Blockware Intelligence Newsletter: Week 14

On-chain analysis, Macro-analysis, Equity-analysis; overview of 11/06/21-11/13/21

Dear readers,

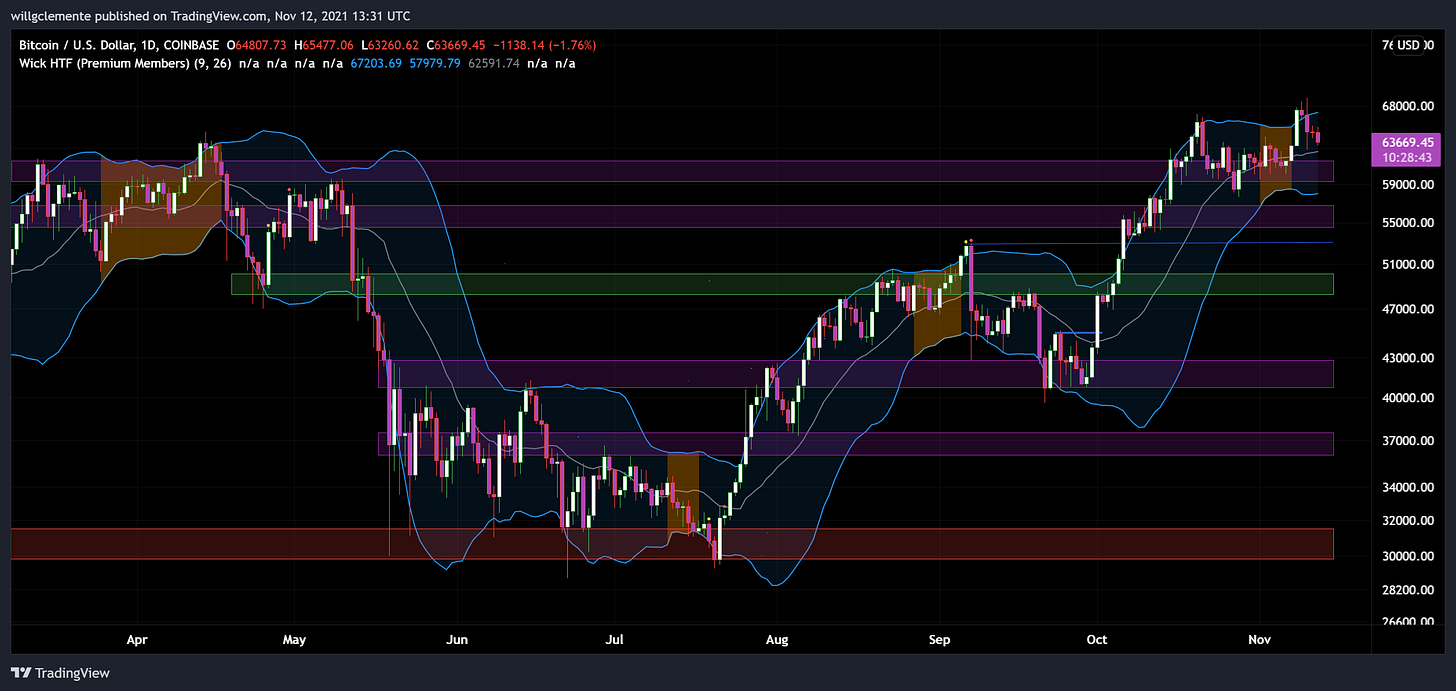

Hope all is well and you had a great week. Last week we discussed that we were expecting volatility, although I had no strong immediate term price view. What we did discuss however is the fact that during each of the 3 previous volatility squeezes we had, BTC first faked out to grab liquidity from breakout traders before reversing.

This did happen again (in addition to getting volatility), making it now 4 times in a row that we’ve had this occurrence.

From purely a price structure standpoint, remain bullish above the green zone.

