Blockware Intelligence Newsletter: Week 140

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 7/13/24 - 7/19/24

Bitcoin: News, ETFs, On-Chain, etc.

1. Blockware x BTC Nashville

More than a dozen members of the Blockware team will be in attendance for Bitcoin 2024; come meet us! This is shaping up to be the biggest IRL event in Bitcoin history. You don’t want to miss this once-in-a-lifetime experience! Speakers include:

Donald Trump

Vivek Ramaswamy

RFK Jr.

Michael Saylor

Cathie Wood

Edward Snowden

and more!

Click here to purchase your ticket and use the code ‘BLOCKWARE’ for 10% off.

We hope to see you there!

2. BTC Surges to $65,000

In last week’s newsletter, we cited multiple metrics that indicated a local bottom may be forming: Puell multiple, Realized P/L, and German seller exhaustion. As it turns out, we got that call right. Bitcoin is up 12% since last Friday and is now sitting comfortably at $65,000.

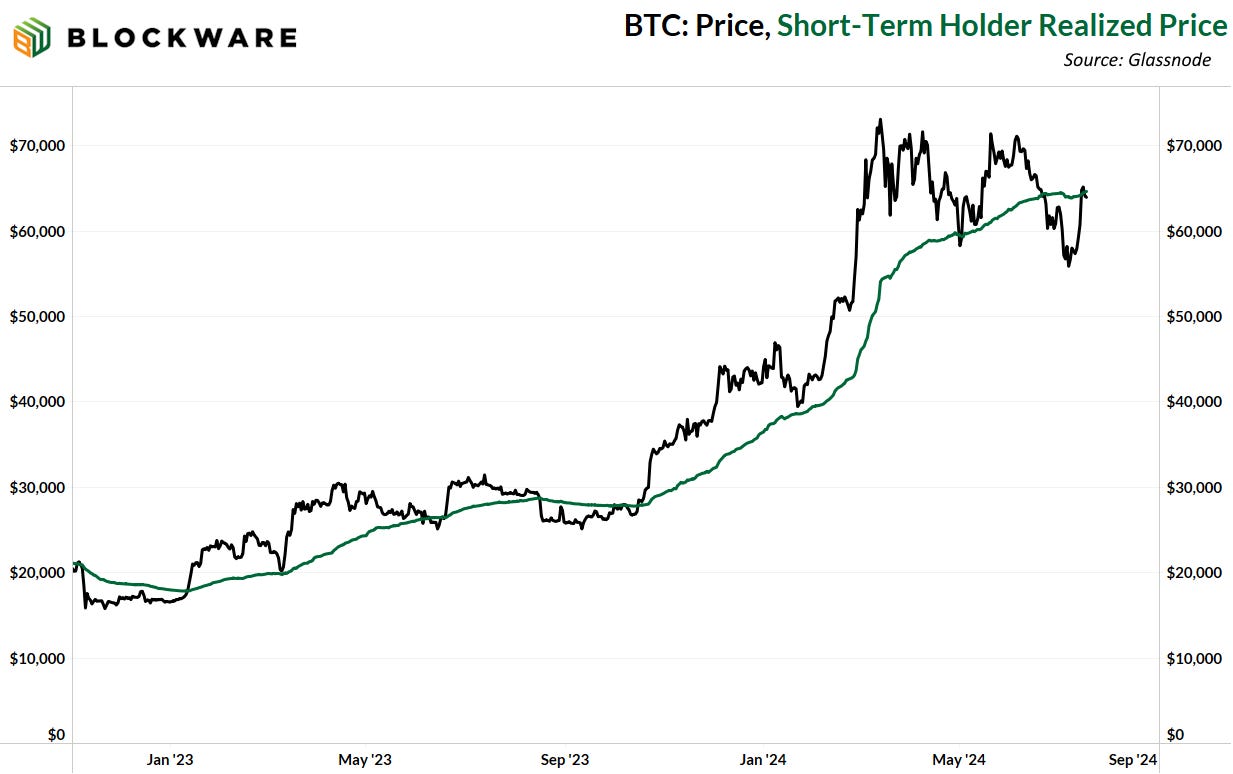

If you’ve read this newsletter for the past two years, you’ll know that the cost-basis of short-term holders is the most accurate on-chain indicator for support/resistance. After June’s price drop, this has now switched to resistance. If/when BTC breaks this level we will likely be looking at much higher prices in the weeks and months that follow; similar to the price action of Q4 2023.

