Blockware Intelligence Newsletter: Week 135

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/1/24 - 6/7/24

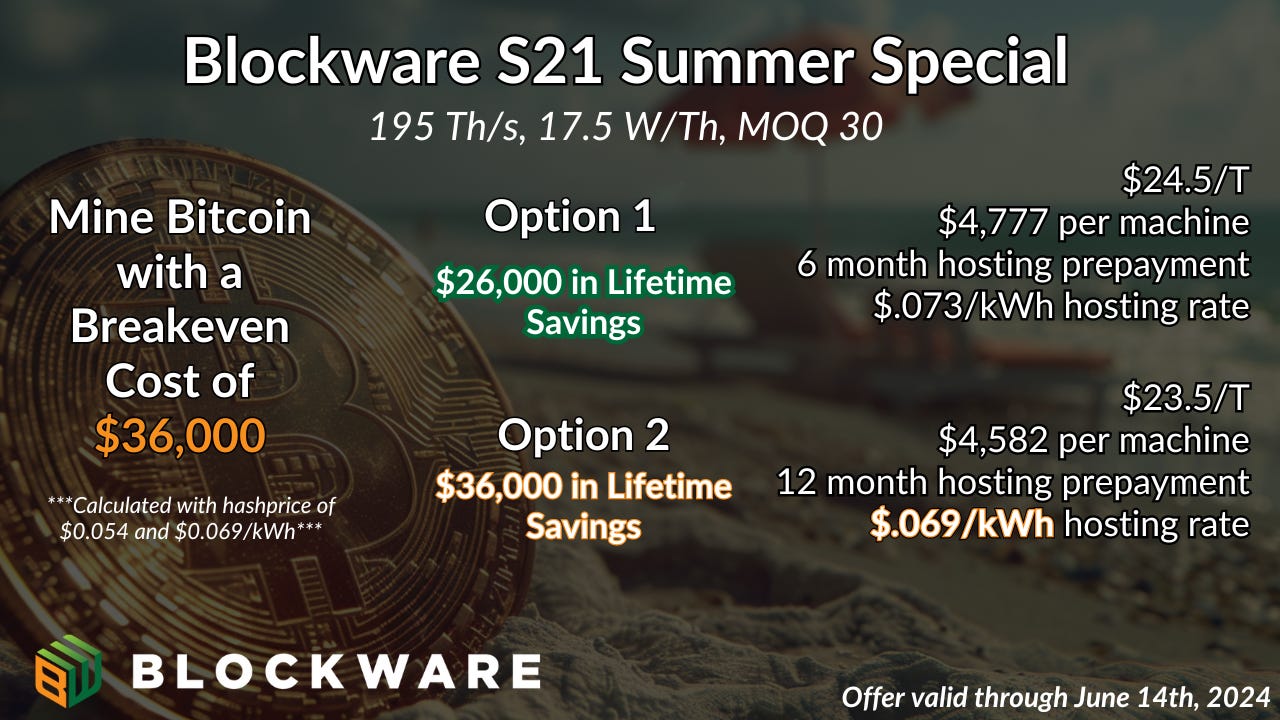

🚨Blockware Bitcoin Summer Special🌞🏖️

To celebrate the start of summer, Blockware is offering a limited-time special where you can mine at $0.069/kWw. Here’s the terms of the deal:

Option 1:

Minimum Order Quantity: 30 Machines

Prepay 6 months of Hosting

Mine at $0.073/kWh

$24.5/T

Option 2:

Minimum Order Quantity: 30 Machines

Prepay 12 months of Hosting

Mine at $0.069/kWh

$23.5/T

At the current hashprice, an S21 mining at $0.069/kWh has a breakeven cost of $36,000 per Bitcoin

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

River

Set up your on-ramp to Bitcoin with a reputable exchange giving you US phone support and top-tier customer service.

Sign up here: partner.river.com/blockware

Bitcoin: News, ETFs, On-Chain, etc.

1. BTC to $71,000, Price Performance Since Halving

Bitcoin posted a cool 5% gain on the week; now sitting comfortably above $71,000 per coin. It may feel like a lifetime ago, but we’re still just seven weeks removed from the 2024 halving. It often takes multiple months for the effect of decreased daily issuance to be felt in the price. Relative to the price performance after previous halvings, we are still in the third inning of what is likely going to be a major bull market. BTC is up ~9% since the halving; past cycles have seen BTC rise by hundreds or thousands of % from halving-to-peak.

