Blockware Intelligence Newsletter: Week 74

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 2/4/23-2/10/23

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs.

Summary:

Fed Chair Powell gave an interview on Tuesday which reiterated much of what he discussed post-FOMC last week with a subtly more hawkish tone.

The Challenger Report indicated that January 2023 saw the most layoffs announced in a single month going back at least 30 years.

2023 has seen the largest short squeeze for global equities since 2015, according to Goldman Sachs’ Prime Book.

Bitcoin price broke below the lower limit of its recent range.

The Bitcoin price is roughly equal to the cost-basis of long-term holders

Long-term holders, who tend to sell into strength, have not done so yet indicating the tides have not yet shifted to a bull market.

New entity momentum is increasingly positive which indicates new market participants are beginning to step back in.

Perpetual futures open interest has built up slightly as low volatility has not allowed for long-liquidations or short-squeezes.

Mason Jappa, CEO of Blockware Solutions, was quoted in the Wall Street Journal regarding the Core Scientific bankruptcy

Bitcoin mining is the optimal strategy to accumulate a long-term position in BTC.

Energy Gravity sits at $0.13, indicating that most modern miners have positive operating cash flows, but significant upside remains.

General Market Update

Following last week’s FOMC decision, it’s been another interesting week of price action. One of the biggest market movers came on Tuesday when Fed Chair Jerome Powell gave an interview at the Economic Club of Washington.

Most of what we heard was the same from his post-FOMC speech. However, there were a few moments where Powell took a slightly more hawkish tone than last week.

Powell noted both last week and on Tuesday that the disinflationary period has likely begun in the US, however this is a long and bumpy road. As we’ve heard continuously from the Fed, they still see the need to continue raising rates and likely hold them elevated for an extended period of time.

As you likely know, January’s jobs report came out last week, which showed an increase of 517k non-farm jobs in January. This was in comparison to 223k in December, and the consensus estimate of 185k.

This puts the US unemployment rate at 3.4%, its lowest since May of 1969. There are plenty of arguments about why this number isn’t totally accurate. For example, a growing number of Americans are taking on a second job, and the BLS updated their methodology, but that’s all a discussion for another time.

That all being said, with jobs numbers blowing estimates out of the water, it creates an incentive for the Fed to raise rates beyond what was initially expected. High employment means that Americans generally have more money in their pockets, which contradicts the pressure provided by a tightening financial environment.

Powell discussed this idea by saying:

“For example, if the data were to continue coming in stronger than we expect and we were to conclude that we need to raise rates more than is priced into the markets, or more than we wrote down in our last group of forecasts in December, than we would certainly do that, we’d certainly raise rates higher.”

While this is fairly obvious, and exactly what you’d expect to hear from the Fed, it is important to keep in mind.

The Fed has not issued forward guidance for months, which allows them to make any decision they please using the full spectrum of monetary policy tools. While it may be a good thing to see data improving, there is still a lot of work to be done, and there’s an ever growing risk of rates ending up significantly higher than previously expected.

FedWatch Tool (CME Group)

Last week we discussed how the market was pricing in a roughly ~60% probability that March’s FOMC meeting would bring the last hike of this cycle, leaving the FFR at 4.75-5.0%. The market has now adjusted to say that May’s meeting will likely bring the final hike, but still gives a strong possibility of another 25bps hike in June.

Remember that market estimates are just that, estimates. They are often wrong and adjust nearly every day to changes in Fed posturing and economic data.

To further touch on this, it is also important to note that historically speaking, many recessions looked like a soft-landing at first (2008 being the most recent example). When the health of the economy becomes a large concern, we’re all inclined to pick a side. Are we in a recession? Are we heading towards a recession? How deep will this recession be?

In the early stages of a recession, or perhaps just prior to one, we see that small declines in housing prices, employment, etc. are often viewed as “Look here, it isn’t that bad!”.

