Blockware Intelligence Newsletter: Week 23

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 1/21/22-1/28/22

Blockware Solutions Staking-as-a-Service Update

Blockware Solutions provides the infrastructure that powers the decentralized, digital economy.

In addition to the continued expansion of our Bitcoin mining services, Blockware will also be expanding its Staking-as-a-Service offerings. Blockware currently supports several Proof-of-Stake protocols such as ETH, SKL, LUNA, & HNT with several other projects in the pipeline.

Let us know what tokens you are interested in staking or if there are any additional projects you would like to see Blockware support.

Fill out this short survey if you are interested.

Summary:

We can confidently say we’ve been in a bear market for technology stocks since November.

Oil & gas manufacturers, financials and consumer staples continue to vastly outperform risk assets like growth stocks and Bitcoin.

Bond yields continue to rise, pulling liquidity out of the stock market and into bonds.

Are Treasury Inflation-Protected Securities showing us that inflation has been priced into the bond market?

Argo Blockchain and Coinbase are currently some of the crypto-exposed outperformers. How can we find more?

Geopolitical Bitcoin Mining Game Theory. What is it and what does it mean for Bitcoin?

Correlation to equities very strong

Bid-side stacked for BTC

Whales holdings starting to tick up for the first time in 6 months

Supply-side still looks great, but only speaks to one half of the equation

On-Chain/Derivatives Update

Another interesting week as always for Bitcoin. After breaking below 40k support, BTC now faces 40k as a heavy resistance level. Below support remains 30k across several timeframes, but the area seems to have been front-run for now.

This frontrunning primarily came from an entity on Coinbase. As Bitcoin reached local lows just below 33K, a fairly aggressive bid stepped in from Coinbase, shown by the heatmap of bids, cumulative volume delta, and volume.

Let’s talk supply and demand. A lot of folks have asked: What happened to the supposed on-chain supply shock? For a supply shock to occur we need: (Low available supply + Demand) Let’s break this down.

First, we’ll talk about supply. Illiquid supply shock ratio continues to climb. This means that coins are moving from entities that hold less than 75% of the coins they take into entities that hold more than 75% of the coins they take in. In laymen’s terms, this shows that coins are moving to strong hands. The qualitative aspect of Bitcoin’s float looks very healthy. Of course, this is only one side of the equation. We can have all the holding behavior in the world but if there’s no marginal demand stepping in it doesn’t translate to price appreciation.

Now to the demand side of things. Generally speaking, I believe demand has been lackluster over the last few months as illiquid supply has increased because of macro uncertainty and general risk-off behavior in traditional finance. But from a more tangible data perspective, I like to look at two different things: Whale balances and Spot CVD (cumulative volume delta). Because of the email limit, I’ll only be including one of the two. This looks at all entities (forensically clustered addresses) on the blockchain with more than 1,000 BTC and then filters out exchanges and other known entities.

Whales had been distributing since September, but it seems that this week they are finally adding to their holdings (see an uptick in blue circle). A very interesting trend to watch for continuation over the coming weeks.

