Blockware Intelligence Newsletter: Week 96

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 7/15/23-7/21/23

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through July 2023.

1. Blockware Intelligence Podcast. Blockware Solutions Head Analyst, Joe Burnett, sits down with “Rational Root”, a prominent Bitcoin on-chain analyst. Using on-chain data to support his arguments, Root articulates a convincing thesis as to why Bitcoin may not actually continue to experience “diminishing returns” during each subsequent bull market.

This is a great deep-dive into the cyclical nature of Bitcoin, and why the future may be more bullish than you think. It is recommended that you watch the video for this episode, and not just listen to the audio, as many supporting charts are displayed on screen.

General Market

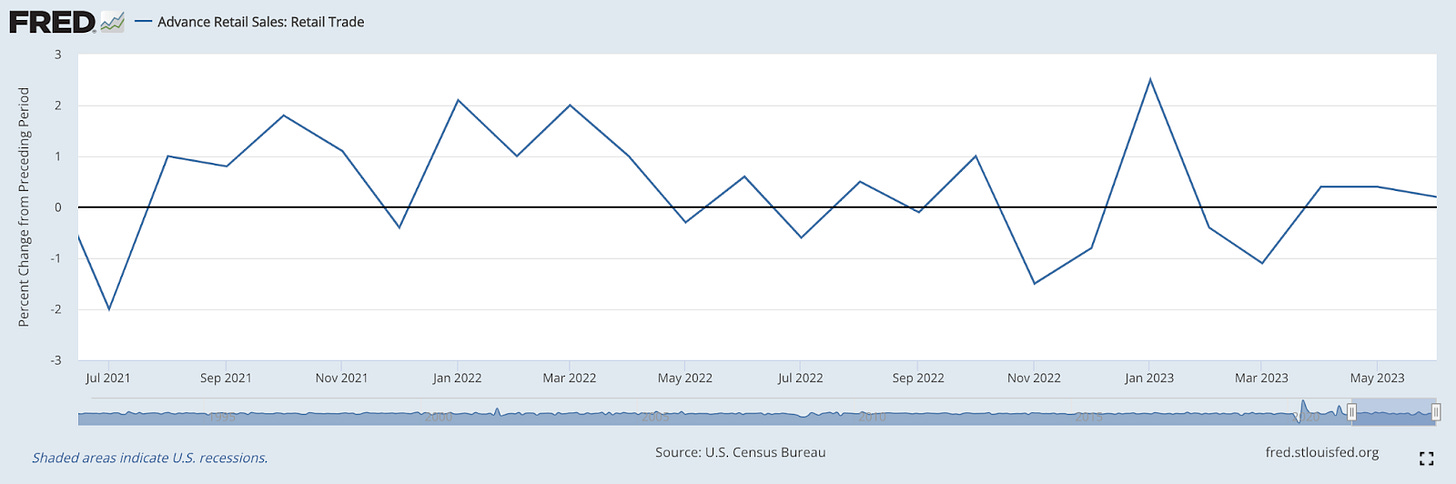

2. Advance Retail Sales. Retail sales rose in June for the third consecutive month. The consumer appears to be quite strong despite prospects of recession. This spending growth largely came from furniture, electronics and online shopping. Sales dropped in grocery stores and gas stations.