3. Billionaires Turn Bullish

Two of the most well-known Bitcoin skeptics, Mark Cuban & Jamie Dimon, abruptly changed their public opinion of Bitcoin this week.

Six months ago, Jamie Dimon went on national television and called Bitcoin a “pet rock.” This week, sources allege that Jamie Dimon has changed his tune on Bitcoin. This could be an attempt to acquire a position as the Treasury Secretary in the Trump Administration. Given Trump’s vocal support for Bitcoin, Dimon is going to need to conform to the orange-coin in order to land that position.

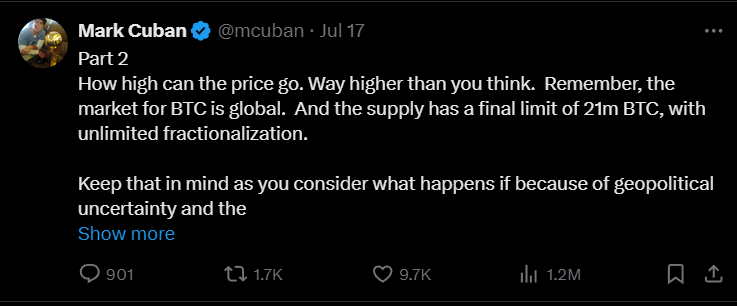

Mark Cuban, who hasn’t been as abrasive as Dimon in recent times, has still gone on public record criticizing Bitcoin multiple times. Most famously is his live Twitter spaces debate against Preston Pysh, Pomp, and other prominent Bitcoiners.

On Wednesday, Cuban launched an provoked series of tweets in which he expressed that the Bitcoin price can “go way higher than you think.” Cuban cited concerns around the dollar’s status as the global reserve currency as one of the driving forces behind rising demand for BTC; something which Bitcoiners have been discussing for years. The tides are changing.

The last point on this is that guys like this don’t just up and change their public opinion on a whim. They have likely been bullish in private for quite some time and waited until it made sense to change their public opinion. With that in mind, there’s likely many more public figures who are privately bullish on Bitcoin. The reputational risk of being a bull is fading away, expect many more people and institutions to publicly endorse Bitcoin over the next year or two.

