Blockware Intelligence Newsletter: Week 153

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/2/24 - 11/8/24

🚨Mine Bitcoin with the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. We have multiple mining facilities across the United States with access to some of the lowest power rates in the world. There are thousands of these machines available for purchase on our Marketplace.

Historically, all commerce on the Marketplace uses Bitcoin. We are thrilled to announce that USD payments are coming very soon to the Marketplace! This way you can purchase machines with dollars, and HODL your bitcoin.

Click here to sign up for the Marketplace and start mining Bitcoin.

Bitcoin: News, ETFs, On-Chain, etc.

1. BTC All-Time High on the Back of Trump Victory

As you no-doubt know by now, bitcoin has soared into uncharted territory in the wake of Donald Trump’s victory. At the time of writing BTC sits at ~$75,700; roughly 10% higher than it’s 2021 high.

As investors it’s important to put emotions aside – especially during times like this – and think rationally about markets. And a Trump administration is bullish for Bitcoin for a few reasons:

He is committed to accumulating a strategic Bitcoin stockpile for the United States Government (and has a congress equipped to actually make this a reality)

He is committed to removing anti-Bitcoin politicians from important committees and positions (Elizabeth Warren, Gary Gensler, etc.)

Corporate tax cuts will widen the fiscal deficits, supporting the rising liquidity environment.

Pro-energy policy will support Bitcoin miners, lowering the operating costs, and allowing them to HODL more of the BTC they mine.

Rising asset prices is one of his top KPI’s (meaning he’ll likely support asset prices at all cost, as he did in 2020)

Howard Lutnik, the Pro-Bitcoin CEO of Cantor Fitzgerald ($13b AUM, primary dealer, bitcoin lending provider), will be responsible for staffing key roles with the Trump administration.

2. Nasdaq, S&P 500, $QQQ

Equity indices pumped as well – with the Nasdaq, Q’s, and S&P all up by more than 4% this week.

Markets are not only pumping because of the fact that Trump won, but also because of the simple fact that the election is over. Markets hate uncertainty – and US Presidential elections are just that. If you’ve been reading this newsletter regularly you’ll know that we have had the election circled on our calendar all year long. The real bull market starts now.