2. Semler Scientific Announces Additional BTC Purchase

Semler Scientific ($SMLR) demonstrated a commitment to the corporate Bitcoin treasury strategy that they announced early last week. In a press release on Thursday they announced the acquisition of ~247 BTC (~$17 million deployment). So far, each of the MicroStrategy copycats have come to play; racing to deploy capital into BTC as quickly as possible. We aren’t using the term “MicroStrategy” copycat in a degrading way. This is objectively the strategy that Metaplanet and Semler Scientific are adopting. MicroStrategy is the proof of concept; others are now wisely following. Corporate Bitcoin adoption will be a dominate theme during this halving epoch.

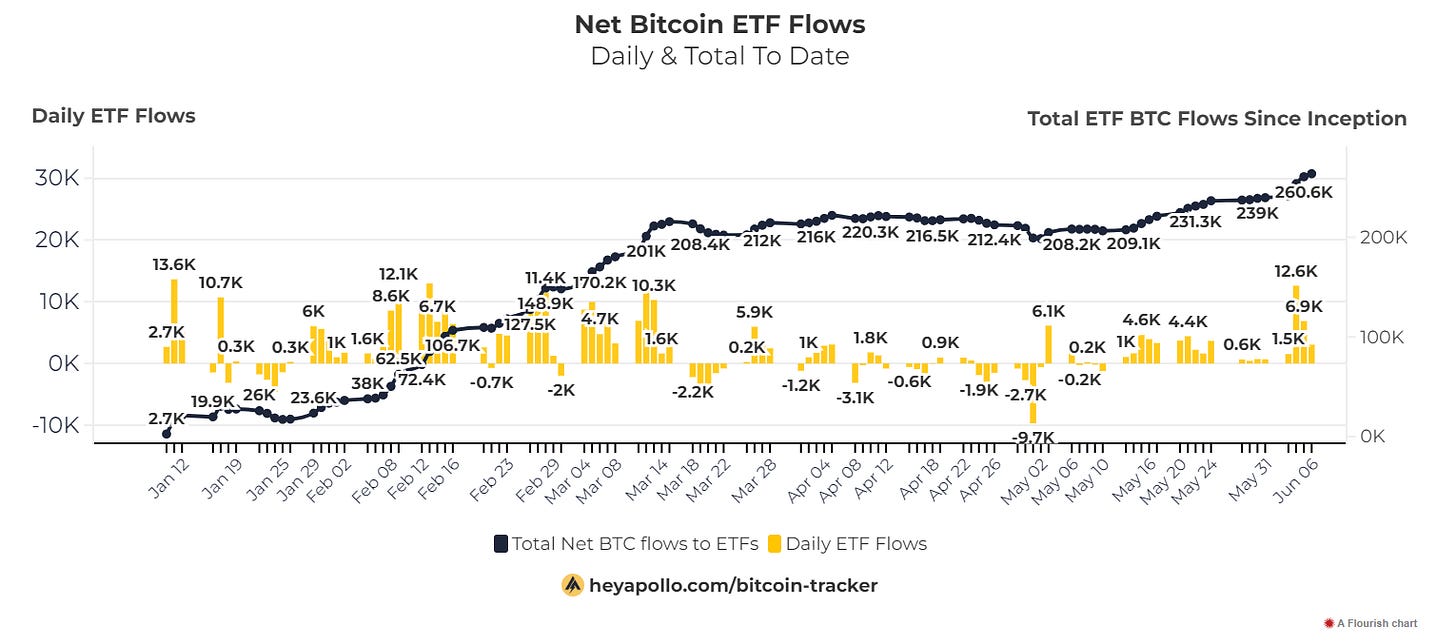

3. ETF inflows - “We are so back”

After stagnant relatively tame inflows the past few weeks, the spot Bitcoin ETFs came back with a vengeance this week. On Tuesday and Wednesday the ETFs received combined inflows of nearly 20,000 BTC (~$1.4 billion). The ETFs (GBTC excluded) are now up to a cumulative ~260,000 BTC in net inflows since launching in January.

