Blockware Intelligence Newsletter: Week 54

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/3/22-9/9/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by securing the network. Your mining rigs, your keys, your Bitcoin.

Know someone who would benefit from concierge service and world class expertise when buying Bitcoin? Give them one year of free membership in Swan Private Client Services ($3000 value) -- email blockwareHNW@swan.com and we’ll hook it up! (And yes, you can give it to yourself 🤣)

Summary

As we’re now less than two weeks away from the September FOMC meeting, CME futures data is predicting that the US will likely follow Canada and the EU’s move for a 75bps increase to the FFR.

The major equity indexes are seeing a solid bounce on Friday, but the primary trend is down and we’re still likely to be in the midst of the third leg down.

The 2-10 Year Treasury yield spread remains inverted at -0.20, and while it has recovered fairly significantly since August, it’s at its lowest since 2000.

Bitcoin found support at $18.6K and, at the time of writing, has caught a strong bid precisely as predicted in this newsletter last week.

STH vs LTH realized price within $1.4k

Bitcoin is approaching 1 year since it hit an ATH

Market Cap to Thermocap Ratio nearly in the buy zone

The White House questions the environmental impact of Bitcoin mining, but begins to recognize the impact mining has on incentivizing the build-out of renewable energy.

Hash price ($ / TH / day) has made new lows not seen since October 2020.

General Market Update

Following last week’s continued selloff, it would appear that the stock market indexes are now getting the oversold bounce that this newsletter discussed last week.

Most important to note and keep in mind is that the Fed Open Market Committee (FOMC) will be meeting in 2 weeks (September 21st) to determine the next move for interest rates in the US.

We are now 2 weeks past Powell’s Jackson Hole speech, in which the Fed Chair injected fear into the market with his promise to bring down inflation by any means necessary.

Furthermore, on Wednesday we saw the Bank of Canada hike their rates by 75bps to the highest level since 2008. Then, on Thursday, the European Central Bank also increased their rates by 75bps, their largest increase in history.

In the US, the market is pricing in the high probability of a third consecutive 75bps hike.

CME FedWatch Tool

The FedWatch Tool is a useful data set provided by CME Group, the world's largest derivatives exchange, which uses Fed Funds Rate futures data to form an estimated probability of certain rate increases for the next meeting.

As you can see above, the FedWatch tool is currently predicting an 86% probability of a third-consecutive 75bps FFR hike. That being said, there’s two follow up points to be made.

First, this tool is just a prediction and has been wrong in the past, and second, we are still 2 weeks away from the Fed’s decision and a lot can change in that time.

But as previously mentioned, the market has been pricing in this information for a couple weeks now. After Powell’s hawkish speech in Wyoming, many investors feel that as though a 75bps hike is more likely than not, thus the sell off we’ve seen in bonds and stocks the last few weeks.

The most likely scenario is that we’re in the midst of a true 3rd leg down, one that would likely undercut the YTD lows. Whether or not that happens, who knows, but 3-legs down is a very common shape for historical bear markets.

2000-02 Bear Market S&P 500 1W (Tradingview)

Take the 2000 bear market for example, as highlighted above you can see the 3 legs it took lower. Now if you compare that to 2022 below, you can see the similarities.

S&P 500 Index 1W (Tradingview)

Whether or not the current decline will end in an undercut of the YTD lows at ~$3637 for the S&P is anyone’s guess, but currently the trend is pushing us in that direction. It’s most likely that, if we reach that low, it would be an area with strong buyers attempting to support price, but we’ll see.

But as we discussed here last week, the market has been due for some sort of oversold bounce. Markets never move in a straight line, and once sellers have extended themselves far, it becomes difficult to find more sellers to continue pushing prices lower from already very low levels.

QQQ Short Interest (Nasdaq Data Link)

The oversold nature of the market has been without discussing the relatively high levels of short interest we saw in the market a couple weeks ago. This week, as we’re seeing a slight bounce in the indexes, short interest has fallen a bit.

This simply illustrates how bounces in the midst of a decline are generally caused by short covering. Short covering refers to the process that occurs when short sellers close out their positions by buying back the shares they had originally sold short on margin.

Alongside the weakness we’ve seen in equities over the last few weeks has been weakness in Treasury securities.