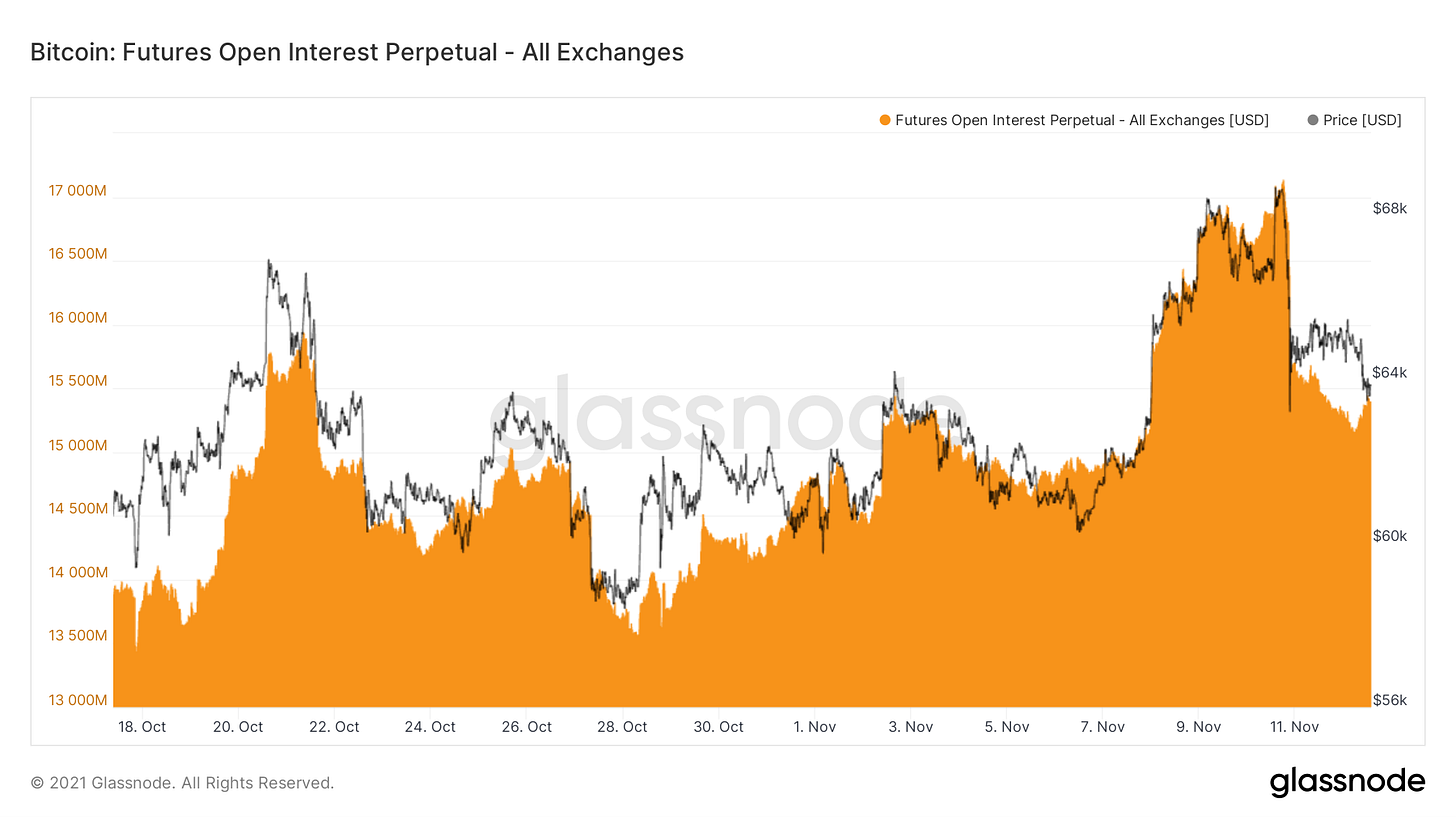

After setting new all time highs at $69,000, on Wednesday we got a large influx of open interest, including a large spike on Binance. As price began trickling down we saw this spike paired with rising funding. At the same time we had the market digesting CPI data, Evergrande news, and a few major exchanges going down including FTX. These things made the perfect recipe for a leverage flush, although price action can never be fully explained by one specific thing IMO. In total $536M in longs got liquidated Wednesday.