Source: https://heyapollo.com/bitcoin-tracker/flows

4. Ark Labs - New Layer 2

Ark Labs has introduced a new layer 2 solution seeking to enhance Bitcoin scalability and enable seamless payments. By leveraging advanced Taproot and introspection opcodes, Ark Labs supports high-volume, low-cost transactions without compromising security. Their solution uses virtual transaction outputs (VTXOs) in a binary tree of Taproot scripts, allowing shared outputs to split into smaller ones, each managed by its own script (GitHub) (GitHub) (GitHub).

This launch addresses the ongoing debate on Bitcoin scaling solutions. Making Bitcoin viable, permissionless money for all 8 billion people involves trade-offs between immediate transaction relief and risks like centralization. Layer 2 solutions like Ark Labs and the Lightning Network emphasize off-chain transactions, providing scalability without altering the core protocol, thus maintaining Bitcoin's foundational principles. The difficulty in achieving consensus on protocol changes ensures network stability and security, as Satoshi Nakamoto stated, “The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.”

For more details, explore their website.

General Market Update

5. ECB & BoC Cut Rates

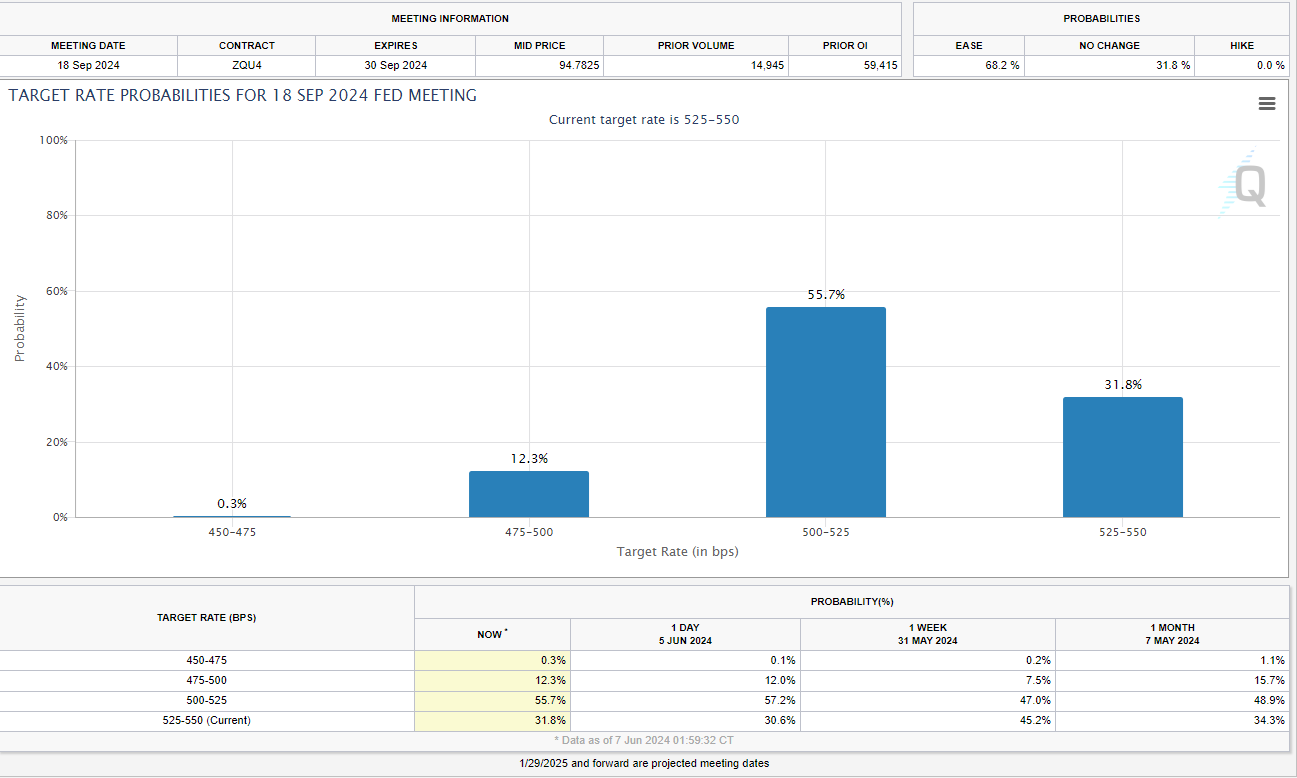

The European Central Bank and the Bank of Canada both elected to cut their respective interest rates this week by 25 bips. Will this force the Fed to make a similar move? Time will tell. The Fed meets next week, and it remains highly unlikely that they cut rates. The current probability based on CME Fed Funds Futures is ~2%. Given their rhetoric from previous meetings, it would be quite shocking to see a cut next week. However, the probability of a cut during their September meeting jumped from 47% to 55%.

