Blockware Intelligence Newsletter: Week 137

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/22/24 - 6/28/24

🚨Blockware Speaks Live at Mining Disrupt🚨

Blockware Chief Revenue Officer Danny Condon presented a keynote speech at Mining Disrupt 2024: “Bitcoin Mining Reimagined: ASICs as an Asset Class”. In his speech Danny highlights the challenges that miners have dealt with historically, liquidity, lead times, and transparency, and how Blockware’s Marketplace is solving them.

Click here to listen to Danny’s 10-minute keynote presentation.

Blockware Head Analyst, Mitch Askew, also spoke at the conference. Mitch participated in a round-table discussion on the various strategies miners can utilize to grow their balance sheets and manage risk.

Click here to listen to Mitch’s panel discussion.

Bitcoin: News, ETFs, On-Chain, etc.

This is a bit of a shorter newsletter this week as the team has been heads-down at mining disrupt. We’ll be back next week with our regular, full-length analysis.

1. BTC Drawdown

BTC has dropped to ~$60,000 which is 15% below its all-time high. The chart below provides perspective on where this drawdown stands in the grand scheme of Bitcoin bull markets. During the 2017 cycle BTC had 10 drawdowns of 20% or more. This is a normal, healthy, bull market correction. Bitcoin’s price volatility shakes out weak hands and provides opportunities for strategic capital deployment to those with a longer time horizon.

2. Short Term Holder Realized Price

The price of Bitcoin has fallen below the aggregate cost basis of short-term holders for the first time since August 2023. In the short-term, we should expect some resistance around the ~$65,000 level as short-term market speculators may look to exit their positions at a “breakeven” level. Last summer when BTC lost the STH RP support level, price traded sideways for another two months before finally breaking out again.

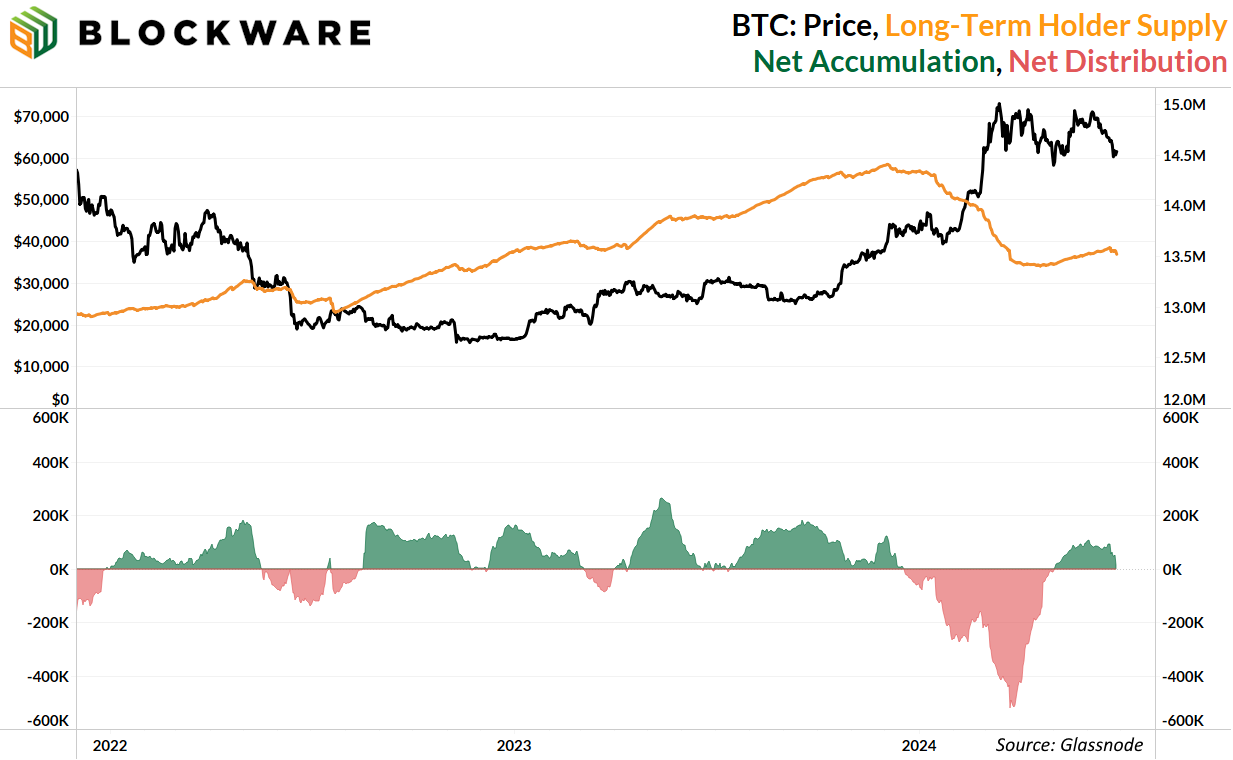

3. Long-Term Holder Net Position Change

In the face of struggling price action over the past month, we’re seeing net accumulation by long-term holders for the first time this year. As the price ripped up throughout Q4 and Q1, we saw a net decrease in long-term supply as some holders expectedly sold into the price strength. Most of those willing to sell BTC at these price levels have exhausted their supply. Moreover, coins belonging to those who entered the market at the beginning of the year are beginning to age into the “long-term holder” cohort.