4. Coin Days Destroyed (CDD)

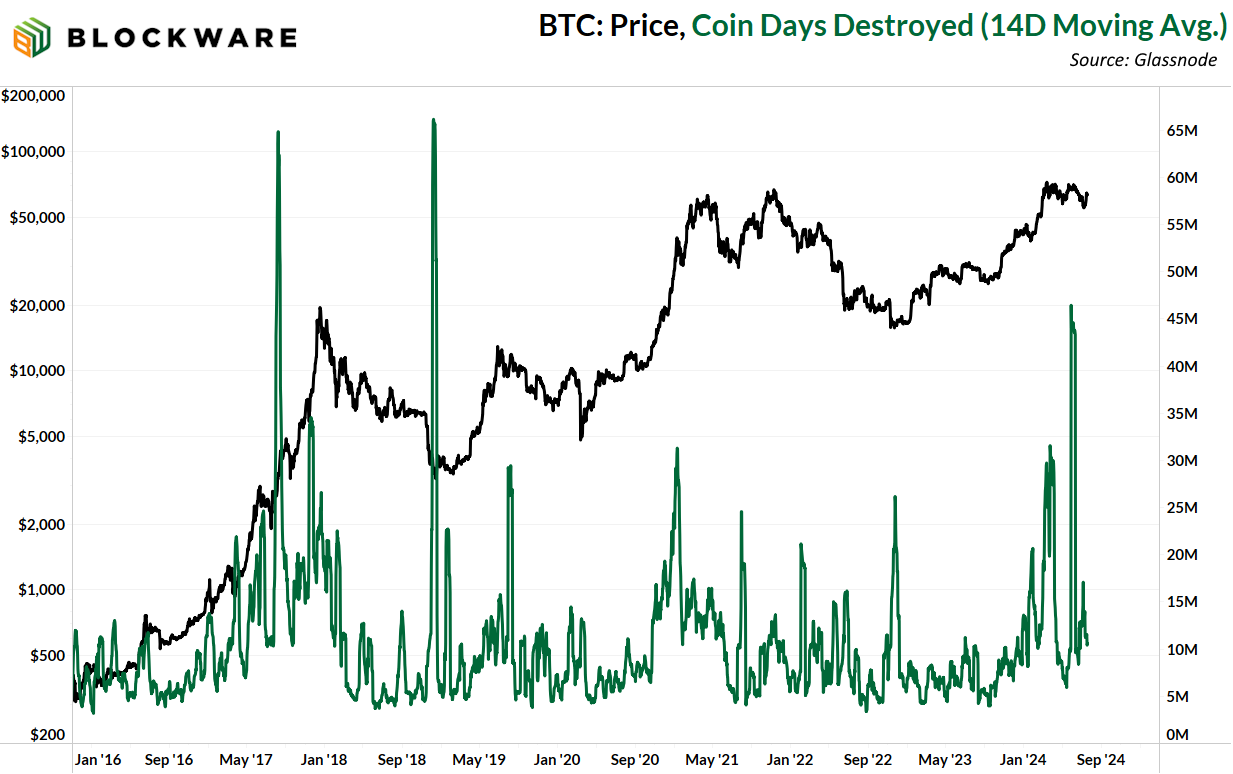

This metric is a measure of on-chain transaction activity with increased weight given towards “older” coins (# of coins moved * days since each coin last moved). This allows us to see moments of profit-taking and moments of capitulation. When large swaths of older coins move, we can presume that these users are doing one of those two things.

The onslaught of sell pressure from the coins seized by German authorities created one of the largest spikes in CDD on record. However, that has since subsided, and BTC is now, expectedly, increasing in price. In fact, CDD is at its lowest level since January which shows us that supply is getting constrained, which is bullish for near-to-mid-term price action.

General Market Update

5. Initial Jobless Claims

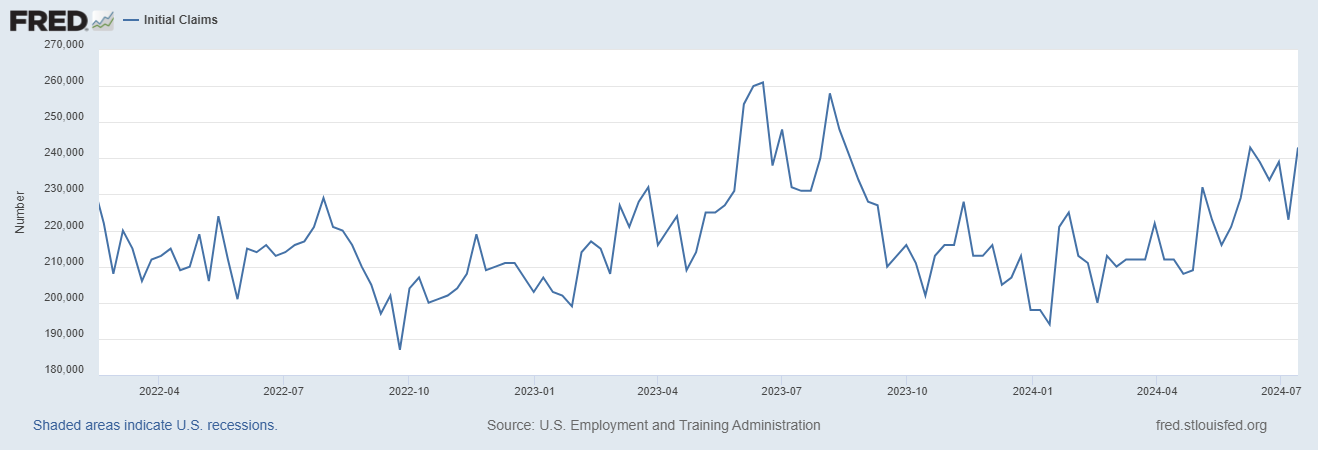

Initial jobless claims rose to their highest level since August of last year, coming in at 243,000. This was in part driven by a rise in claims from Texas due to Hurricane Beryl, but putting that aside, jobless claims have steadily risen throughout 2024.