This week, yields on the US 10-Year Treasury are up nearly 0.1%, and are on track for their 4th consecutive green week. Currently, 10-year yields sit at levels not seen since mid-June.

Throughout 2022 we’ve seen a common theme of the bond market leading price action in equities. In other words, when bonds are selling off but equities are bouncing, the stock market has usually been “wrong” and doesn't take long to follow the fixed income market’s lead.

Furthermore, the spread between 2-year and 10-year Treasury yields has been negative for over 2 months now, after crossing below 0.00 on July 5th.

US 2-10Y Spread (FRED)

Currently, the 2-10Y spread sits at about -0.20, which is its lowest value since September 2000, but it has rebounded from -0.48 on August 9th.

The difference between the yields of these 2 Treasury bonds is significant in that it provides us with a quantifiable way of measuring investor’s aggregated outlook on economic conditions.

When the spread is negative, or when the yield of the 2-year is higher than the 10-year, it signals to us that investors are very pessimistic about the near-term economic environment. A higher 2-year yield (AKA lower 2-year prices), indicates that investors feel safer having their money tied up for longer.

But the effect of an inverted yield spread is tangible, and not just a signal of turmoil. When short-dated bonds have high yields, it forces banks to increase interest rates on consumer loans. We’ve seen this playing out in the housing market as of recent, but more on that in a bit.

Alongside rising yields this week, we’ve seen more strength from the US Dollar early in the week.

At the time of writing, DXY price has retraced a bit to be red on the week, but earlier in the session on Wednesday we saw the index break above $110 for the first time since June 2002.

This rise in USD’s value has exacerbated the recent declines we’ve seen in oil and gold prices. While the decline in oil prices likely has something to do with a decline in demand, which is a recessionary indicator, when USD is rising, it requires less dollars to buy the same amount of the commodity.

Now that DXY is reversing, it could aid the bounce we’re seeing in equities and fixed income securities.

As we’ve previously mentioned, we’ve seen a rise in consumer interest rates. There are a variety of reasons for this.

30-Year US Average Fixed Mortgage Rate (FRED)

The chart above shows the average 30-year mortgage rate in the US, which sits at 5.89% as of Thursday. This is the highest rate since November 2008 and shows us just how aggressive the Fed’s hikes have been.

In the US, under fractional reserve banking, banks are required to keep a certain amount of capital on reserve. Some banks may not have enough, while others have a surplus.

Banks that are light on cash borrow money (usually just overnight) from other banks. The Fed Funds Rate is what determines that overnight lending rate.

So because the cost of capital is rising dramatically for banks, they are forced to raise interest rates for their customers in order to retain profits. This is what is going on in the housing market.

US New Home Sales (Trading Economics)

Furthermore, we’re seeing a steep decline in new home sales in the US. So because banks are signing less mortgages, they will also raise rates in order to accommodate the drawdown in interest revenue.

Now despite higher interest rates, and declining demand for houses, we’re yet to see housing prices catch up.

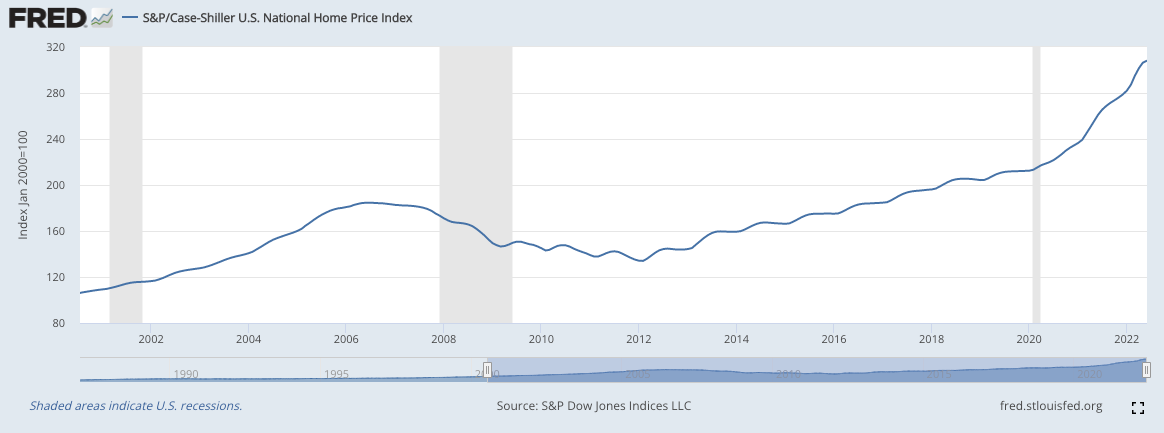

Case-Shiller US Housing Price Index (FRED)

Above is the Case-Shiller Index for home prices. This index hasn’t been updated since July but it still shows the fact that housing prices have been continuously rising, at a steepening rate, since 2012.

