Monday Mining Metrics: Bitcoin is Pumping

Bitcoin Mining Update - 5/20/2024

Bitcoin is Pumping

After a slight pullback post-halving, BTC is working its way back up, hitting $68,000 this afternoon.

Subsequently, Bitcoin miners are now earning $0.053/Th/Day. It’s becoming more and more likely that hashprice has bottomed, and miners can start to breath easy.

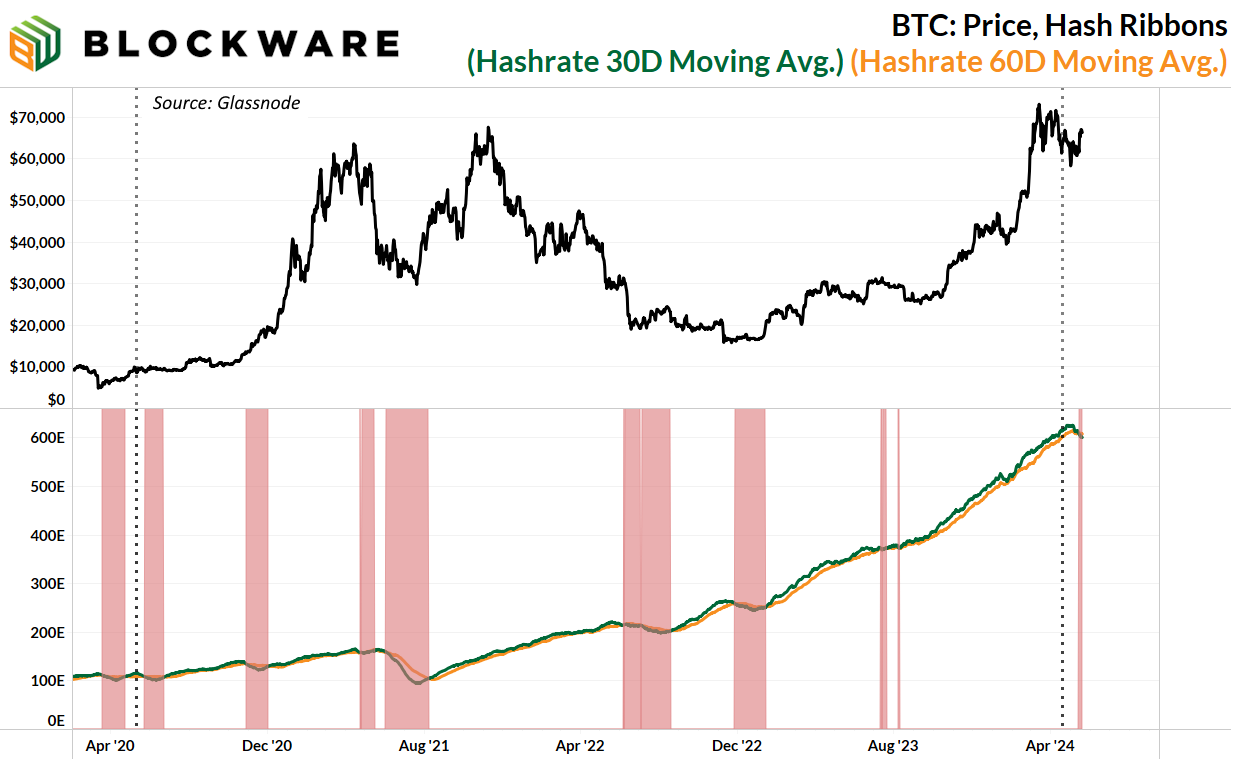

Mining Capitulation (Hash ribbons)

Hash ribbons look at the 30 and 60-day moving average of hashrate to gauge periods of miner capitulation. When the signal flashes red on the chart, miners in the aggregate are unplugging their machines.

After the 2020 halving, there was a brief miner capitulation before hashrate continued its perennial bull run. With the next difficulty adjustment projected to be positive, the current miner capitulation is likely coming to an end.

Signal:

1. The majority of Bitcoin miners are still profitable despite the halving

2. The weakest miners, who were selling a majority of the BTC they mine, have unplugged their machines. This relief in sell pressure will manifest in the form of a higher BTC price.

Profitability Breakdown by Machine Type

The table below shows the monthly profit for various ASICs based on the current hashprice at an electricity rate of $0.078/kWh. In terms of annual return, the Antminer S19K Pro is in a comparable position to that of the Antminer S21. With a market price ~⅓ of an S21, the K Pro is the best ASIC choice for retail-sized miners.

Another attractive ASIC for retail-sized miners is the M50s. The Blockware Marketplace has M50's’s available for $10/Th in as low of a quantity as 1 unit. Click here to check out these listings! Scroll down for more detailed ASIC pricing.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.