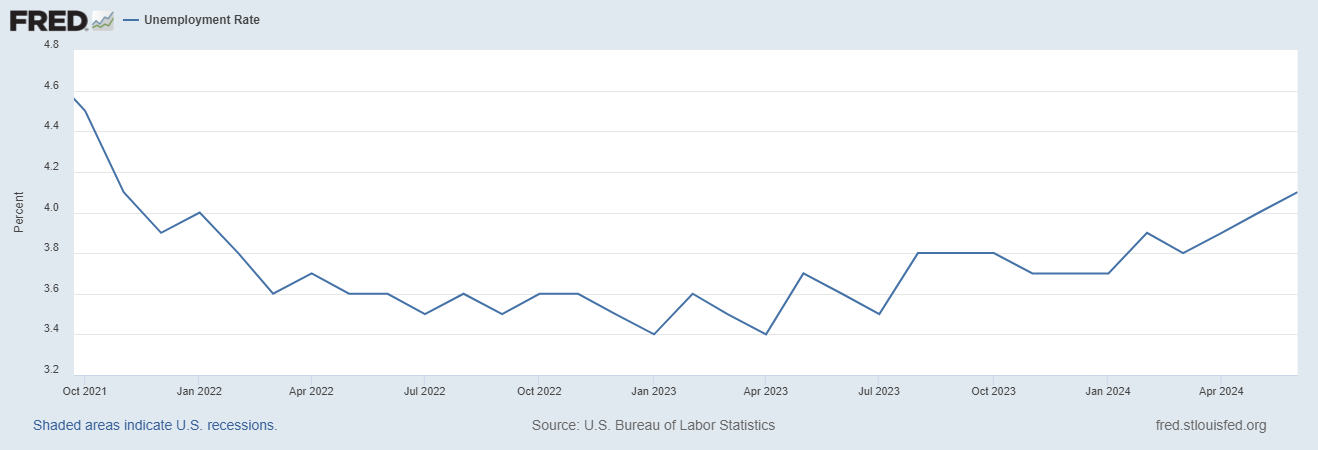

6. Unemployment Rate

The rise in initial jobless claims comes on the back of June’s labor report, released earlier this month, in which the national unemployment rate rose to 4.1%, the highest level since 2021 in which the economy was dealing with the tail-end effects of COVID-19 lockdowns.

The labor market, while not in a state of disarray by any means, is steadily cooling. Powell has alluded to a desire to pre-emptively cut interest rates, prior to a wave of mass unemployment/recession. Any data that might suggest we are headed that way will give Powell justification for near-term rate cuts; a fact which is being priced in more and more by the day.

7. US Stock Market

Equities had a bit of a down week:

$SPX: -1.96%

$QQQ: -3.4%

$NDQ: -3.8%

This is a reasonable drawdown in light of the fact that equities have performed exceptionally this year, reaching new all-time highs week after week. There is no structural change in the broader market: global liquidity is rising, risk is on.

