Blockware Intelligence Newsletter: Week 52

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/19/22-8/26/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by securing the network. Your mining rigs, your keys, your Bitcoin.

Know someone who would benefit from concierge service and world class expertise when buying Bitcoin? Give them one year of free membership in Swan Private Client Services ($3000 value) -- email blockwareHNW@swan.com and we’ll hook it up! (And yes, you can give it to yourself 🤣)

Summary

This week, the Biden administration announced their plan to provide student loan debt relief to millions of Americans.

The major market indexes finally got the pullback that this newsletter has been discussing for a couple weeks.

European energy prices have reached all-time highs, which has major effects on the rest of the world.

According to Black Knight, housing prices declined in the month of July and was the largest monthly decline since 2011, signaling a decline in demand and a squeeze on consumers.

After the negative price action this week Bitcoin has re-entered the “value” zone in various accumulation metrics

On-chain activity is congruent with that of past bear markets

The lightning network is continuing to grow as a means of sending small payments

The futures market is placing a higher likelihood of negative price action going forward

Hash ribbons indicate the worst of the miner capitulation is over and are flashing a strong buy signal for Bitcoin.

Bitcoin’s Energy Gravity currently sits at $0.10, meaning that the modern mining rig (~ 38 W/TH) earns 10 cents for every kWh consumed.

General Market Update

It’s been another interesting week in the markets with lots to talk about. One thing that should be kept in mind is that Fed Chair Jerome Powell gave a talk today at 10AM EST which certainly injected some volatility into the market.

Powell, unsurprisingly, took a very hawkish stance at Jackson Hole today, after his very dovish talk after the last FFR hike. His colleagues have been working to walk back his dovishness for the last month or so.

There were a few quotes that stood out to me from Powell.

“Restoring price stability will take some time and requires using tools forcefully to bring demand and supply into better balance… likely to require a period of below-trend growth.”

This is Powell saying that they are going to continue raising interest rates aggressively, and then hold them higher for however long it takes to get CPI to their 2% target. They are willing to do this even if it causes a recession.

He also made it quite clear that “prematurely loosening policy” would be a grave error, and made it seem like a Fed pivot would not be coming anytime soon.

Earlier in the week, the big headline this week came from the Biden administration’s announcement of the forgiveness of up to $20,000 per individual for their Federally financed student loans.

As midterms grow nearer, this is certainly an effort to economically aid millions of Americans. This, of course, comes following one of the toughest economic environments we’ve seen in most of our lifetimes.

While this may appear to be a great thing for the highly indebted American majority, the issue lies in the fact that could be viewed as an inherently inflationary action. Lowering debt levels means that Americans will, in aggregate, have to spend less money on the servicing of debt.

This is essentially the opposite effect that raising interest rates has. Higher interest rates take money out of pockets so that aggregate demand is lowered and thus, prices fall. Lowering outstanding debt levels places money back into the hands of Americans and allows for more spending on goods, which equates to higher prices.

That being said, payments on Federal student loans have been suspended for over 2 years now. This means that the effect that lower debt levels have might not actually matter since nobody is making loan payments at the moment.

President Biden extended the suspension period for student loan payments through the remainder of 2022, with payments expected to begin again in January 2023.

Moving on, the stock market finally got the pullback that this newsletter has been discussing for a couple weeks now. Last week we discussed the effect that the 200-day SMA tends to have on bear market rallies.

This week, we saw that thesis validated as prices fell lower to open up the week on Monday. As of Thursday, the market is attempting to find its footing, but the short-term trend is certainly down.

Nasdaq Composite 1D (Tradingview)

After falling 2.55% on Monday, in the worst single day performance since June, the Nasdaq is attempting to find some stability around the previous June high. This would be the most ideal place for the Nasdaq to consolidate and continue higher.

According to Goldman Sachs, the rally we saw the last couple of months was the 3rd largest short-covering event of the last century.

QQQ Short Volume 1D (Tradingview)

The chart above shows the short interest for the Nasdaq ETF QQQ. As you can see, we saw a peak in short volume on June 17th, the day after the market bottomed.

