Blockware Intelligence Newsletter: Week 13

On-chain analysis, Macro-analysis, Equity-analysis; overview of 10/29/21-11/05/21

Dear readers,

Hope all is well and you had a great week. Bitcoin consolidating in a tight range between $60K and $64K. On the daily chart we’ve entered a volatility squeeze shown via the Wick HTF indicator. Hate to be that guy but, “it’s time to pay attention soon” and “volatility incoming” are the only strong opinions I have about the immediate term price action here. One thing to note though, during the last 3 squeezes we’ve had (shown in chart below) the market has first faked out to grab liquidity from breakout traders and then swiftly gone in the opposite direction. We’re currently sitting smack dab between the upper and lower bands, but that’s something to keep in mind as this plays out.

On Wednesday, after the Fed announced they would be slightly tapering during the FOMC meeting, we got a price correction along with a nice little reset of funding rates. We’ve seen funding recover a bit, but nothing outlandish. As we’ve talked about in the past, the real actionable signals from funding IMO come when there is a dislocation between price action and funding rates. At the time of writing we don’t have that. However, keep in mind we’ve haven’t seen aggregated negative funding in 30 days. This isn’t actionable in itself, but more of a precautionary fact to keep in mind, as at some point we will come back and reset financing.

Taking a peek at orderbooks, we see a confluence of bids across several major exchanges right around $60K. But, we’ve talked before about how these orders can be spoofs looking to generate liquidity above/below bid/ask walls.

Traders seem to be noticing these bids along with $60K holding as a strong bottom of this local range as well. I say this because a lot of long liquidations are set just below $60K, shown by the chart below. I know I probably sound like I’m saying that it “could go down or up” in the short term, so to clarify: $60K is a strong level until proven otherwise, if broken with volume would expect a liquidation cascade to trigger. Between $60K and $64K we’re still just ranging, but shown by the volatility squeeze in our first chart, I do think a move is coming soon. This range seems to be more about lack of liquidity than indecision & we talked about how with the last 3 volatility squeezes have faked out to grab liquidity before the real move.

Ok we talked about the short term for the people who care, now let’s zoom out to our bread and butter, the broader picture.

Weekly and bi-weekly SOPR showing that overall the market is still maintaining a state of profit and there’s no reason to be macro bearish until we would theoretically break below 1.

Short term holder profit/loss ratio, created recently by David Puell, is another way to guage the state of profit the market is trading in. Very similar to SOPR, except this compres the amount of short term holder supply in profit to short term holder supply in loss; rather than comparing the profit to loss that coins realized on each given day.

Just like SOPR, macro bullish until a theoretical failed underside retest of 1.

My illiquid supply shock ratio continues to climb, reaching an aggresive rate of ascent. The ratio is now at 2021 all time highs and the highest it has been since 2017. This shows that supply is getting locked up by entities who hold at least 75% of the BTC that they take in historically.