The most logical conclusion to be made based on all of the data just presented is that housing prices are headed lower. Of course anything could happen, but declining demand and rising interest rates is a recipe for a decline in home prices.

As a signal of the state of banks, consumer health and the overall economy, mortgage rates are a key thing to have an eye on in this environment

Crypto-Exposed Equities

Overall, it’s been a relatively stronger week for crypto-equities. We’re some pretty sizable bounces in select names as of Thursday.

Multiple times in 2022 we’ve seen crypto-equities leading price action in crypto-assets themselves. The reason for this is unclear, most likely is that institutional investors are front-running crypto buys in an attempt to double-dip on their profits.

As of Thursday, the better looking bounces we’re seeing have come from: MARA, RIOT, CLSK, and SI.

That being said, as of mid-session on Friday, many of these names have run into declining key moving averages. These are likely zones to see profit takers or shorts step in, so keep an eye on whether the current strength will be enough to absorb this selling.

Above, as always, is the table comparing the weekly price action of numerous crypto-related equities in comparison to spot BTC and the mining ETF WGMI.

Bitcoin Technical Analysis

On Tuesday, Bitcoin broke below the flag range that we highlighted and predicted in this section last week.

BTCUSD 1D (Tradingview)

As of Friday morning, we’re seeing BTC gain fairly strong support around late-June and early-July levels. Above we’ve left the levels highlighted in this newsletter last week, our discussion of a pullback to $18,600 before bouncing has played out to a T.

It’s likely that the buyers here are strong enough to keep price afloat for a bit, but it’s more likely than not that price continues lower rather than retaking the August highs.

Tuesday’s selloff came on relatively large volume, ~55% larger than its 50-day average. Wednesday’s candle was supportive and regained some momentum, but the buying wasn’t enough to drastically change the current price structure.

On Friday we’ve seen strong bids for BTC pushing price back higher, the volume candle for today will likely be massive too. One thing to watch for is a reversal in price.

BTC currently has a massive volume shelf sitting overhead at about $19.7K-21.6K. The volume profile indicator (shown on the chart above) shows us volume from a vertical perspective.

The regular volume indicator shows us the amount of coins being traded each day, volume profile shows us the amount of coins traded at each price level. When there is a lot of volume sitting overhead, we can expect some of this volume to turn into profit taking selling.

Thus far, BTC has handled this overhead supply well, but keep in mind the psychology of looking to get out at breakeven. That is why a downside reversal candle is a concern of ours.

If that isn’t the case, $21.7-21.8K is a likely area to run into some resistance.

While, once again, anything could happen, and we at Blockware Intelligence unfortunately cannot predict the future, remaining open to any responsibility is how participants can better manage risk and gauge emotions.

Bitcoin On-chain and Derivatives

This newsletter is written on Thursday nights to be released on Friday. We are writing this quick note Friday morning to address the 10% pump in the Bitcoin price that occurred during the night.

While this is exciting, Bitcoin is still below important levels such as its 4 Year Moving Average and Realized Price. Until Bitcoin can flip these levels into consistent support the short term outlook is crabbish/bearish.

Now let's get back to your regularly scheduled programming.

We are continuing to keep an eye on Long Term Holder Realized Price and Short Term Holder Realized Price. They are now within $1,400 of each other.

STH Realized price crossing below LTH Realized Price will be a strong signal that we are in the deepest part of the bear market.

The BTC price currently being below the Realized Price for both classes of holders means that a majority of the people accumulating BTC right now are doing so at a price less than their cost basis. Sats stacked in this range will likely be extremely valuable in 2-5 years.

