Blockware Intelligence Newsletter: Week 72

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 1/21/23-1/27/23

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs. Bulk purchase the brand new S19J Pro+ from Blockware at a price below directly ordering from Bitmain. Limited remaining supply.

NordVPN - Privately and securely browse the web. This is critical to handling your Bitcoin carefully. Use code: “Blockware” for a 30-day money-back guarantee.

Summary:

The yearly growth rate of the M2 money supply slipped into negative territory, providing a visual on the monetary illiquidity driven by contractionary Fed policy.

Real GDP estimates from Q4 2022 show that the US economy grew 2.9%, above consensus estimates but below Q3’s growth.

Initial Jobless Claims ticked lower last week for the 3rd consecutive week, but Continued Claims are steadily rising.

The S&P 500 cleanly broke above its 200-day SMA this week, but a high percentage of stocks above short-term moving averages could signal that a correction is due.

Blockware Intelligence published a new mining report: Pricing ASICs - A Valuation Model for Bitcoin Mining Rigs

Energy Gravity sits at $0.12, indicating many miners are operating slightly above their breakeven.

Blockware Intelligence Podcast

This week we sat down with @luke_broyles to discuss the long term future of Bitcoin, accelerating technology growth, and an optimistic future. It was The Most Bullish Bitcoin Podcast of All Time.

General Market Update:

Following the strength in price action shown the last couple of weeks, this week has seen a continuation of bidding.

Some interesting news this week came after the year-over-year growth in the US’ M2 money supply flipped negative for the first time since the Great Depression.

The M2 money supply is a measurement of the amount of US currency in circulation. M1 takes into account highly liquid forms of money such as paper/digital currency held in banks, checkable deposits, physically, etc. M2 takes M1 and adds on savings deposits, small time deposits and retail money market funds.

For the last ~100 years, M2 has always grown from the previous year, as a result of a strengthening economy and monetary policy that largely favors expansionary financial conditions.

The fact that M2 growth has flipped negative is a significant indicator of the historically tight financial conditions perpetuated by the Fed over the last year or so. That said, the real takeaway here is that it shows just how well the US economy has held up in that time.

A restrictive monetary environment generally precedes recessionary conditions, when growth slows, asset prices crater, and large portions of the populace are unable to find work. While there’s certainly consensus belief that this is coming, most expected it to be here by now.

On Thursday, the real GDP advance estimate released by the US Bureau of Economic Analysis showed that in the 4th quarter of 2022, gross domestic product increased by 2.9% after adjusting for inflation.

This was slightly above the consensus estimate of 2.8%, and below Q3’s 3.2% growth. A second estimate will be released on February 23rd, which will take into account even more data as it comes in.

In Q4 we also saw that real wages grew from Q3, and consumer spending remained positive. While certain sectors of the economy are seeing large drawdowns in transaction volume, such as in the housing and M&A banking divisions, the American consumer remains fairly strong.

For these reasons, it becomes very hard to argue that the US is currently in a recessionary environment. Once again, despite the monetary illiquidity driven by the Fed, the US remains in a state of growth that’s not far off the average quarterly growth rate of 3.2%.

Furthermore, this week we saw the 3rd straight week of declines in Initial Jobless Claims.

The data released on Thursday shows that last week 186,000 Americans filed for unemployment benefits for the first time following job loss. This number was in line with April 2022.

While we’re certainly seeing large publicized layoffs in the technology sector, labor market data is indicating that as a whole, employment is fairly strong. That said, real wages increasing and employment remaining high could incentivize the Fed to remain contractionary by policy for longer than currently expected.

Looking at Initial Jobless Claims solely tells us how many are applying for unemployment benefits for the FIRST time following unemployment. Instead, we can look at Continued Claims to show us how many Americans have been receiving benefits for at least 1 week.

As you can see above, the number of Continued Claims has been overall increasing since June 2022. This tells us that despite the fact that we aren’t seeing a sharp rise in layoffs, those who do become unemployed are struggling to find new jobs.

In order for the Fed to effectively lower demand (inflation), they’ll be looking for a rise in unemployment to confirm that their policy is having its intended effect. It appears that we’re not quite there yet, but are potentially beginning to move in that direction.

That all being said, the decline in savings balances we’re seeing could eliminate the need for a rise in unemployment to lower inflation. Generally speaking, Americans are saving the least amount of money as a % of total earnings since 2005.

