Monday Mining Metrics: Bitcoin Breaks $100,000 (Again)

Bitcoin Mining Update - 1/6/2025

Bitcoin Starting Strong in 2025

Today was the first Monday of open markets for the new year and Bitcoin is off to a HOT start – breaking $100,000 (again). End of year tax harvesting is a meme in the financial market community – but it has a strong element of truth. Such sell pressure certainly contributed to the recent turbulence in the Bitcoin price, but that is now behind us.

Investors have their sights set on Monday, January 20th, as President-Elect Donald Trump will return to the Oval Office. The next President and his team have the right people in their ear when it comes to Bitcoin policy. Case in point, Michael Saylor recently made a trip to Mar-a-Lago.

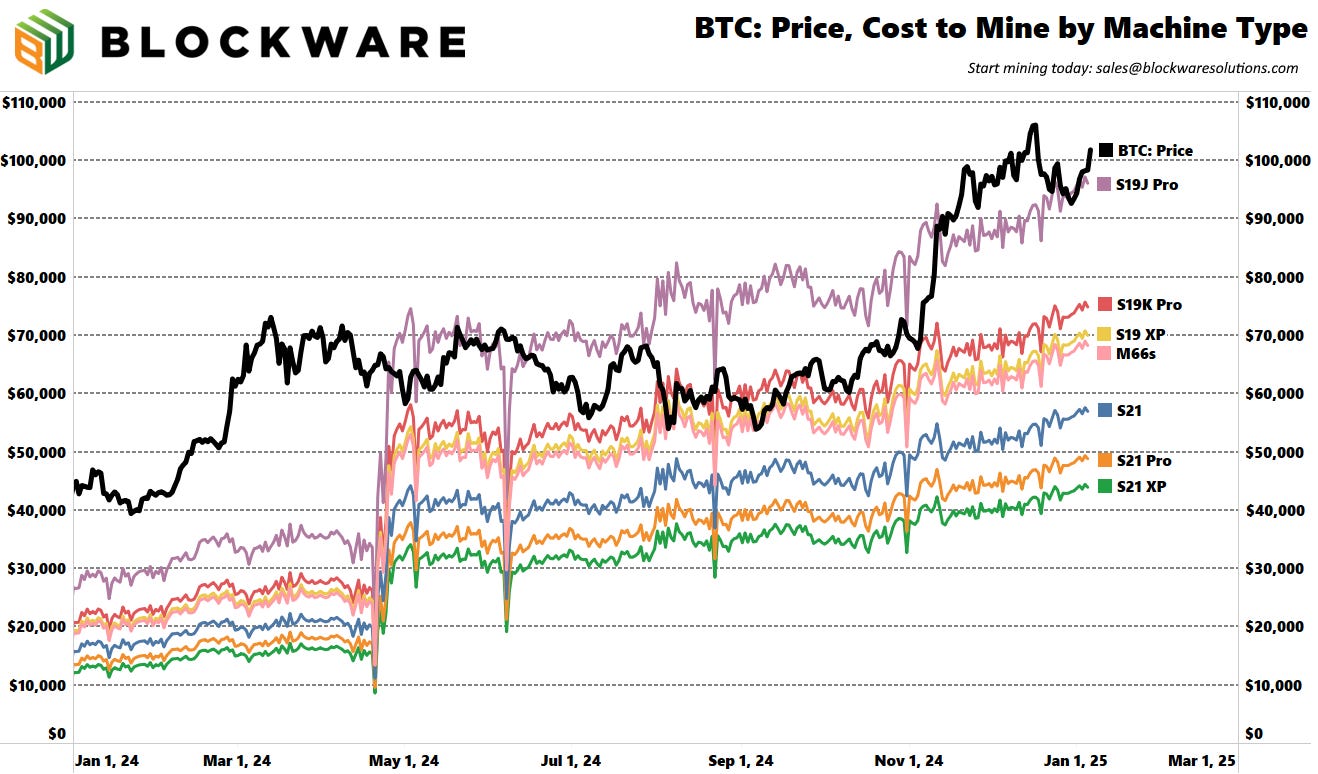

$101,000 to buy Bitcoin

$44,000 to mine Bitcoin

The breakeven cost for miners continues to rise gradually as hashrate (mining difficulty) hits new all-time highs. With a 30-day moving average, hashrate is about to eclipse 800 EH/s. We expect hashrate to break 1,000 EH/s (1 ZH/s) in 2025.