Net distribution from long-term holders has historically denoted local tops due to the introduction of previously immobile supply to the market. This shift to a regime of net accumulation is bullish.

General Market Update

4. S&P 500

Since the last market update, traditional markets have been relatively uneventful. Markets, which in the short-term are highly “news” and “narrative” driven, have had no major news events to catalyze price action as there were no key data point releases or Fed meetings. The S&P 500, after pushing to new all-time highs right around 5,500, has traded sideways for the past two weeks. Consistent all-time highs and healthy price action for traditional “risk-on” assets like the S&P, Nasdaq, and $QQQ, are bullish for the most porous of all “risk” assets: Bitcoin.

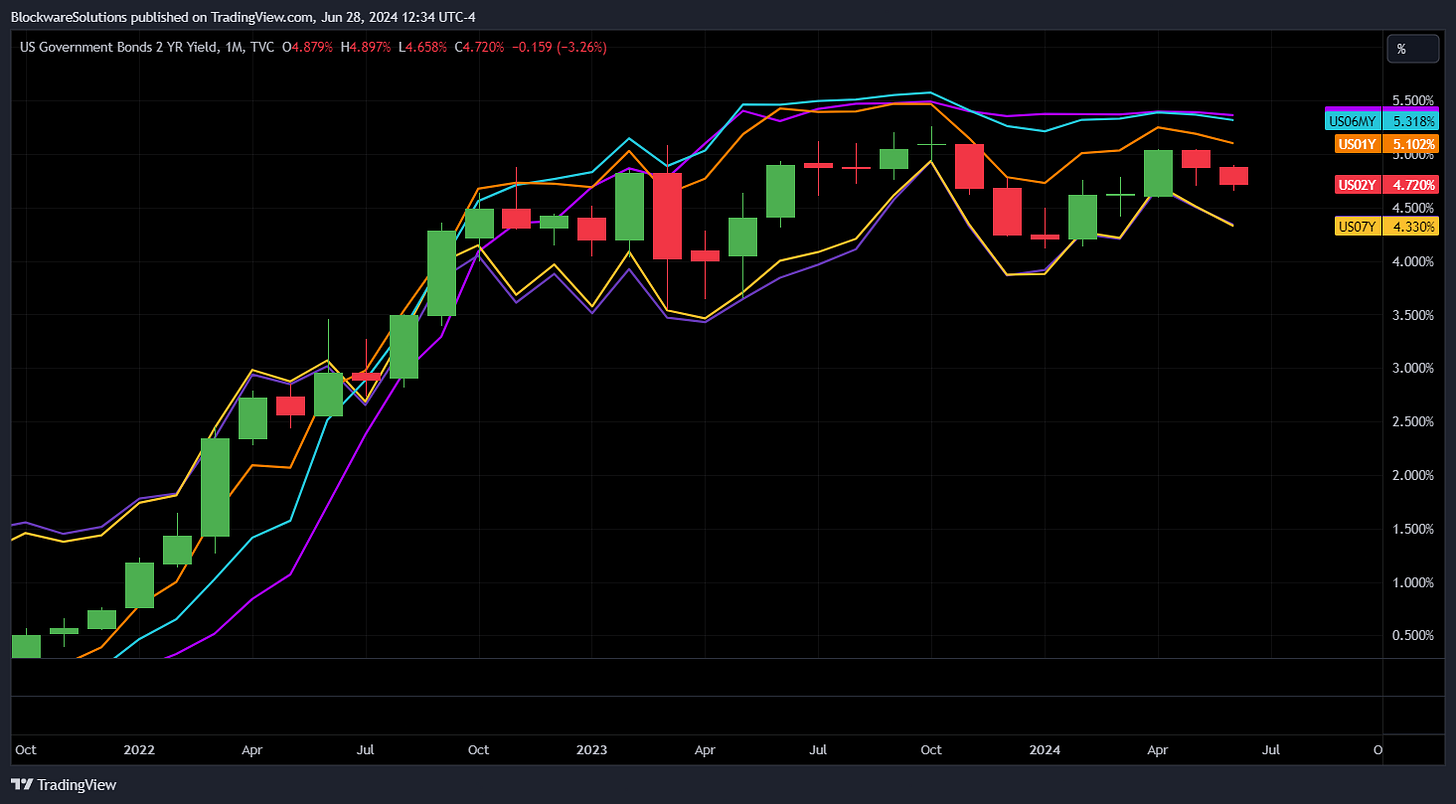

5. US Treasury Yields

2 and 10-year treasury yields have also traded with little volatility over the past two weeks. Yields across all durations are starting to come down after making an attempt at new cycle highs earlier this quarter. The most important yields to keep an eye on at the moment are short duration (3m, 6m, and 1y) as these tell us what the bond market is expecting from the Fed in terms of monetary policy during said durations. The longer duration bond yields (10y, 20y, and 30y), which have ripped over the past few years, are important to watch due to growing concerns around the US national debt and inflation. US treasuries, which are notorious for being the “safest” asset in the market are running out of allure due to unsustainably high debt-to-GDP and yields that greatly underperform inflation.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

6. CleanSpark