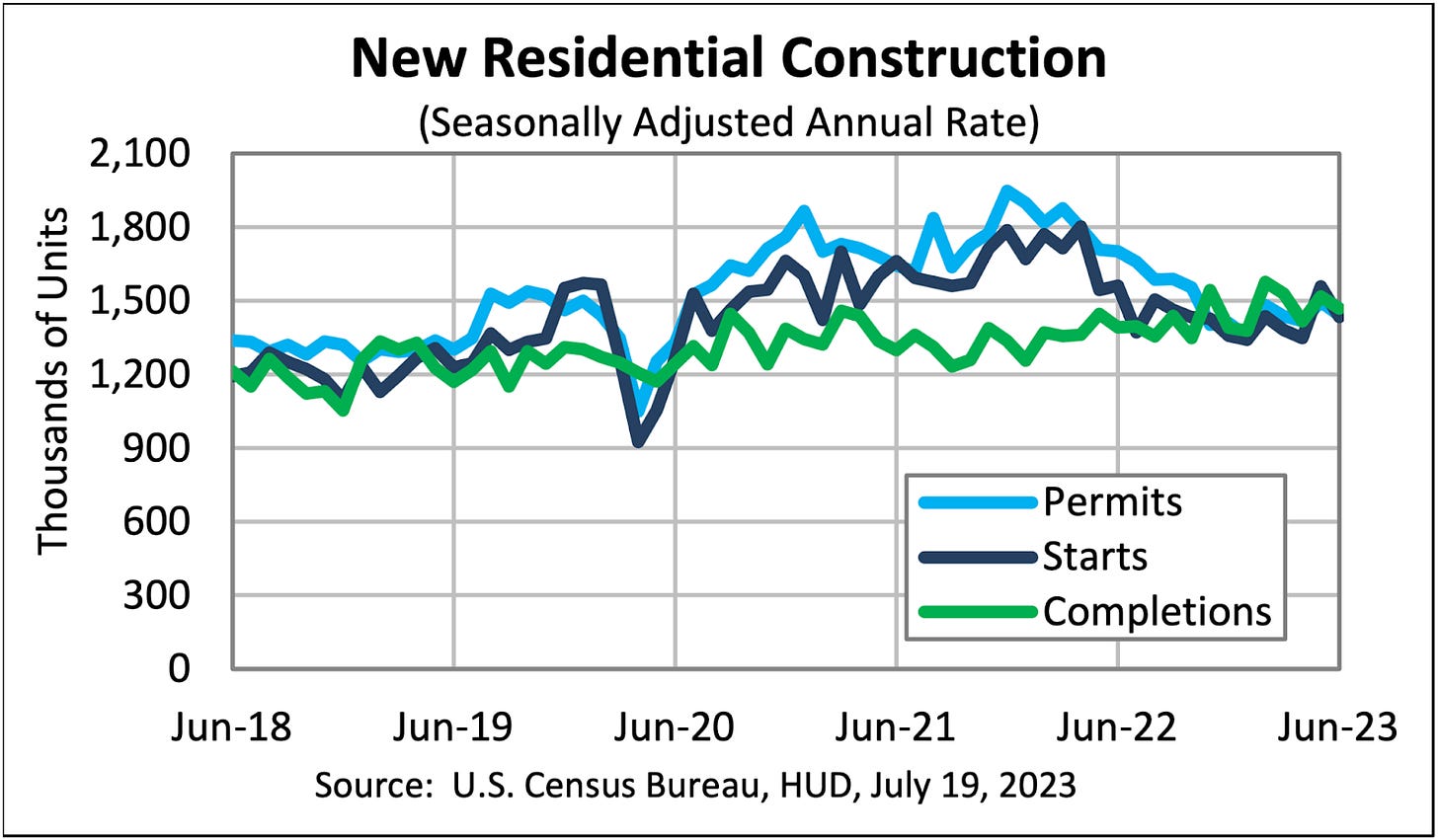

3. New Residential Construction Starts. US residential housing starts declined 8.0% in June, as the US 30-year average fixed mortgage rate nearly cracked above 7.0% last week. It appears that the housing recession may be underway.

4. Russell 2000 ETF (IWM). Stocks have begun to see a pull back (as of the time of writing), after many weeks of strong gains. While there isn’t any major reason to believe this will be sustained for long, investors would be wise to adjust stop losses accordingly. The Russell 2000 small-cap ETF, as seen below, hit resistance this week.

5. 10-Year Treasury Yield. The pullback from many US equities was accompanied by a jump in Treasury yields on Thursday. While yields have begun to retreat at the time of writing, this is something to keep an eye on for the remainder of the session.