What analysts often forget to take into account is just how quickly data points can move once a crack in the foundation is exposed. For example, rises in unemployment are not linear. Instead, unemployment tends to have a cascading domino effect that creates exponential increases over the course of several months.

Are we saying that this is going to happen? Not necessarily, it’s just important to keep in mind that markets and data can move very quickly.

On the subject of jobs, it’s interesting to note that we’re seeing a large uptick in layoffs from the tech sector. The unemployment rate is aggregated based on the countless industries that employ American workers, but when we look at just the tech industry we can see recession-type layoffs on the rise.

The Challenger Report, compiled by Challenger, Gray & Christmas, shows us the total number of job cuts announced in the US. Specifically looking at the tech sector (shown above), we see that nearly 42,000 cuts were announced in January.

This was up nearly 58,000% from Jan 2022, and was the 2nd highest number of layoffs in a single month since Challenger began this report in 1993 (1st was November 2022’s ~53,000).

Retailers came in 2nd place with 13,000 job cuts in January, up 3,225% from January 2022. Next was the financial industry at 10,603 cuts.

As a whole, we see that announced layoffs are rising steeply, with the total across the economy coming in at 241,749 for January. There were nearly 57% more layoffs announced in the month of January than the entire 4th quarter of 2022.

Of these layoffs, approximately 84% cited economic conditions as their reasoning.

Furthermore, there were announcements of 32,764 planned hirings in January, this was down 58% from January 2022. So while unemployment doesn’t appear to be a major issue on the surface, when we look under the hood we’re seeing several industries weakening.

Now the question is, how is it that we’re seeing layoffs increase dramatically while we’re also seeing lower unemployment and initial jobless claims?

There are likely numerous reasons for this, there are 3 more obvious reasons our team sees. First, the labor market as a whole appears fairly robust, meaning that newly laid off individuals likely aren’t seeing the need to file for unemployment because they believe they can find new jobs quickly.

This would explain how we can have high layoffs but low initial jobless claims. Furthermore, despite the layoffs in tech, we’re seeing growth in hirings from industries such as energy, entertainment, and government.

Second, approximately 8M Americans are working more than one job. This means that it's possible to see layoffs with employment as a percent of the workforce remaining high.

Finally, it could have to do with the fact that the unemployment rate is a lagging indicator. The Challenger Report is somewhat forward-looking because it measures announcements of layoffs. The WARN Act from 1988 makes it so that companies with >100 employees must provide 60-day notice about planned mass layoffs (>50 layoffs at one location).

Generally speaking, when companies announce layoffs they are talking about a planned layoff. For example, this week Disney announced plans to layoff 7,000 workers, not that they’ve already fired 7,000 employees.

Therefore, there can be a lag between spikes in the Challenger Report and spikes in the unemployment rate. This doesn’t occur every time, but it has certainly happened before.

A good example of this was Q3 2000, when layoffs ticked higher with the unemployment rate moving lower. The unemployment rate then began climbing in Q1 2001, which was the “official start date” of that recession.

The chart above overlays the sum of layoff announcements with the US Unemployment Rate on a quarterly basis. Looking at the last 3 recessions (2000, 2008, 2020), we’ve seen 1 of 2 things occur.

Layoff announcements moving significantly higher alongside the unemployment rate

Layoff announcements moving significantly higher prior to the unemployment rate

Based on historical data, when layoffs cross above 250,000 it appears to be a fairly accurate recession indicator.

Over the last 30 years, 2001, 2008, and 2020 are the only times we’ve seen layoff announcements cross from below 200,000 to above 250,000 within 2 quarters.

In 2003, 2004 and 2005, layoff announcements also crossed above 250,000, but because they never substantially recovered from the previous recession, we are not counting these as recessionary indicators.

We’ve only closed 1 calendar month this quarter and layoff announcements already sit at ~242,000, therefore I don’t think it’s controversial to say that 2023 will mark the 4th time that layoffs hinted at recession in the 21st century.

