Blockware Intelligence Newsletter: Week 118

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 1/20/23 - 1/26/23

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

Bitcoin ETFs Update

The ETF narrative this week has been defined by the FTX Bankruptcy Estate selling their ~$2B worth of GBTC shares as part of their liquidation. Now that we’re ~2 weeks into ETF trading, much of the GBTC rotation has seemingly subsided which has allowed net inflows to drive BTC price higher on Friday. Total GBTC outflows have equated to ~$4.4 billion, and, according to JP Morgan Analysts, the majority of outflows are likely over.

In total, the spot Bitcoin ETFs hold ~132,000 BTC. For reference, Microstrategy has been stacking BTC religiously since August of 2020, and they hold ~189,000 BTC. The ETFs have accumulated ~70% of MSTR’s BTC holdings in just over two weeks. The degree to which these ETFs will continue to attract inflows has not and cannot be priced in. The short-term price action has been nothing but noise. To say the ETFs are net-bullish over the long term is an understatement.

General Market Update

2. BTFP Net Loans. In the wake of the March 2023 regional banking crisis, the Federal Reserve opened a new credit facility called the Bank Term Funding Program (BTFP), designed to improve the liquidity position of banks by allowing them to borrow capital from the Fed by swapping collateral for cash at par value. The emergency program will cease operations on March 11th, in an effort to end an arbitrage trade available by borrowing at BTFP rates and investing at higher market rates.

3. January 31st FOMC. The Fed is set to conduct the first of its 8 yearly meetings on Wednesday, January 31st. Likely to the surprise of very few, the market almost fully expects the Fed to continue on this pause and leave the FFR at a target rate of 5.25-5.50%. At the time of writing, the futures market sees the first cut coming in May with ~88% certainty.

4. Nasdaq 100. It’s been a fairly choppy week of price action from the equity market, as some profit-taking has occurred throughout the week. On Wednesday, things looked a little “toppy” as the Nasdaq put in a downside reversal candle after gapping up nearly 1%. With a gap down to start today’s trading session, things so far have recovered well. If a pullback is coming, keep an eye on the ~$17,000 level for the convergence of the 21-day EMA and December 28th high to provide support.

Bitcoin Exposed Equities

5. Valkyrie Bitcoin Miners ETF (WGMI). With the rebound in Bitcoin price action this morning, we’ve so far seen a very strong day of performance in publicly traded Bitcoin miners. The miner ETF WGMI saw a ~50% peak-to-trough drawdown from 12/27-1/19, but has so far recovered nearly 9% today.