Since then, we’ve seen an overall decline in short interest, which has fueled this move higher. This metric is certainly something to keep an eye on, as a prolonged increase in short interest would push the ETF lower.

At this point, it would appear that more downside is the most likely scenario. Some areas to watch on the Nasdaq for support would be $12,000-12,100, $11,700, $11,100, and the lows at $10,800.

It’s also worth noting that the anchored VWAP from the June 16th lows sits at $303.23 on QQQ, which equates to roughly $11,900 on the index.

That is assuming that the market will continue lower here, it is certainly possible that the support found around $12,300 will be enough for the market to continue higher.

This week we’ve also seen treasury yields moving higher as the dollar index has continued its strength. At the time of writing, the yield of the 2Y Treasury is up 13bps on the week, with the 10Y yield up nearly 10bps.

Last week, we discussed how a rising dollar value invites sell pressure on equities, but rising Treasury yields has an even more direct effect. This newsletter discusses this relationship often, but the basic idea is that Treasury yields are used as the discount rate for calculating the present value of future cash flows.

When that discount rate is rising, it lowers the present value of equity cash flows, thus causing sellers to enter the market. The combination of a rising dollar, yields, and potentially short interest, would lead us to believe that there’s likely more downside for equities in the near-term.

But as previously mentioned, we cannot read the future and this is merely speculation.

Another interesting new story this week comes from our friends across the pond, with the ongoing European energy crisis.

Average Monthly Electricity Wholesale Prices in Selected EU Countries (Statista)

Following their own inflationary pressures of the last couple years, followed by the restricted flow of oil from Russia, the European continent is seeing an unprecedented rise in energy prices.

German Year-Ahead Baseload Power (Insider)

German year-ahead baseload power is the benchmark used to measure energy prices in Europe. As of this week, the price of electricity (Euros/MWh) sits at €640 (~$640), which makes European energy the most expensive it’s ever been.

This came alongside an unplanned outage from a French nuclear power plant, which only exacerbated the issue and caused energy futures to spike.

Currently, the average price for a barrel of oil in Europe is now over $1000, but this crisis doesn’t just affect Europeans.

In 2021, the US was the second largest importer of European goods, behind China.

US Imports from the European Union (Trading Economics)

In 2021, the US imported $463.6 billion worth of goods from Europe, with pharmaceuticals, machinery and vehicles being the top imports.

With European energy prices screaming higher, this has a direct impact on the price of European goods. So not only does the European energy crisis create higher prices for EU goods in the US, it also increases the US’ trade deficit.

Moving on, this week we saw the announcement of new housing data from the month of July from Black Knight, a mortgage analytics firm.

Home prices fell for the first month in 3 years, and it was the biggest monthly decline since 2011.

New Home Sales (Trading Economics)

Furthemore, July saw 511,000 sales for new homes in the US. This is the lowest value since 2016 and signals that the economic pressure of higher interest rates is truly beginning to set in for consumers.

30-Year Fixed Rate Mortgage Average (FRED)

As of Thursday, the average interest rate for a fixed 30-year mortgage sits at 5.55%. When the Fed Funds Rate is rising, it makes it so the overnight lending rate for banks is increased, resulting in higher interest rate for customer loans.

The effect is the same when you see a decline in home sales. Less sales means that banks are selling less mortgages, and thus, interest rates are increased to maintain operating profitability.

Currently, a 5.55% average 30-year mortgage rate puts new homeowners paying the largest interest rates since June 2009.

Generally speaking, sentiment in the housing market leads the unemployment rate. When homeowners are considering selling, or are not interested in buying, compared to the recent past, it can be a recessionary signal.

While housing prices and demand are a lagging indicator compared to interest rates, unemployment lags even more in comparison to economic conditions.

NAHB Housing Index vs. Unemployment Rate (@MacroAlf)

The chart above shows the inverse of the NAHB Housing Index in orange, which is a monthly survey of National Association of Home Builders (NAHB) to gauge the sentiment among single-family home owners.

