Blockware Intelligence Newsletter: Week 157

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 12/6/24 - 12/13/24

It costs $100,000 to buy 1 Bitcoin.

It costs $40,000 to mine 1 Bitcoin.

Bitcoin: News, ETFs, On-Chain, etc.

1. Bitcoin Trades Sideways $100,000

If you had told me earlier this year that this would be the title of a newsletter section in 2024, I would have been ecstatic. Bitcoin facing friction around the $100,000 mark is unsurprising given the psychological effect of such a large price milestone.

On every time frame (long, medium, and short) the set up is bullish:

Short: Clear formation of a bull flag, positive near term catalyst of a Strategic Bitcoin Reserve (SBR) after the Trump Inauguration in January

Medium: SBR, Fed Rate Cuts, Broader Macro Bull Market, Halving-Induced Supply Shock / Historic Bitcoin Cyclicality

Long: Fiat Debasement, Widespread Bitcoin Adoption

2. BlackRock Suggests 2% Bitcoin Allocation

In a recent report called “sizing Bitcoin in portfolios”, BlackRock recommends a 2% allocation to Bitcoin. The 2% figure was derived from the fact that within a typical 60-40 portfolio, each of the Magnificent 7 stocks represent roughly 1-2% of the total portfolio. Equal exposure into BTC can enhance the returns of the portfolio without exposing it to too much excess volatility – ideal for institutional investors.

“Those stocks (Mag7) represent single portfolio holdings that account for a comparatively large share of portfolio risk as with bitcoin. In a traditional portfolio with a mix of 60% stocks and 40% bonds, those seven stocks each account for, on average, about the same share of overall portfolio risk as a 1-2% allocation to bitcoin. We think that’s a reasonable range for a bitcoin exposure.”

