Mid-Week Update

Anatomy of Monday's sell-off

Dear readers,

Hope all is well and you’re having a great week thus far. Although nothing in the on-chain structure has changed, I wanted to address Monday’s sell-off that seemed to unsettle some folks. Key takeaways:

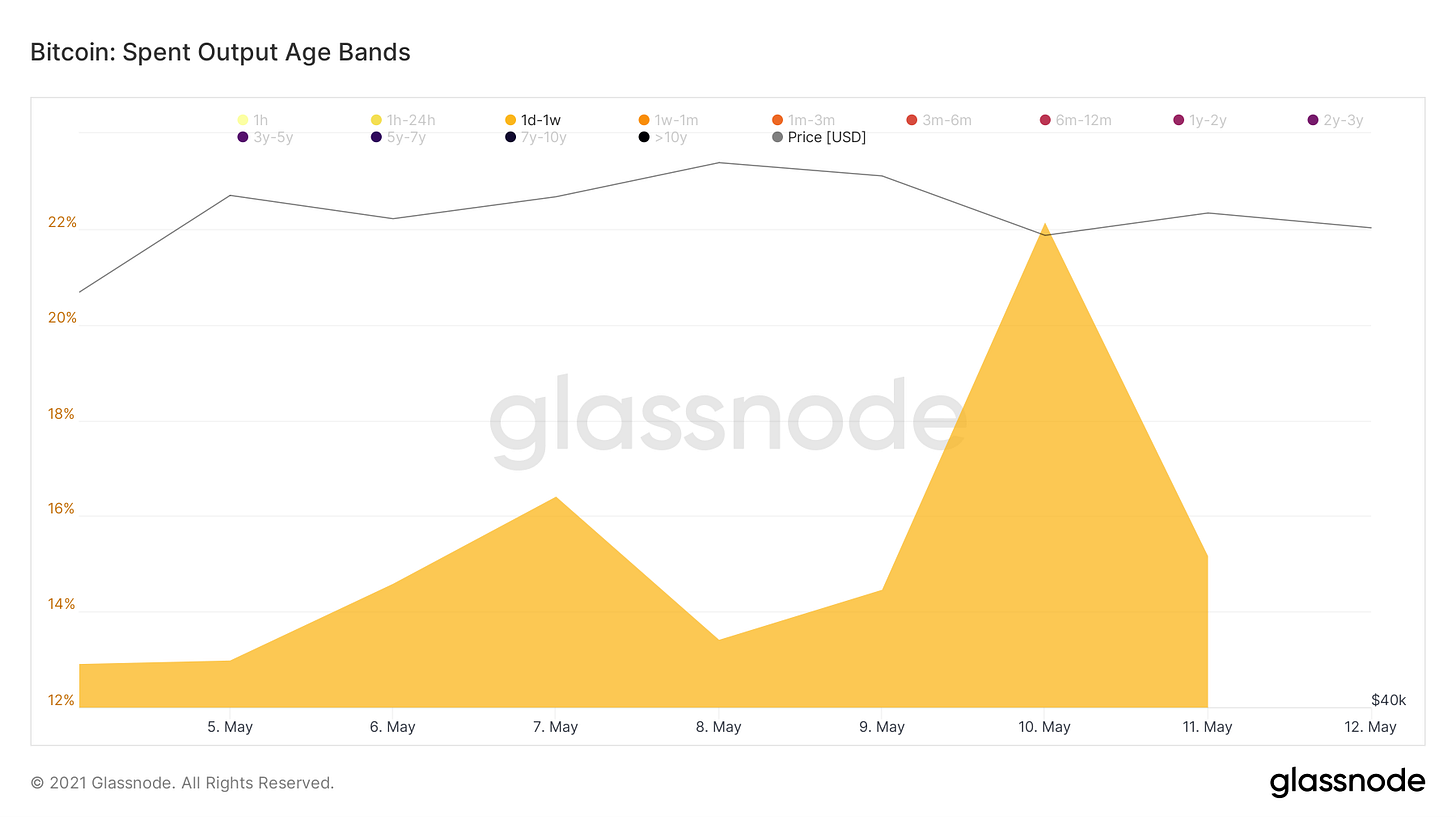

Younger coins did most of the initial selling

Leveraged futures contracts then sold off in a cascade of liquidations

OTC desk outflows spiked, meaning institutions/high net-worths took advantage of the Bitcoin discount

Monday had a quick sell-off from just under $56,000 to the mid $53,000 range within an hour. Let’s look at what the fundamental on-chain drivers were.

The coins that were sold Monday were very young. In total 68.59% of the coins sold were sitting in wallets for a week or less. In particular, there was a spike in coins 1 day to 1 week old.

