an S19XP is only ~ $8,000.

IRS to potentially only tax block rewards when sold.

General Market Update

This week has been a nice change of pace for the markets, as we’re finally seeing a bounce in tech that has lasted more than a couple days. We’ve seen select names catching solid bids but this rally isn’t quite broad enough for me to be fully confident yet.

Last week I reminded readers of the concept of a follow-through day (FTD). This week, on Monday, we finally got our awaited FTD.

If you don’t remember, a FTD occurs once any of the 3 major indexes (S&P, NSDQ or DOW) has appeared to bottom. From the apparent bottom, we begin counting the number of days.

On or after day 4, if there’s a day where the index is up >1.5% on volume greater than the previous day, then we can declare a follow-through day. A FTD signals the start of a new uptrend.

S&P 500 Index 1D (Tradingview)

FTD’s aren’t a guarantee and they have been known to fail occasionally in the past. Most recently there was a FTD in December that failed. The biggest tell to whether the FTD will fail are the first few days following it.

If there is a distribution day within a few days after the FTD, the chances of that FTD failing increases exponentially. A distribution day is any day where price is down >0.2% on volume greater than the previous day. We have not seen a distribution day this week so far, but Friday will be a key day.

S&P 500 Index 1D (Tradingview)

Above is the failed FTD from December 15th, here you can see that the FTD was immediately followed by back to back distribution days. We knew almost immediately that the December 3rd lows were extremely likely to be undercut.

If there is a distribution day on day 1 or 2 following the FTD there is 95% chance of that FTD failing. Luckily this week, that wasn’t the case.

This week has been a solid vote of confidence in this market but we’re certainly not out of the water yet. Many growth names appear to be trying to set up to run higher, but at this point in the rally it’s impossible to determine whether these are dead cat bounces or true bottoms.

A select group of names are leading the market and some are already making new highs. In my opinion, some of the leading names at the moment are ZIM BROS CME V MA AAPL and UPS.

This is a solid group of leaders but for a “rip your face off” bottom I would expect to see more than 7 names strongly outperforming the market. This doesn’t have too much weight in the grand scheme of things, but it is definitely something I can’t help but notice.

Furthermore, as of Thursday we’re seeing solid upticks on the 10 year treasury bond, consumer staples (essentially the opposite of tech stocks) and the VIX (Volatility index). These all point towards the idea that there’s likely further downside for the S&P/Nasdaq.

How far we have left to fall is anyone’s guess. But ideally, we would see the S&P find support at the 200 day SMA and not retest the lows.

It’s my personal opinion that this market is probably close to a bottom, based on the price action we’ve seen this week. But I’m not one to base my trading on a personal opinion like that. It is the job of a technical analyst to base decision making on the data the market is currently giving you, not what you think it should do.

On-Chain and Derivatives:

BTC has broken a 3-month long downtrend dating back to November. However, horizontal levels are far more important than diagonal. Major horizontal resistance still lies at 40.7K; start closing above that, and we can start eyeing the confluence of yearly open and short-term holder realized price around 47K. Above that 47K area, will have reclaimed HTF momentum in my opinion. One step at a time though, still haven’t even closed above local resistance yet.