Bitcoin Exposed Equities

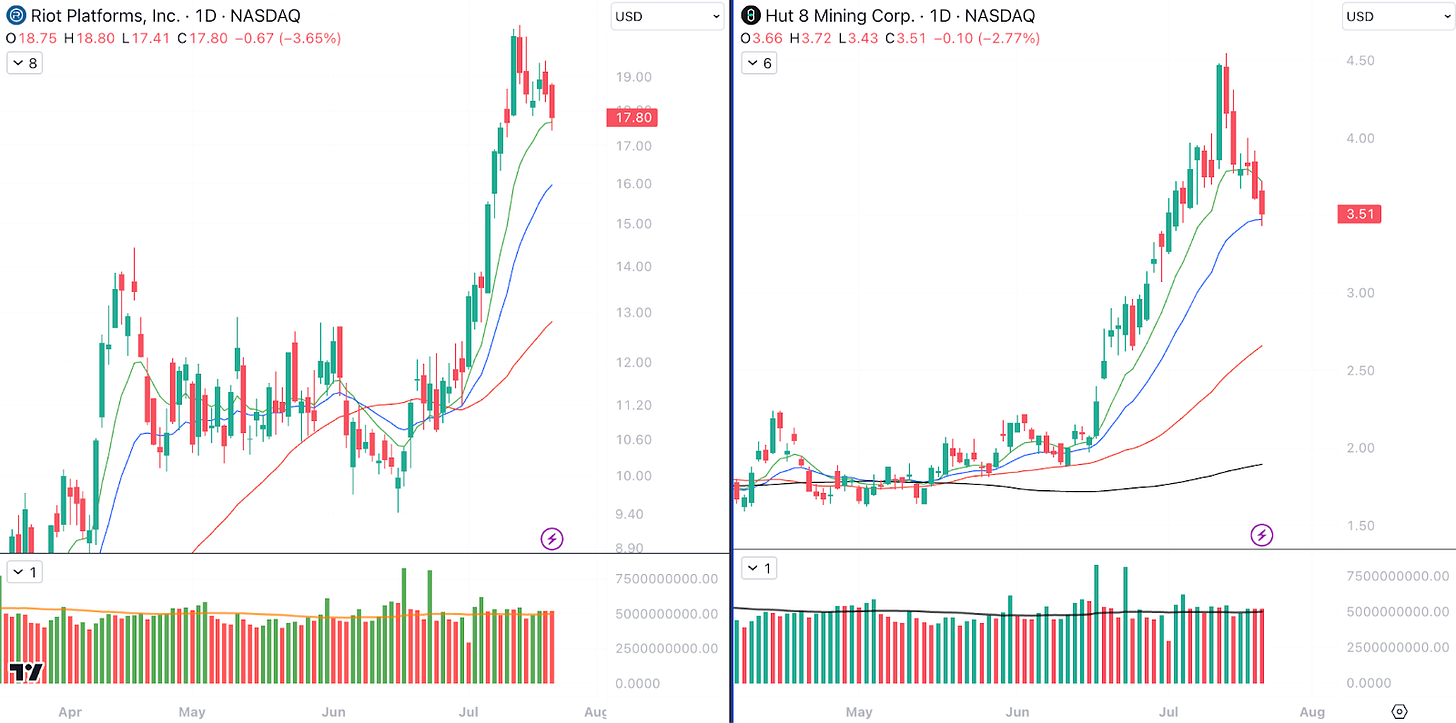

6. Riot Platforms vs. Hut 8 Mining. Bitcoin-exposed equities have also seen a pullback in recent days. This provides an excellent opportunity to spot names showing strength relative to the rest of the industry group. One example of this can be seen below, with RIOT pulling back to its 10-day EMA, while HUT came down to its 21-day EMA. Shallow pullbacks on light volume are ideal, and should be welcomed by those who missed the initial move higher.