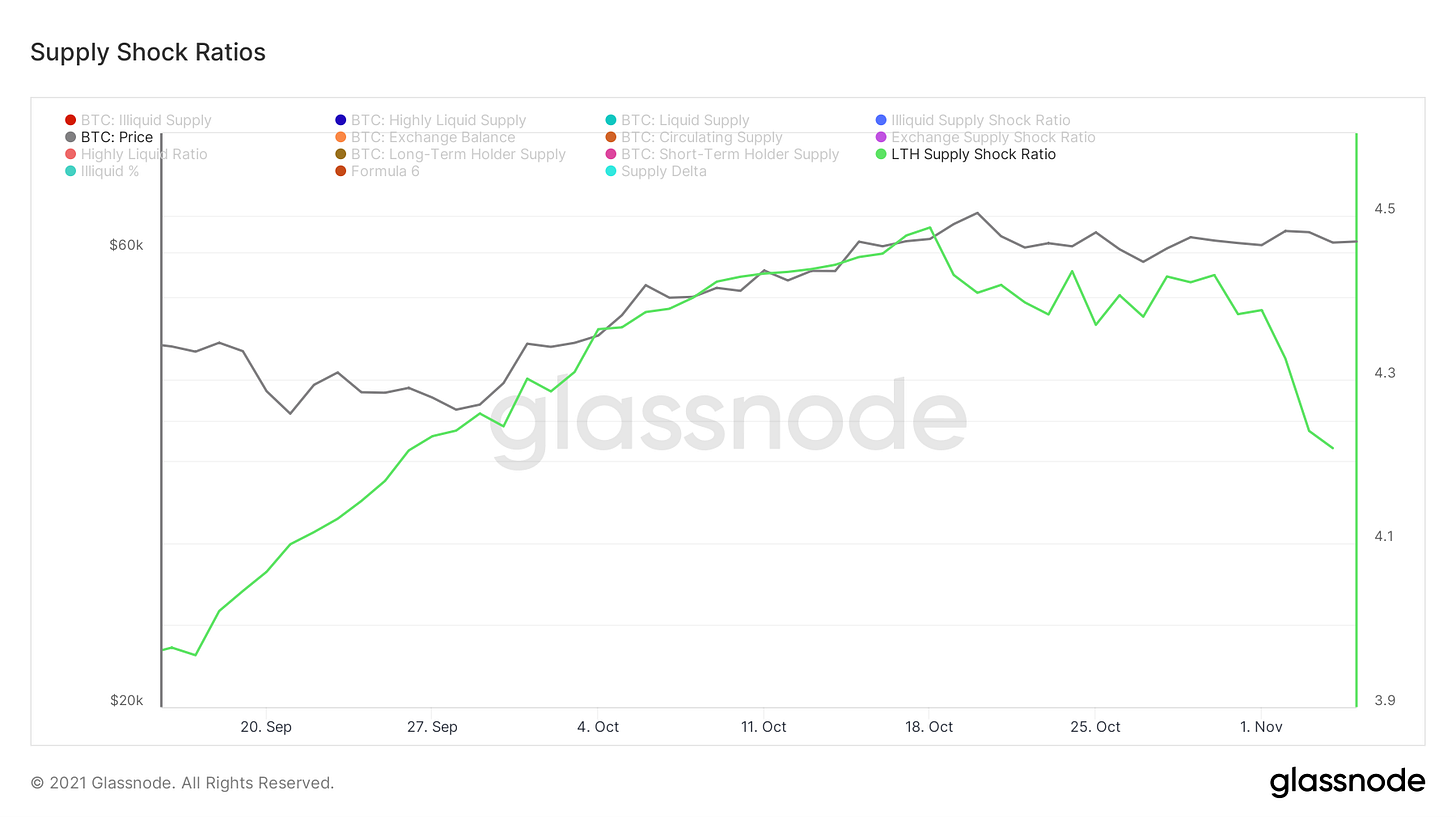

After reaching all time highs a few weeks ago, long term holder supply shock continues to roll over. This means that long term holders now feel comfortable distributing their coins to new market entrants, which is natural bull market behavior. Here’s an excerpt from the newsletter 3 weeks ago: “Long term holder supply shock has soared to unquestionable new all time highs. Remember: At some point we will start to see LTHs begin distributing, which is normal. Long term holders (and whales) buy weakness and sell strength. (see 2017 & 2020)”

The spending from older coins is also evident by our spent volume age bands, showing the amount of spent volume coming from each denominated time cohort at the top of the chart. Seeing the warmer colors (>1M old coins) increase means older coins are being spent.

Entity adjusted ASOL (with a 2 week moving average) also reflects this. This metric shows the average age of coins being spent on any given day, but doesn’t take into account volume. Confluence between this, SVAB, SOAB, CDD, and Dormancy; all showing old coins are starting to be spent

Last, we take a look at on-chain cost basis, created by my good friend Dylan LeClair. This looks at the realized price (or cost-basis) of short term holders and long term holders. When short-term holder’s cost basis is below LTH’s, it has historically been a great time to accumulate BTC. This is representative of short term holder capitulating and leaving during the bear market. When STH cost basis overextends LTH cost basis, it is time to be cautious because of exuburance in the market. Currently sitting lukewarm.