CleanSpark Inc. has announced its plan to acquire GRIID Infrastructure Inc. in an all-stock deal worth $155 million. This acquisition is set to expand CleanSpark's capacity significantly, with over 400 megawatts expected to be added in the state of Tennessee over the next two years. CleanSpark, after mining exclusively in the state of Georgia for the entirety of its existence, recently expanded operations to Mississippi, and now has its eyes set on The Volunteer State. Diversification across jurisdictions is one of the best ways Bitcoin miners can mitigate risk. And given CleanSpark’s branding as “America’s Bitcoin Miner”, expanding across various states makes perfect sense.

This move will boost CleanSpark's total capacity to over 1 gigawatt. The deal, which is pending shareholder approval and standard closing conditions, is anticipated to be finalized in the third quarter of 2024.

7. Mining Difficulty

Mining difficulty is projected for a significant drop of ~7.3%. This comes in the wake of the halving, a lower BTC price, and lower transaction fees all putting downward pressure on miner revenue. The winners in this scenario are the Bitcoin miners with the lowest operating costs and the most efficient ASICs. A 7% drop in difficulty means that incumbent miners will mine 7% more BTC per unit of hash. The hyper-competitive nature of Bitcoin mining punishes inefficiencies and rewards the best operators in the industry.

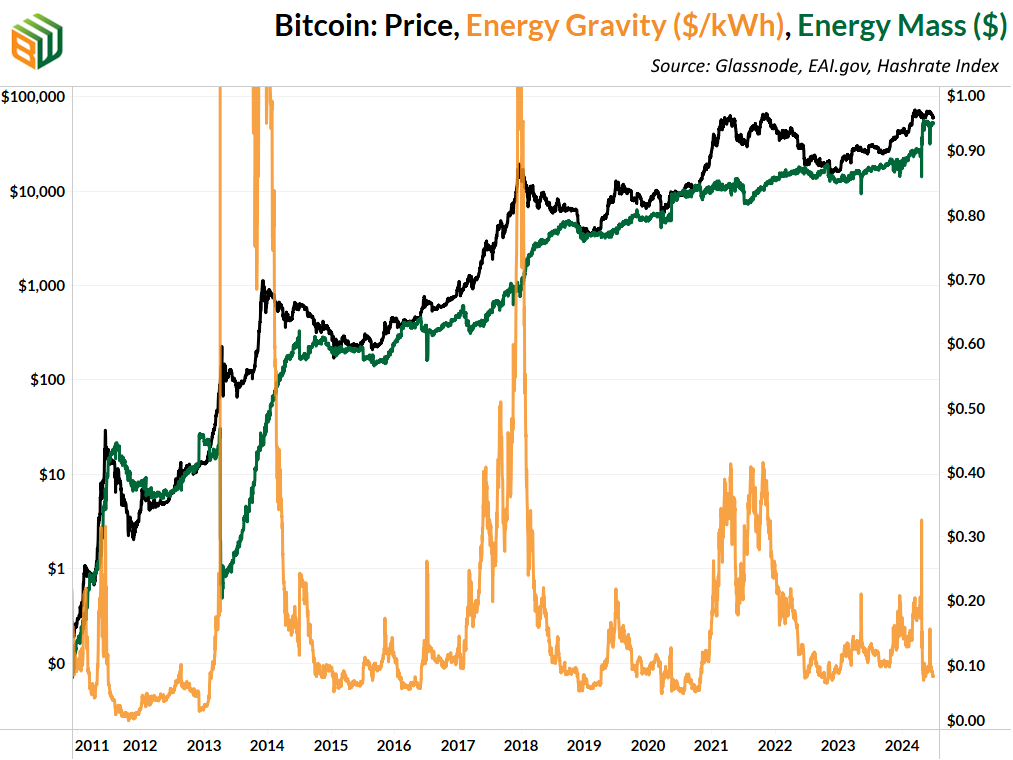

8. Energy Gravity:

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$53,475 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

Theya:

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Your efforts and content are appreciated. Thank you.