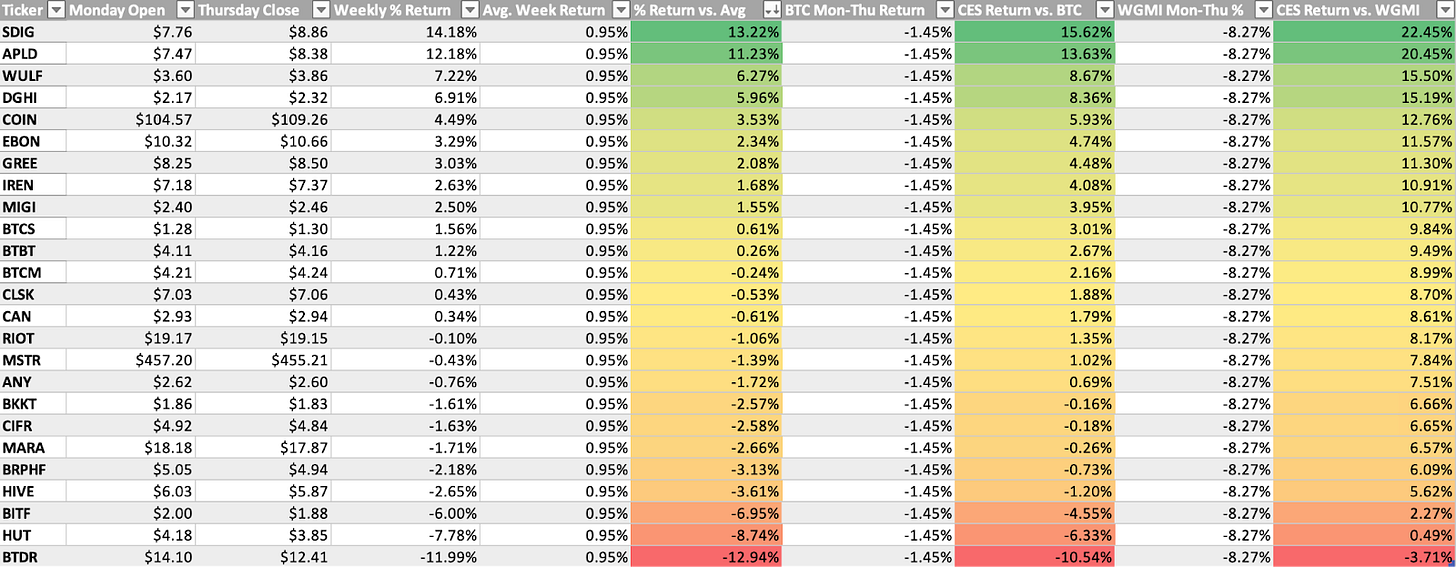

7. Bitcoin-Exposed Equity Comparison. Below, as always, is the table comparing the Monday-Thursday performance of several Bitcoin-exposed equities, Bitcoin, and Valkyrie's Bitcoin Miners ETF. Notice how most individual names are outperforming BTC and WGMI here. While sellers have regained some control this week, it doesn’t appear too overwhelming.

Bitcoin Technical Analysis

8. Bitcoin / USD. Unsurprisingly, Bitcoin has also seen a pullback this week within this current flag. BTC has been able to hold the lower limits of this range thus far, but keep an eye out for a break below ~$29,500 to signal a failed breakout this weekend.

Bitcoin On-Chain / Derivatives

9. BTC’s year-to-date correlation with $SPX (used as a proxy to represent risk assets as a whole) is at -0.25. Investors may be shifting their perspective on where BTC lies on the risk spectrum.