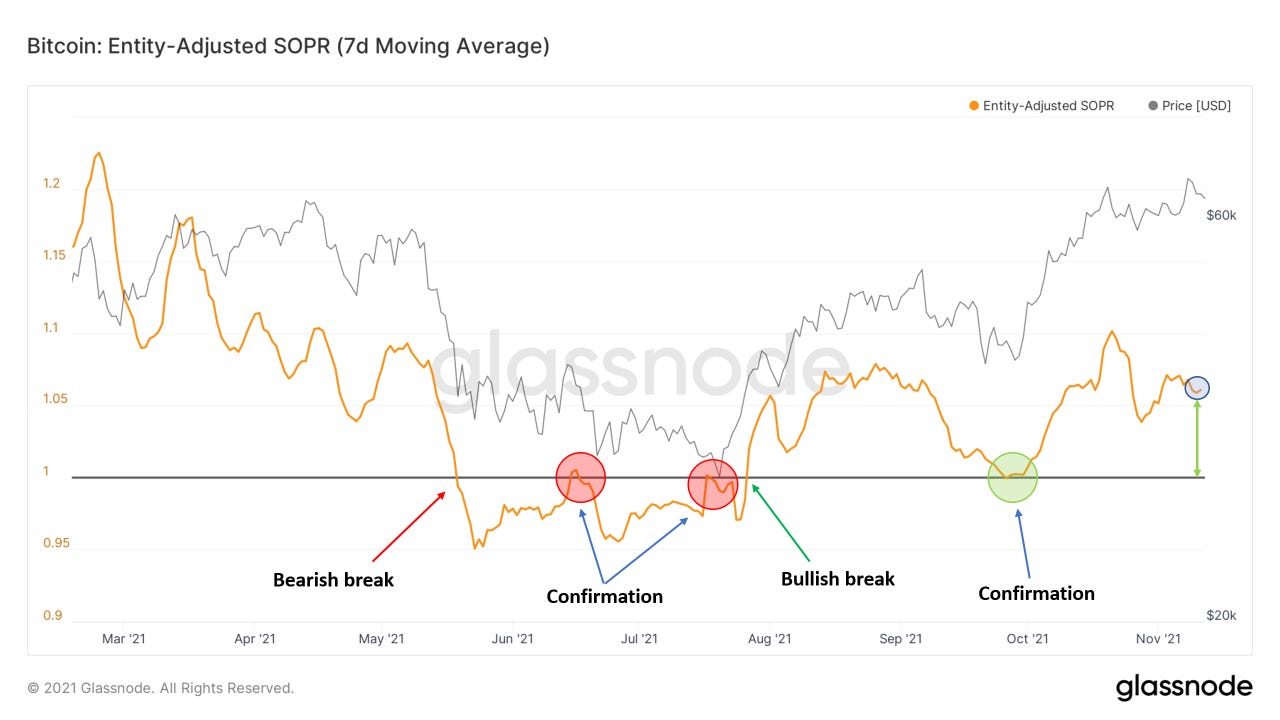

Here we take a look at the entity adjusted 7D (weekly) version of SOPR. This is spent output profit ratio, comparing the profit market participants are realizing to losses. As long as we are above the “1” threshold (black line) I’m not worried. Would love to come back down and reset + bounce off 1 for further bull confirmation, but last year after confirming in September the ratio just kept trending higher.

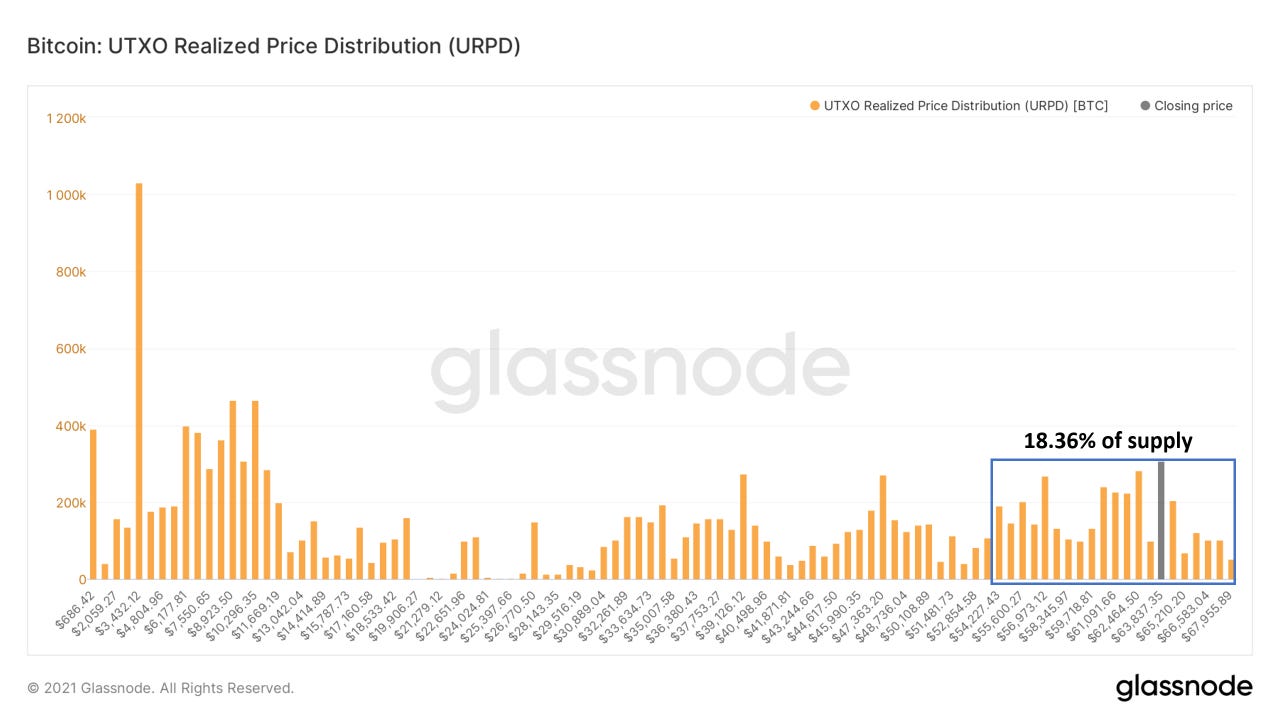

In addition to $53K being a key price level, it is also the $1T market cap threshold for Bitcoin. This is evident to be a line in the sand for investor’s, shown by this cluster of on-chain activity. 18.36% of Bitcoin’s money supply has now changed hands above $1T market cap, showing confirmation from market participants that this growing asset class is here to stay.

Next we take a look at a new variant of illiquid supply that I created yesterday. Usually we look at illiquid supply shock ratio, but I wanted to switch it up for you guys so decided to throw this in. This is the 60D relative strength index of illiquid supply shock ratio. Using this metric we can find some interesting signals on the macro state of the Bitcoin market. In 2017 we had a clear bearish divergence between the ratio and price. Once that downtrend was broken in early 2019, the bottom was in. Also note the bearish divergence earlier this year and once the uptrend was broken from 2019, the market drew down in May. In September we broke the previous downtrend, showing we are now back in bullish territory. What we now need to look for is a bearish divergence between the metric and price action to start being cautious over the coming months.

Next up we have Checkmate’s Market Realised Gradient. In Check’s own words, “Delta Gradient is calculated as the difference between the gradient of the spot Price, and the gradient of the Realised Price. This metric therefore measures the relative change in momentum between speculative value, and true organic capital inflows.” What this essentially shows is whether the rate of change in price is aligned with the rate of new capital inflows (shown via realized price).