6. BEE Comparison Table.

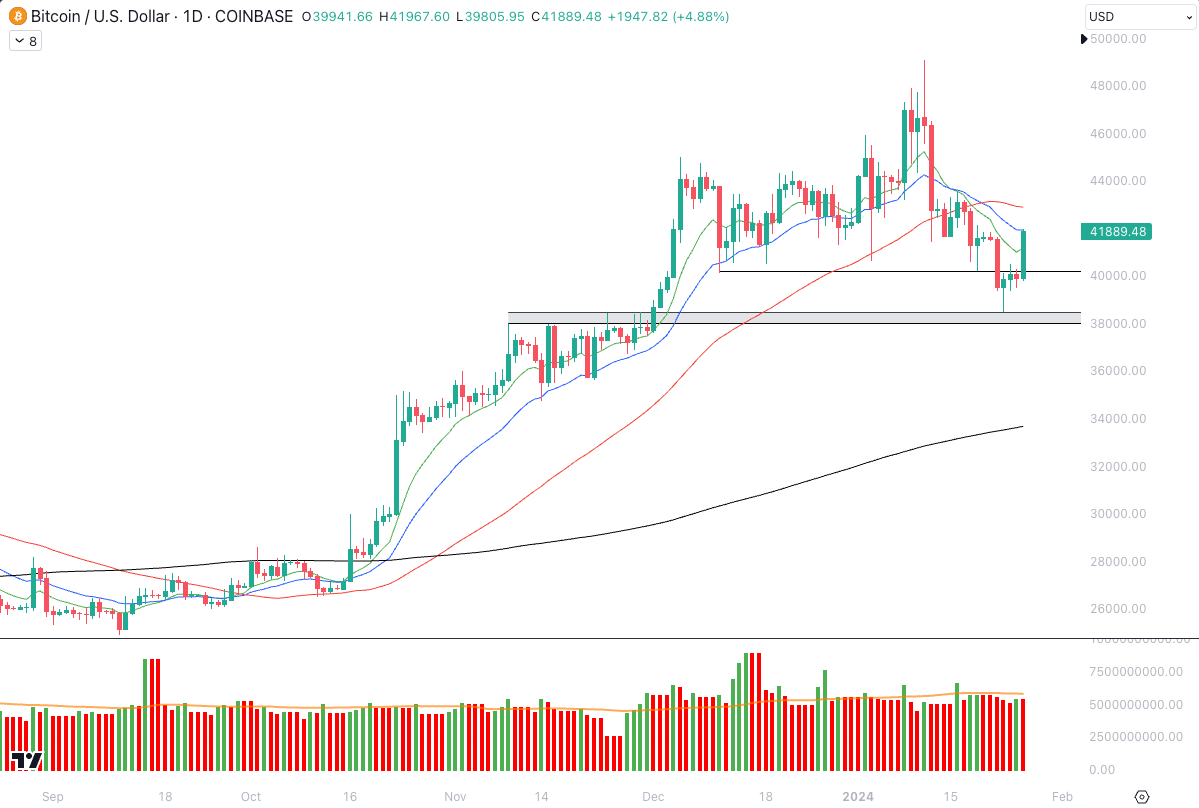

Bitcoin Technical Analysis

7. Bitcoin / USD. Despite the generally negative week of price action, BTC has recovered well today and is back up to ~$41.9k at the time of writing. Price managed to attract buyers again right around the $38-38.5k support level this section highlighted last week. The path forward here may not be easy, with several key moving averages hanging overhead, and a lot of volume lying in the $42.5-43.5k range. If price manages to hold these levels heading into next week, we see the previously noted range as the key to watch before BTC takes another stab at breaking $49k.

Bitcoin On-Chain / Derivatives

HODL Waves: After incessant growth throughout the bear market, the % of supply last active 1+ year(s) ago has finally begun to trickle down. Notably, the activity is coming from the 1-2 year and 2-3 year cohort, courtesy of ETF traders “selling the news” and GBTC holdings being liquidated respectively. Older cohorts of coins have remained put, and, despite the increase in on-chain activity, we are still at record levels of supply illiquidity. The convicted base of Bitcoin holders is unshaken.

MVRV Ratio: This is one of the best on-chain metrics for evaluating if the BTC price may be overheated or undervalued. It is a ratio measuring the price of BTC to the aggregate cost-basis of the market, higher ratios mean that the average holder is significantly in profit, and values less than 1 mean that the average holder is underwater. Based on historical bull market levels for the MVRV ratio, BTC is nowhere near being “overheated.”

ETH/BTC: ETH/BTC made a big jump after the approval of the Spot Bitcoin ETF(s) as investors shifted their anticipation towards a potential ETH ETF approval. However, much of the recent gains have subsided over the past week. The securitized nature of ETH makes an ETF a much more complicated proposition than the Bitcoin ETF. Moreover, it is likely not in the best interest of ETH holders due to the proof-of-stake protocol; Blackrock holding a large chunk of the ETF supply would pose a major security risk with a PoS consensus protocol.

Bitcoin Mining

Swan Mining: Bitcoin financial services firm Swan has quietly deployed 4.75 EH/s over the past six months, equating to ~1% of the total network hashrate. They’ve announced plans to increase capacity to 8 EH/s by March, which means they are likely deploying the latest generation ASICs, which are due to land in the US this quarter. A company like Swan deploying capital into Bitcoin mining is a major green flag, signaling that now is the best time in the cycle to start mining Bitcoin.

For more information, read their press release here.

Mempool: Miners have made noticeable progress in chipping away at the swarm of mempool transactions in the 20-40 sat/vByte range. It’s possible that these transactions could all clear in the next couple of weeks, barring a significant surge in on-chain demand. We’ll continue to monitor the mempool to see if/when transaction fees drop. However, fees remain at historically high levels considering we are not yet in a solidified bull market.

Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$22,441 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.