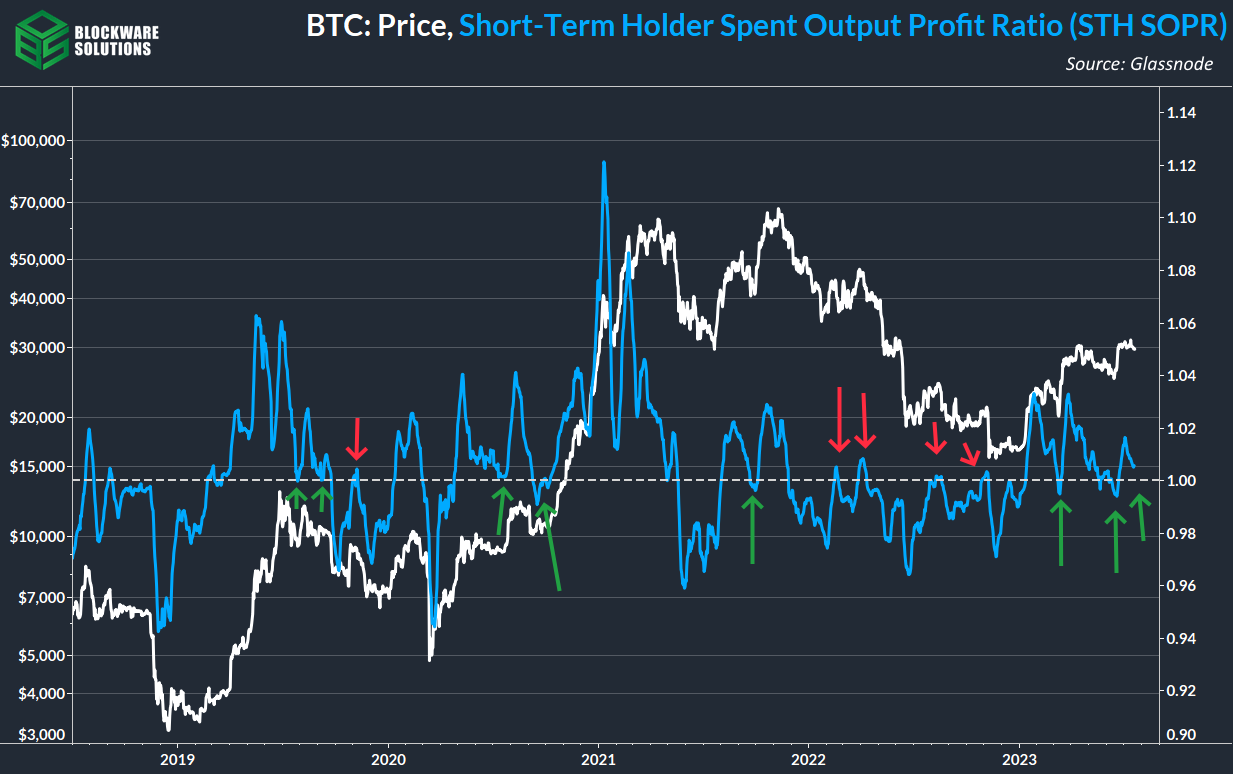

10. Short-Term Holder Spent Output Profit Ratio (STH SOPR) indicates that STHs, in aggregate, are moving coins at a profit. It appears to be nearing a rebound at breakeven which tends to signal local bottoms during bull markets.

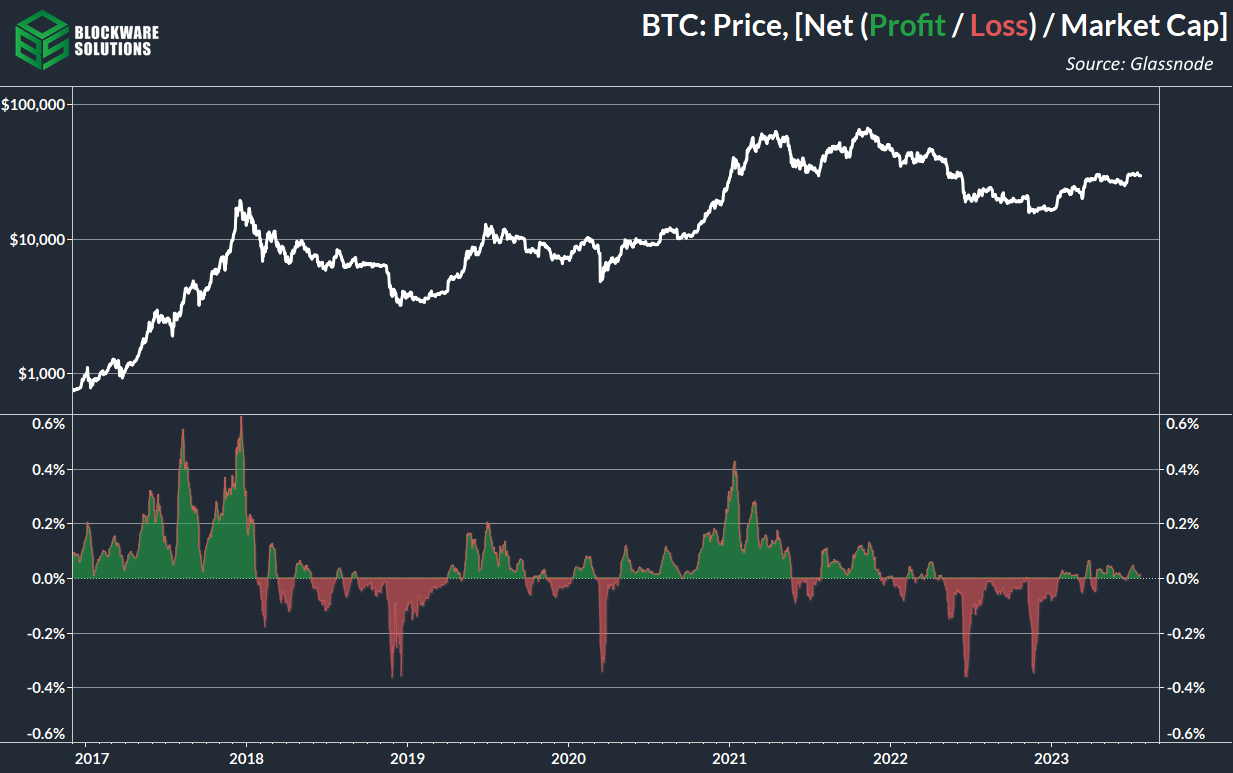

11. Net Realized P/L as a % of Market Cap. The market as a whole remains in a regime of net profit taking. However, on a market cap adjusted basis, very few profits are being realized which indicates those deepest “in the money” are continuing to HODL.