Another favorite valuation metric of mine is the Puell Multiple. This measures the daily issuance value of BTC (in dollar terms) with the 365 day moving average of the daily issuance value.

The Puell Multiple has entered deeper into the value zone. Dollar-cost averaging in this range has historically been a very wise move.

A point worth mentioning is that we did not have a blow-off top during this previous bull run. The Puell Multiple highlights that idea. Given that this cycle’s bull run was different from previous cycles is reason to believe that this bear cycle could be different as well. Only time will tell.

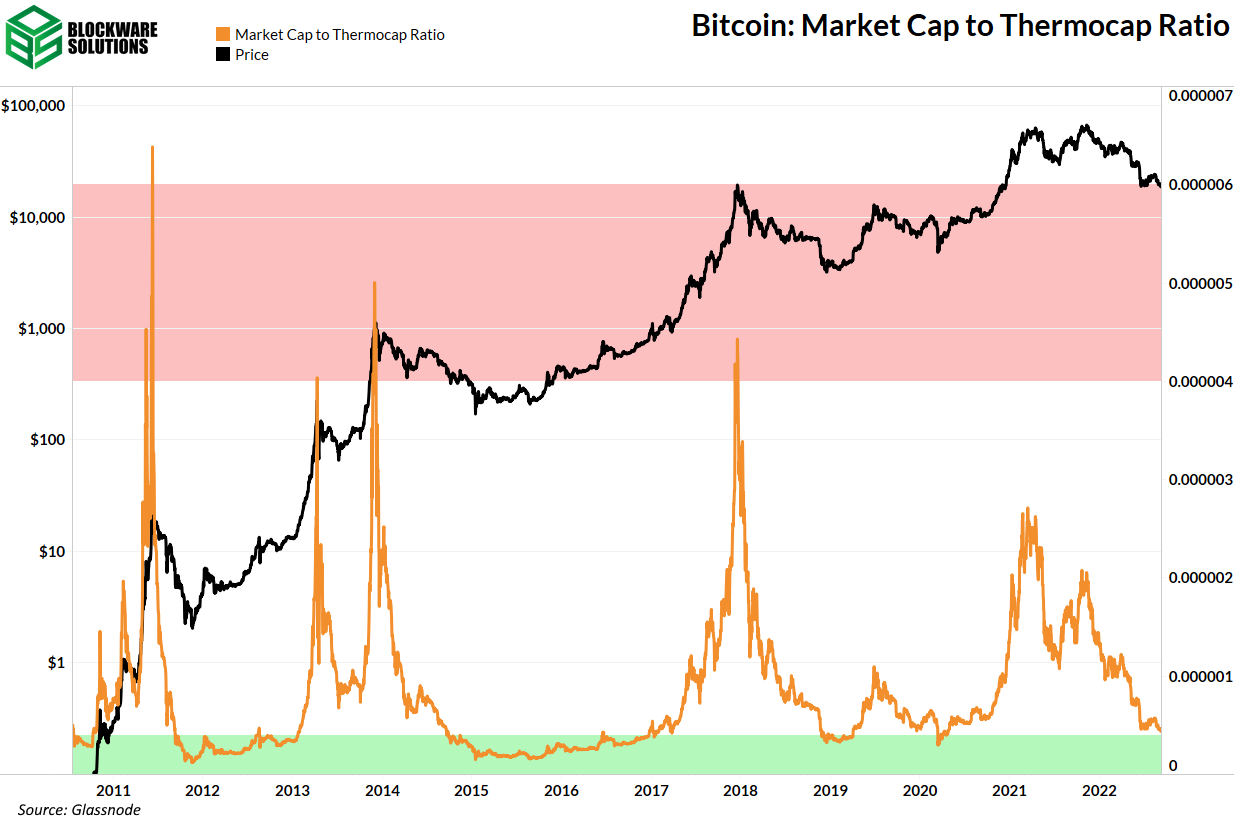

Marketcap to Thermocap Ratio is a measurement of miner profitability. This measure is further evidence of the relative mild intensity of this cycle’s bull run. Moreover, it has not yet entered the value zone during this bear market. We will be keeping an eye on this ratio to understand the current status of bitcoin miners.

