Blockware Intelligence Newsletter: Week 35

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 4/22/22-4/29/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

FTX US - Buy Bitcoin and crypto with zero fees on FTX. Use our referral code (blockware) and get a free coin when you trade $10 worth.

Blockware Solutions (Mining) - It is difficult to buy ASICs, build large mining facilities, and source cheap scalable electricity all on your own. Work with a trusted partner like Blockware to deploy capital into Bitcoin mining.

Blockware Solutions (Staking) - Ethereum 2.0 is almost here, now is the time to stake your ETH with Blockware Solutions Staking as a Service to take advantage of 10-15% APR when the Ethereum network switches over to Proof of Stake

Summary:

Blockware Intelligence’s newest report, titled “Bitcoin is Certainty in an Uncertain World”, compares the uncertain macroeconomic environment of 2022 with the immutable transparency and scarcity of the Bitcoin network.

BTC still ranging, volatility compressing

13.8% of BTC supply has now moved between $38K-$41K

BTC correlation to NQ remains near all-time highs

Funding rates neutral

Asian trading hours are back at a premium for the first time since January

Be on the lookout for our podcast episode with Jack Mallers dropping tomorrow morning

Also, be on the lookout for our upcoming report on Bitcoin user adoption

With the Bitcoin market trading essentially sideways, this week for the macroecon/equity and mining sections we’ve decided to switch it up a bit and include a summary of the newest free Blockware Intelligence research report titled: Bitcoin is Certainty in an Uncertain World. This report contrasts the certainty of Bitcoin’s immutable scarcity with the macroeconomic uncertainty associated with record-high inflation.

Before diving in, let’s look at a few updates on the Bitcoin market. Many of these items have been discussed in letters from the previous few weeks; because quite frankly not a whole lot has entirely changed.

Price/On-chain/Derivatives:

Bitcoin is still in the price range we’ve been tracking for months. Price still sits between our value and momentum thresholds, with value being in the low-mid $30,000s and momentum above $47,000.