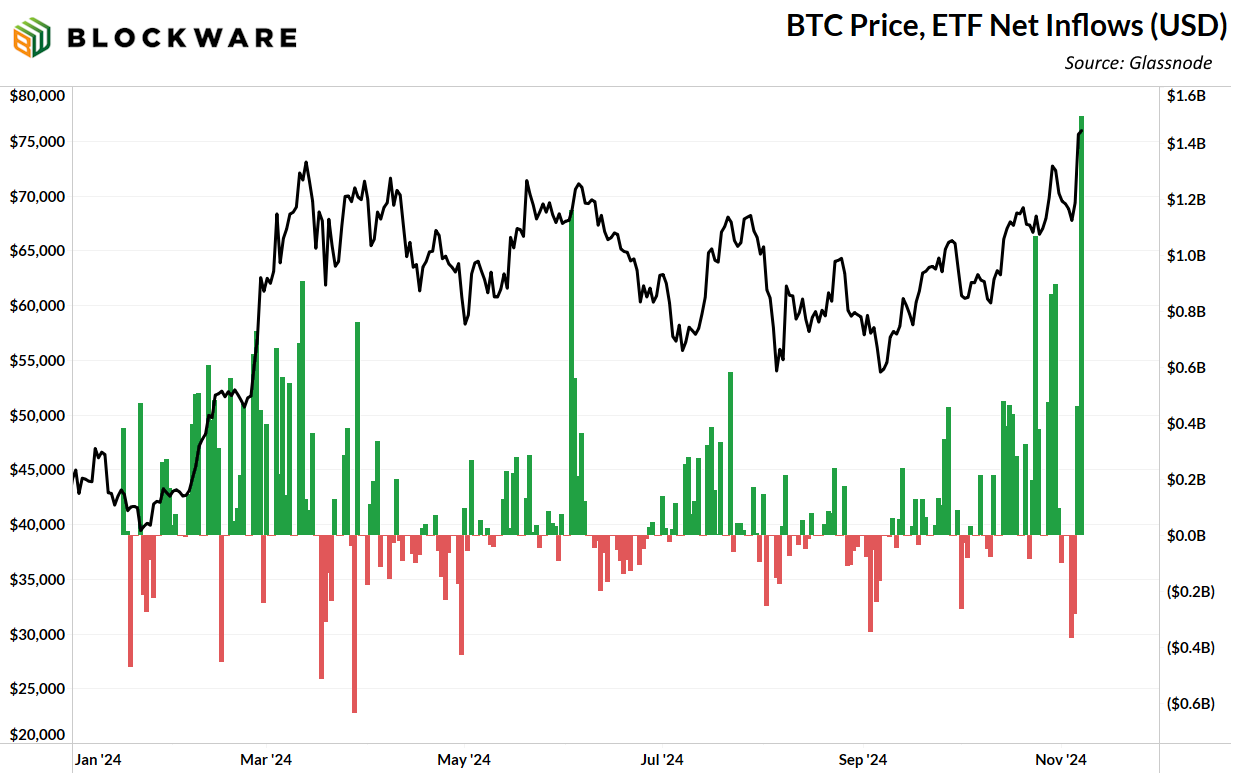

3. Spot Bitcoin ETFs

The ETF’s had an absolute monster week. Thursday set the all-time record for single-day net-inflows, with ~$1.5 billion combined across all the spot ETFs. The Blackrock ETF alone was responsible for ~$1.1 billion of the net inflows.

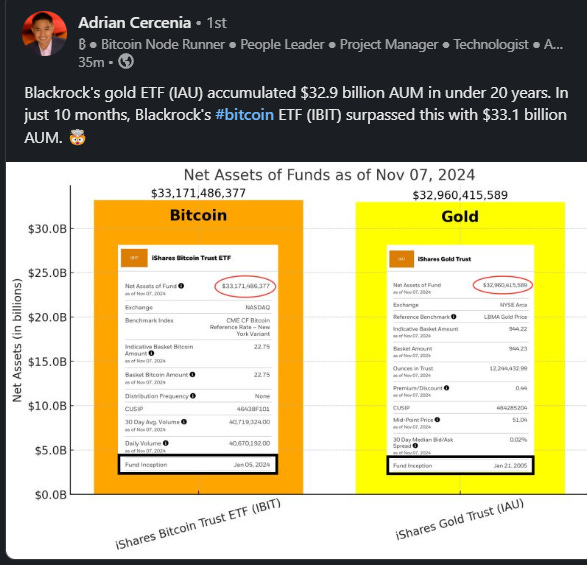

4. $IBIT Surpasses Gold ETF AUM

Blackrock’s Bitcoin ETF ($IBIT) has surpassed their gold ETF ($IAU) in net assets, despite the former having a 16-year head start. Investors see the writing on the wall and are responding accordingly, choosing digital gold over analog gold.

Gold, who has had a great year in itself, is now up to a market cap of ~$18 trillion. The gold market cap going higher signals even more upside potential for Bitcoin. At an $18 trillion market cap, Bitcoin-gold-parity would bring the price of BTC to ~$865,000 per coin, a nominal increase of more than 1,000%.