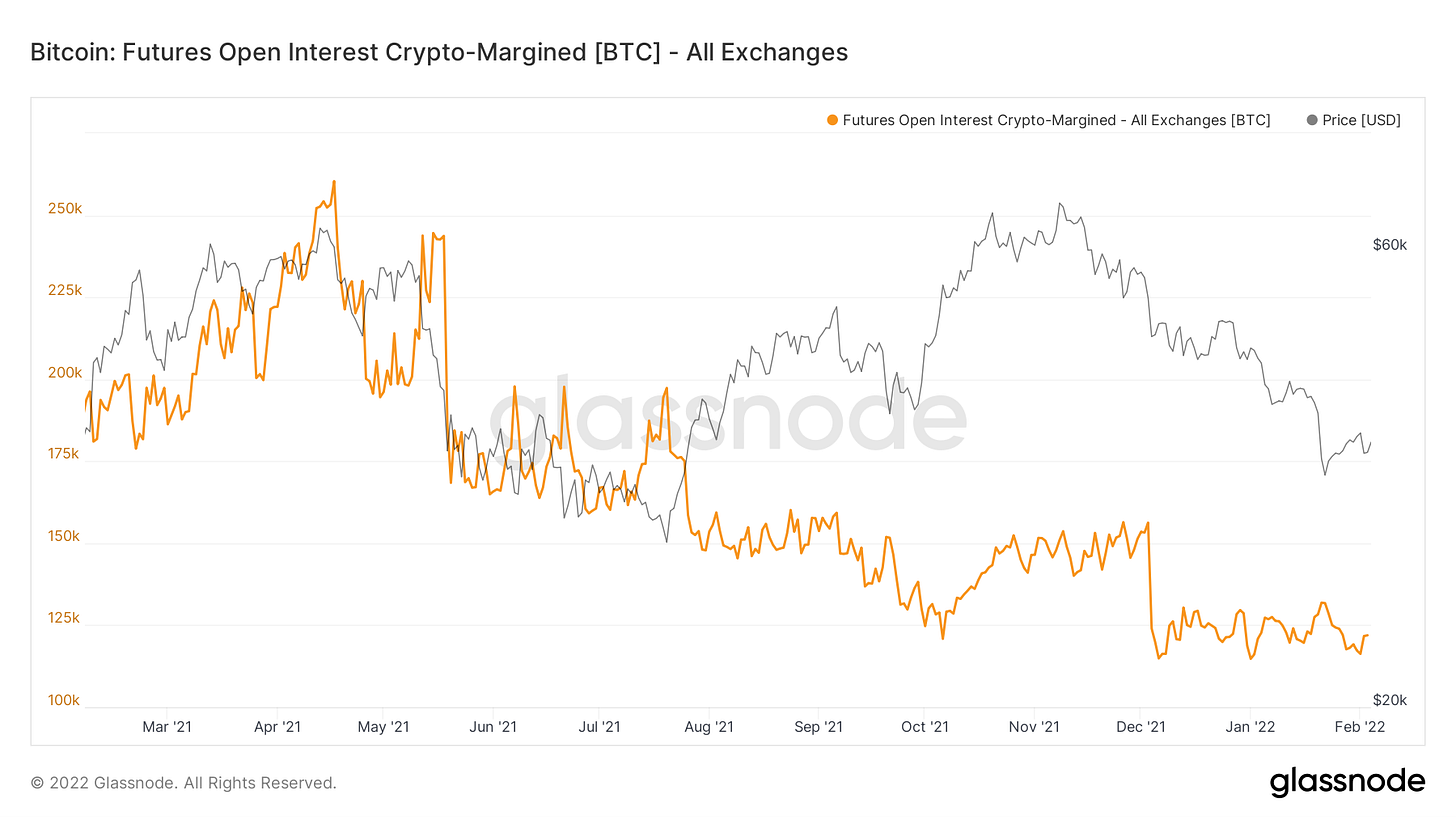

Open interest still remains relatively high with no wipeout. With no major wipeout on the push down over the last month and based on the context of where open interest has reacted with price action, tend to think the aggression of this open interest is mostly on the short side, but likely low leveraged hedging making up the majority of it.

