Blockware Intelligence Newsletter: Week 175

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/3/25 - 5/9/25

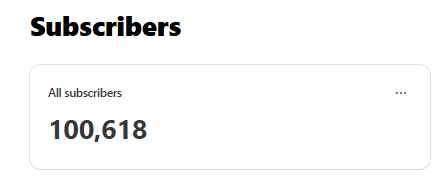

100,000 Subscribers — Thank YOU!

Bitcoin’s price surpassed $100k and the Blockware Intelligence Newsletter surpassed 100,000 subscribers. Sincerely, thank you. We’re honored to share our market insights with you each and every week. Here’s to the next 100,000.

Your money can buy more Bitcoin than you think.

Slash your trading fees on the biggest exchanges like Coinbase, Binance, Bybit + more. Blockware has partnered with REF to offer you incredible trading fee discounts.

Get up to 54% off when you join REF here: theREF.io/a/blockware

$150,000 May Be Closer than it Appears

We’ve been calling for a rally the past few weeks and it is here. BTC, as you no doubt know by now, is back above $100,000 – reaching the top portion of its 6-month trading range. The trend from the past two and half years has been this:

> Pump

> Consolidate

> Shakeout

> Repeat

A series of 50% moves higher followed by a period of consolidation, shaking out the weak handed holders. A 50% move from the current range would see Bitcoin hit ~$150,000. Given many of the bullish indicators we discussed in last week’s newsletter (and one’s we’ll discuss in this newsletter as well), we wouldn’t be surprised to see $150k BTC by the end of Q2.

The continuation of this trend is the best case scenario for those dollar-cost averaging, and the worst case scenario for high-time preference speculators.