Blockware Intelligence Newsletter: Week 113

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 12/02/23 - 12/08/23

1. Blockware Intelligence Podcast. The Blackrock Bitcoin ETF is set to get approved in January. This, along with the 2024 halving, as well as certain macroeconomic factors, is setting the stage for a massive Bitcoin bull market. Mitch Askew discusses these bullish developments with Brandon Keys, Founder of Green Candle Investments.

General Market Update

2. Q4 GDPnow. Although it’s been a relatively quiet week on the macro front, the Atlanta Fed updated its GDPnow estimate to reflect an estimated 1.3% growth this quarter. This is up from the previous estimate of 1.2%. This is showing that, despite all the doom and gloom from economists online, the economy is currently not reflecting signals of recession underway. There are certainly arguments to be made that we’re heading in that direction, but economic output simply isn’t reflecting this yet.

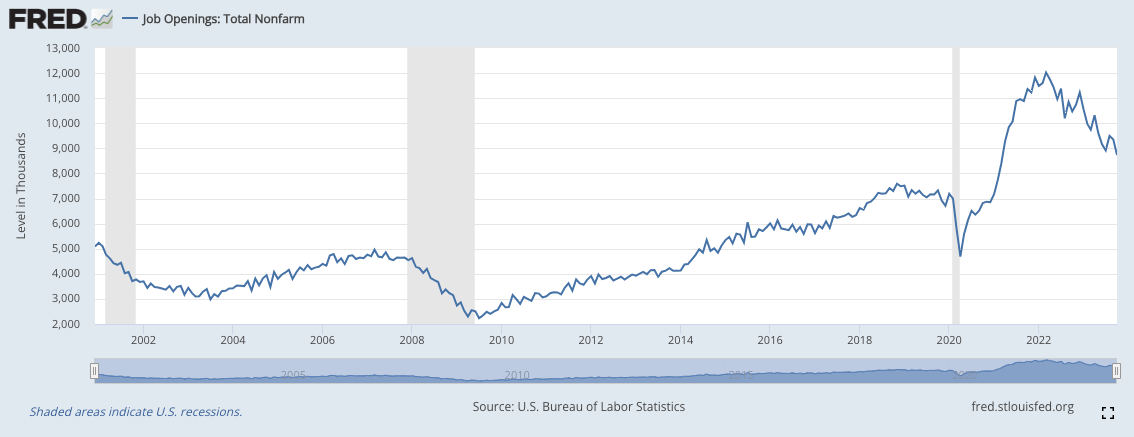

3. Job Openings and Labor Turnover Survey (JOLTs). The JOLTs report for October, released on Tuesday, showed that Job Openings in October totaled 8.73 million, the lowest reading since March 2021. With Chapter 11 bankruptcy filings on the rise, this is likely a number we see continue to decline, as companies scale back hiring practices in the face of uncertain economic conditions in 2024.