However, there’s still a wide discrepancy between the cost to buy and the cost to mine – Antminer S21 XP’s at $0.078/kWh have a breakeven price of ~$44,000.

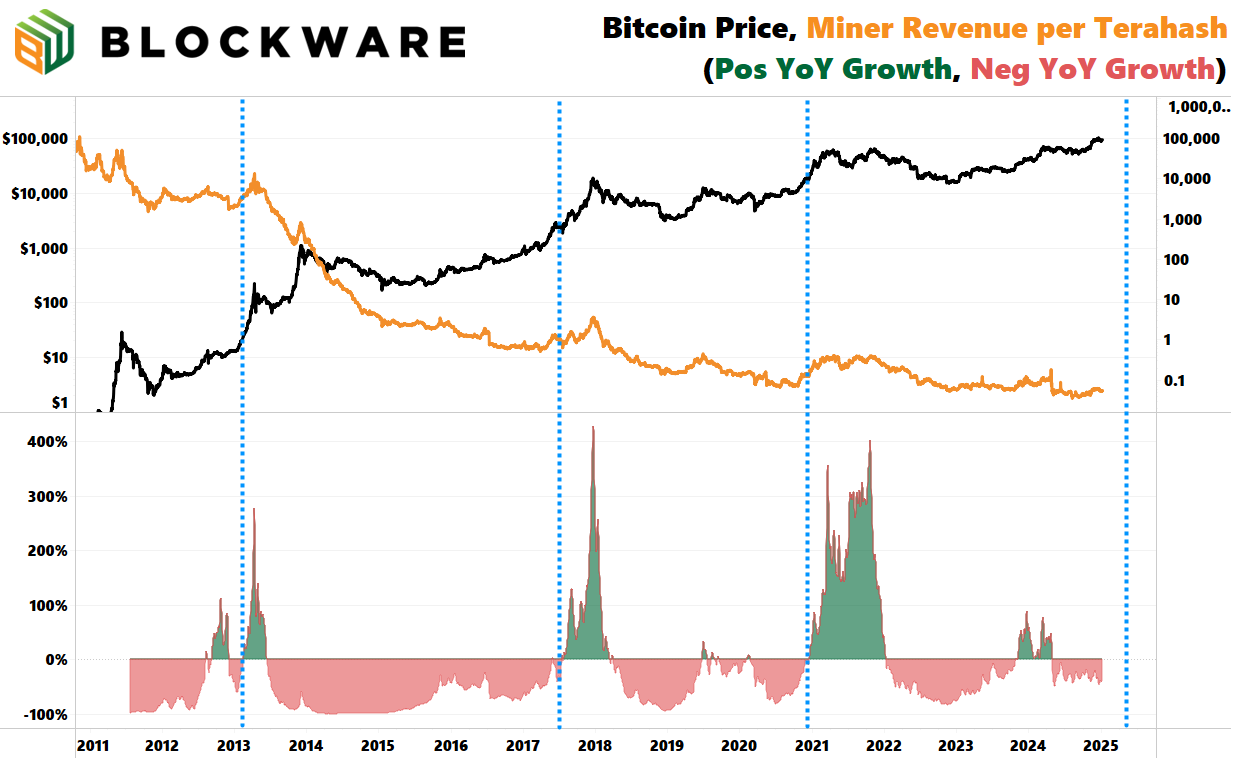

Hashprice (Miner Revenue per Terahash)

The most common measure of mining revenue is Hashprice – which measures $ earned per unit of computing power. On a year-over-year basis, hashprice is down ~46% (due to the Bitcoin halving).

The ‘parabolic’ phase of past bull markets has been denoted by positive year-over-year growth in Hashprice (note the exponential growth in the Bitcoin price in the months after the dotted blue lines). We expect that to be the case in this epoch as well – but it is likely a few months away.