Source: AC

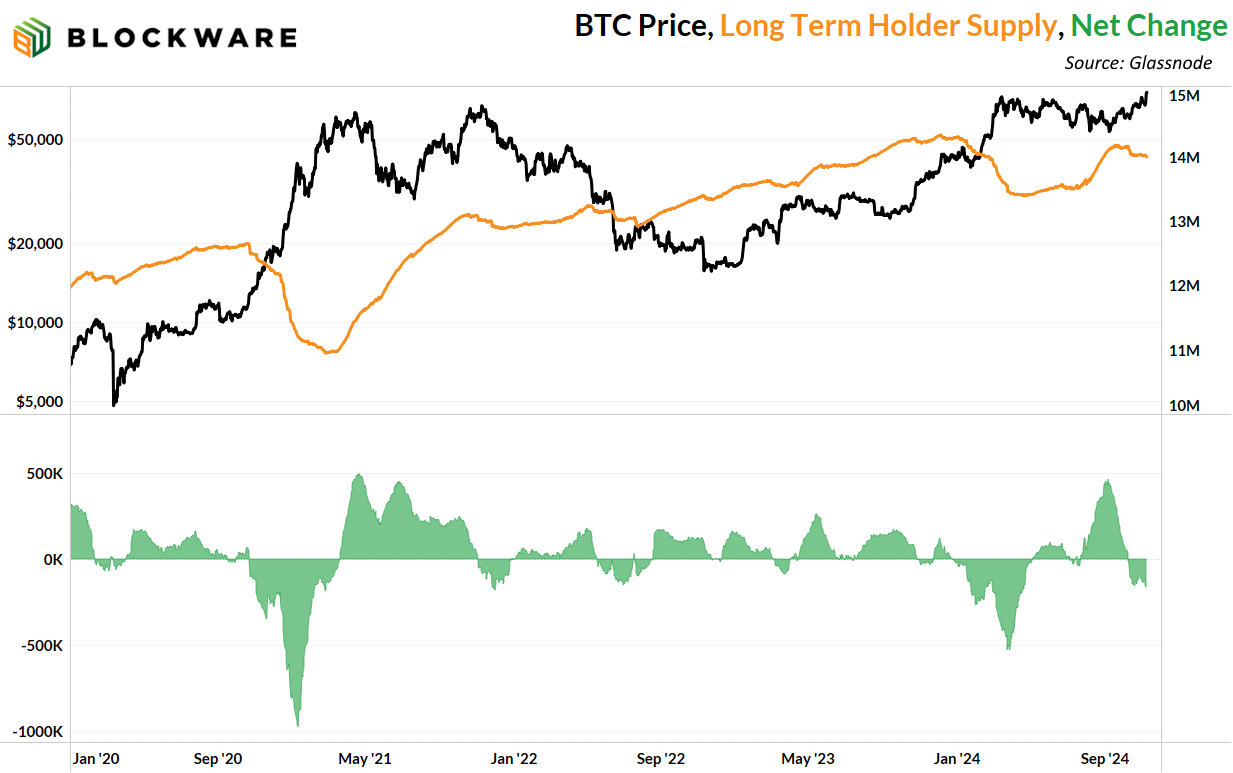

5. Long Term Holder Supply

With price hitting new all-time highs there has (expectedly) been a shift in supply from long-term holders to short-term holders, as the former sends coins to exchanges to sell. However, the selling from this cohort is far more muted than it was in Q1 & Q2.

There’s two ways for an increase in demand to find supply:

From the 450 new BTC mined per day

Bid price higher to incentivize existing HOLDers to part with coins

There’s far more demand than what can be matched by selling from miners, so #2 is the only option, and we’re seeing this play out on-chain. However, there’s clearly less desire for HOLDers to sell now, at $75k, than there was at the start of the year at $69k. There’s far more upside ahead. This is the early innings of a massive bull market.

Theya - Simplified Bitcoin Self-Custody

For secure, intuitive self-custody that fits seamlessly into your life, we recommend Theya.

Theya is the simplest way to safeguard your bitcoin, whether you're using their mobile app or their new web app. With flexible multi-sig and cold storage options, you choose how to hold your keys securely. Experience the ease of a true multisig solution, on your terms.

Ready to secure your bitcoin? Click here to get started and enjoy 10% off an annual subscription!

Click here to download the app and get 10% off an annual subscription!

General Market Update

6. Fed Cuts Rates by 25 Basis Points

After a 50bps cut in September, the Fed cut again on Thursday, this time by 25bps.The last time the Federal Reserve started cutting rates, BTC was ~50% below its previous all-time high. Right now BTC is 10% ABOVE its previous all-time high.

Nobody is bullish enough.