To add on, have also seen a prolonged regime of spot premium over perpetual swaps. This means that the market has been led by spot rather than derivatives and is a healthy backdrop for market structure, but not something to decide to immediately smash buy based on. Notice as well in recent weeks how the premium has gone more aggressively towards spot. This trading view script is credited to derivatives trader CL. (who we had on the podcast last week)

Quarterlies, or the 3-month basis between spot and futures is now down to 6 percent. Typically we see quarterlies reach these lower levels when market sentiment is low, and in extreme conditions quarts flipping negative have been a strong buy signal. The Bitcoin market has been in a slump & the lowest quarterlies (essentially the BTC "risk-free" rate) reached is 5.7%. Compare this to 1Y Treasuries yielding 0.75%. Over the next few years an influx of capital will come in not just on the directional side, but to capture yield. One last note on this though: I do doubt quarts ever get back up to 40-45% or funding ever gets to the outrageous levels reached in early 2021 again. Why? Becuase more capital will come into this market to arbitrage these spreads and make the market more efficient.

Another backdrop for the Bitcoin derivatives market has been the migration from traders using BTC as collateral to stablecoins. Why is this significant? Because of the underlying risk profile brought on by using both forms of collateral for futures contracts. Using Bitcoin as collateral has a negative convexity. This means that if you’re long Bitcoin with Bitcoin as collateral and the trade starts going against you, not only is your PnL decreasing, but so is the value of the margin you are collateralizing the contract with. On the flip side, stablecoin margined shorts are more likely to be squeezed. Why? Becuase when collateralizing a short with Bitcoin, even if the trade starts going against you your PnL may be decreasing but your collateral is increasing in value, giving you an inadvertent hedge. Overall the migration from BTC to stablecoin margined contracts is a healthy backdrop for macro market structure.

From the on-chain side, we can see most of the selling over the last few months has come from younger and younger coins, very similar to the downtrend from February to July/August last year. Older coins (smart money/more experienced market participants) sell into strength, not weakness.

This is also shown by short-term holder (<155 days) realized price because it is trending down. This means that coins previously bought at higher prices by short-term hodlers are now being sold at a loss.

STH realized price is also the level from an on-chain perspective that I think is the most important to reclaim for HTF momentum. This is in confluence with the yearly open around $47K.

Continuing to see whales holdings tick up after a multi-month downtrend. Watching over the next week or two to see if this trend continues. Looking promising thus far. This is one of the few on-chain metrics that provides us a peek into what’s going on on the demand side of the equation.

Overall, we still stand by our thesis that from a broader standpoint, the asymmetry is not skewed to the downside with BTC in the 30Ks. For example, this is the Mayer Multiple, which compares BTC price relative to the 200 day moving average. We can see that the potential upside far outweighs the potential downside.

This is also shown by dormancy flow, reaching the 4th lowest value in Bitcoin’s history. All in all, hard to think asymmetry is still skewed to the downside with Bitcoin at these levels. As I’ve mentioned over the last 2-3 weeks, still see this area as a good zone to dollar cost average in more heavily. (Not financial advice of course)

Crypto-Exposed Equities This Week

From Friday last week through Tuesday this week, many crypto-exposed names saw generally low volume bounces. This felt like potential bottoms for these stocks but as of the time of writing on Thursday, it no longer appears that this is the case.

The true test for these stocks will come if they retest their lows.

A few readers said they liked the excel sheet I included last week, which showed how much % several names were down since November, compared to Bitcoin. As I mentioned last week, this is an easy way for investors to judge the strength of crypto stocks relative to Bitcoin.

This week I’m including the same spreadsheet but I have included two new columns. The first new column (2nd to the right) calculates how much each name has bounced since bottoming in the last week or two until they peaked this week (mostly on Tuesday). The second new column (far right) compares how much each name has bounced to how far they previously fell.

This study tells us that, in general, the names that fell the least caught a stronger bounce in proportion to how much they fell.

In vanilla % returns, the names that fell the most had bigger bounces. Which makes sense as these are simply higher beta (more volatile) stocks.

But in terms of a more sustainable, institutional grade investment, it’s interesting to see that the names that held up the best had the strongest bounces, relatively speaking.

I’ve conditionally formatted the two columns showing how far each name fell compared to BTC and how much they bounced relative to how much they fell. This provides a color scale to quickly judge the strongest (green) names from the weaker (red) ones.