There have been several instances where layoffs ticked higher without unemployment following suit, but these were all single quarter jumps that didn’t cross 250,000. Examples of this are Q4 1998, Q3 2011, and Q3 2015.

In the equity markets, we remain very overbought as a result of a massive short-covering event. Consequently, downside risk is elevated this week.

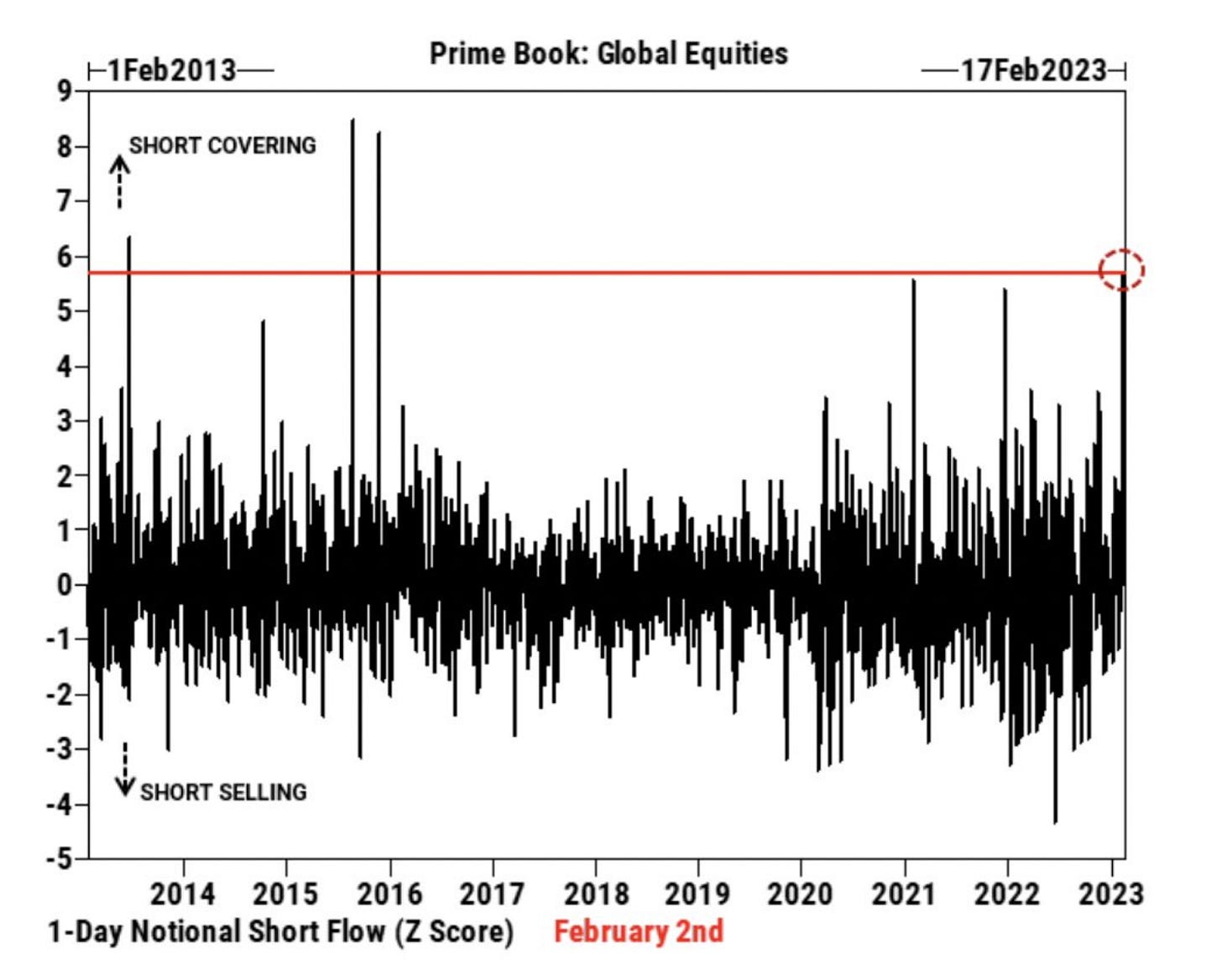

GS Prime Book: Global Equity Short Flow, 1D (@Schuldensuehner)