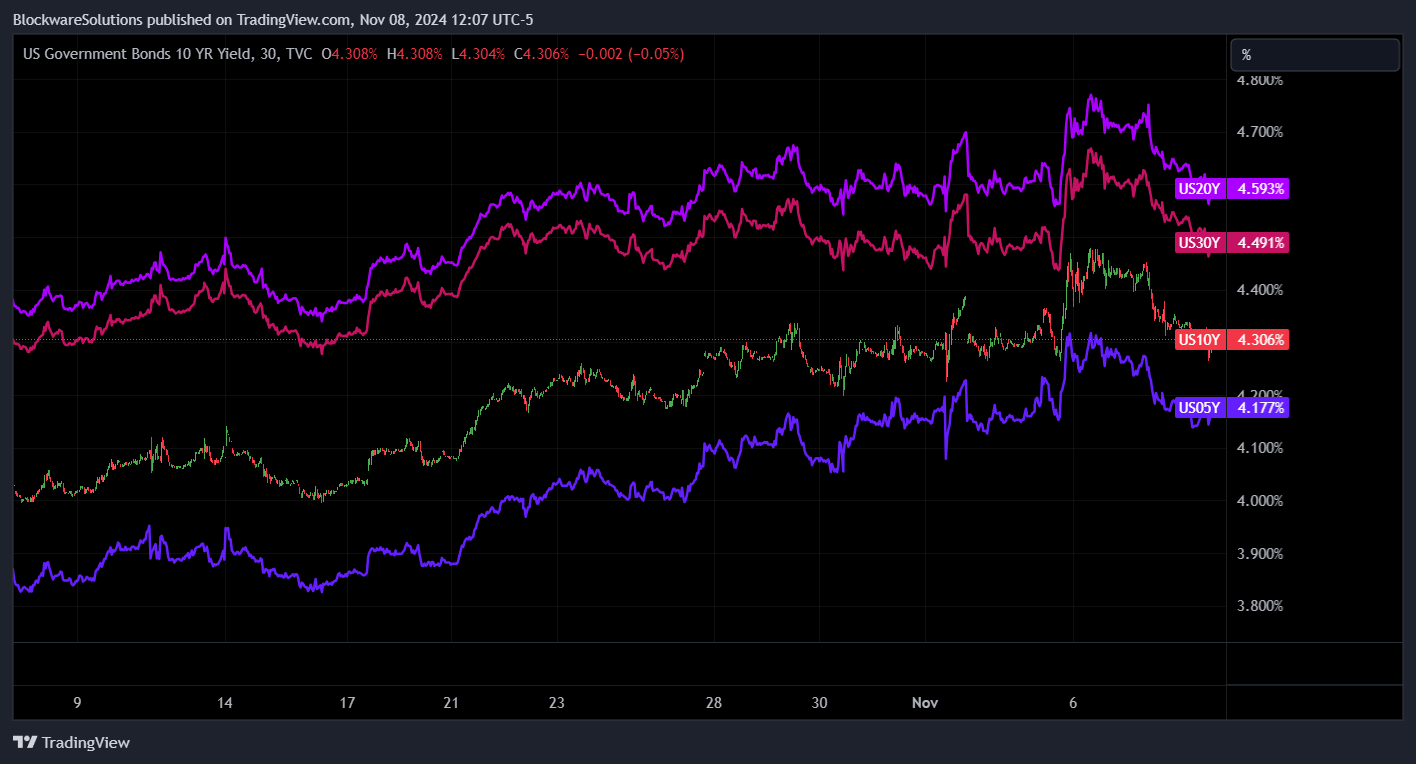

7. US Treasury Yields (Long Duration)

The price action in the bond market this week tells an interesting story. Upon Trump’s victory there was a spike in long bond yields (bond sell-off). The environment created by Trump policy will bode well for the price of risk assets – staying in bonds represents a significant opportunity cost, so it makes sense that this event resulted in a capital rotation.