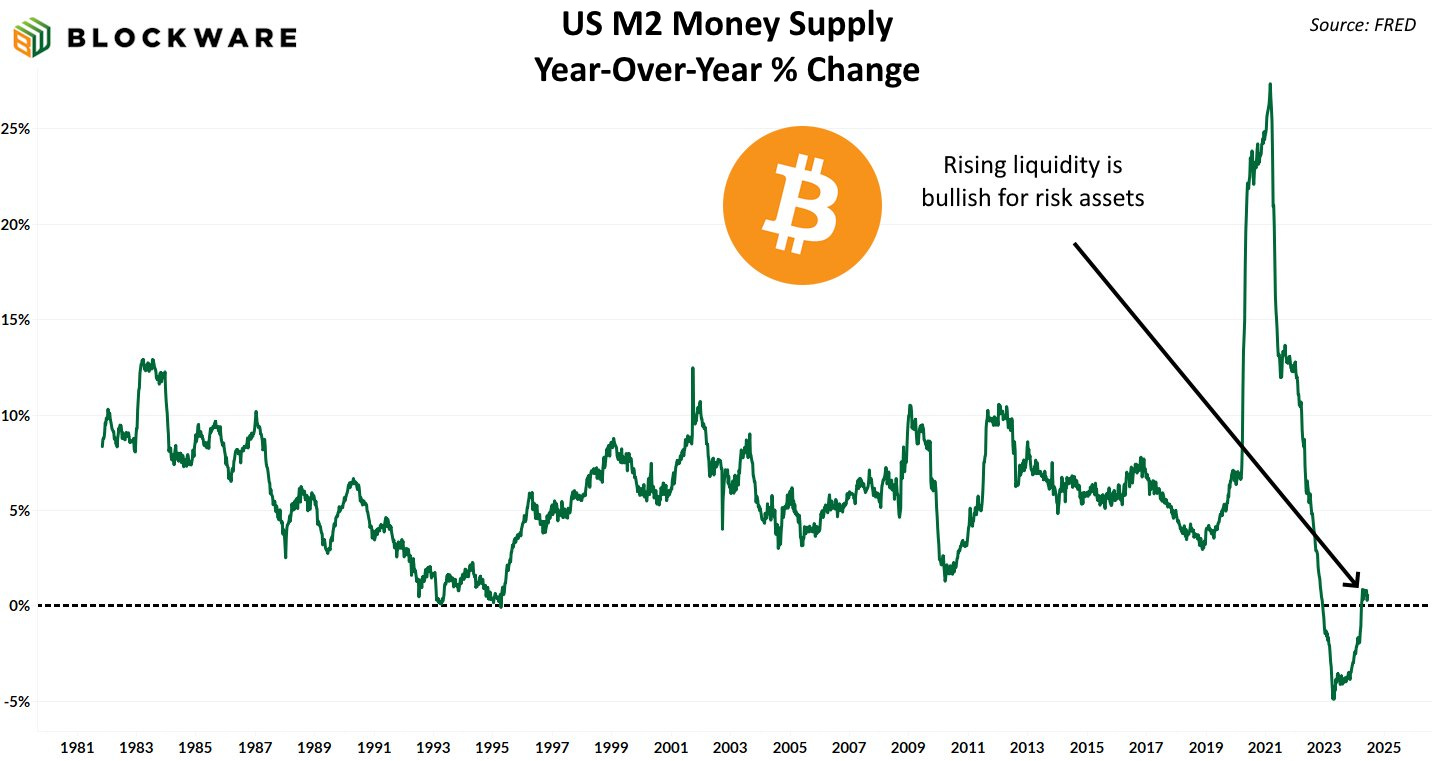

8. US M2 Money Supply

Speaking of liquidity, here’s a chart of the year-over-year change in the US M2 Money Supply. The change has been positive on a year-over-year basis. When the supply of fiat money expands, Bitcoin is one of the top beneficiaries due to its limited supply of 21,000,000.

BTC price action has been relatively stagnant for the past three months due to its native sell pressures: German Coins, struggling miners, etc. Meanwhile, major stock indices have pushed to new all-time highs, showing that the market is firmly "risk on" right now. As the selling pressure native to Bitcoin subsides, risk-seeking capital will continue to bid the price up, as it did in Q1 of this year.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

9. $WGMI (Bitcoin Mining Stock ETF)