With the price of goods at historically elevated levels, it would make sense why Americans are forced to give up savings or their current lifestyle. In 2023 it’s not terribly surprising to hear that many citizens would rather sacrifice contributing to their Roth, or buying more Bitcoin, instead of their Starbucks trips or driving habits, for example.

Moving on, we’ve seen another strong week of price action in the world of risk assets.

S&P 500 Index, 1D (Tradingview)

After briefly crossing above it last week, the S&P has now spent the last 4 sessions above its 200-day SMA. This is an extremely important tool used to judge longer-term market trends.

The Nasdaq Composite closed just below its 200-day on Thursday.

As you can see above, the 200-day was a clear area where sellers had stepped in to bring previous bear market rallies to a halt. However, this time has been different.

Now, just because price has cleared above the 200-day does not mean that the bear market is 100% over. But the price action of individual stocks and Treasuries leads our team to believe that the worst of this bear cycle is most likely behind us.

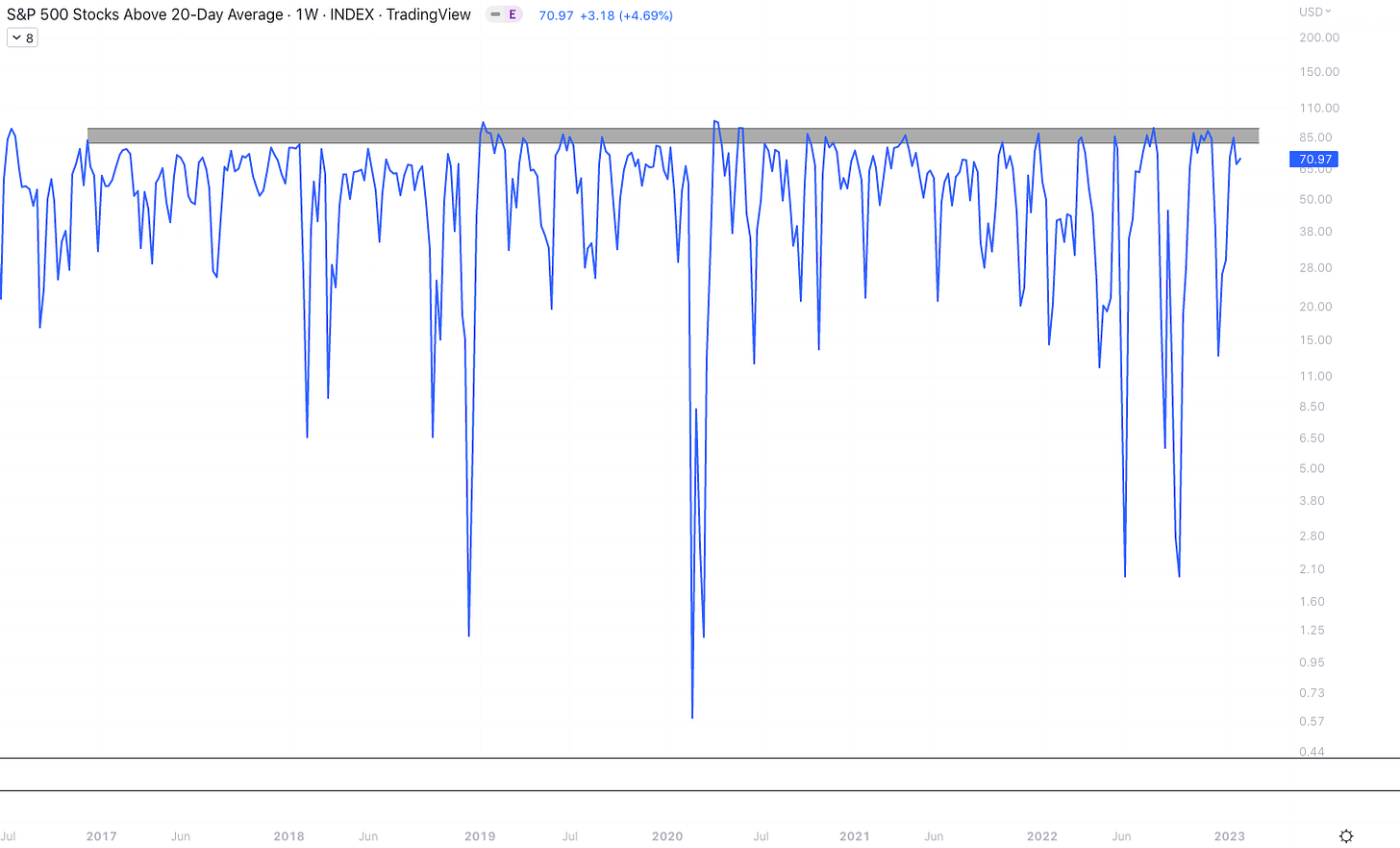

Percentage of S&P 500 Stocks Above 20-Day SMA, 1W (Tradingview)

As of Thursday’s close, the market remains in very overbought conditions. The chart above shows the percent of stocks in the S&P that are above their 20-day moving averages. As you can see, once 80-90% of stocks are above this short-term trend indicator, the index is usually due for a correction.