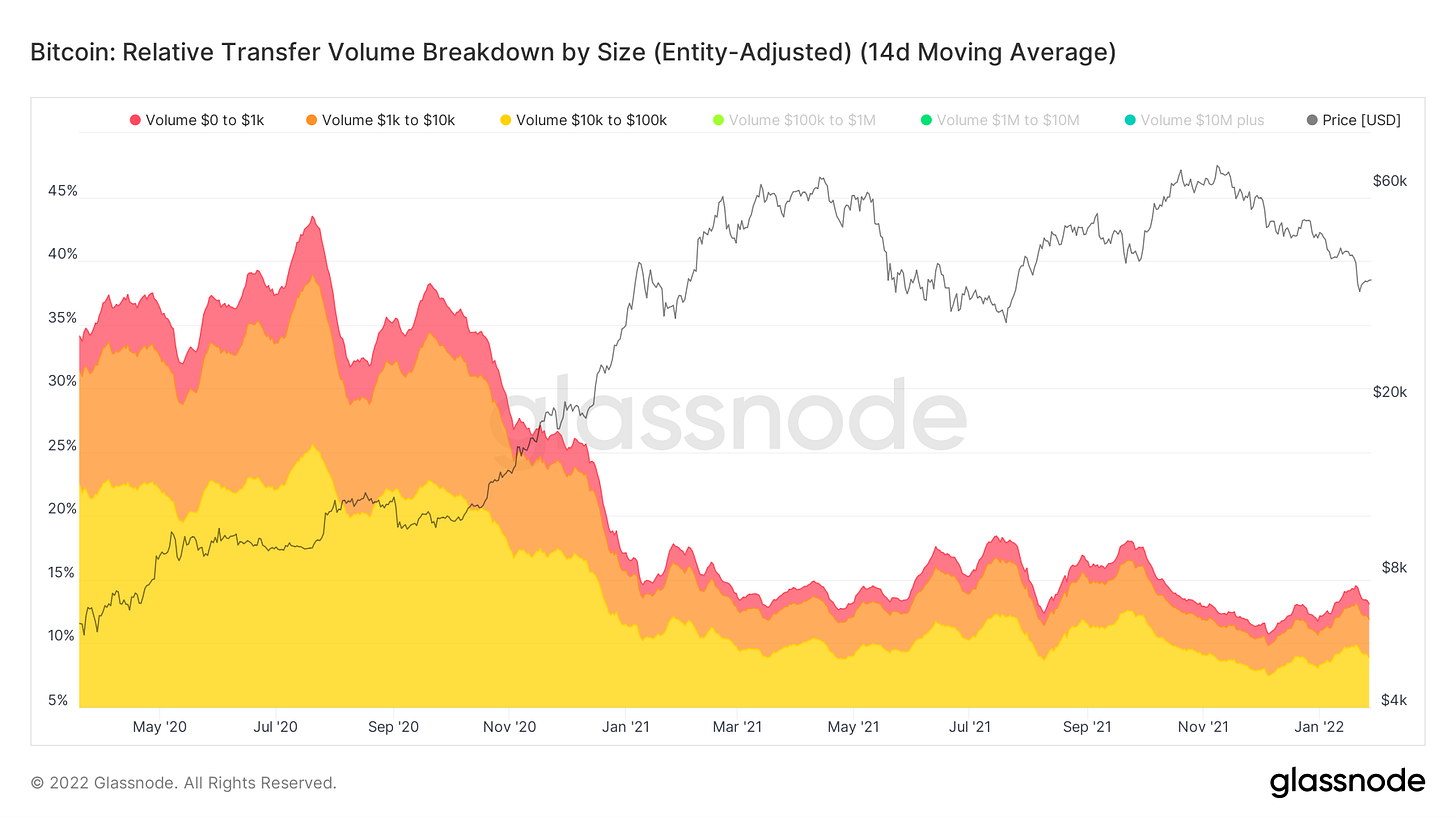

On a side note about large market participants: Large transactions are currently dominating volume. This is a trend that has been growing for over a year now. Since 2020, the big boys are here and their share of transfer volume is only growing. This is also likely a reflection of transaction batching becoming more popular with major exchanges.

At the same time, we’ve seen a decrease in transfer volume dominance coming from transactions less than $100K.