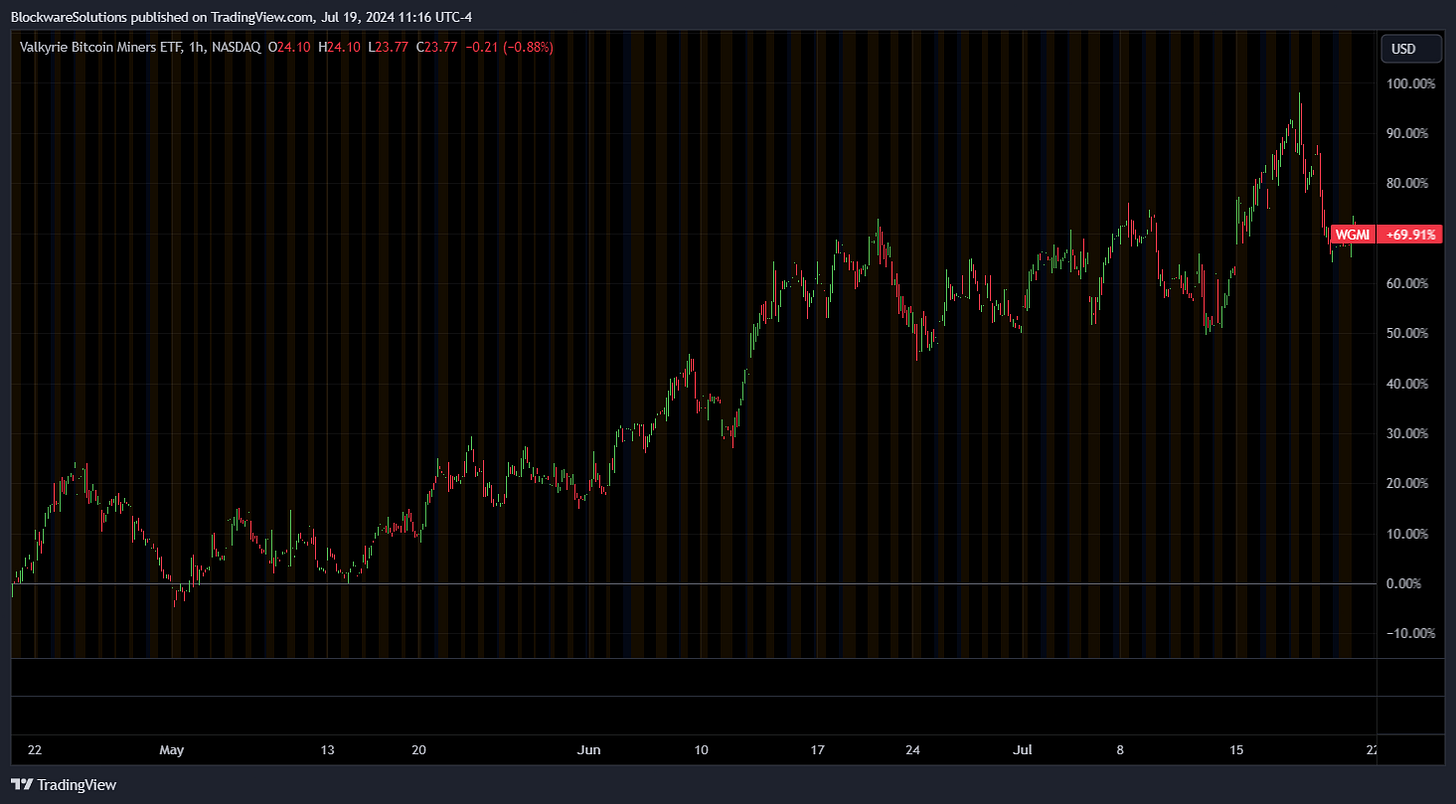

The mining stock ETF, which has been on the run of its life time the past three months, pulled back slightly the past couple days. This comes after a meteoric 73% rise since the 2024 halving back in April.

The exceptional performance of mining stocks and other BTC-exposed equities such as $MSTR (+42%) over the past three months, while BTC has traded sideways, is further evidence that what was keeping the BTC price down was not a broader market shift to risk-off. But rather selling native to BTC/USD; with the most noteworthy culprit being the miners themselves.

10. Cipher Buyout Rumor

Cipher ($CIFR) is up 27% on the week after a report circulated suggesting that they are interested in offloading their operations. As demand for HPC/AI continues to increase, data centers are becoming a desirable asset. This could prove to be additional bone in the basket for Bitcoin miners.