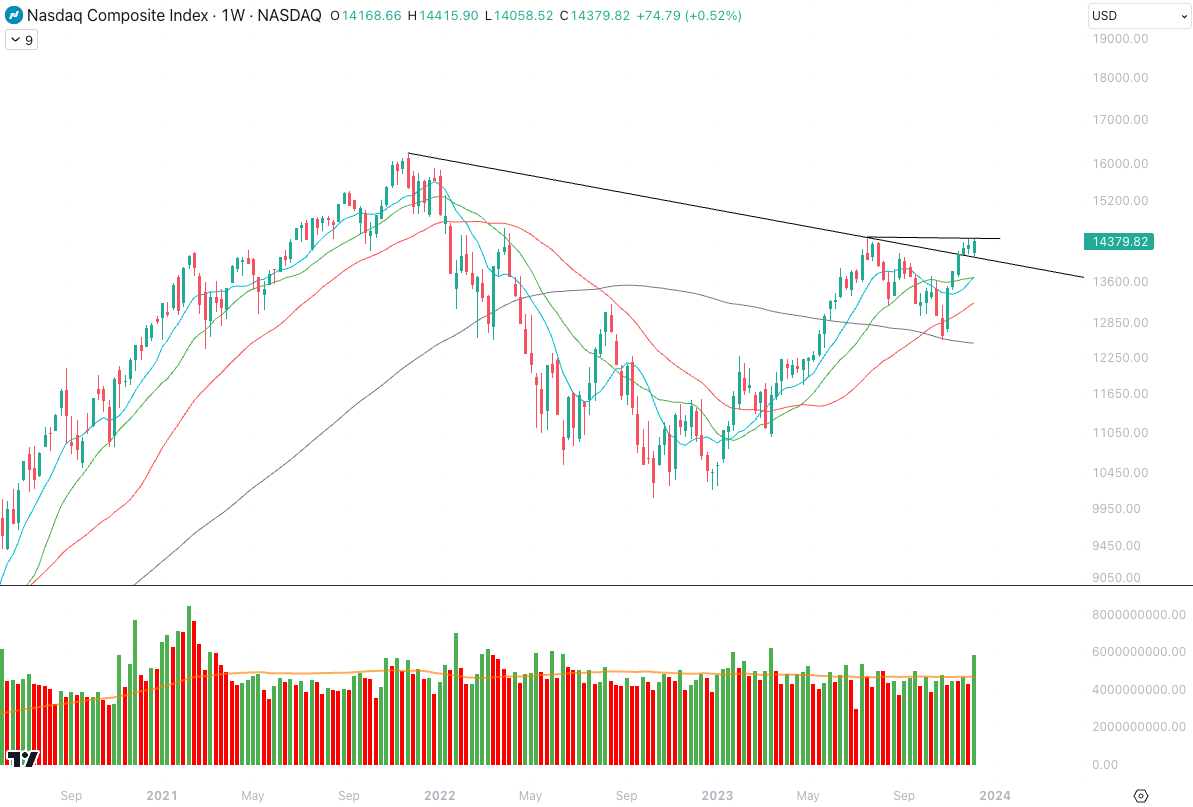

4. Nasdaq Composite (Weekly). With the market looking ahead to rate cuts coming in Q2-Q3 2024 (estimation), we’ve seen quite the rally from equities across the last 6 weeks. It’s hard to believe, but the Nasdaq is now only ~11.2% below all-time highs. For context, the index is currently up ~14.7% since October 26th. While anything could happen, of course, the weekly chart below currently looks like a textbook cup and handle pattern, with buy volume exploding up the right side.

Bitcoin Exposed Equities

5. Riot Platforms. The biggest news from public Bitcoin miners was the announcement of Riot’s $290.5M order of Whatsminer M66S’s, one of, if not the, largest ASIC orders in history. This batch of 66,560 machines is set to increase their hashrate by 18 EH/s, bringing their operation to 38 EH/s in H2 2025. The deployment of cash and debt financing into ASICs has been a recurring theme in 2023, which is why it's no surprise to see RIOT up over 350% YTD.

6. BEE Comparison Table. Publicly traded Bitcoin companies have been on a tear in Q4, and this week was no exception. It was interesting to watch this group on Wednesday/Thursday. As the leaders (RIOT, MARA, CLSK) digested their gains, we saw a rotation of capital into smaller names. ANY led the pack this week, seeing a 53% gain between Monday’s open and Thursday’s close.

Bitcoin Technical Analysis

7. Bitcoin / USD (weekly). You probably haven’t heard, but Bitcoin has had another glorious week of price action. After tapping $45,000 on Tuesday, we’ve seen a very orderly digestion between $42,900-44,150. Despite what Jamie Dimon would have you believe, this is a clear signal of institutional accumulation. Price now sits just below a fairly significant resistance zone between ~$45,800-48,400. This is likely a range where we see some logical profit-taking, before taking a stab at $50,000.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

Bitcoin On-Chain / Derivatives

8. Swan Bitcoin Deploys $200,000,000 in 2023: Increasing venture capital interest in Bitcoin-only businesses is a major shift from the 2017 & 2021 cycles in which most VC capital was deployed into “crypto”, rather than Bitcoin. Swan Bitcoin is the latest Bitcoin start-up to raise and deploy an eye-catching amount of capital, joining the likes of Unchained who raised $60 million earlier this year.

Capital being allocated to Bitcoin businesses is a remarkably bullish development. For Bitcoin to become more widely adopted, user-friendly infrastructure needs to be in place that can service the masses.

This is likely just the beginning of a VC rush into Bitcoin businesses. As the market cap of BTC grows, so will the opportunity for profitable, value-creating businesses that interface with every aspect of the network; from mining, to custodial solutions, to financial services, to lightning/L2s, and more.