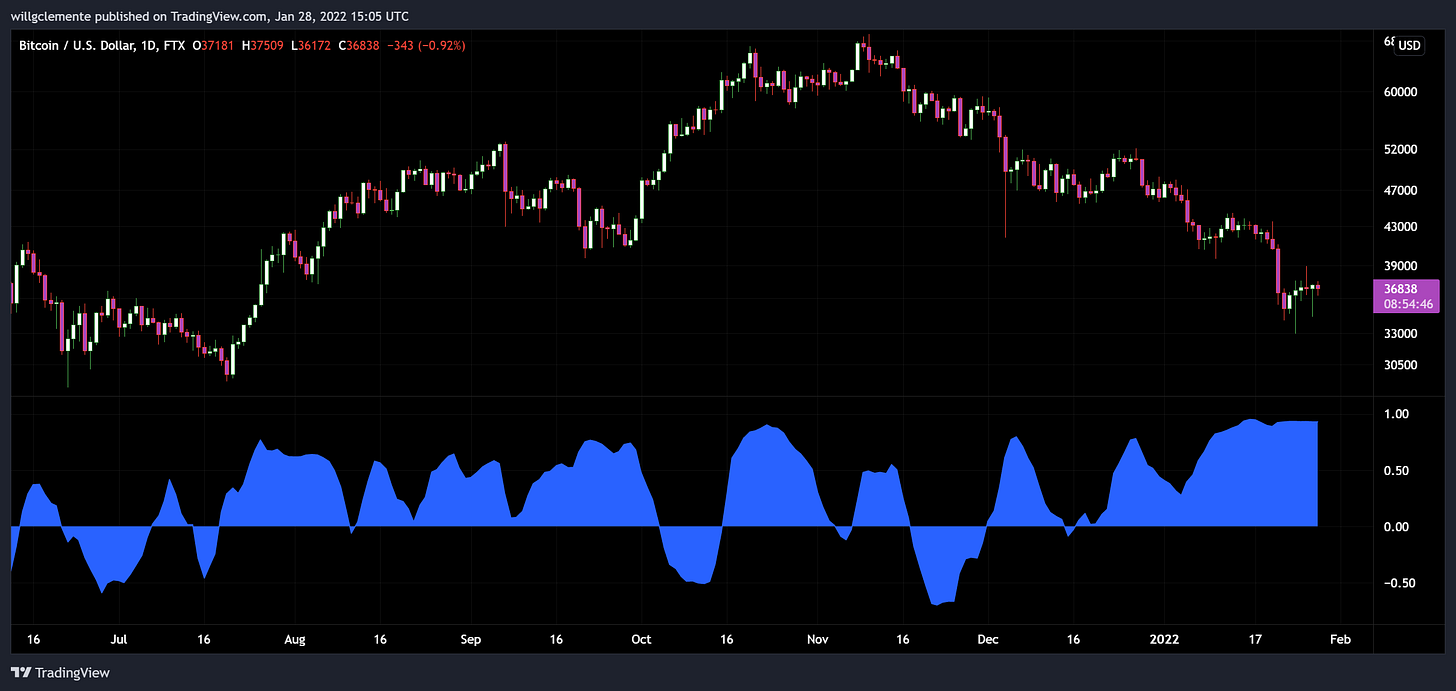

Correlation to equities continues to be a driving factor for BTC. We’ve seen some intraday “decouplings” of BTC, with an example being this Monday when the Coinbase buyer stepped in sub 33K, but the general trend has been tight correlation. This is shown by the blue indicator below: As you can see correlation has been the strongest in months.

Part of this is that without a catalyst, there are no idiosyncratic flows to BTC for the time being. For this correlation to break, we either need traditional finance (particularly QQQ) to rebound, allowing Bitcoin to trade like a high beta asset to rebounding equities; or some time of catalyst for BTC to break the correlation. There is no shortage of interesting news for the asset lately: Russia rumors, Intel getting involved in mining chips, Google looking to store crypto in partnership with Coinbase, Apple and Microsoft talking about the “metaverse” on earnings calls, El Salvador Bitcoin bond raise coming up, rumors of other LatAm countries following them. I’m not saying you should blindly bet on one of these catalysts occurring, but these are some of the potential events that could break the correlation. For the time being, we are stuck to the hip of equities.

To wrap up, I think there are two types of players in the Bitcoin market: Momentum buyers and value buyers.

For momentum buyers, particularly from a high time frame perspective, short-term holder cost basis is the level that I believe is most important to reclaim and flip as support from an on-chain perspective. The psychology behind this is that above this level, newer market participants are in a state of profit; when below they are sitting in a state of loss. Historically it has been wise to be cautious once below this level and ideally, you want to buy the retest of support once broken back above. This currently sits at $41,500. Again this is for momentum-based market participants.

For value-based market participants, we feel that the low 30Ks/upper 20Ks are a value area for Bitcoin. this is partially based on price action, as well as macro bottom indicators such as the 200W, realized price, and delta price being in the mid 20Ks. Calling the exact bottom is a bit of a fool’s game, but sometimes it’s as simple as asking yourself where the asymmetry lies. We believe the asymmetry is not skewed the downside with Bitcoin in the low 30s/upper 20s. Does this rule out a potential capitulatory wick on some type of macro breakdown? No. This is also why buying a lump sum and trying to time the bottom is probably not the best idea. Averaging into these levels with a multi-month horizon is the approach we are taking. (NOT FINANCIAL ADVICE)

General Market Update

Another brutal week, so much so that we can confidently say we’re in a bear market for tech stocks. The indexes are not yet 20% off their highs, as the bear market benchmark requires, but the price action we’re seeing across tech/growth stocks is extremely typical of an extended downtrend.