Earlier this year there was a clear bearish divergence between price and the gradient, showing new capital inflows weren’t supporting the speculative price bid. Will be watching for a similar signature in the metric over the coming months.

Another metric based on realized price, this is On-chain Cost Basis ratio. This comapres the cost basis (or realized price) of both short and long term investors. When short term holder’s cost basis falls below long term holders’, it has historically been a good time to accumulate BTC. When STH CB overextends LTH CB, it is a good time to be cautious. Yes we’re still far from overheated, but note in 2013 it took just 3 months to shoot up past the red line.

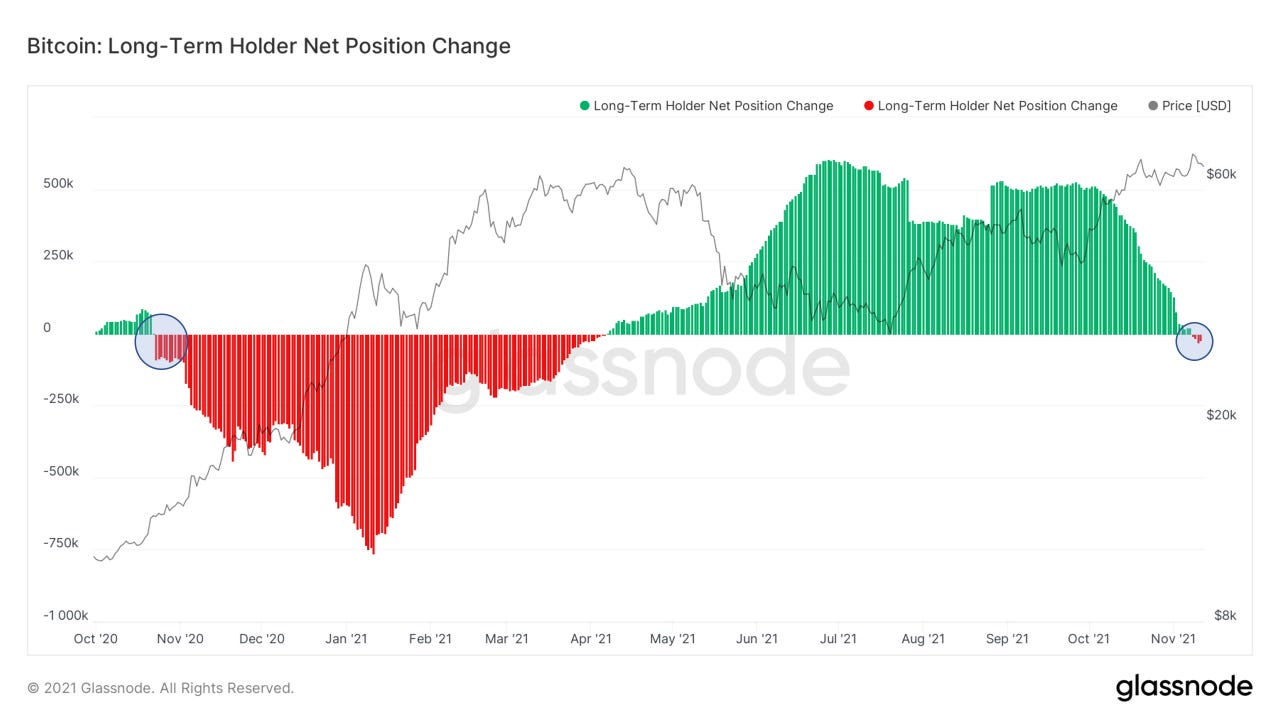

This week we have seen our first red prints in long-term holder net position change. This looks at the 30 day net change in long term holder supply. Becuase of this, there must be a fairly strong trend to start seeing a trend in LTH net position change. This is representative of long term holders starting to sell into strength. As we have discussed many times: long term holders buy into weakness (don’t perfectly buy the bottom) and then sell into strength (don’t perfectly sell the top). This is natural bull market behavior; as you can see in 2020 this distribution began in October and peaked out in January of this year.