However, after the Fed meeting on Thursday we saw yields come back down. The previous cut of 50bps and the dovishness that represents spurred investor concerns about long-term inflation, resulting in a sell off of long duration. The Fed took notes and cut by just 25bps this time around. Consequently, yields fell, which is a desired goal of their policy (even if they won’t say this outright). Moreover, cutting by 25bps leaves more “ammo in the chamber” in case they need to make emergency cuts in the event of a sharp economic downturn.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

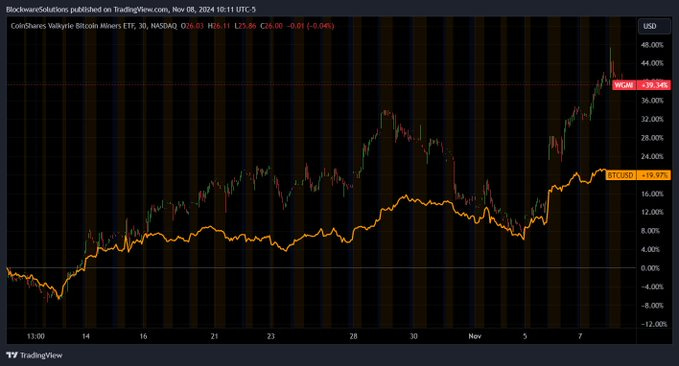

8. Mining Stocks Outperform

Over the past month $WGMI, the Bitcoin miner ETF, is up 39% compared to 19% for BTC. Mining stocks struggled to perform well this summer as the BTC price treaded sideways, and revenues were down after the halving.

But the tides are now turning. Mining difficulty is on the rise, signaling health among the miners: capital deployment hardware upgrades, energy production, etc. The ability of miners to produce bitcoin at a discount to the market price gives them the potential to outperform BTC significantly during a bull market. Moreover, they will have outsized benefits during the Trump administration due to the increase in energy production driving down prices for their largest operating expense.