Bitcoin-Denominated Incomes Are Going Down Forever

Normally we focus on data and breaking news in this newsletter, but I (the author, Mitchell Askew) am going to break the 3rd wall here to share an anecdote.

When I was sixteen years old (summer of 2017), I bussed tables at a pizza restaurant for $8/hour. Over the course of the summer, I made ~$3,000.

Had I saved my earnings in Bitcoin, I could have stacked 1.2 BTC. Today that would be worth ~$120,000

I theoretically could have saved everything too because I lived with my parents at the time (again, only sixteen years old at the time) and I had zero living expenses.

Unfortunately, I was unwise and blew all my wages on typical teenage nonsense.

This is the opportunity cost of not stacking Bitcoin. In Bitcoin-denominated terms, my teenage job as a busboy is my highest-paying job ever. 1.2 BTC in 3 months is equivalent to a ~$500,000 annual salary at current BTC prices.

The lesson here is this:

For almost every worker, your income will go down forever in Bitcoin terms.

For almost every business, your profits will go down forever in Bitcoin terms.

Over the next year, your Bitcoin-denominated income will likely go down.

However, there is one cohort of people whose Bitcoin-denominated income will remain the same (or go up) in 2025.

Bitcoin miners.

When mining with a host like Blockware, you only have 1 operating expense -- electricity -- and it is fixed in dollar terms.

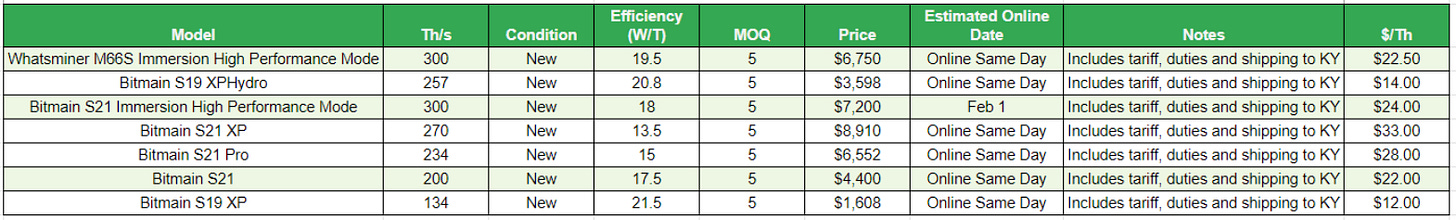

Let's walk through an example. Say you have 1 Antminer S21 (200 Th/s, 17.5 W/Th). Let's say your hosting (electricity) rate is $0.078/kWh.

Every month this machine consumes $200 worth of electricity. At the current BTC price this is ~.0020 BTC per month.

At the current difficulty level, this machine will mine ~.0036 BTC per month.

36 - 20 = 16

This is a monthly profit (income) of ~.0016 BTC ($164)!

For easy math, let's say over the next 12 months, the Bitcoin price increases by 125% (our base case) and difficulty increases by 50%.

Price --> $225,000

Difficulty (Hashrate) --> 1,200 EH/s

The miner still only consumes $200 worth of electricity. However, in Bitcoin terms, this is now .0008 per month.

A 50% increase in difficulty means the miner would now mine ~.0024 BTC per month.

24 - 8 = 16

.0016 profit per month ($360 at $200k BTC price).

Unless you run a VC-funded Bitcoin-based start-up (which is not most people), you're going to be hard-pressed to find a business in which your capital & profits can keep up with Bitcoin price-appreciation.

Mining enables this.

> Hard Assets tied to BTC Price

> Cash flows tied to BTC Price

With BTC-denominated incomes dropping FAST, you should secure a mining position so that you can keep stacking sats.

You don't have to run the machines yourself to have a successful mining operation. Blockware makes it easy.

We have countless client success stories. You purchase the machines, we run them for you, and you earn Bitcoin.

You can sell the machines at anytime too on our marketplace -- capitalize on ASIC price appreciation and the growing secondary market.

Send sales@blockwaresolutions.com if you want more information, or, fill out this form on our website.

If you’re looking to purchase machines immediately, you can use our self-service marketplace to pay with BTC or USD!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.