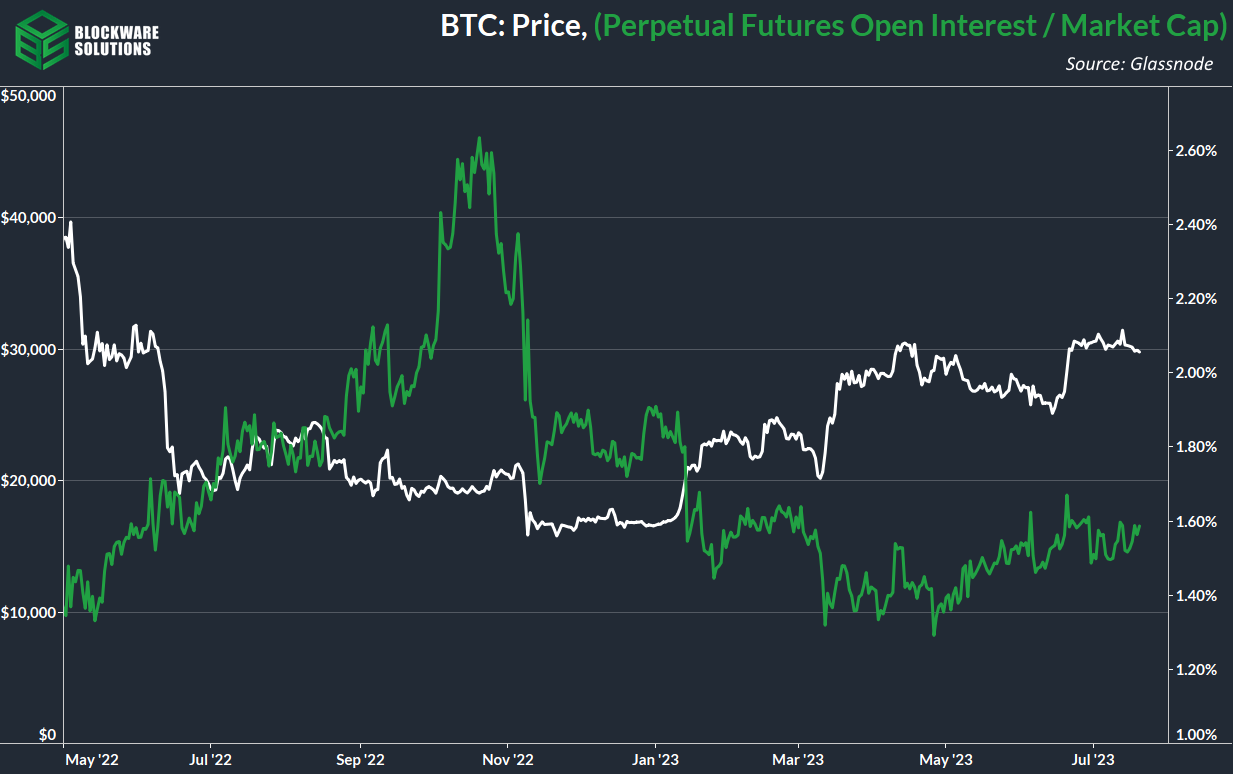

12. Perpetual futures open interest as a % of market cap (OI / MC) has remained flat over the past thirty days. This shows that there has not been a change in the risk appetite of futures traders, despite BTC holding this ~$30k mark for the past month. OI/MC remains relatively low, which means that spot will likely keep driving the price higher in the short to medium term as supply continues to slowly contract into the hands of long term holders.

13. ETH / BTC has continued its months-long downward trend following “the merge.” This metric is a good proxy for the performance of alts as a whole vs BTC. It declined significantly during the regulatory crackdown on “crypto” exchanges; and the attempt to rebound those losses appears to be failing.

Bitcoin Mining

14. $WULF. Public miner TeraWulf is purchasing 18,500 Bitcoin ASICs following $RIOT and $CLSK who also have both made large ASIC purchases earlier this year.