That being said, just because something is overbought doesn’t mean it can’t become more overbought. Furthermore, if the market is going to continue this strength, we would hope to see a sideways consolidation to let short-term moving averages catch up to price before heading back higher (as discussed in this newsletter last week).

If the index is truly as strong as it appears, the most likely area we could see a consolidation range is between $4,100 and $4,170 for the S&P. That being said, if sellers are able to vastly out-muscle buyers we could see $4,100 mark a local top before heading back lower.

Another bullish macro observation is that the price action from Asian and European indexes has been even more bullish than that of US indexes in recent weeks.

It is important to note, however, that the Fed Open Market Committee meets on Wednesday (Feb 1st). This rally has largely stemmed from the market pricing in a ~98% probability of a 25bps increase to the Fed Funds Rate.

While our team would agree that this is likely what will happen, if the low probability 50bps hike occurs, the market’s reaction could be bloody.

In the fixed-income market, we’ve seen confirmation of institutions beginning to reallocate into riskier assets for several months now.

IEI/HYG, 1W (Tradingview)

The chart above shows the spread between IEI, an ETF tracking the price action of 3-7 year Treasuries, and HYG, an ETF tracking the price of high-yield corporate bonds (junk bonds).

When the spread is declining it shows us that the price of riskier securities (junk bonds) is rising faster than that of Treasuries (riskless assets from a credit risk perspective).

We’ve seen that since July 2022, the spread has been in an overall decline. Interestingly, we’ve seen an increasingly strong decline since December 28th. If you weren’t aware, 12/28 was the last day to sell assets to capture capital losses for 2022 tax returns.

Therefore, we likely saw the selloff across risk assets in December come as a result of tax loss harvesting. Now that we’ve entered a new tax year, funds appear to be reallocating newly held cash into riskier assets.

Crypto-Exposed Equities

Overall, it’s been a very bullish week of price action from the crypto-related equity group.

What has stood out to us most this week has been the ability for several of these names to consolidate their gains in a constructive fashion. Names such as CIFR, GREE, SDIG, CLSK, and BTCS (among several others) all have seen fairly tight sideways price action following large gains over the last several weeks.

In our opinion, this is a strong sign of institutional conviction in the reaccumulation of this industry group.

When the buying behind illiquid names is weak, or unconvicted, we tend to see prices explode higher, followed by equally aggressive selloffs. The fact that this is largely not what we’re seeing in crypto-exposed equities tells us that buy strength is likely here to stay for the time being.

Furthermore, sideways consolidations are what create continuation bases and allow investors who missed the initial bounce to step in.

Our team is closely watching the price action of the equity indexes and Bitcoin to judge whether this rally will be sustained.

Above, as always, is the Excel sheet comparing the Monday-Thursday price action of several crypto-equities.

Bitcoin Technical Analysis:

If you recall, last week we discussed how BTC was in the midst of a sideways consolidation and a break above $21,650 would signal more upside. Of course, this is what we got, and this week the price structure is very similar.

Bitcoin/US Dollar, 1D (Tradingview)

BTC hit $23,800 this week after breaking above last week’s consolidation zone. This week, we’re seeing a similar behavior where BTC has found support at its 10-day SMA and looks keen towards higher prices.

That being said, Bitcoin is at a very key spot here, and prices could easily go either way. As you can see above, VWAP anchored from the March 28th ‘22 peak currently sits at ~$27,500 and has turned into resistance for this rally.

Our team would like to see a clean break above this AVWAP followed by an explosion of higher prices. That being said, BTC is very extended here. Currently, we sit ~8.7% above the 21-day and ~24.5% above the 50-day.

Just because BTC is extended doesn’t mean that the rally is over, it just makes it harder for buyers to retain firm control over price action. Our team is watching for a break above ~$23,800 to signal bullish confirmation, and a break below ~$22,300 could indicate a retest of moving averages.

Bitcoin Onchain and Derivatives

We are continuing to look for trends that indicate a bear market recovery. The trends we are looking for are: increasing on-chain activity, increased volume from short-term entities, and realized and unrealized profits in the market.