Another way to look at this, the average age of coins sold that day ticked down. (the spike is from Sunday)

Leveraged traders also played a big role in the quick sell-off. As stop losses got triggered it caused a cascade of liquidations that led to price dropping so quickly.

There were $62.5M of liquidations during the day total.

Of those liquidations, $33,104,590 occurred during one hour. This was the same hour as the wick down in price. Meaning, the acceleration of the sell-off was driven by longs getting liquidated.

However, there is some silver lining here for two reasons. First, some leverage was wiped out during this event, which is healthy for the market. Over a three-hour period, $500,245,174 of futures open interest was wiped out.

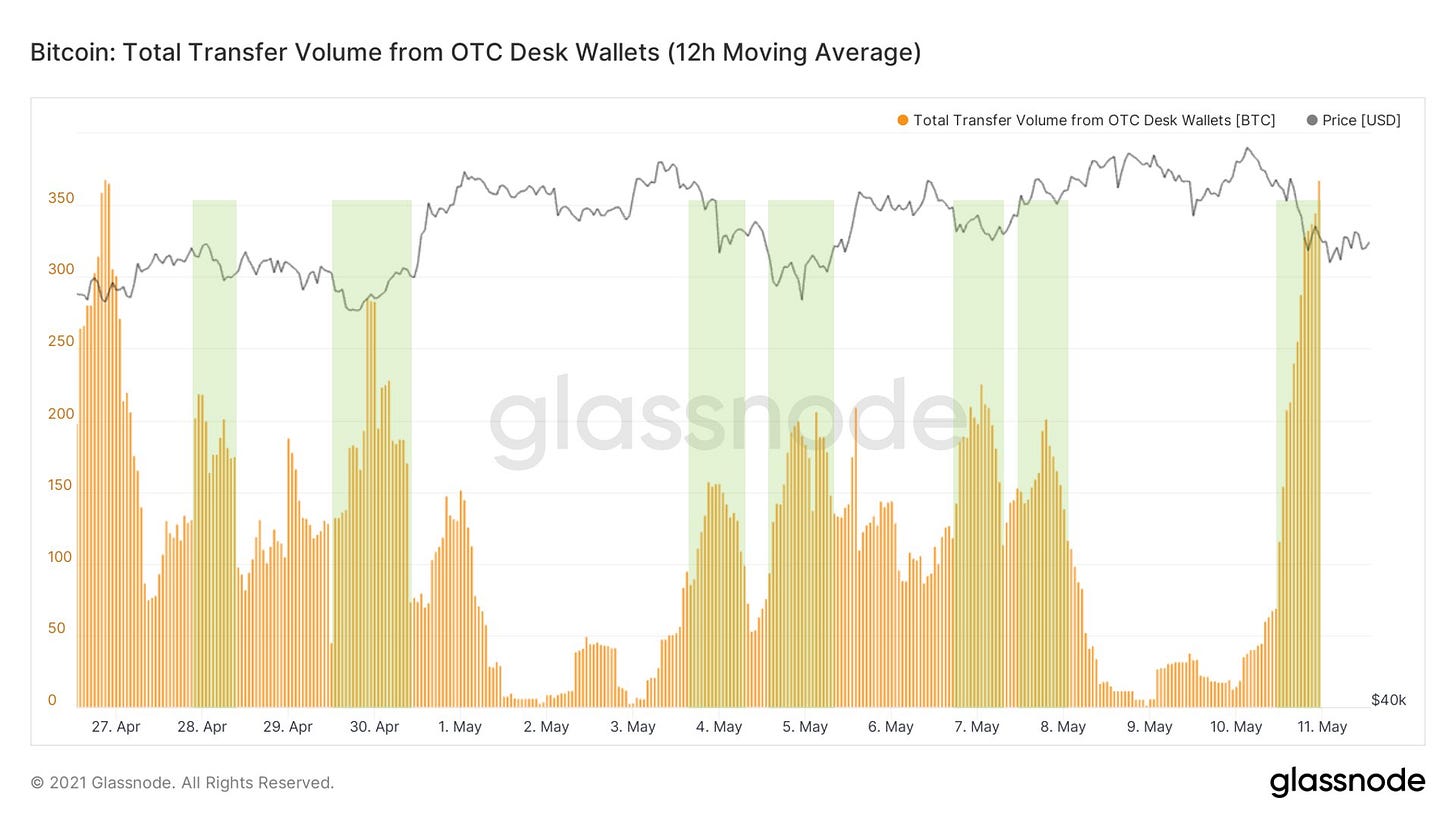

Second, outflows from OTC desks spiked again during this event in a big way. This shows that institutions/high net worths were there to scoop up those cheap Bitcoins during the dip.

Great work, Will. You're a champ!

Love the work, learning a lot every article and appreciate your efforts.!