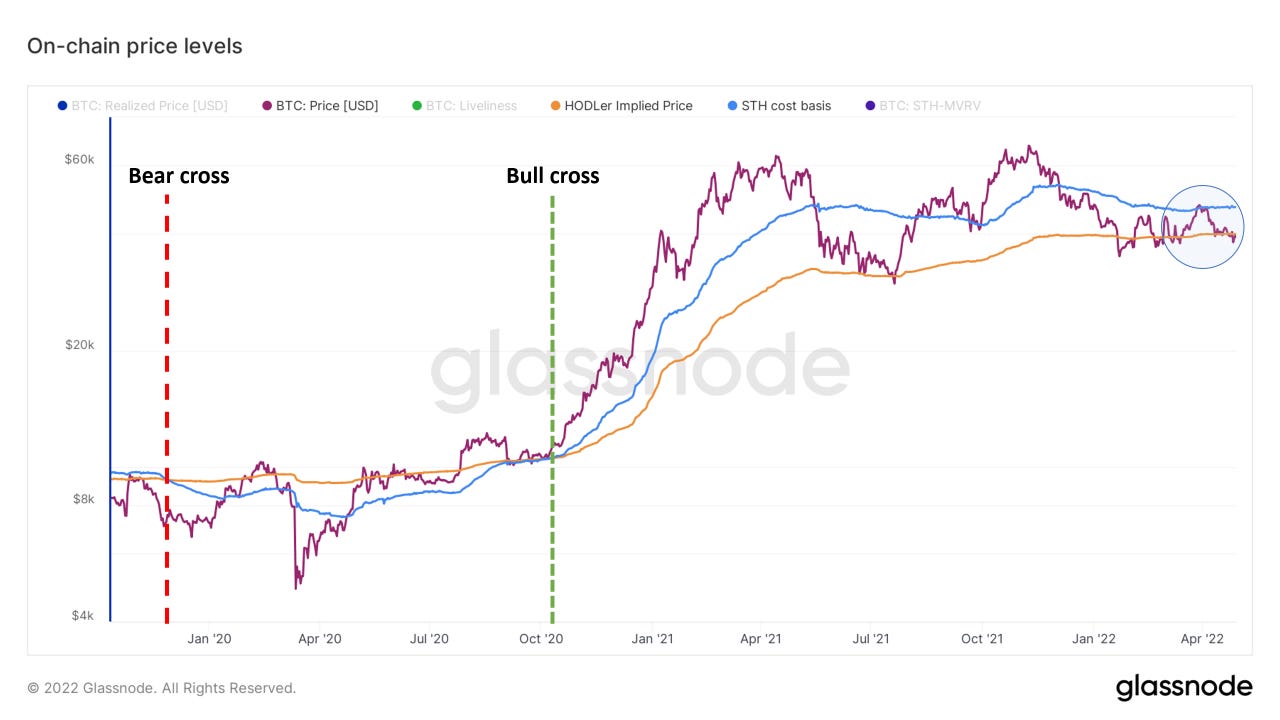

This is also evident from an on-chain perspective as well. In blue the short-term holder cost basis, in orange, a ratio of realized price-liveliness; called HODLer implied price. Bullish scenario based on this chart would be the push above STH cost basis we’ve been talking about to regain momentum; bearish case would be a cross of STH cost basis before HODLer implied, a sign of capitulation to come.

To illustrate how significant these price levels are, we can look at realized price distribution: visualizing the amount of BTC last moved at each denominated price level. 13.8% of Bitcoin’s money supply has last moved between $38,000 and $41,000.

Funding rates remain muted/mixed, an indication of a lack of strong opinion from the perpetuals market as well as increasing market efficiency (entities arbing funding rates) in our view.

Asian trading hours have been trading Bitcoin at a premium for the first time since January. This has been a fairly strong signal of local recoveries aside from a slight premium in late November before an unprecedented dump of inventory by Asia in December. Previous premium regimes: post covid crash, dip to $47K bought in April 2021, Massive dip-buying in summer 2021, dip to $40K bought in September 2021, dip bought in January.

Still continuing to see the amount of supply not moved in at least a year climbing, reaching new highs of 64.5%.

Also have seen entities with over 1,000 BTC (filtering our for exchanges, GBTC, Purpose ETF, etc.) adding to their holdings for the first time since January.

As we described last week in more detail, for BTC to move up you either need:

A: Tech to rebound, pulling up BTC through correlation

or

B: A decorrelation

The case for a decorrelation over the next 3-6 months can be made by looking at this data in our opinion. You have one group of correlation trading entities and one group of crypto natives holding their BTC/adding to their holdings. The case for a decorrelation comes in the thesis that after a period of time the supply transfer will complete from the former to the latter. In the meantime correlation to NQ continues without any clear catalyst in the short term for BTC.

Bitcoin is Certainty in an Uncertain World

Bitcoin is different from all other assets (crypto and traditional) due to its unique property of immutable scarcity.

Unlike other commodities, Bitcoin has a predetermined algorithmic supply schedule that cannot be changed.

The 2015 - 2017 Blocksize War revealed just how immutable the Bitcoin protocol really is. A large number of corporations and miners supported a Bitcoin hard fork that would have changed key consensus rules (block size).

Bitcoin users (node operators) were able to resist consensus-altering changes and upgrade the network in a backward-compatible way.

This battle set the precedent that Bitcoin is highly resistant to any changes that could alter its value proposition of being perfectly scarce, portable, durable, divisible, and fungible.

Bitcoin is a Schelling point on a set of rules with no rulers.

There is no second best when it comes to money. This has become abundantly clear as trillions of US dollars continue to be added to the money supply, driving inflation to historic highs.

Above we can see the M2 money supply of the US over the 21st century.

Bitcoin’s new supply issuance, by contrast, continues to be Halved every 4 years, as expected, with the most recent Halving taking place in May 2020.

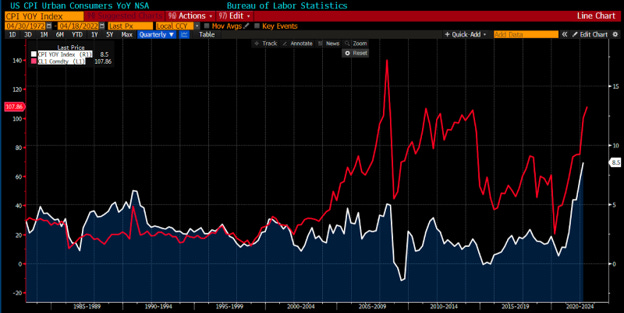

Not only is M2 growing at a rapid rate, but on April 12th, the CPI came in at an elevated 8.5% annual increase.

As you can see below, prices in the Consumer Price Index have not risen this fast since 1981, over 40 years ago.

Source: Bloomberg

Even more concerning is the level of inflation being seen by producers. Below we can see the Producer Price Index (PPI) over the last 40 years.

Source: Bloomberg

PPI is currently at 15.2%, and the only time it has ever been higher was for two quarters in 1974, as seen above. PPI tends to lead CPI as input costs rise for producers and eventually spill over to the consumer in the form of higher prices for produced goods.