For more on the broader picture, check out this thread I posted last week. I went in depth, looking at over 20 different metrics/on-chain behaviors that I’ll be watching closely throughout the next few months.

Conclusion:

Immediate-term not clear but we know what to watch for as things unravel

Long-term bullish

Reminder that the Blockware Intelligence Dashboard is coming soon!

Also be on the lookout Saturday for my discussion with PlanB and Willy Woo, was an epic conversation.

Bitcoin-related Equities (written by Blake Davis):

So far it’s been a pretty awesome week for us in the land of crypto-exposed equities. With many coins trading in price discovery and Bitcoin looking to be gearing up to do the same, there are opportunities all around. As an investor of my particular style, we’re always looking to be in the strongest names in the market. These true market leaders are the names that are showing the most strength vs. the rest of the market and indexes. True market leaders will always outperform your average strength name. Like I said a few weeks ago, why buy a Toyota if you could get a Ferrari for the same price? We’ve only seen crypto-exposed names truly leading the market a few other times, when Bitcoin was making highs. We can now see similar behavior, institutions are gobbling up shares of crypto stocks as if they expect a rally in Bitcoin through all-time highs.

The best part about being a technical analyst is that we don’t need inside information to see this strong demand. It takes two seconds of looking at a chart to see how aggressively institutions are buying shares. There’s an investment saying that goes “No matter how slowly an elephant gets in the bathtub, the water level is going to rise.”. This means that no matter how slowly an institution builds their position, they are still going to cause price to increase. This week we aren’t seeing elephants dipping their toes in the tub, they’re jumping in from a high dive. When demand outweighs supply, price goes up. The stronger the demand, the more aggressively price upticks. When we see price screaming into highs with volume in the 100%+ range it's clear that institutions are aggressively buying.

One chart that makes me bullish for a sustained rally in both growth and crypto-exposed stocks is IWO. This is a Russell 2000 ETF specifically focused on growth stocks. Since the market topped back in February, we’ve seen a 9 month base being built. We know that historically, the longer the base, the bigger the breakout. On Monday, we saw IWO breakout of this 9 month wedge to the upside. This simply adds jet fuel into the engines of growth stocks. A breakout among growth names, combined with Bitcoin right at highs, provides a great launchpad for crypto-exposed equities into the new year. Ideally we would’ve liked to see IWO breaking out on huge volume, this would be another sign that there’s massive demand for this fund. But volume doesn’t pay, only price does. That is why we say “price is king”, volume is just a secondary indicator. Volume often comes in days or weeks after a breakout, so for now this is not a concern.

Going through my watchlist of crypto-exposed names, there’s no shortage of relative strength. It seems this week you could’ve pulled a crypto stock out of a hat and built a profitable position. Instead of giving a short list of the top names, I’d like to help people build their own watchlists. I find it important to keep a few different watchlists, personally I keep one huge one and then from there separate it into smaller lists based on level of strength or industry group. I posted my crypto-exposed watchlist on Twitter a couple weeks back. I’d highly recommend making your own or adding names from mine that you don’t have. I understand that there are certainly more companies out there with exposure to crypto and blockchain. It also should be noted that most of these names are now extended from a buy point and most of their moving averages. For me, that isn’t a place I’d like to be buying. FOMO can absolutely hurt an investor who is unwilling to wait for a new set-up to buy. If you missed the move this week, don’t beat yourself up, give yourself the knowledge and tools to get the next one.

There are, of course, varying degrees of leadership qualities among these names. If I had to sort this list into two separate tiers, the good and the not as good, I would put NVDA, AMD, BITF, VYGVF, BRHPF, HIVE, COIN, RIOT, BITQ, BLOK, CRPT, MARA, MSTR, GBTC, SI, HUT, ETHE in my top list.

👍🏼

lets goooooo