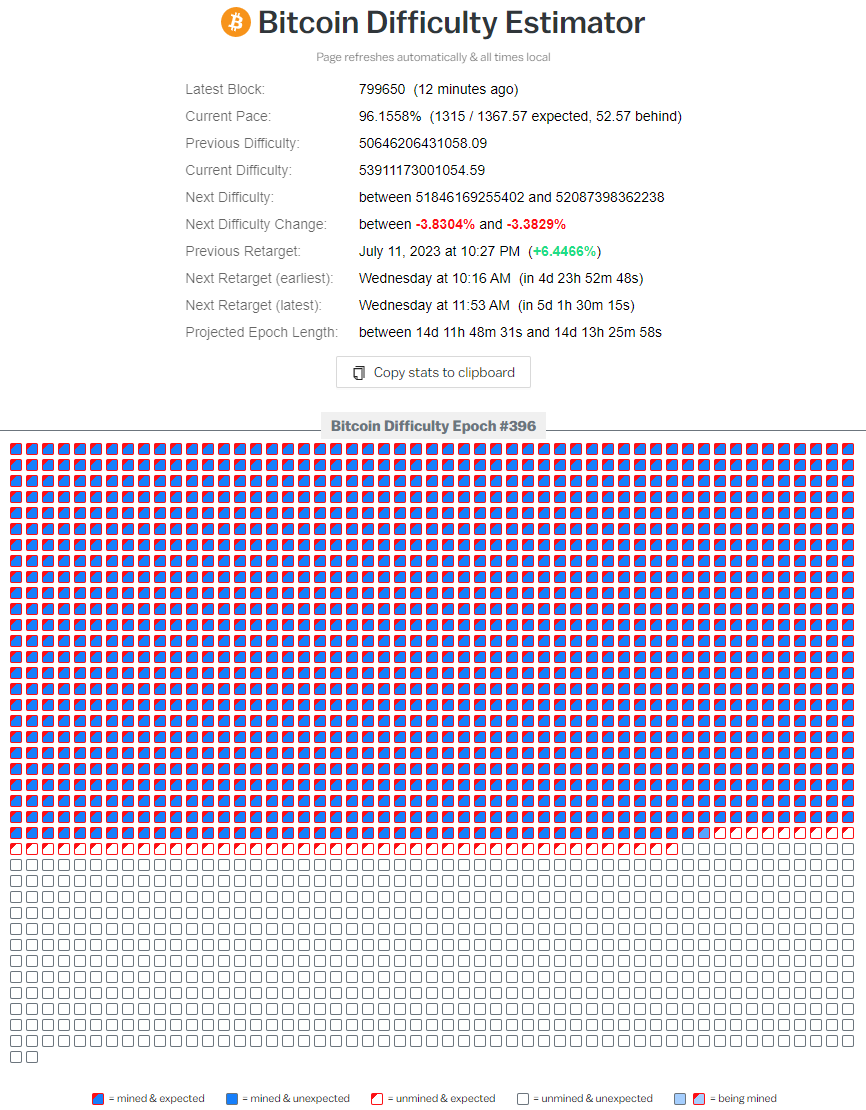

15. Next Difficulty Adjustment. We are now 5 days or so away from the next difficulty adjustment. Unsurprisingly, we’re not quite going to see another massive drop, but it does seem likely we see a small downward adjustment. It is currently estimated to be around 3.5%.