Progressively lower interest rates since the early 1980s have enabled consumers, corporations, and governments to borrow more and more. Over the long run, this creates a highly fragile financial system.

Source: Bloomberg

Below you can see the relationship between CPI (white) and the price of WTI crude oil (red). When oil prices rise, the cost of transporting and manufacturing goods rises. This only exacerbates the ongoing supply chain issues.

Source: Bloomberg

With oil prices on the rise in 2022, it has only had fuel to the inflationary fire underway in the United States.

Amidst such massive uncertainty, consumer confidence continues to take a hit. This confidence metric, calculated by the University of Michigan, currently sits below the local low in March 2020, and it is approaching a level not seen since the 2008 financial crisis.

On top of high inflation, the yield curve is inverting.

Investors expect the Fed to increase interest rates in the short term so much (to fight inflation) that it ends up squeezing credit, causing a recession and ultimately leading to lower interest rates in the future.

Lastly, US Public Debt to GDP is at record highs.

Historically when this occurs as the global reserve currency, governments don’t actually default on their debt, but they end up paying bondholders back in printed, less valuable currency.

Bitcoin, like gold, is a hard, scarce commodity with no counterparty risk, meaning if you hold it yourself, you do not have to trust any other entity to custody (like gold), pay you back (like fixed income), or successfully run a company (like equities).

Not only does Bitcoin have superior monetary properties compared to gold, but it is also disruptive new technology. This tech is starting to gain traction at the same time as incoming supply is exponentially decreasing.

By 2030, ~ 97% of all Bitcoin will be in circulation.

Bitcoin’s Sharpe Ratio

Many investors are confident that Bitcoin will outperform most asset classes on a 4+ year time horizon, but the high potential returns come at the expense of short-term volatility.

There is a metric in finance called the Sharpe Ratio that can be used to calculate Bitcoin’s historical risk-adjusted returns. Meaning, after accounting for volatility and short-term risk, is the return justified?

Looking at a 4-year holding period, Bitcoin’s Sharpe ratio is historically almost always higher than all other major asset classes including gold, US stocks, US real estate, bonds, and emerging currencies.

While the 4-year holding period Sharpe ratio validates that the short-term volatility can be justified by the large returns, that doesn’t mean investors want to stomach that short-term volatility.

What if it was possible to still capture a large amount of the future upside and reduce short-term volatility risk, all while earning a positive daily BTC “dividend”?

Mining Bitcoin

An S19XP, Bitmain’s newest generation Bitcoin mining rig being released in July, currently would have an operating margin of ~80%. Plugged in, the machine would cost $5.42 to run (at $0.075 kWh), and it would mine $26.60 worth of Bitcoin every day at the current BTC price and network difficulty.

Mining Bitcoin becomes increasingly interesting in an inflationary environment. Due to the nature of energy contracts with utilities, miners can lock in their electricity rate for a number of years. This means you can keep your operating expenses fixed while prices of virtually everything else, including the Bitcoin you earn and the machine itself, are likely to be increasing over time.

If you are buying a new generation machine, the value of the new machine historically has a beta of 0.96 compared to Bitcoin (Hashrate Index Research). While it tracks the volatile price of Bitcoin, it continues to earn a consistent daily cash flow regardless of daily fluctuations.

These daily positive cash flows will likely persist even under extreme short-term (12-18 months) volatility. As noted in this Blockware Intelligence Research Report, new generation mining rigs behave as safe haven Bitcoin dividend assets. If the price of Bitcoin falls significantly, older less efficient rigs become unprofitable first, they turn off, difficulty drops, and new generation machines begin earning more Bitcoin.

Bitcoin Mining in Practice

While the Bitcoin mining case is compelling, it is difficult to procure ASICs, build large mining facilities, and source cheap scalable electricity all on your own. As an institution, hedge fund, or high net worth individual, it makes sense to purchase and host ASICs with a trusted partner like Blockware Solutions.

With Bitcoin mining experience dating back to 2013, Blockware Solutions has sold over 250,000 ASICs, hosted 200+ MW of clients, and mined thousands of BTC from the Blockware Mining Pool.

If you are looking for a trusted partner to assist you in deploying capital to the Bitcoin mining space, Request a Quote from Blockware Solutions.

If you gained some insight from this summary be sure to check out the full report for even more charts and explanations. The newest Blockware Intelligence report makes it abundantly clear why Bitcoin is Certainty in an Uncertain World.

badass Will

Incredible deep dive on the current state of the market!! Fantastic work!