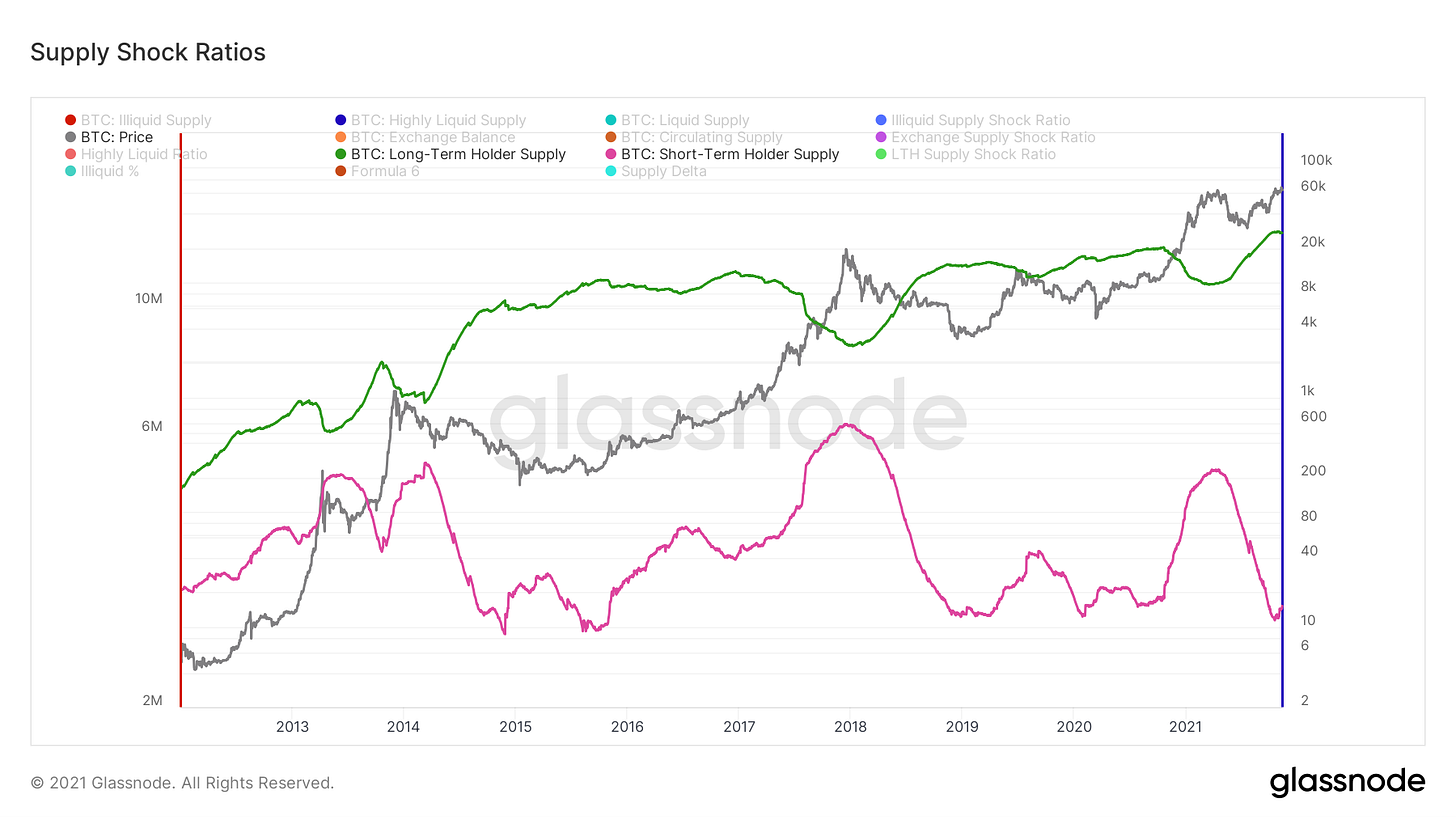

This is another visual of this phenomena to help solidify the point I’m trying to get across. Green is long term holder supply, Purple is short term holder supply.

