Monday Mining Metrics: BITCOIN DOWN 20%

Bitcoin Mining Update - 3/10/2025

Difficulty Rising, BTC Price Falling

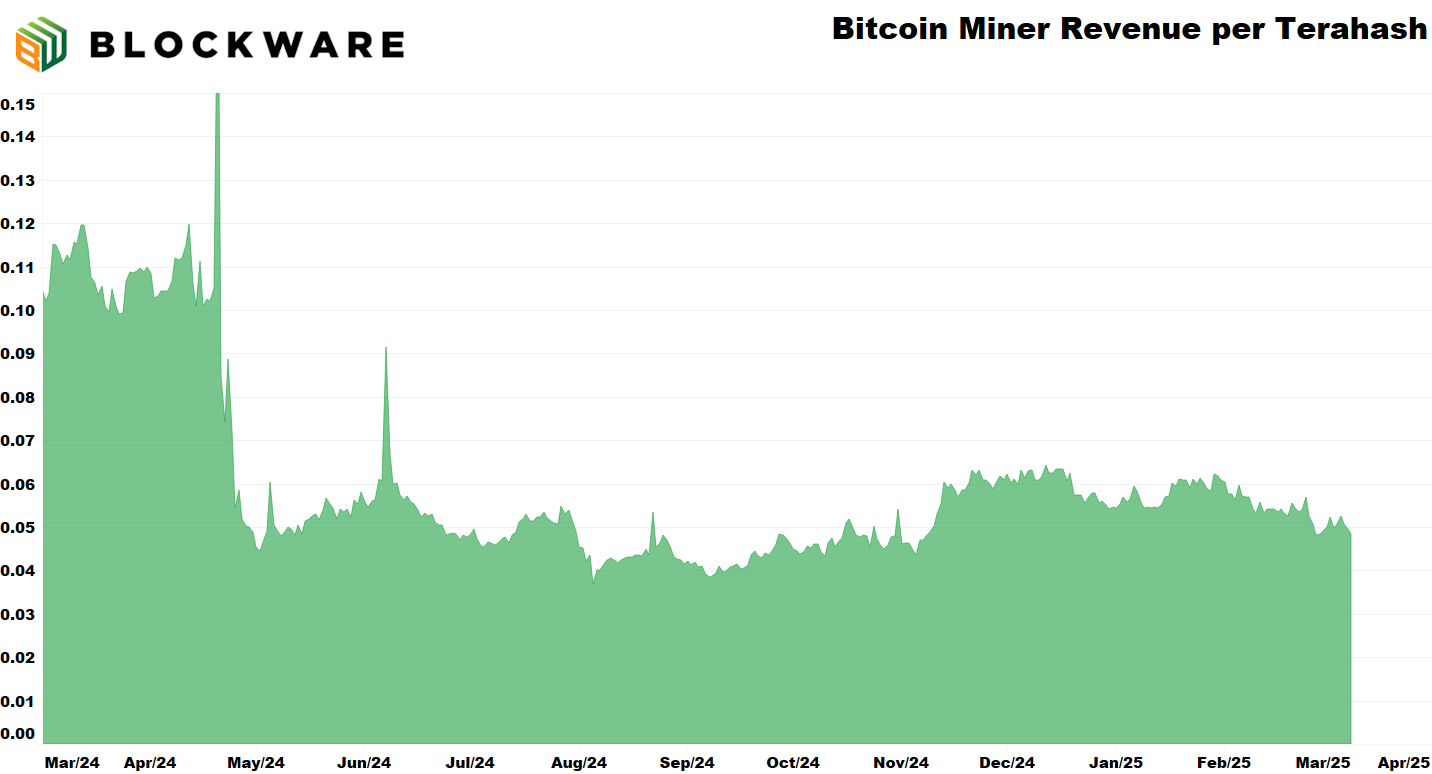

In the past two weeks, mining difficulty has risen by 3% and the Bitcoin price has dropped by ~20%. Consequently, ‘hashprice’ has fallen to $0.045/Th/Day, its lowest level since November.

Despite these two factors working against Bitcoin miners, all of the latest-generation miners are still operating profitably. The chart below shows the cost of production for miners operating at $0.078/kWh.

Even miners like the S19K Pro and S19 XP, which have energy efficiencies higher than 20 W/T, are still operating in the money. Miners with the newest machines (S21 or better) may actually be hoping for the Bitcoin price to drop further in the short-term. BTC falling below $70,000 (unlikely) could result in S19 XPs unplugging, causing a drop in mining difficulty.