This metric has an inverse relationship to the unemployment rate. Currently, it is signaling that we should see a large increase in unemployment in the next 6-12 months. But for now, employment remains fairly strong, with Initial Jobless Claims sitting at 243,000 last week.

GDPNow real GDP Estimate for Q3 2022 (Atlanta Fed)

This week we also saw the Atlanta Fed revising their GDP estimate for Q3 lower for the 3rd week in a row. While this isn't necessarily a good thing, they still are predicting GDP to come in positive in Q3.

Currently their estimate sits at 1.4% (seasonally adjusted annual rate). But it should be noted that this is simply an estimate, and is often changed, as you can see in green above.

Crypto-Exposed Equities

Overall, it's been a pretty poor week for the crypto-exposed group of equities.

Following last Friday’s breakdown in spot Bitcoin, it isn’t too much of a surprise to see these equities attempting to catch up (or down). With Bitcoin currently forming what could be considered a bear flag, it’s more likely than not that we see more downside from these names.

A few names currently look better than the rest of the group, such as MOGO, SI, BRPHF, and BKKT. That being said, the short-term trend is certainly down and with weakness in Bitcoin, these names are likely to see more downside.

Above, as always, is the Excel sheet comparing the Monday-Thursday price performance of several crypto-native equities, Bitcoin and WGMI.

Bitcoin Technical Analysis

BTCUSD 1D (Tradingview)

As discussed as a possibility here last week, Bitcoin was able to find some buyers around $20,700 after falling 10% last Friday.

Since then, BTC has been forming a positive sloped flag. This looks to us like a textbook bear flag, after breaking down from an even larger flag.

Keep an eye on BTC today as it runs into a declining 10-day EMA, which is likely to inject a bit of sell pressure into the market. Of course, we don’t know what will happen, but this appears most likely in the short-term.

It is certainly possible that we found true buyers here that could support another major rally higher, but historical price action would argue otherwise. If lower prices is the case, some logical places BTC could find support would be 2017 high around $19,900, $18,900, or $17,600.

Bitcoin On-chain and Derivatives

We are continuing to monitor the valuation metrics as they provide a good perspective of where Bitcoin is currently at in this cycle relative to past cycles.

Starting with MVRV Z-Score; which compares the market price of Bitcoin to the realized price

For those that may be new to on-chain, and as a refresher for our weekly readers, I have listed the calculations for Realized Price and Realized Cap are below.

Realized Cap = SUM(UTXOs * Price of BTC at the time each UTXO was last moved on-chain)

Realized Price = Realized Cap / Coins in circulation

These metrics are valuable as they show us the average cost-basis for the market as a whole; which in turn can give us insight into the overall sentiment of participants. When the market in aggregate is in the red, ie. price < realized price, it’s unlikely to see any sell pressure beyond that from miners or liquidated traders. Most people will not willingly sell their coins at a loss.

Last week we noted how the MVRV Z-Score exited the valuation zone. However, this week it has gone right back. Historically buying when this metric is in the valuation zone has led to great returns.

Looking at the realized price itself we can see that Bitcoin has been flirting with it since early June. It served as resistance, then support, and over the next week we will be looking to see if it flips back to resistance.

And to further hammer down on the importance of viewing these metrics with a long time horizon in mind, here is the realized cap.

As you can see, over the long term, the average cost basis of the network continues to be up and to the right. Big moves up occur during bull runs as new participants buying BTC for the first time brings up the aggregate cost basis tremendously.

Another key valuation metrics is the 4 year moving average.

In the words of Michael Saylor “when deciding to invest in Bitcoin, your minimum time horizon should be at least 4 years.” This is due to the cyclical nature of Bitcoin based on the 4 year halving schedule.

And, just as with MVRV Z-Score, we watched last week as Bitcoin broke past the 4 year moving average only to come back below this week. Again, with a long time horizon in mind, this is a great time to be dollar cost averaging in.