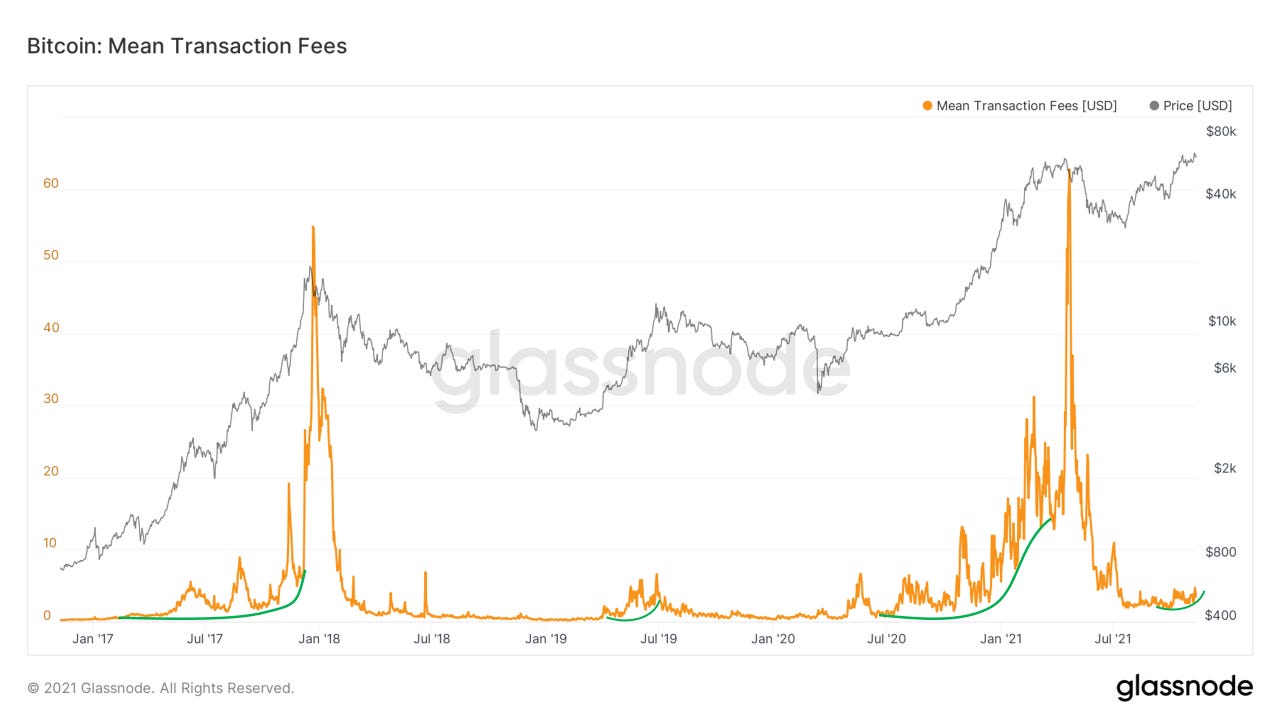

Next up we take a look at mean (or average) transaction fees. Transaction fees are a decent way to gauge the demand for blockspace. It looks like we are initiating an uptrend here, similar to prior bull rallies. I think you could also use this as a topping indicator as well. When there are large blow off peaks in fees that has been a signal of exuberance/mania in the market.

Exchange balances are currently in heavy outflows. Zooming out you can see the clear change in market dynamics following March 2020, as outflows dominated. Also note the large amount of coins that moved to exchanges in May. The day before the May 19th crash, we saw a record number of daily BTC inflows to Binance.

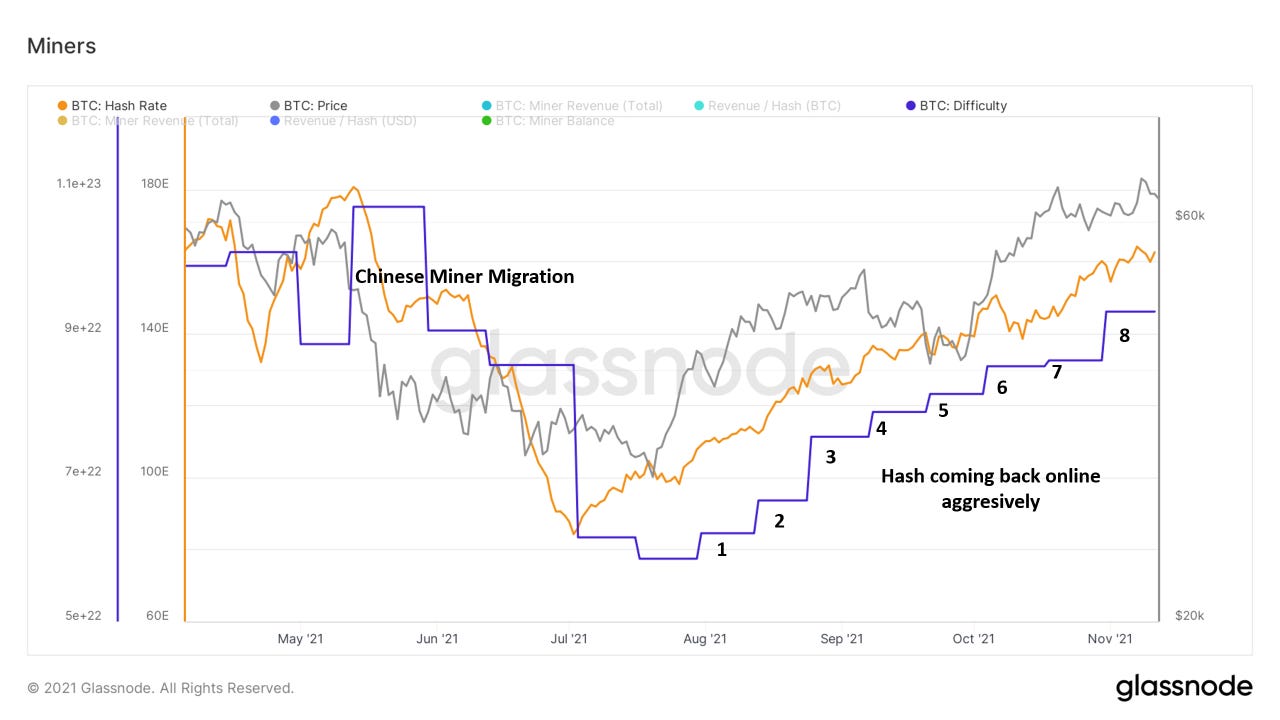

Last we take a peek at what’s going on with miners. Hash continues to come back online, showing how resiliant the Bitcoin network truly is. This is also reflected by difficulty. We’ve seen 8 consecutive positive difficulty adjustments.

PS: Our Blockware Intelligence Indicator Dashboard is coming soon! Be on the look out.

Bitcoin-related Equities (written by Blake Davis):

This week has not been an easy one for investors as we currently are experiencing a pullback in Bitcoin and in the general equity market. It goes without saying that the class of crypto-exposed stocks has pulled back too. Earnings season adds volatility to the market, and this go-around has been no exception. Many names that missed earnings were down double-digit percentages and the names that surprised us were up big. I highly recommend folks listen to earning calls, they are usually recorded and posted under the investors’ section of company websites. It provides a lot of value to hear crypto-exposed companies explain their vision for the future of the industry group. These companies appear to be very optimistic.

Last week we saw strong breakouts, with many names making new all-time highs. This week many of these names have pulled back, retesting support levels and moving averages. This price action is totally normal and at this time, not something to panic about. As institutions start to take profits, new demand enters from those who missed the initial breakout, or want to add further to their existing position. A pullback is also good to find buyers at a retested support level and shake out weak-handed shareholders who will likely buyback in the future.