Based on the below indicators we are in the “late stage” of the bear market. The price has broken the resistance of realized price, but, the short-term holder realized price is still below realized price. Once the short-term holder realized price crosses back above realized price, we will likely begin seeing short-term holders start to FOMO in.

The percent supply in profit has jumped massively from 50% on January 1st up to 69%. A continuation of this trend would signal the beginnings of a bull market.

Below I have net unrealized profit/loss (NUPL) separated by long-term and short-term holders. This juxtaposition is interesting to me because it highlights an important distinction between the two cohorts.

Short-term holders tend to care much more about fiat denominated profits than long-term holders.

When the NUPL signal is green or blue, it indicates a high amount of relative unrealized profits are present. Note how this is rarely the case among short-term holders. This is because they are quick to realize fiat gains during a bull market and quick to jump ship during a bear market.. Long-term holders on the other hand will go through prolonged regimes of unrealized profits and unrealized losses; demonstrating their belief in a future world in which BTC is the primary reserve asset.

Net realized profit/loss adjusted for market cap. We have noted in previous additions the two major capitulations of this bear market. In June and in November of 2022, were the same amount of relative realized losses as previous capitulations; such as the 2018 bear market bottom and the 2020 covid-crash.

We have now seen the market realize net profits for basically the first time since April 2022.

SOPR allows us to see who it is that is actually realizing profits at this level. And, to no surprise, it is the short-term holders. As we observed with NUPL, STHs are much quicker to take fiat gains, while long-term holders are not satisfied with a 30% bounce off the bottom. We will likely not see a significant drop in the supply of BTC held by long-term holders until we near the previous all-time high.

STH SOPR just became greater than zero; indicating that coins moved by STHs have been done so in a state of profitability.

LTH SOPR on the other hand is still less than zero. This means that coins moved recently by long-term holders have been done so at a loss.

Moving on to transactional activity, there has not been a crazy uptick in new addresses, however, the 30-day moving average is still greater than the 365-day moving average, which indicates positive momentum.

To reiterate, bear markets are highlighted by declining on-chain activity, while bull markets are highlighted by increasing on-chain activity. Looking at the number of new addresses created daily is a good way to gauge which environment we are in.

There’s been a non-trivial surge in the number of on-chain transactions over the past two weeks; reaching a level not seen since the thick of the bull market in the spring of 2021. Increasing on-chain transactions is a sign of increasing demand; definitely a trend we want to see as we look for more confirmation of the end of the bear market.

On the derivatives side of things, the funding rate for perpetual futures open interest is positive. There were 2 days of negative funding during the pump back to $20k; showing traders were initially in disbelief of the rally.

There has been no significant build-up in open interest following this pump either which is good. Traders are still fearful of taking a long or short position. The decline in open interest relative to market cap has continued as well.

Lastly, realized volatility still remains relatively high but is showing signs of cooling off. The price action has been relatively flat the past couple of days and I expect this will remain the case until the Fed meeting on January 31st.

Bitcoin Mining

Pricing ASICs - A Valuation Model for Bitcoin Mining Rigs

Bitcoin mining rigs (ASICs) are a special segment of computer hardware that can be priced as a derivative of BTC and time. This report will use the terms mining rigs, ASICs, and machines interchangeably. Historically, the first Bitcoin ASICs depreciated quickly due to next-generation ASICs being multiples more efficient than their predecessor. Over the past few years, ASICs have clearly started to commoditize as technology approaches the limits of what is thermodynamically possible.

Due to the commoditization of ASICs, the Bitcoin mining industry has experienced a tectonic shift when attempting to determine the market value of this hardware. ASICs are no longer run for 6-12 months until they end up as e-waste. These machines now retain their value for significant periods of time and a large (yet fragmented) secondary market has developed for their nearly inevitable resale to a miner with a lower energy cost.

In this Blockware Intelligence Report, we describe:

How intelligent miners think about purchasing modern Bitcoin mining rigs.

A method to calculate beta (to BTC) and theta (time decay) on mining rigs to forecast future market prices.

Why mining Bitcoin is an attractive method to accumulate BTC and potentially outperform buying and holding spot BTC.

Energy Gravity

The following chart is based on a previous Blockware Intelligence Report that models the relationship between the price of Bitcoin and its cost of production. The model makes it easy to visualize when the price of Bitcoin is overheated or in the process of bottoming.

This week we continue to see more confirmation that Bitcoin is likely in the process of bottoming.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.