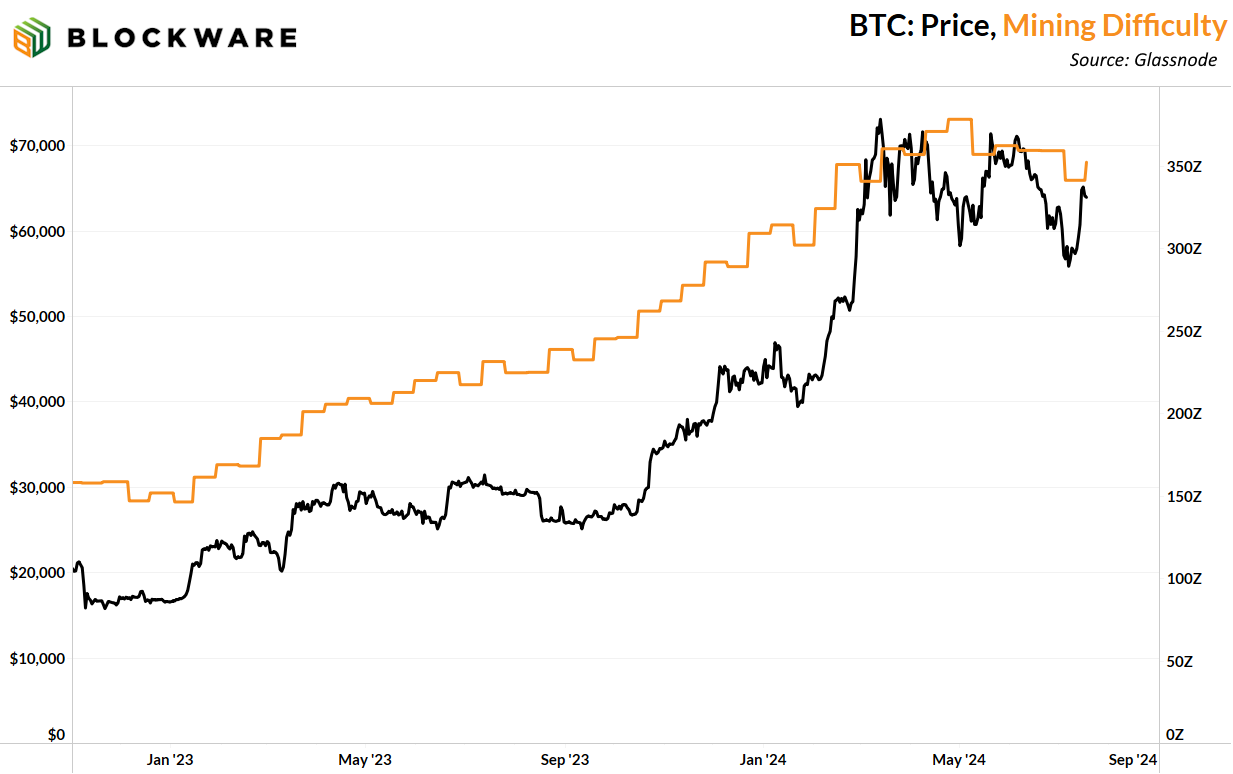

11. Difficulty

Mining difficulty rose 3.21% this week. The first positive adjustment in difficulty since May. If the next difficulty adjustment is also positive then we can officially declare the end of the miner capitulation. Now that the least profitable Bitcoin miners have been purged from the network, sell pressure will relent, and price will have to adjust upward.

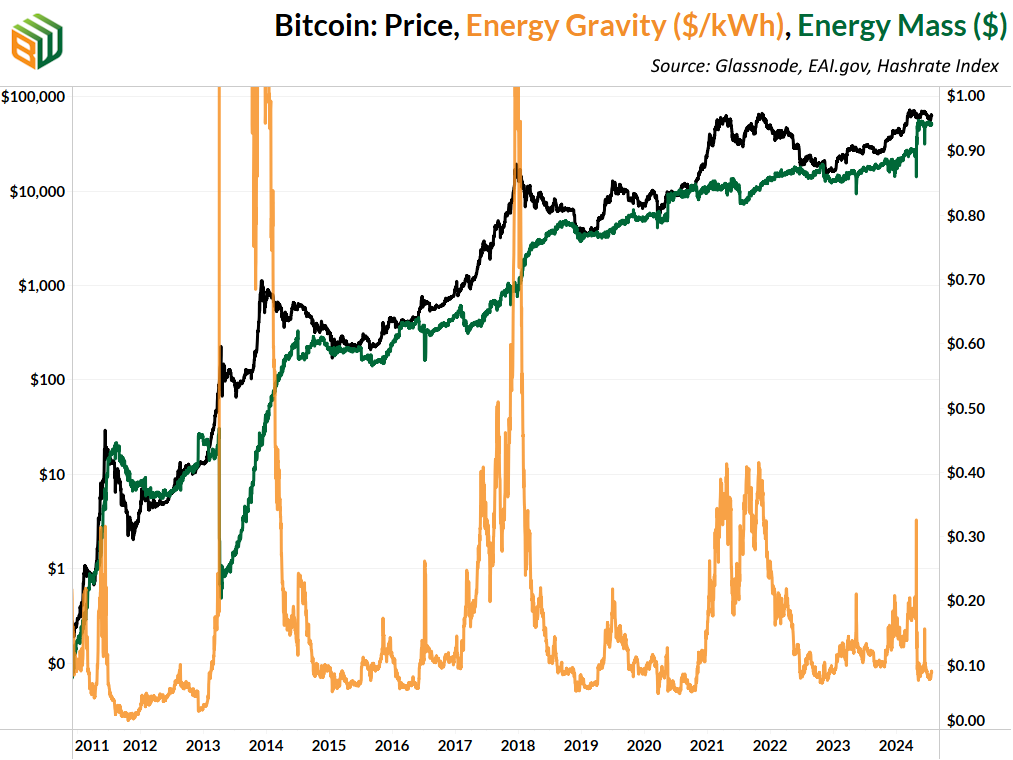

12. Energy Gravity

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$52,208 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.