9. % Supply Last Active 1+ Year(s) Ago: Despite a ~160% increase in the BTC price over the past year, 71% of the supply has stayed put, and that number continues to rise.

There is much debate over what causes the Bitcoin cycles. Is it halvings? Is it global liquidity? I’d argue that both of those are catalysts, but the biggest catalyst is HODLer behavior. The contraction of supply into the hands (wallets) of convicted Bitcoiners creates a supply squeeze that forces price to respond.

The HODLer behavior is much different now than it was the first time BTC surpassed $40,000 back in 2021. At that time, HOLDers were distributing coins, with the supply last active 1+ year(s) ago at 57% and dropping. Seeing the exact opposite this time around means that $40,000 is likely just the beginning of the bull market.

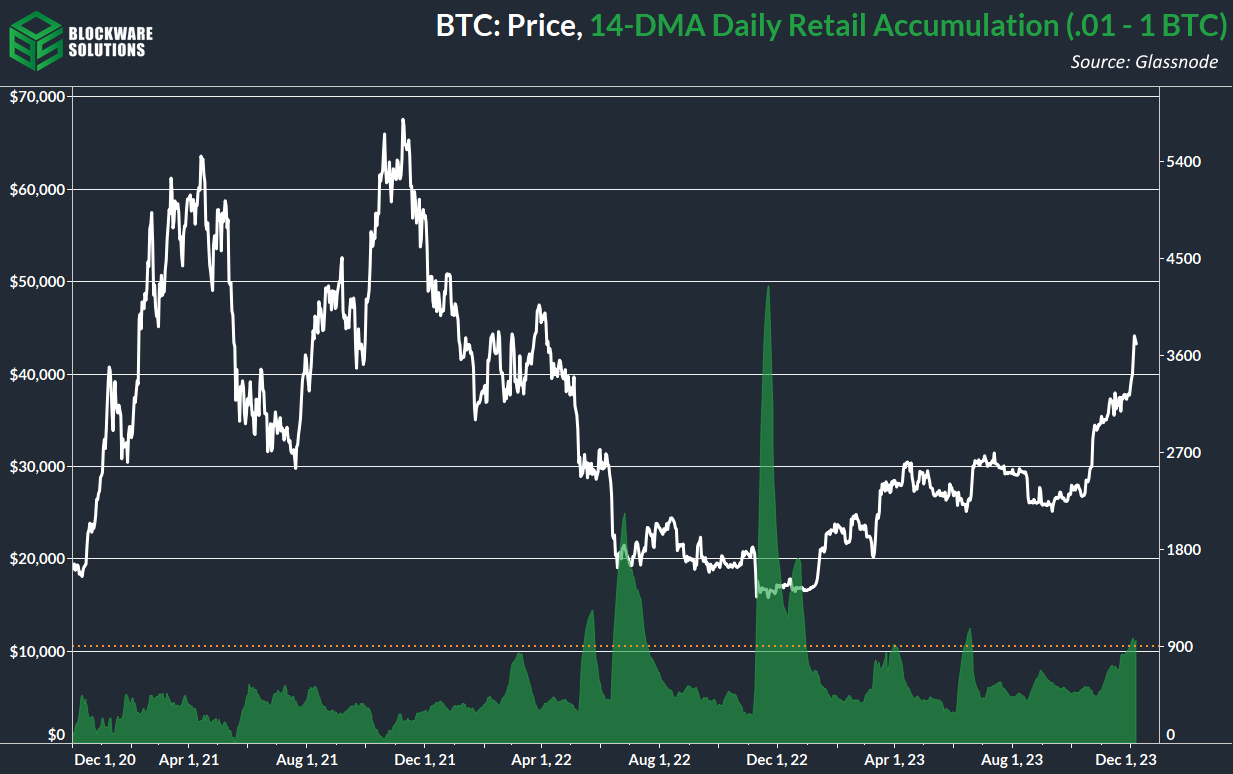

10. Retail Accumulation: This chart measures the single-day change in the supply held by on-chain entities with .01 BTC to 1 BTC; with a 14-day moving average applied. Retail has been accumulating harder into the recent price rally, rather than selling the coins they accumulated in the bear market. The orange dotted line is the rough measurement of daily issuance to miners; 900 BTC per day. At the current pace, retail is stacking more BTC per day than what is getting mined by miners.