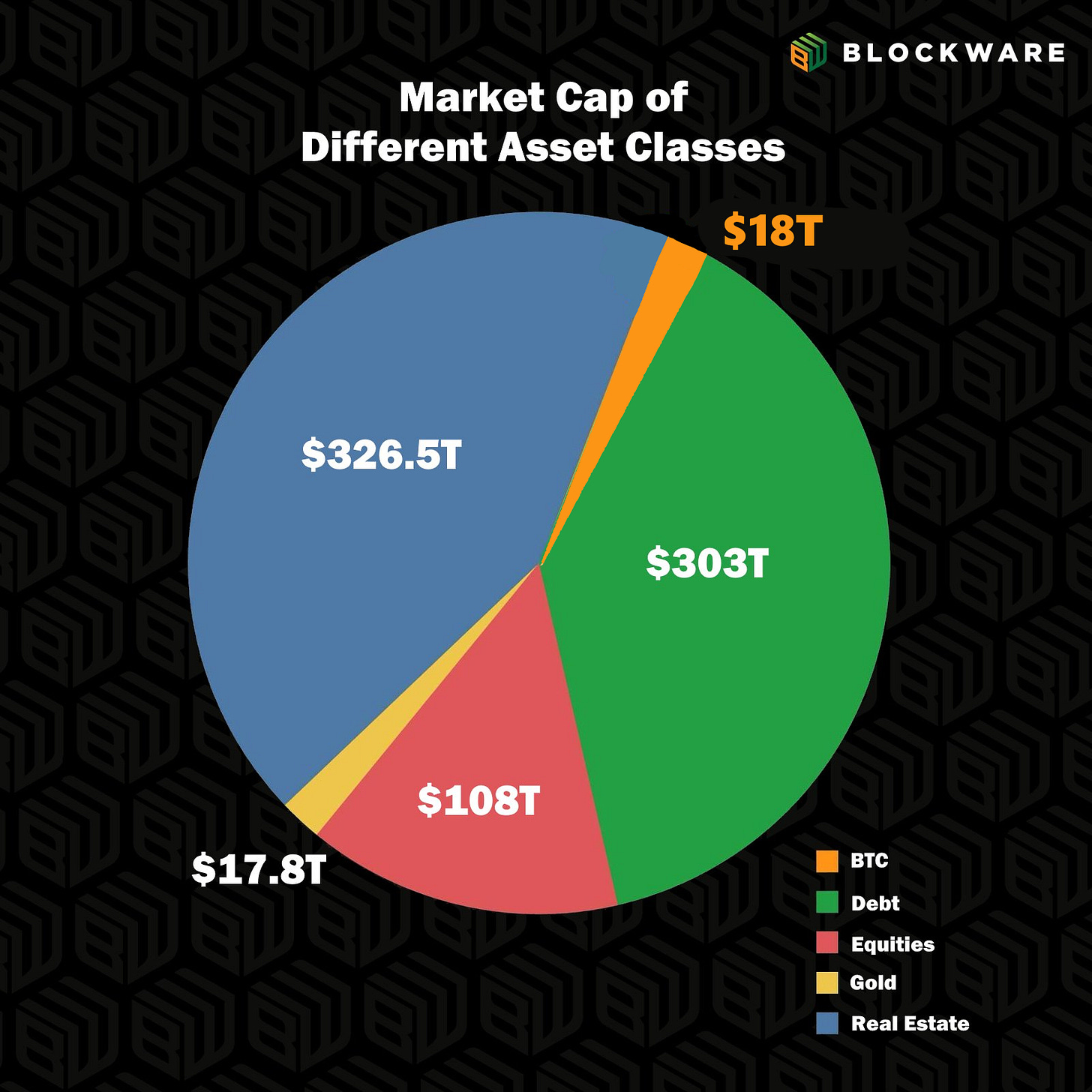

3. BTC Capturing 2% of Global Wealth = $857,000 per Coin

Total global wealth currently equals $900 Trillion. This is effectively Bitcoin’s ‘Total Addressable Market.” Bitcoin is a savings technology, competing with Real Estate, Stocks, Bonds, and Gold as assets with which humans can use to store value.

Bitcoin capturing just 2% of the “wealth pie” will result in a Bitcoin market cap of ~$18 trillion, and a price of ~$857,000 per Bitcoin.

This provides a great perspective on how early we still are to Bitcoin. A 2% allocation is minor in the grand scheme of things, but it will impact the Bitcoin price by orders of magnitude.

Theya - Simplified Bitcoin Self-Custody

For secure, intuitive self-custody that fits seamlessly into your life, we recommend Theya.

Theya is the simplest way to safeguard your bitcoin, whether you're using their mobile app or their new web app. With flexible multi-sig and cold storage options, you choose how to hold your keys securely. Experience the ease of a true multisig solution, on your terms.

Ready to secure your bitcoin? Click here to get started and enjoy 10% off an annual subscription!

Click here to download the app and get 10% off an annual subscription!

General Market Update

4. Long Duration Treasury Yields on the Rise

Investors are continuing to express their concerns about long-term inflation and fiat debasement. While assets like Bitcoin & Gold push to all-time highs, long-duration US Treasuries are plummeting (yields rising).

The 10-year yield is up nearly 20-basis points this week to 4.379% while the 30-year yield is up ~4.599%.

We are on the verge of the 4th consecutive year of negative returns for long-duration treasuries ($TLT). Meanwhile, Bitcoin and gold are reaching new all-time highs.

Listen carefully to what the market is telling you: inflation IS NOT transitory. High inflation is here to stay and you need to purchase hard assets in order to preserve your purchasing power.

5. MicroStrategy to Enter Nasdaq 100

At the time of writing this has not been 100% confirmed but the PolyMarket odds are up to 90%. The Nasdaq 100 ($NDX) is one of the largest, most liquid stock indices in the world. There are hundreds of billions of dollars that passively allocate to this index every single year – this will provide more structural buy pressure for $MSTR. Moreover, MicroStrategies inclusion into the $NDX provides the market with yet another signal towards the significance and success of a Bitcoin treasury strategy.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

6. RIOT & CleanSpark Announce Convertible Note Offerings

The parade of convertible note offerings keeps marching down the proverbial streets of the Bitcoin world. This week Riot & CleanSpark became the 3rd & 4th large, publicly traded US Bitcoin miner to replicate the MicroStrategy play: issuing convertible notes, enabling low (or zero) interest rate borrowing in order to grow their Bitcoin treasury.

Riot raised $525 million at 0.75% interest and CleanSpark raised $550 million at 0%

Bitcoin companies with access to public capital markets are quickly realizing the tremendous advantage they have. There is a race to acquire as much Bitcoin as possible and public companies have tools at their disposal that are unavailable to private investors or entities.

7. Energy Gravity

At a typical hosting rate today, the average miner requires ~$65,000 worth of energy to produce 1 BTC (green line). The orange line shows how many $ (output) miners are able to earn for each kWh of power (input).

This metric is different from the chart at the top of the newsletter. This one looks at the aggregate cost of production (combination of all miners) while the former chart breaks it down by machine type

To learn more about Energy Mass & Energy Gravity, read our report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.