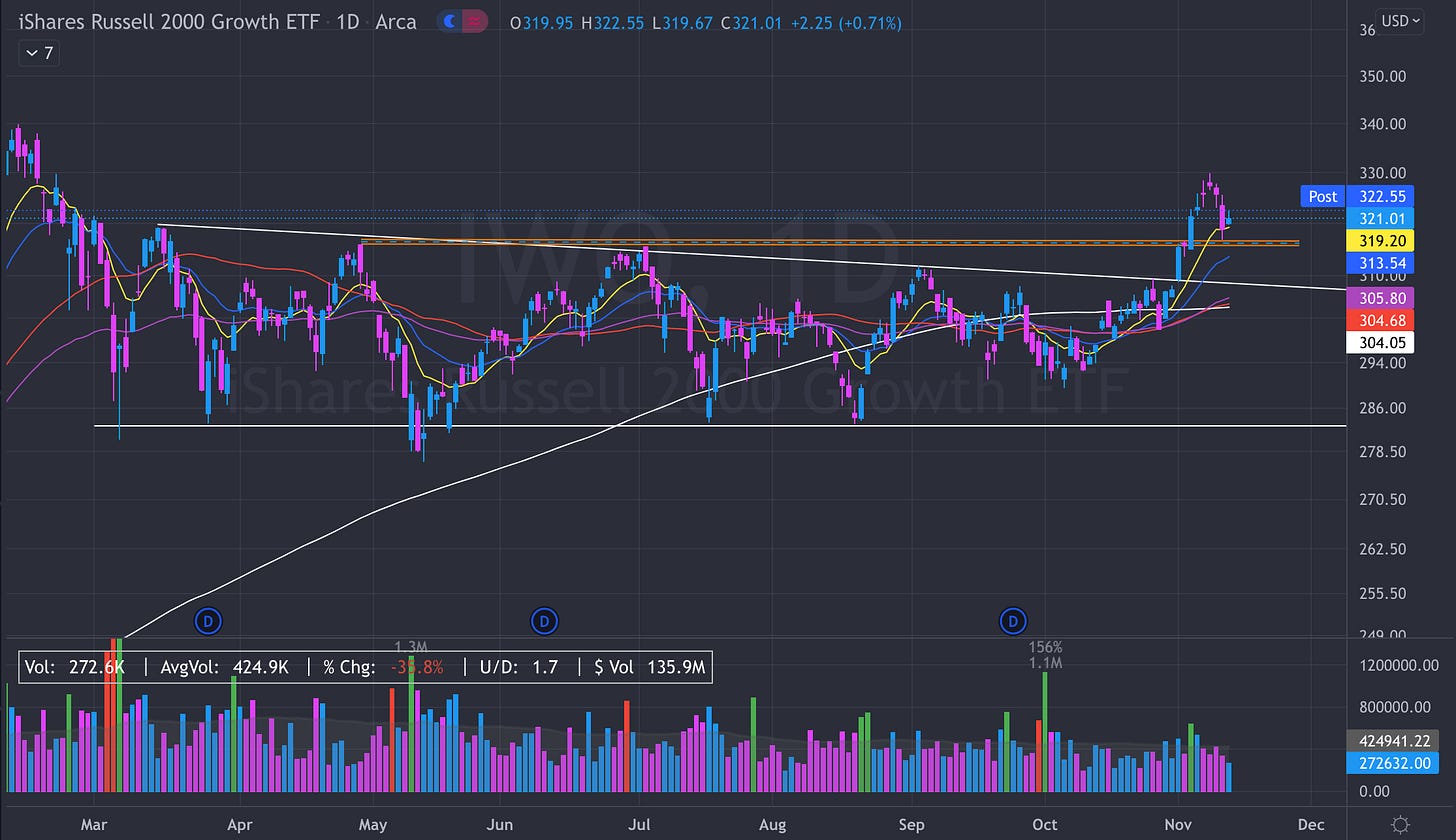

Last week, I broke down a chart of the Russell 2000 Growth ETF, IWO. This week, IWO has continued to give us a strong insight into what most growth names look like. IWO is acting healthy in my opinion, notice how it tested its 10-day exponential moving average (yellow line) right where this previous resistance area is. The fact that it was able to hold this area is encouraging, I like that we saw a buyer step in once we undercut the 10EMA intraday on Wednesday. Another thing that stands out is that when IWO sold off the last couple days, it was on relatively low volume. This says to me that although people began to take some profits, it appears that most funds held the majority of their position. This sell-off wasn’t very aggressive, it looks to me more like profit-taking rather than panic selling. There is still much to prove before we can be too confident, but for now, it appears to me that growth stocks will trend higher this quarter.

This week I’d like to discuss the Coinbase Q3 earnings report, released on Tuesday. I would wager that most readers have, at least, heard the headline that COIN was down 8% Wednesday after an earnings miss. I’ve chosen to discuss Coinbase because this is a stock I’m very optimistic about as it has a few high growth characteristics. We have a recent IPO, in a highly disruptive industry, that is being accumulated aggressively by institutional investors. Marketsmith data shows us that since IPOing in April, over 400 high-quality funds have bought shares of COIN.