Juxtaposing Market Cap to Thermocap Ratio gives insight into the resilience of Bitcoin miners and thus the Bitcoin network as a whole. Despite miner profitability being at extremely low levels, more hash rate has been coming online recently. Last week we saw a 9% increase in difficulty.

When the price dropped to $20k there was initially a large miner capitulation (talked about in the mining section of this newsletter). The machines of the over-leveraged, forced-to-sell miners have now made their way into the hands of solvent miners. Through the difficulty adjustments, the Bitcoin network automatically purges inefficient resource allocation and rewards efficient resource allocation. No amount of central planning would ever be able to allocate resources as effectively as the Bitcoin network.

We have recently surpassed 300 days since the last all-time high in the BTC price. In the previous two Bitcoin cycles, it took roughly three years to return to the all-time high of the previous bull run. If you bought the top in 2021 then there’s a fair probability that you have another two years to accumulate cheap sats and lower your cost basis.

Historically, the bottom of the bear markets have occurred around one year following the most recent all-time high. Coupling this knowledge with the gloomy macro situation is an indicator that we could see more sideways price action for the rest of the calendar year.

Revived Supply Last Active 1+ Years (90d Moving Average)

Large volumes of Bitcoin historically move for one of two reasons.

1. Euphoria (price top)

2. Capitulation (price bottom)

Below helps you visualize each period of euphoria and capitulation. Euphoria occurs when a subset of Bitcoiners are so wealthy that they feel a need to cash out some of their position and diversify their portfolio. Capitulation occurs when the stronger hands get seriously tested and some break under pressure. After they break, the true strong hands are the only users remaining, and it historically marks a bottom.

HODL waves

This metric also helps clearly visualize periods of euphoria where many coins are moving (few are being held).

Bitcoin Mining

White House Climate and Energy Report

Just released this week, the White House Climate and Energy Report contained 46 pages of research, ideas, and mixed signals. It varies from explaining how Bitcoin mining can be powered by standard methane and renewables to Bitcoin mining results in greenhouse gas emissions and other environmental impacts.

It is ironic that electric cars are subsidized, but electric money is not. Whether Bitcoin is “good” or “bad” for the environment quite literally relies on the subjective thoughts of a unique individual perspective. While Bitcoin miners will reduce greenhouse gas emissions (standard methane) and incentivize the production of new renewable energy, there’s a bigger more important topic: producing and using energy is not bad.

Humans thrive on energy. It is how all economic systems scale. Bitcoin consumes a lot of energy and it is likely going to consume multiples more. This is not a problem. It is the free market balancing energy production and economic savings.

If energy is scarce, energy producers will be selling a highly valuable product for traditional economic activity.

If energy is abundant, Bitcoin (monetary savings) will be highly valuable and producers can convert energy into BTC (mining).

Bitcoin mining is good for humans, good for the economy, and good for Earth. Even if the White House does attempt to slow hash rate growth in the US (which still seems unlikely), it will only incentivize new mining facilities to be built in other countries around the world, doing nothing for their stated “climate change objectives.” The rational response should be to embrace Bitcoin mining as much as possible.

Mining Rig Price History

As mentioned in the White House report, most investors still view mining rigs as equipment that depreciates into worthless e-waste.

Market reality says otherwise. Below are historical market prices for Bitmain’s Antminer S9. From post-halving 2020 lows, the market value of an S9 soared in both USD terms and BTC terms, indicating that simply holding the rig unplugged actually outperformed holding spot BTC itself.

This topic of rig market values was covered deeper in a recent post on Blockware Intelligence.

Hash Price ($ / TH / day)

A common metric Bitcoin miners use to judge how much revenue their fleet of mining rigs are generating is hash price. Hash price shows how much a machine earns per day per TeraHash. If a machine runs at 100 TH and the hash price is ~ $0.08, then the machine will generate ~ $8.00 of Bitcoin daily.

Due to the recent price drop in Bitcoin and the +9% difficulty adjustment, hash price has made new lows not seen since October of 2020. This drop in mining revenue has certainly compressed margins for all Bitcoin miners.

Hash Ribbons

Despite the recent price action pushing Bitcoin below $20,000, Bitcoin’s hash rate continues to fly. As mentioned before, this is likely due to new-gen ASICs starting to get plugged in (including S19XPs) and a good portion of weak miners already wiped out this summer.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.