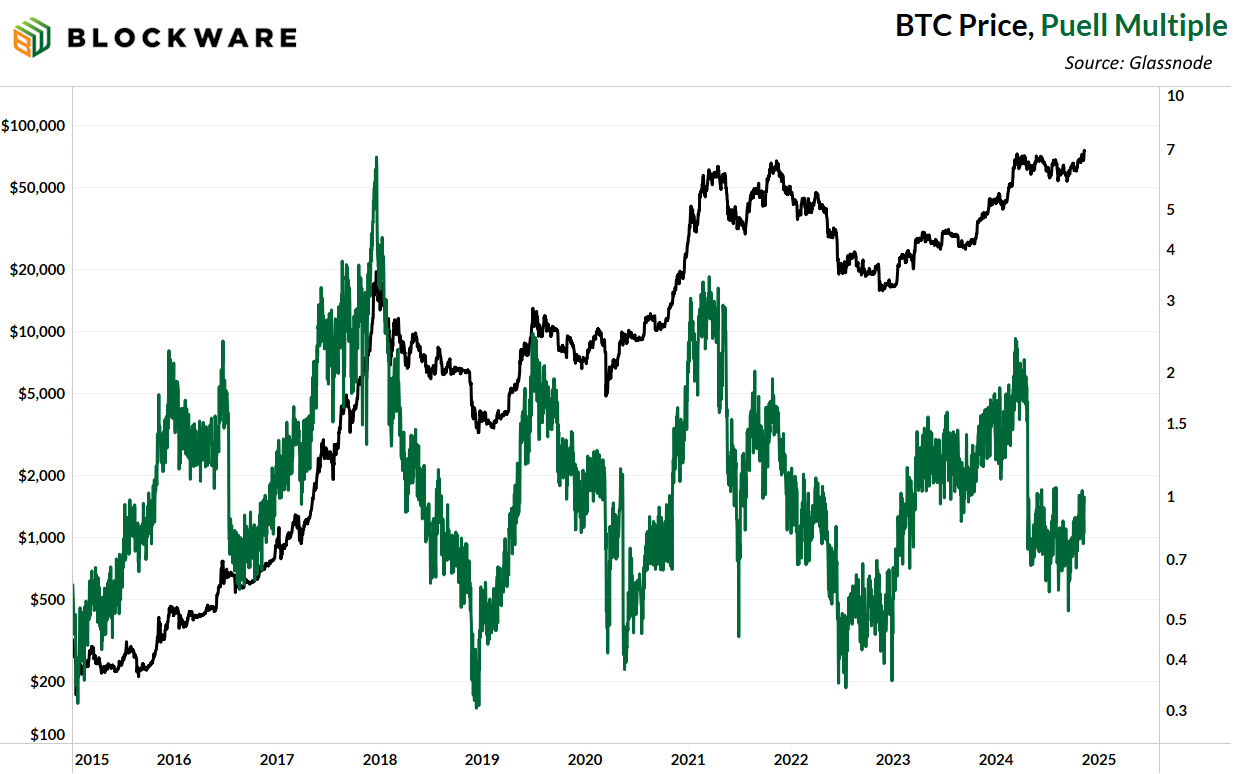

9. Puell Multiple

The Puell Multiple is an interesting on-chain metric that measures the revenue of Bitcoin miners while also showing potential upside in the Bitcoin price. It’s calculated by dividing the daily revenue of miners (in dollar terms) by the 365-day moving average of miner revenue. In other words, how much are miners earning now relative to the past year. The less they are earning on a relative basis the more upside exists in the price.

Puell multiple is less than half of what it was in Q1 2024 and Q2 2021. Lot’s of upside remains. BTC is nowhere near being “overheated.”

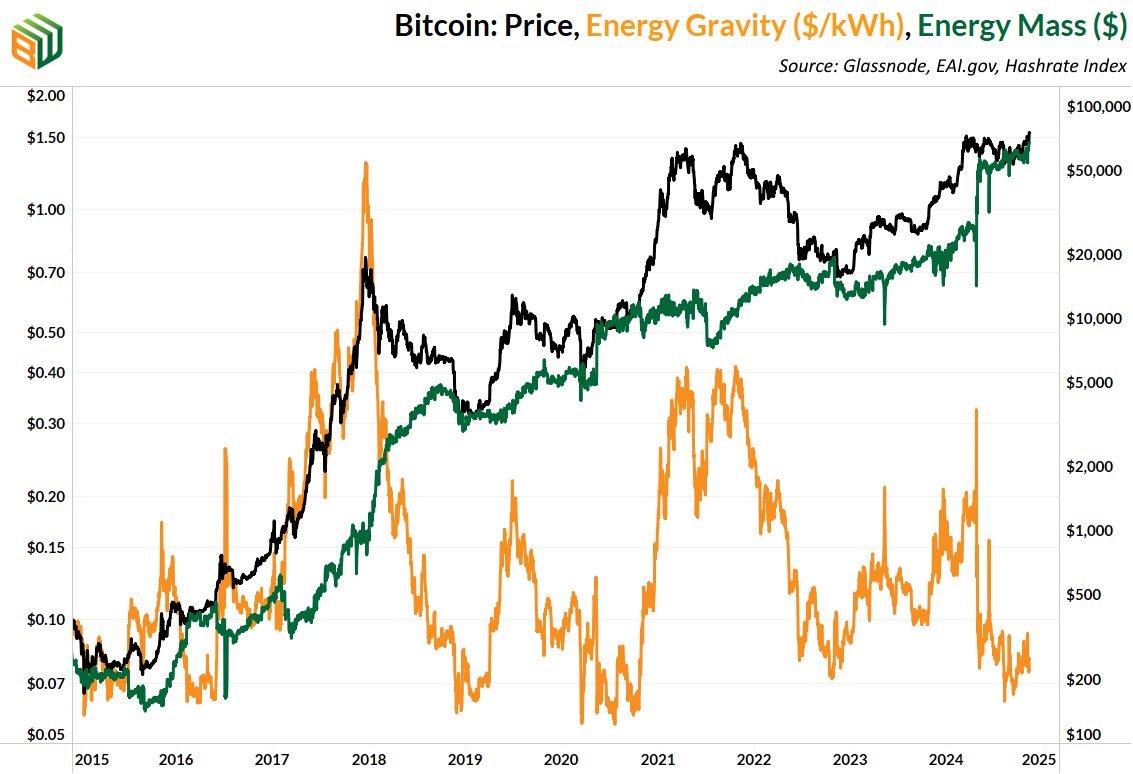

11. Energy Gravity

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$65,000 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig.The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Hi,

I am looking for excellent writers about the btc industry (which I'll pay).

Could you reach out to me via pieter@compoundingquality.net?