The chart above from Goldman Sachs shows a Z-score of the short flow, currently this is indicating that early-2023 has seen the largest outflow of selling (short squeeze) since 2015.

Short squeezes are very common in bear markets, and often create short lockout rallies before ultimately heading back lower. However, the old saying that “Markets climb the wall of worry” is a testament to the idea that short squeeze rallies can usher in market bottoms.

Whether or not the rally continues is anyone’s guess, but the short dynamic is certainly interesting and important to note.

That being said, we are seeing strength being sold fairly significantly here. Small-cap names that bounced last week largely saw selling this week. Energy stocks also saw similar price action, as a whole.

Nasdaq Stocks Above 20-DMA, 1D (Tradingview)

Furthermore, we’re starting to see a decline in breadth, as more names begin to sell off this week. The chart above shows the percentage of Nasdaq Composite stocks that are above their 20-day simple moving average.

Last week, as the % of stocks above the 20-DMA reached the mid-80’s, it indicated that a significant rally was underway, but was likely due for a cooldown. Now as buyers lose a bit of steam, we’re seeing the number of stocks participating in the rally fall.

Nasdaq Composite with McClellan Oscillator, 1D (Marketinout.com)

The McClellan Oscillator (bottom of chart above) is a breadth metric that compares 2 moving averages of the Advance/Decline Line. In summary, it shows us how breadth is behaving in the short-term compared to the longer-term trend.

At the moment, the Advance/Decline line for the Nasdaq is rolling over. The McClellan Oscillator above confirms that less names are increasing in price in the near term than were in the past.

Specifically, the McClellan Oscillator is indicating that, as of Wednesday, the average number of stocks increasing in price over the last 19 days is less than the average over the last 39 days.

While this could ultimately mean nothing, or even be bullish as it allows stocks to attract new buyers, it highlights that risk has significantly increased from the last several weeks.

In the Treasury market, we’ve seen a strong jump in yields this week that has also attracted demand for the US Dollar.

US 2-Year Treasury Yield, 1D (Tradingview)

Between Friday last week and Monday this week, we saw the yield of the 2-year jump nearly 16bps. This appears to be directly correlated to the 517k jobs number we discussed previously in this newsletter.

Once again, higher employment = higher demand = higher rates = higher yields

Treasury price action has been a strong leading indicator for risk assets throughout much of the last year. The weakness currently being shown from these securities, combined with the US Dollar (DXY) rising ~1.4% over the last few sessions, only adds to the increased sell pressure across the equity markets.

The factors discussed throughout this week’s Blockware Intelligence newsletter indicate a heightened risk of lower prices across assets in the coming weeks.

Crypto-Exposed Equities

Large selling of Bitcoin, combined with weakness from smaller-cap equities and Treasuries, has certainly generated some sell pressure for crypto-exposed equities this week.

The low liquidity and high short interest that we see across the vast majority of this industry certainly works to inject volatility into this group. Despite largely being up monstrously on the year, many of these stocks are seeing a deeply red week.

That being said, things are looking up for many public miners, at least for now.

RIOT released their January 2023 production update this week, showing that they earned a company record of 740 BTC last month.

Hash is continuing to come online despite the financial distress shown across this group in 2022, especially from miners that are liquid relative to the rest of the industry group.

RIOT, for example, topped Blockware Intelligence’s financial ranking of public miners using Q3 data. Nearly 4 months later, as the dollar-denominated value of the block subsidy grows, we’re seeing sidelined capital and hash put to work.