The 2-year treasury yield is also signaling agreement on a hastened interest rate cut. The 2-year yield dropped from 4.88% to 4.74% this week.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

6. Hash Ribbons

Bitcoin is currently experiencing a "Hash Ribbon.” What does this mean? Why is this important? What does this mean going forward? Hint: This is BULLISH🐂 🚀

Let's discuss👇

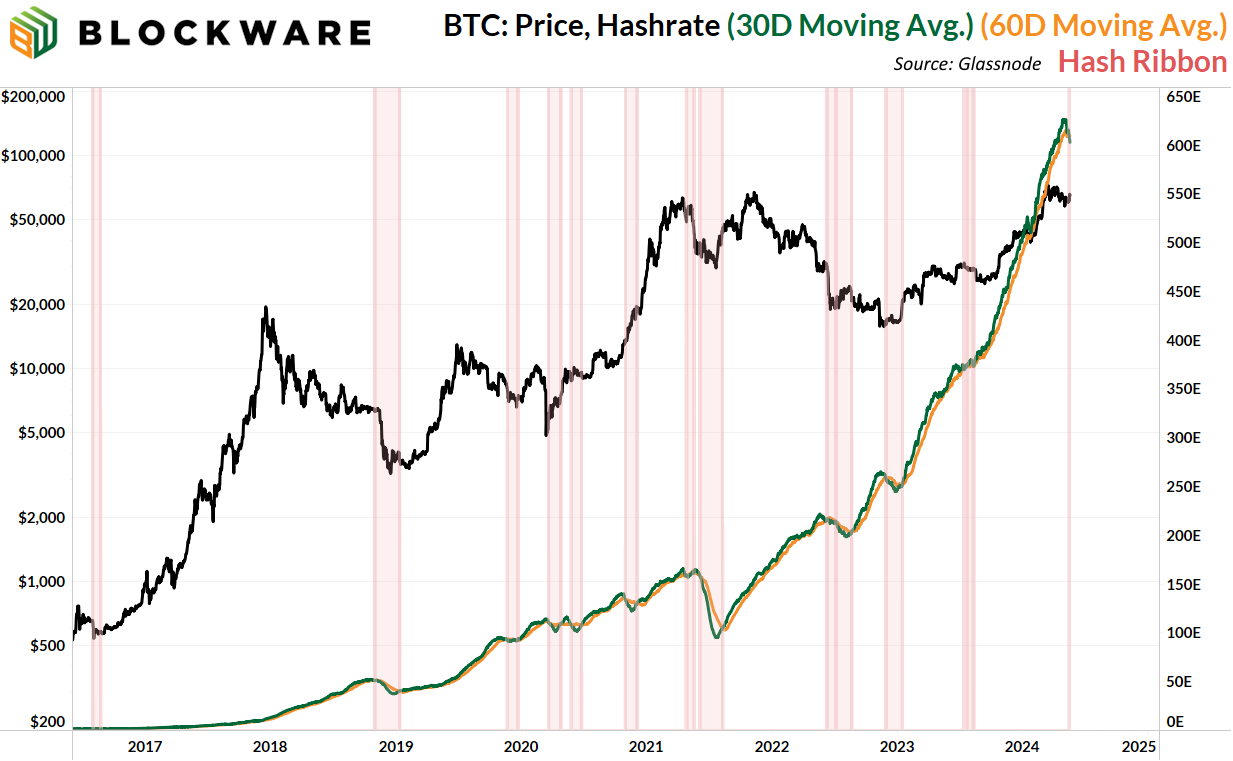

A "Hash Ribbon" occurs when the 30-day moving average of hashrate crosses below the 60-day moving average. This means that there is less computational power on the Bitcoin network (miners) during the past month compared to the past two months.