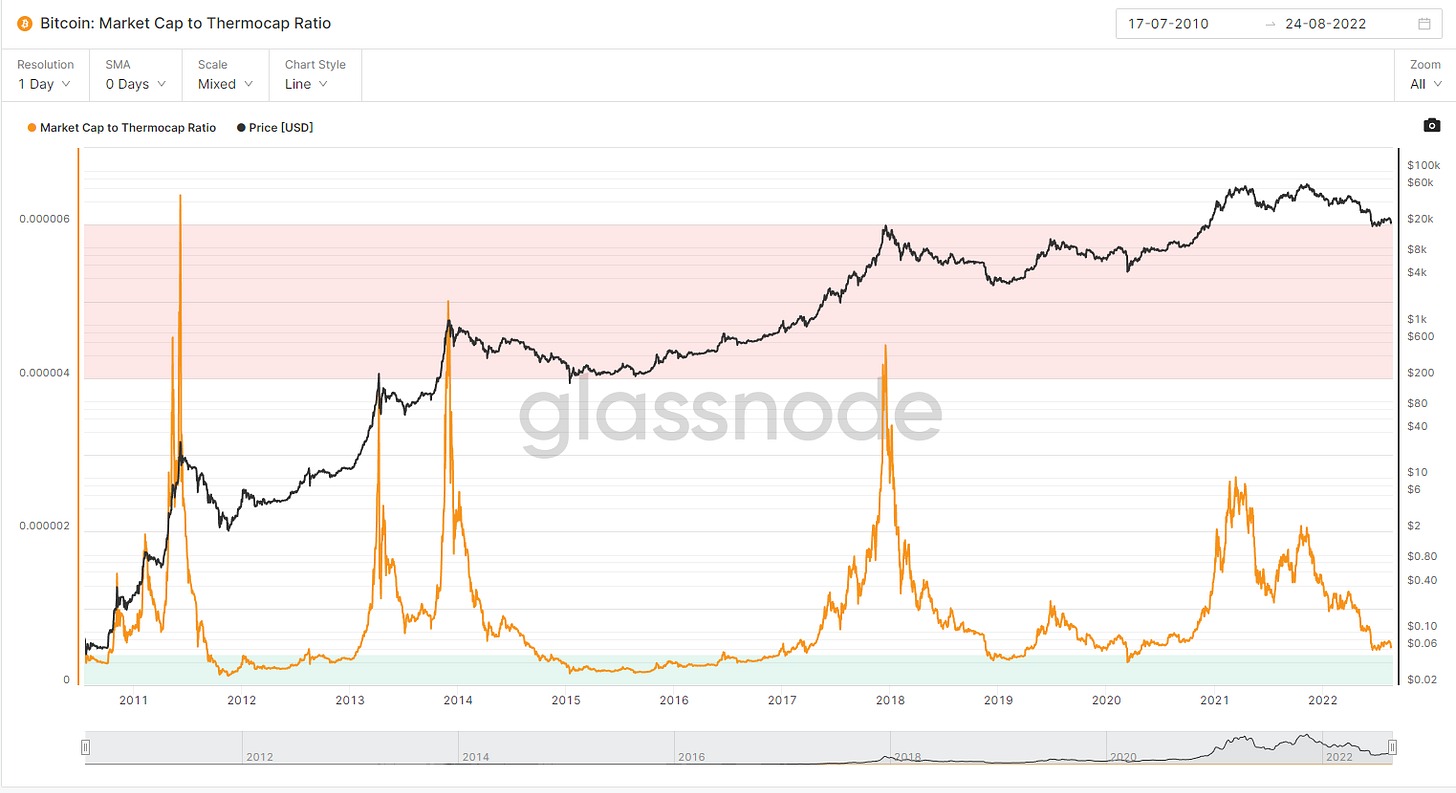

We’ll look at one more valuation metric but before we do so let’s discuss Thermocap.

This metric shows the aggregated amount of coins paid to miners (in USD). This shows us that miners have not stopped making money since day one. This is important as miners making money is what incentives them to dedicate computing power into securing the network.