Last week we sent out an email exclusively to Blockware Clients and people with accounts on the Blockware Marketplace. In this email we highlighted the performance of miners who purchased hardware during an equally tumultuous period.

In August of 2024, BTC dropped below $50,000 in the wake of the ‘Yen Carry Trade’ imploding. This combined with the recent halving resulted in hash price falling under $0.04/Th/Day for the first time in history. If someone purchased a Bitcoin miner then, how has that machine performed? Exceptionally.

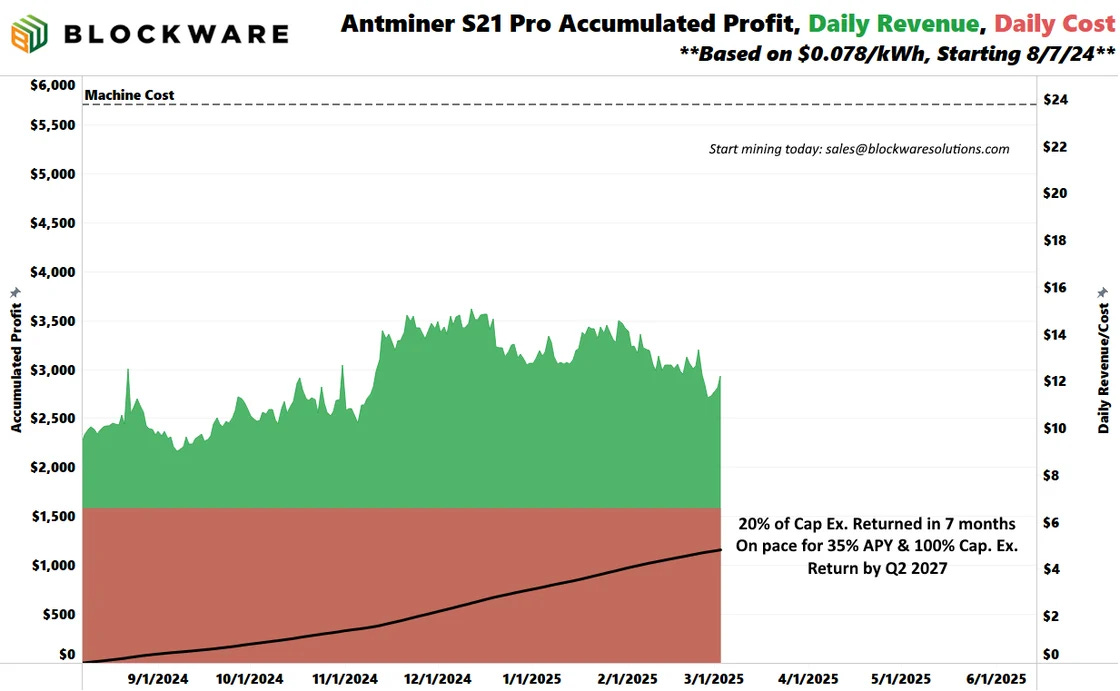

In early August, Antminer S21 Pro’s were selling on the Blockware Marketplace for ~$5,700. The chart below plots the daily revenue and daily cost from one of these miners. To-date, a single machine has returned more than 20% of its up-front cost, averaging $5 to $6 in net daily profits. This is on-pace for a 35% APY and a 100% return on the cost of the machine sometime in Q2 2027.

While the underlying business of Bitcoin mining has performed well over the past six months, the stocks of publicly traded Bitcoin miners have not fared as well. $WGMI has been hammered on the recent move down for Bitcoin, and it’s now down 14% over the past six months.

Publicly traded mining stocks tend to perform worse than the actual underlying business of Bitcoin mining due to the additional overhead that comes with large mining operations, executive compensation, stock dilution, etc. Moreover, many publicly traded mining companies have re-positioned themselves into the ‘Artificial Intelligence’ sectors. Which means they may find themselves on the wrong side of what many analysts are referring to as the ‘AI Bubble.’

Blockware's Mining-as-a-Service enables you to start mining Bitcoin, without lifting a finger. Blockware handles everything, from securing the miners, to sourcing low-cost power, to configuring the mining pool - they do it all.

With multiple data centers across the US, Blockware is the most reliable mining partner in the industry.

Click here to check out our Marketplace where you can see real-time analytics on our miners, and make an immediate purchase using BTC or fiat.

If you’d like a more hands-on mining experience, fill out this form on our website. One of our Account Executives will be in touch and they can walk you through our entire product and service offerings! The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does not consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.