In case you missed it, be sure to check out the newest Blockware Intelligence report titled “Ranking Public Bitcoin Miners”.

Per usual, the table above shows the Monday-Thursday price performance of several crypto-exposed equities.

Bitcoin Technical Analysis

On Thursday afternoon we saw Bitcoin break below the lower-limit of the range we’ve been trading in for the last 3 weeks.

Bitcoin/US Dollar, 1D (Tradingview)

Last week we discussed the heightened downside risk that is associated with upwards sloping digestions in a bear market rally. These types of patterns generally don’t attract significant new buyers because price doesn’t fall back to attractive levels.

We also mentioned last week to keep an eye out for a break below $22,500 to signal weakness in the short-term. BTC cleanly broke through this level, along with its 21-day EMA. This selling, however, was on fairly light volume.

As previously mentioned, there is significant volatility risk around these levels as a result of weaker stocks and bonds, and a strong dollar.

Heading into the weekend, we’re looking at $21,500 to attract new buyers. If this level doesn’t hold, $21,000 or $20,500 are the next potential support levels we see.

Bitcoin Onchain and Derivatives

It’s been a quiet week for Bitcoin on-chain; nothing has changed structurally since last week’s newsletter.

The primary on-chain themes we are examining are, firstly, a change in psychology and behavior as the market enters a state of net profitability. Moreover, during the bear market on-chain activity has decreased significantly and the weak hands have capitulated. We are looking to see an increase in on-chain activity and/or more participation from speculators as a sign of an overall change to a bullish regime.

Yesterday was the most volatile day in a while yet BTC seems to be holding the line in this area around $22k. As of this morning (2/10/23) price is at $21.8k, just below LTH realized price which is $22.2k. The absolute lowest level I would expect BTC to drop to is STH RP, which currently is $19.3k; such a drop seems unlikely. BTC is still at historically cheap levels as indicated by STH RP being less than LTH RP.

Again, not much has changed over the past week. However, the market has sustained a state of net profitability, both unrealized, as indicated by the metrics previously shown, and in terms of realized profitability as shown in the chart below: net realized profit/loss relative to market cap.

Let’s take a look at long-term holder net position change. This measures the 30-day change in the supply of BTC held by long-term holders (a long-term holder is someone that has held BTC for 155 days or longer).

LTHs tend to sell coins into strength and accumulate during sideways/downward price action.

In spite of the recent positive price action, LTHs have net positive accumulation over the past thirty days. Continued accumulation from LTHs is a bullish sign; they understand that BTC is still cheap at the moment, and they are not content to sell here.

A point to keep in mind is that the threshold for a long-term holder is 155 days; roughly five months. All the entities that began accumulating after the initial drop to the low $20,000’s in June of 2022, not counting those that capitulated in the FTX collapse, are now classified as long-term holders. So if the price begins to move further up, into the mid to upper 20,000s, we will likely see some of those entities begin to realize profits, and the long-term holder net position change could flip negative.

Coin days destroyed multiplies the number of coins moved times the number of days since those specific coins were last moved. Essentially, this is measuring transaction activity with a higher weight given to the movement of old coins. Here I have charted the 50-day moving average.

Large spikes denoted a period of mass capitulation or profit taking. As it stands, CDD spiked when FTX collapsed (mass capitulation), and has now settled at a relatively low value which indicates we are still in a period of accumulation. Before we can declare a shift to a bullish regime, we would need to see CDD gradually increase, showing long-term holders distributing coins into strength.

The number of on-chain entities has sustained the positive momentum that we observed last week. As stated in the beginning of this section, increasing on-chain activity is a bullish sign.

Last week in the mining section of the newsletter we discussed the rise in NFTs on Bitcoin, also known as ordinals. This was made possible by the soft-fork known as taproot. The rapid increase in the popularity of NFTs on Bitcoin is measurable when looking at the rise in the on-chain adoption and utilization of taproot.