Bullish.

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

Bitcoin Mining

11. Hashprice: Due to the confluence of the higher BTC price & higher TX fees, hashprice, the primary measurement for miner revenue ($/Th/Day), is nearing $0.10; it’s the highest level in months.

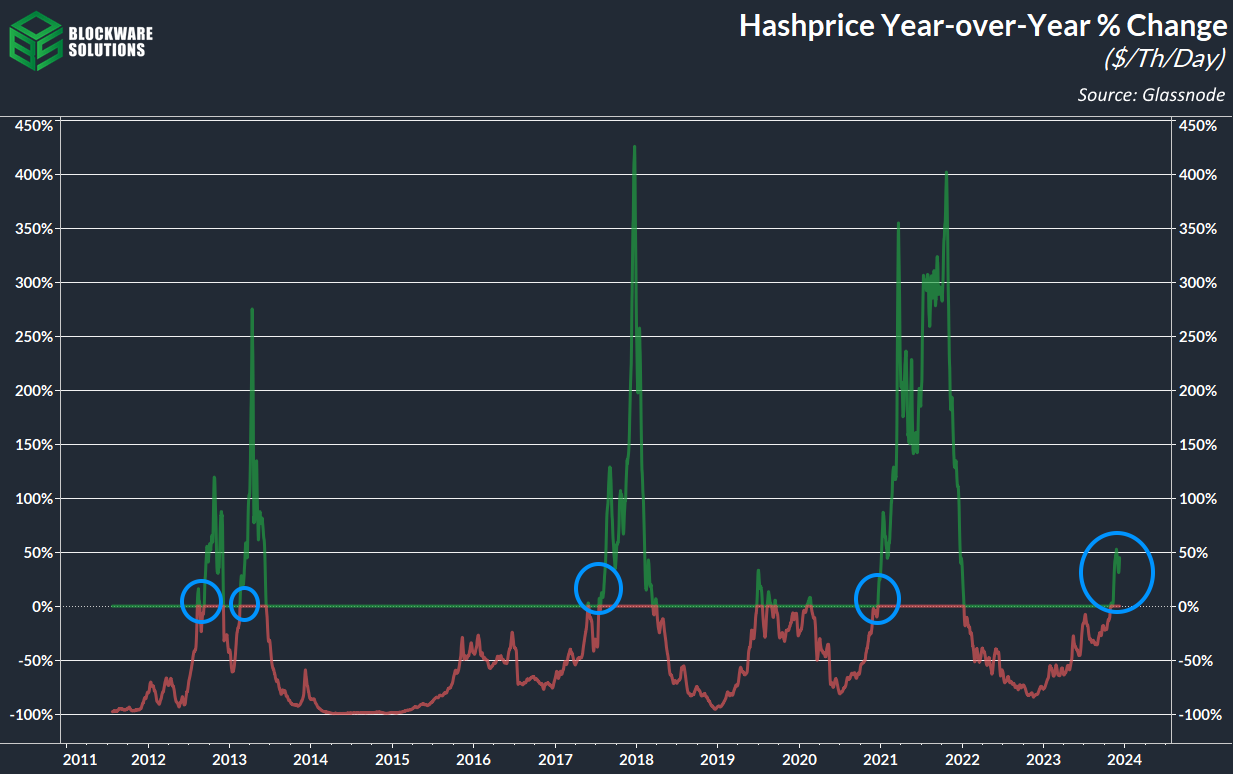

12. Hashprice Year-Over-Year % Change: Hashprice, the primary measurement for Bitcoin mining revenue, has crossed the Rubicon. When hashprice goes from negative year-over-year growth to positive, that historically precedes a parabolic move. This is likely the best time in the cycle to acquire Bitcoin mining rigs, as they are still more or less at bear market prices, despite the storm of bullish catalysts that is brewing.

13. % Miner Revenue from TX Fees: in the wake of the higher BTC price, Bitcoin mining difficulty/hashrate has risen as well. However, the rise in transaction fees has more than offset the rising difficulty, which is the reason for the continual rise in hashprice. The 30-day moving average of transaction fees has surpassed that of the ordinal craze that took place in the spring, which signals that this bout of high fees will likely stick around for the foreseeable future.

14. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,714 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.