This week on Tuesday and Wednesday we saw many stocks gapping up, meaning they traded higher pre-market in order to open higher than their close the previous day. Gap ups can be great opportunities in an uptrend but in this environment we’ve seen them sold hard.

This tells us that the market isn’t ready for higher prices yet. Gap ups trap aggressive bulls then sellers step in for the exit liquidity. Gap ups turning into gap fills nearly every day is classic bear market price action.

This market has seen a strong rotation into, generally, more commodity and value based stocks. Industry groups like oil & gas manufacturers, coal producers, banks and transportation have seen big inflows of capital over the last couple months.

BTCUSD vs. XLP vs. XLF vs. XOP vs. ARKK (Tradingview)

The chart above compares two classes of risk assets since early December. Higher growth (riskier) assets have been hit the hardest in this current capital rotation.

The high growth fund ARK (orange) has been shown no mercy, now down nearly 50% off its previous all-time highs. From the November peak, ARKK is down about 47%. As we all know, Bitcoin has been hit too, also down roughly 47% off its highs at the time of writing.

On the other hand, XLP (consumer staples), XOP (oil and gas) and XLF (financials) have vastly outperformed risk assets. I’ve included the above chart to illustrate the idea of capital rotation.

In the stock market, we often don’t see an all-encompassing bear market. We may have a bear market in some sectors, while other ones breakout of bases. It reminds me of a seesaw, where one area dips and forms bases while the other one makes all-time highs, and then the macro environment changes and they flip positions.

The most impressive move I’m seeing at the moment is coming from the bond market, which is never a good sign for technology equities. The US Treasury 2 Year Bond has increased yields by over 16% this week alone. The 10 Year hasn’t been as volatile on the week, up about 1.70% at the time of writing.

US10Y vs. SPY vs. BTCUSD (Tradingview)

Above is one more comparison chart to help further reiterate the relationship between bond yields and risk assets. This chart shows the returns of the US 10 Year Treasury Bond (dark blue), the S&P 500 (orange) and Bitcoin (teal).

More interestingly, in the bond market we have something called Treasury Inflation Protected Securities (TIPS). These treasury bonds work as a way for investors to hedge against inflation. So generally, when market participants believe inflation is on the rise, TIPS rallies too.

TIP 1D (Tradingview)

What’s interesting is that TIP (The TIPS ETF) is at the same level it was in July of 2020. Furthermore, TIP is actually down about 4% since November, as seen above.

This would tell us that despite the somewhat recent news of likely seeing 3-4 interest rate hikes in 2022, the bond market has been pricing this news in for months. I believe this is a bullish signal and helps back the theory that the first interest rate hike could potentially be a “buy the news” event.

Nasdaq Daily Market Indicators (Marketsmith)

Last week I discussed a few of the metrics that point to the idea that we may be nearing the bottom. But as I had said last week, while the Nasdaq may appear oversold, it can always become more oversold. That is precisely what we saw this week.

If you compare this set of indicators to the same set I posted last week, you see even more extension from neutral levels. This is why we wait for confirmation before re-entering the market. My favorite way to do this is to wait for a follow-through day.

I’ve discussed the follow-through day (FTD) before in this newsletter. If you don’t remember, a FTD occurs once the market has put in an apparent bottom. Once there’s a potential bottom in any of the three major indexes, we begin to count the number of days that have passed without undercutting the lows of the bottom.

If by day 4 we haven’t undercut the lows, and there is a day where price is up >1.5% with volume greater than the previous day, we get a FTD. (Go back to the Week 18 Newsletter for an example).

A follow-through day is a signal that a new uptrend has likely begun.

What’s Going On With Crypto-Equities?

Once again, the market for crypto-exposed equities isn’t ideal. Between the hits we’ve seen Bitcoin and other higher growth assets take, it’s clear that these names are going to need some time to recover.