That sets us up to look at our last valuation metric for this week: Market Cap to Thermocap Ratio.

This allows us to assess if the price is trading at a premium relative to the security spent by miners. Right now it is extremely close to lows only seen during the deepest parts of past bear markets. Furthermore, this metric did not experience as hyperbolic of a move during last year's bull run as it had during previous bull runs.

Another key signal of a bear market aside from valuation metrics is network activity.

Looking at the Median Transfer Value (in USD terms) that occurs on the Bitcoin network shows that activity is low relative to last year's bull market. This is typical as during the bull markets many people are experimenting with Bitcoin for the first time and using it to process transactions of increasing value.

An important point to note is that while volume may be down from its highs, it continues to increase every cycle. This shows that more and more people are using Bitcoin the network as a means of sending large payments.

The Bitcoin network can settle transactions worth billions of dollars, anytime, to and from anywhere, with no third parties, in about 10 minutes. It is objectively a great tool for sending high value payments.

We should expect to see this metric continue to rise as the lightning network becomes the de-facto way of sending smaller payments and the base layer is used to settle large payments.

The growth in lightning as a successful and useful layer-2 for Bitcoin is evident when looking at the amount of BTC locked in lightning channels over time.

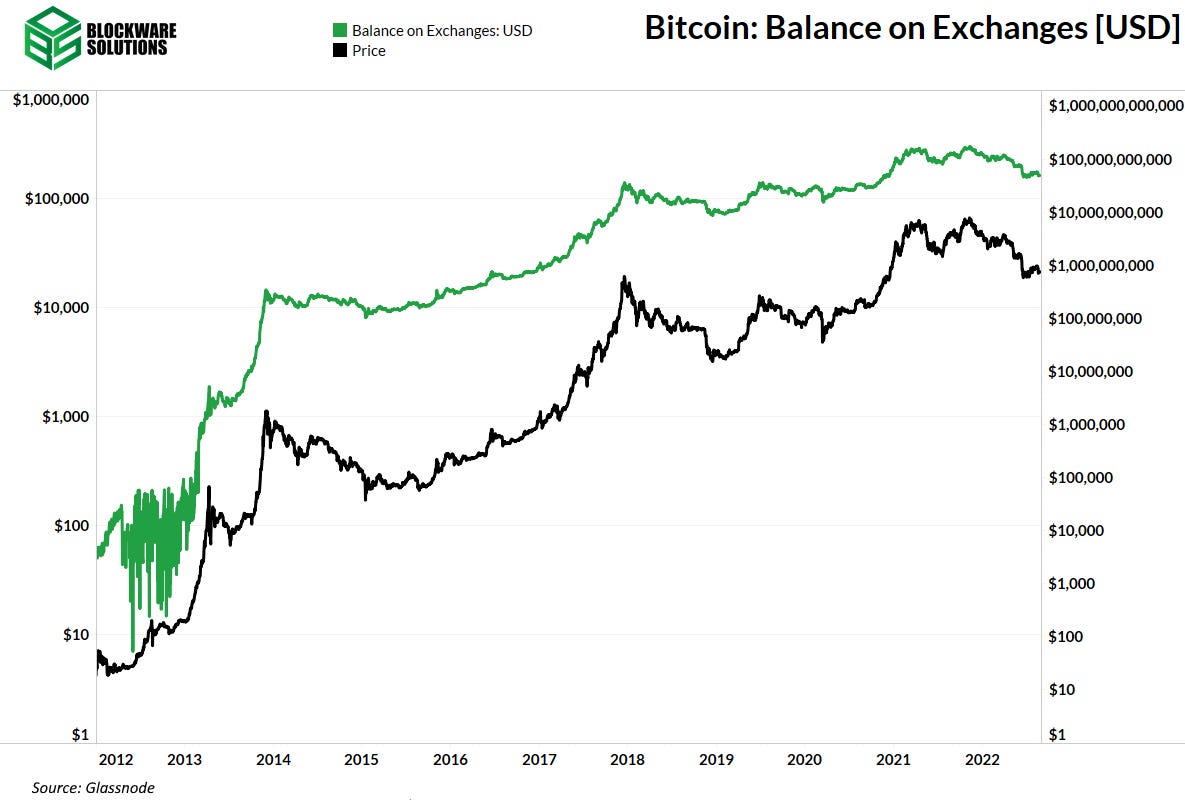

Balance on exchanges is another metric that can provide insights into the long term development and adoption of Bitcoin.