It’s interesting to see, in general, how close the colors match in both columns.

In other news, I am working on the script for a new youtube series that will be an introduction to technical analysis, growth investment and crypto-equities. If you are someone who is less experienced in any of these areas please leave a comment below or DM me on twitter @blakedavis50 with topics you’d like explained.

Mining

Mining is Buying Bitcoin at a Discount

What if you don’t have to pay ~ $37,500 to stack 1 Bitcoin?

If you were the owner of ~ 3,000 S19 pros, today you would mine 1 BTC and only pay $11,437.50 in electricity expenses (assuming a $0.075 per kWh hosting rate).

How is the calculated?

Daily revenue can be calculated by multiplying Bitcoin’s hash price by the number of TH a machine can produce. The current hash price is ~ $0.18. Hash price is determined by the price of Bitcoin and network mining difficulty.

Daily cost can be calculated by dividing a machine's watts by 1,000 (kW), multiplying by the electricity rate ($/kWh), and multiplying by 24 (hours in a day).

As you can see, these new generation machines (S19 pro and S19XP) are currently very profitable even after the Bitcoin price drop and increase in mining difficulty.

As outlined in our report: Why the 2020s will be a Golden Age for Bitcoin Mining, Blockware Intelligence has a thesis that new generation machines today will remain profitable and hold their value significantly longer than the new generation machines released 5 years ago. This is great news for miners buying today’s new machines.

Another thing to note is even under an EXTREME price drop to $15,000 or lower, the cost to mine may actually drop and your BTC denominated revenue could start increasing at some point! This would be due to inefficient old-generation miners dropping off the network resulting in network difficulty dropping.

Rig Value Over Time

While it’s important to determine whether your rigs are producing a positive cash flow, you also should consider the appreciation or depreciation of the machines you purchase.

The value of the machine will be roughly the same as the price you purchase it at, but over time that value will change.

In the very long run, the machine will trend to both $0 and 0 BTC. But in the short to medium term, the value of the machine could trend up in both USD and BTC terms.

The above example is the historical value of an S19 as calculated by the Hashrate Index.

Astonishingly, the dollar value of an S19 has increased significantly since the beginning of 2020. Even the BTC denominated value of the rig just reached a high not seen since August 2020.

Not only will new generation machines be spitting off positive cash flow, but it’s possible they could increase in value too.

At the end of the day, mining is a fantastic strategy to accumulate Bitcoin, and Blockware Solutions is happy to be your trusted partner.

Mined Bitcoin to Potentially Only be Taxed when Sold

In 2021, Joshua Jarrett sued the IRS for a refund on his block rewards. In 2019, he earned block rewards and paid taxes on them as income, but asked for a refund saying the block rewards were new property and shouldn’t be taxed until he sells them. The IRS denied the refund and Joshua sued.

The lawsuit is not over, but the Proof of Stake Alliance announced the IRS is offering Joshua a refund without admitting the merits of his argument.

Coin Center said, “Rightly, Josh is not taking the refund because he wants clear guidance from the IRS, not a mere monetary victory. So he hasn’t won yet, but it does look like the IRS is realizing that their current policy may not be adequately justified by law, and may not survive a judgment from the court. That’s great news.”

It makes sense that block rewards should not be taxed as income. If you build a corn farm, are you taxed the moment you harvest the corn? No, you’re taxed when you sell the corn.

Bitcoin mining should be treated the same way. You invest in machines and infrastructure to create Bitcoin, but you shouldn’t be taxed on that Bitcoin until you sell it (if you ever do).

As of now, nothing has officially changed, but keep an eye out for an important court ruling that could significantly improve the margins of Bitcoin miners.

Read more here: https://www.coincenter.org/irs-signals-retreat-in-court-battle-that-could-reshape-block-reward-taxation/

Love the excel chart! Can you keep this in the letter going forward?

Nice one Will...You "Eli5" and that's great.

Take it easy man