It is highly likely that during the next bull run, when demand for base layer block spaces increases, the majority of the entities using Bitcoin for the purpose of ordinals will be out-bid by those seeking to use the network for its most important property: financial settlement.

An interesting juxtaposition with the rise in taproot adoption is the fact that capacity on the lightning network has quietly reached new all-time highs. Over 5,100 BTC are currently being used to route transactions on the lightning network.

The lightning network is proving to be a critical component to the global adoption of Bitcoin as not only a store of value but also a medium of exchange. It is highly likely that the capacity of the lightning network will continue to grow throughout 2023.

Not much has changed in the derivatives market either. The funding rate is still positive; meaning longs have to pay a slight premium to shorts.

Perpetual futures open interest relative to market cap did see a slight increase recently. The increase is certainly worth noting and it was to be expected as we are, temporarily, in a state of low volatility. During periods of low volatility perpetual futures open interest is able to accumulate as neither shorts nor longs are being liquidated.

However, the increase doesn’t appear significant enough to say that the broader downward trend from the past couple months has broken yet per-say. Should we prolong in the sideways regime for a long period of time, open interest will continue to accumulate, and the next wave of volatility will be more wicked as a short-squeeze or liquidation-cascade will be triggered.

Bitcoin Mining

CORZ Bankruptcy

Blockware Solutions CEO, Mason Jappa was quoted in the Wall Street Journal discussing the Core Scientific bankruptcy. He explained how Bitcoin mining is highly energy intensive, and many of the large energy bills from the winter are just now being received, indicating that the BTC price increase in 2023 does not mean CORZ shareholders will get an unexpected windfall. Mining is a complex process and many of the CORZ shareholders likely don’t understand completely how it works.

Read the full article here.

Mining is the optimal form of DCA

On the Blockware Intelligence Podcast, we recently recorded a podcast with Sam Callahan from Swan Bitcoin. One topic discussed was the pros and cons of lump sum vs DCA investing in Bitcoin.

Sam explained how lump sum ironically historically outperformed DCA (ie: if you have cash, buy BTC today), but it came with extreme volatility that many might not be able to mentally handle.

Bitcoin is about survival. Everyone wants to buy at the top and everyone wants to panic sell at the bottom. If you are overallocated or overleveraged, it only exacerbates this problem, so it is important to balance potential reward with potential risk.

Mining offers capital allocators a unique opportunity when reviewing Bitcoin’s historical volatility. You can purchase new generation hardware like Bitmain’s flagship S19XP, earn a safe positive cash flow in the short to medium term, and likely still capture massive profits whenever the next parabolic bull run occurs.

At a $0.085 kWh hosting rate, the BTC breakeven price for an S19XP is ~ $13,700 today. If the price of BTC somehow did move towards that, older less efficient machines will shut off before that, moving the breakeven price even lower.

By purchasing Bitcoin ASICs and signing a hosting contract, you effectively lock in your USD monthly DCA (hosting bill) and your BTC-denominated cash flows (mining rewards). It’s like being able to purchase ~ 1 BTC every month for the next 12 months at $13,700. If the price of BTC moves up, the cost to mine that BTC only slowly moves up. The cost to mine will likely continue to rise due to halvings and upward difficulty adjustments, but historically the price of BTC rises much faster than mining difficulty in a bull market, meaning your cash flows from mining rewards can increase significantly.

The capital expenditure to purchase the ASIC is the price you pay to lock in future BTC at a relatively fixed price (difficulty adjustment).

Mining BTC enables you to maximize reward, minimize risk, and perform both a lump sum and DCA strategy. If you want to start mining, work with a trusted experienced partner like Blockware Solutions.

Energy Gravity

The following chart is based on a previous Blockware Intelligence Report that models the relationship between Bitcoin's price and its production cost. The model makes it easy to visualize when the price of Bitcoin is overheated or bottoming.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.