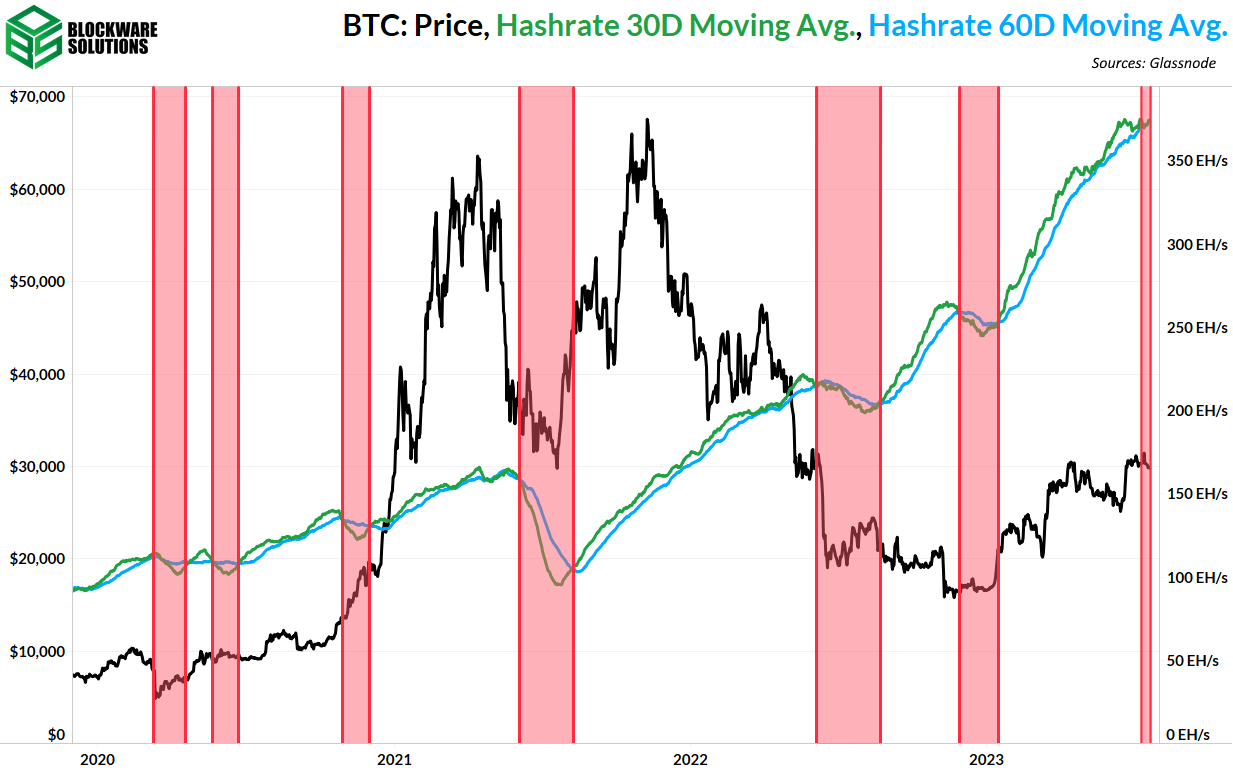

16. Hash Ribbon. A small “miner capitulation” as indicated by the Hash Ribbon metric recently occurred. This can likely be attributed to the significant downward difficulty adjustment at the end of June when miners were curtailing in the summer heat.

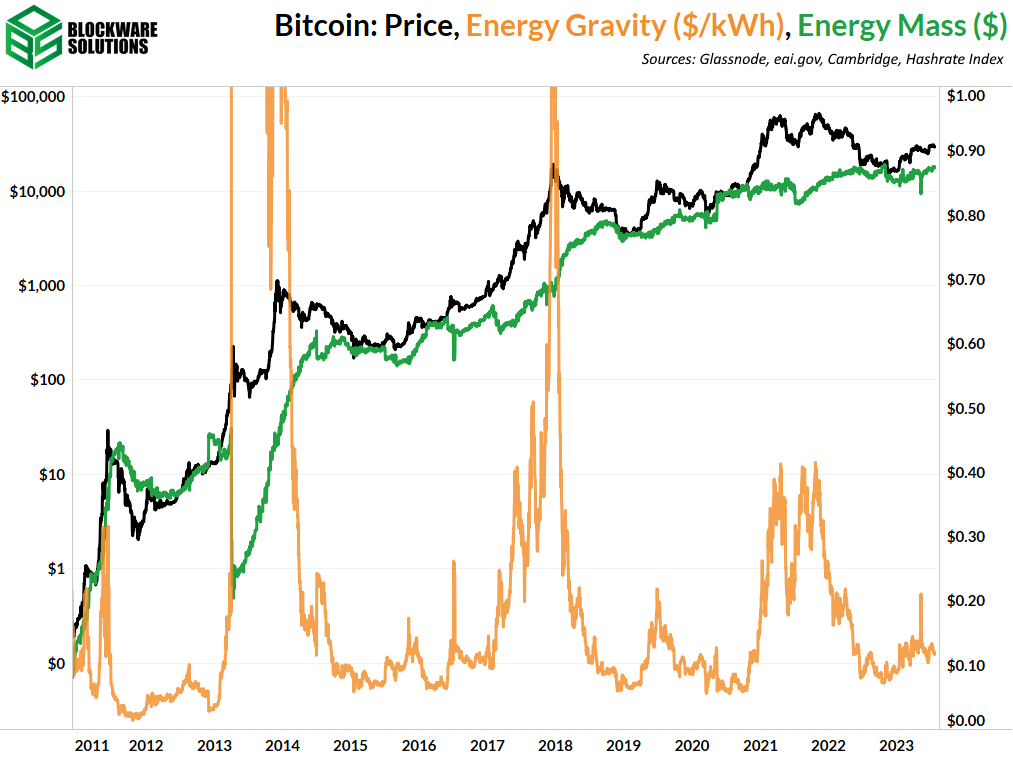

17. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$17,896 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.