This is important because it means that miners, in the aggregate, have been unplugging machines. Or in other words: there is a miner capitulation! Hash Ribbons tend to occur for two reasons:

- The Bitcoin Price has dropped

- There was a halving

Both of these events make it less profitable to mine Bitcoin. As such, miners with outdated hardware and/or high electricity rates (we call them weak miners) become unprofitable, and pause their operations.

This means a few different things going forward.

Firstly, we can reasonably expect a local bottom in the Bitcoin price. Why? Because the weak miners were selling most of the Bitcoin they mined to cover their operating expenses. These miners were barely getting by before capitulation; so their capitulation will provide a relief of sell-pressure on the network. Moreover, hash ribbons result in lower mining difficulty, which means that the surviving miners will be able to mine more Bitcoin at the expense of the weak miners, strengthening their balance sheets.

Note the vertical red lines on the chart, indicating hash ribbon, and then note the price performance in the following months.

Secondly, weak miners capitulating can result in a surplus of old-generation ASICs hitting the market as miners look to upgrade to new-generation ASICs. S19J Pro's notoriously traded north of $10,000 per machine at the height of the 2021 bull cycle. Now, they are going for less than $700 on the Blockware Marketplace (the number 1 secondary marketplace for ASICs).

The flashing of the Hash Ribbon adds to the laundry list of bullish indicators for Bitcoin:

- Rising Global Liquidity

- Positive ETF Inflows

- Corporate #Bitcoin Adoption

- Friendly Legislation in the US

The short, medium, and long-term outlooks for Bitcoin are all bright. Miners will benefit the most during the coming bull market. Blockware can cover all of your mining needs. Competitive ASIC pricing, turnkey hosting, instant liquidity via our marketplace, etc. Send us an email to learn more about mining Bitcoin with Blockware! 📩

7. Energy Gravity:

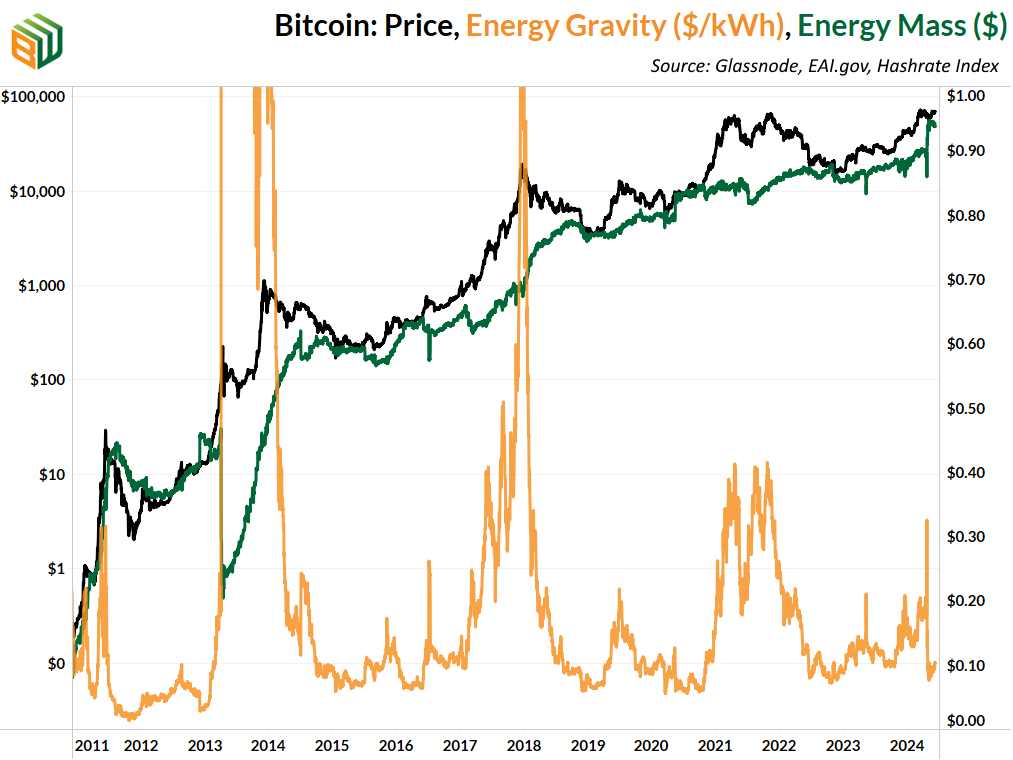

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$49,200 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig.The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.