**I should note that I own a position in COIN**

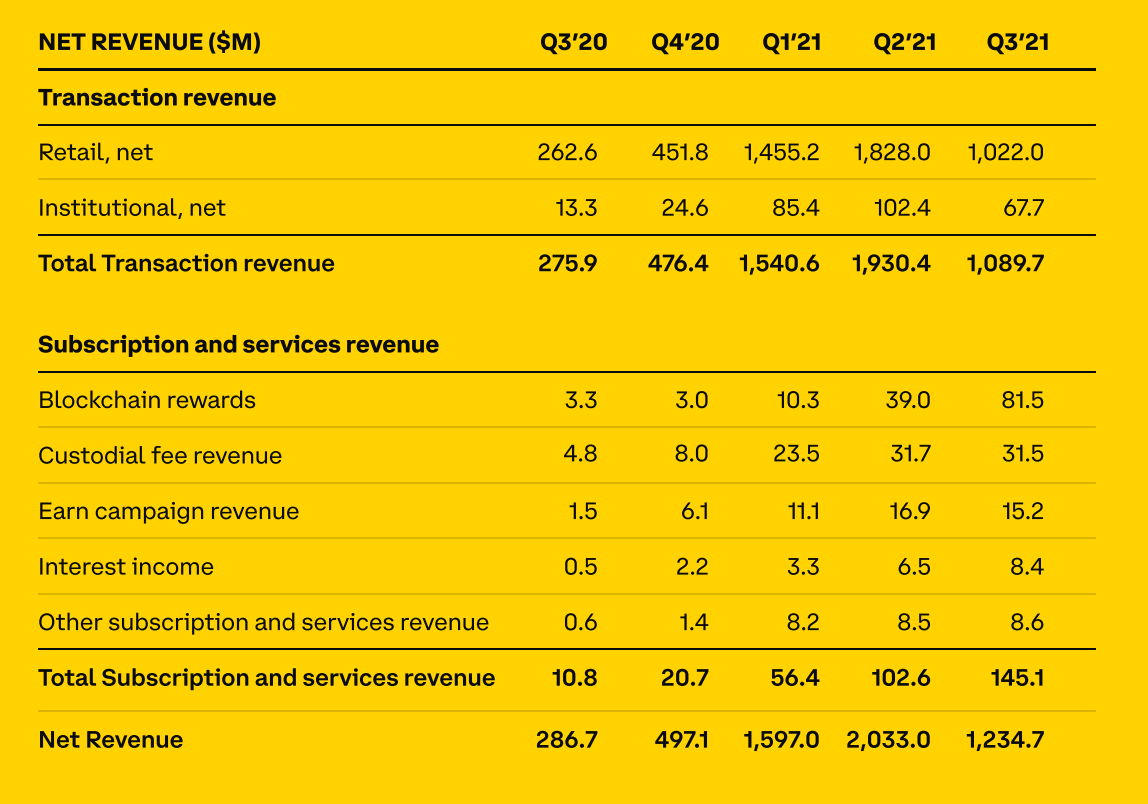

The first thing that needs to be noted is that crypto trading volume was down throughout the entire market this quarter. Meaning that all exchanges likely saw some sort of drawdown on this front. Because of this, Coinbase saw a decrease in the amount of active users and overall trading volume this quarter. That being said, COIN’s institutional trading volume outperformed the industry average and their retail trading volume was right around average. Also, the total amount of assets on their platform increased.

Below we can see that revenue from subscriptions and services was up quarter-over-quarter. But transaction revenue, where COIN generates most of their earnings, was down in-line with the rest of the industry. This is likely the largest contributor to why COIN missed earnings estimates, simply there wasn’t much transaction volume because crypto volatility decreased this quarter. We know that as volatility increases, so do the amount of transactions. If we see a Bitcoin breakout this quarter, we can expect to see transaction volume increase too.

Coinbase is an innovative company, focused on reinvesting income to provide customers with more functions and access to their platform. They have a plan called “Project 10%”, where they allocate 10% of resources towards developing new ideas. COIN executives seem very excited for a variety of new products and features coming out due to this initiative. They discussed a new NFT marketplace, internet 3.0 infrastructure, the Coinbase software wallet, DeFi products, and metaverse projects that are all in development. COIN’s goal is to be the Amazon of crypto products and services, and from this call, it appears they are well on track to do so.

The most exciting of these products, in my opinion, has to be the development of the internet 3.0. The COIN letter describes internet 2.0 as the addition of the cloud and social media infrastructure to the internet. Internet 3.0 is the new era, initiated by the introduction of blockchain and crypto-assets to the internet. Included in this section of the shareholder letter is a graph depicting the growth rate of the internet from 1990-2000 alongside the growth of crypto from 2014-present. It’s unclear whether or not crypto will continue to follow this trend but this chart does imply a Bitcoin price of $130,000 by 2023 assuming the growth rates stay as they are.

Wow, really top quality analysis. Will Clemente, Willy Woo, Plan B, and Glass Node are all a crypto investor needs to guide their investment strategies. Like a lighthouse on a stormy night - they don't tell you exactly where the rocks are, but provide enough info for you to steer appropriately.

in one sentence:

"As we have discussed many times: long term holders buy into weakness (don’t perfectly buy the bottom) and then sell into strength (don’t perfectly sell the top). This is natural bull market behavior."

... 👆🏼... all good. buy more ₿!