It can be debated about whether or not this metric provides anything valuable in the short term; lots of coins leaving exchanges doesn’t necessarily mean they are going to cold storage forever and lots of coins being moved onto exchanges doesn’t necessarily mean they are going to be dumped (in March 2020 it did though).

Nevertheless, the amount of Bitcoin on exchanges grew tremendously from 2014 to 2020 as the industry was developing into what it is today. However, since 2020 we have seen the balance on exchanges grind down. And we have seen a sizable decrease in the past few months ever since the blow up of various exchanges and Bitcoin “yield” products. Perhaps the message of “not your keys not your coins” is beginning to resonate with more and more people.

There is also value in juxtaposing the balance on exchanges in bitcoin terms with the balance on exchanges in dollar terms.

Because Bitcoin is divisible into many smaller units, exchanges will still be able to function as businesses even as large quantities of Bitcoin are withdrawn from exchanges into permanent cold storage.

What exists is a positive feedback loop between a decrease in exchange balances in BTC terms and an increase in exchange balances in dollar terms. As more users withdraw coins to cold storage for long-term hodling, Bitcoin essentially becomes more scarce, resulting in the coins that remain on exchanges having their prices bid up.

Lastly, on the derivatives side, the funding rate has flipped negative. This means that short positions on perpetual futures contracts are periodically paying out long positions; this is to incentivize people to take the long side of the trade (because for every short there must be a long).

To frame this in the perspective of sports betting, Vegas will set a point spread in order to get an even number of betters on both sides. That is essentially what exchanges are doing with the funding rates of perpetual futures contracts.

A negative funding rate means that participants in the futures market are putting a higher chance on negative price action than positive price action.

Bitcoin Mining

Miner Capitulation Ends Marking Historic Buying Opportunity

As mentioned in previous Blockware Intelligence Newsletters, hash ribbons (chart below) indicate when miner capitulations are occurring. The hash ribbons metric was created by Charles Edwards. Miner capitulations occur when a significant net % of miners turn off machines over an extended period of time.

Hash ribbon cross-backs have historically occurred during Bitcoin price bottoms. This bullish cross occurred Friday, August 19th, foreshadowing that now is potentially the ideal time to acquire cheap Bitcoin and mining rigs before the next bull run.

Historically, miner capitulations induced by poor miner margins are the greatest buying opportunities. Other miner capitulations (not included below) were caused by political (China mining ban) or environmental (China rainy season) reasons.

January and June 2015 - marked the $200 bottom

August 2016 - halving occurred and Bitcoin started its bull run to $19k from $500

January 2019 - marked the $3k bottom

April 2020 - marked the $6k bottom

July 2020 - halving occurred and Bitcoin started its bull run to $69k from $9k

August 2022 - TBD

While there’s no guarantee that a macro contention won’t lead to further pressure on Bitcoin and Bitcoin ASIC prices, the hash ribbon metric is indicating that the worst may be over.

Bitcoin Energy Gravity

Last, Bitcoin Energy Gravity continues to be in the buy zone. Bitcoin Energy Gravity models the relationship between the price of Bitcoin and its mean operating cost of production for modern mining rigs. Energy Gravity currently sits at $0.10, meaning that the modern mining rig (~ 38 W/TH) earns 10 cents for every kWh consumed.

Since Energy Gravity’s low this summer (when the mean operating cost of production for modern mining rigs was close to the price of Bitcoin itself), the metric has slowly drifted up. This has been due to declining mining difficulty, increasing Bitcoin price, and Bitmain’s new XPs starting to ship. Both are lowering the mean operating cost of production for modern mining rigs.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.