This is a great period of time to be focused on research, and ranking these stocks by relative strength. There are many ways we can go about doing this, but the simplest would be to calculate how much % these names are off their November highs and then compare that to BTC.

The names that have corrected the least amount are much more likely to outperform once the selling pressure dissipates.

Above is an excel sheet with mostly miners, but also a couple other types of crypto-exposed names. On the right-hand side, you can see how much percent down these names are compared to Bitcoin. We can use this to identify the names that are strong relative to the rest of the pack.

Argo Blockchain and Coinbase are the two clear leaders of this basket of stocks, according to this study. I’d highly recommend doing your own relative strength research to put yourself in the best possible position once the trend flips bullish.

By understanding which names are seeing aggressive capital outflows, and which names are being held onto by institutions, you can find where to focus your attention.

Mining

Geopolitical Mining

About a week ago, Russia’s Central Bank proposed a ban on all crypto mining, but the president of Russia, Vladimir Putin, recently backed a Russian government proposal to tax and regulate crypto mining. He effectively rejected the central bank's proposal to ban mining.

With that said, Putin does still insist on restricting mining to regions with a surplus amount of electricity, which is likely where a large number of mining farms would exist anyway due to the lower cost of electricity.

Putin basically ordered the government and central bank to work out their differences and reach an agreement. This is good for Bitcoin as the network can continue to grow in a geographically decentralized manner. After the China mining ban in the Summer of 2021, Russia became the 3rd largest country mining Bitcoin in the world. As of August 2021, Russia had 11.2% of the total network hash rate as estimated by Cambridge. For comparison, the US has more than 35%.

Geopolitical Bitcoin Mining Game Theory

Bitcoin mining at the geopolitical stage is a massive Prisoner’s Dilemma with 195 different players (195 countries). A Prisoner’s Dilemma is one of the most common games recognized in game theory. It shows why two individuals may not cooperate even if it is in their best interest to do so.

Relating to mining, countries may try to ban mining for a variety of misinformed reasons, but in reality, most countries aren’t banning it and shouldn’t ban it.

This table was inspired by Parker Lewis’s original Banning Bitcoin Prisoner’s Dilemma.

The general idea of geopolitical Bitcoin mining game theory is that if a country does decide to ban mining, they will lose.

We clearly saw this occur with China in 2021 when mining was banned. As a result, capital in the form of ASICs and Bitcoin escaped Mainland China and that capital was attracted into other countries around the world. Other countries benefited from lower network mining difficulty (due to machines turning off) and higher mining profits. This has resulted in the growth of Bitcoin mining everywhere else leading to more capital creation and higher tax revenues for all other countries.

Su Zhu from Three Arrows Capital tweeted that he thinks China will reverse its mining ban and allow mining within the next 3 months. While we don’t know what the exact probability of this happening will be, it wouldn’t be too much of a surprise as China would greatly benefit from increased capital flows / investment and more tax revenue.

At the end of the day, Bitcoin is an immutable new technology tool. As society begins to understand what this is, we are seeing a race to accumulate and mine Bitcoin. It’s a race on the individual level, a race on the local level, and a race on the geopolitical level.

This is the only asset in the world that has no counterparty risk and no dilution risk. So get stacking and get mining.

If you’re looking to deploy capital into the mining space, geopolitical risks are an important factor to consider. Always deploy your own capital into a jurisdiction that will not shut down your operation overnight.

Loved it Will. I've been thoroughly enjoying these weekly newsletters. Not only is the information solid and sound, but the writing is great too. I'm 23 years old, studying law and economics in Amsterdam. If you need absolutely any assistance at all, be it research, writing or video production - I'd be happy to help. My email address is oscar.stubbs@gmail.com - feel free to shoot me a mail !

Great article. Awesome analysis. Loved reading this weeks newsletter!!!

I especially liked the excel sheet comparing Bitcoin's performance with the performance of the Bitcoin related stocks!

As an idea... could the excel sheet be included on a weekly basis? I think it is a cool thing to quickly get an overview about the performance of the different stocks.

Maybe it could also be extended a bit... e.g. include columns for weekly and 12-month changes... maybe instead of the all-time high comparison if the sheet gets too complex to look at.

Just an idea, but I would definitely love that.

Keep up the good work! :)