Monday Mining Metrics: BTC SMASHES $125,000

Bitcoin Mining Update - 10/6/2025

Bitcoin Surpasses $125,000

With almost zero fanfare, Bitcoin has reached a new all-time high; briefly tapping $126,000. On a year-to-date basis Bitcoin is up 33%, but you wouldn’t know it if all you were going off was retail investor sentiment (based on the lack thereof).

Welcome to the institutional-era. Billions of dollars of capital is slowly dripping into the market via Bitcoin ETFs and Public Companies. This passive bid is molding BTC into a mature, institutional-grade asset with less downward volatility, but while still having a impressively high Compounded Annual Growth Rate.

Bitcoin is the hurdle rate.

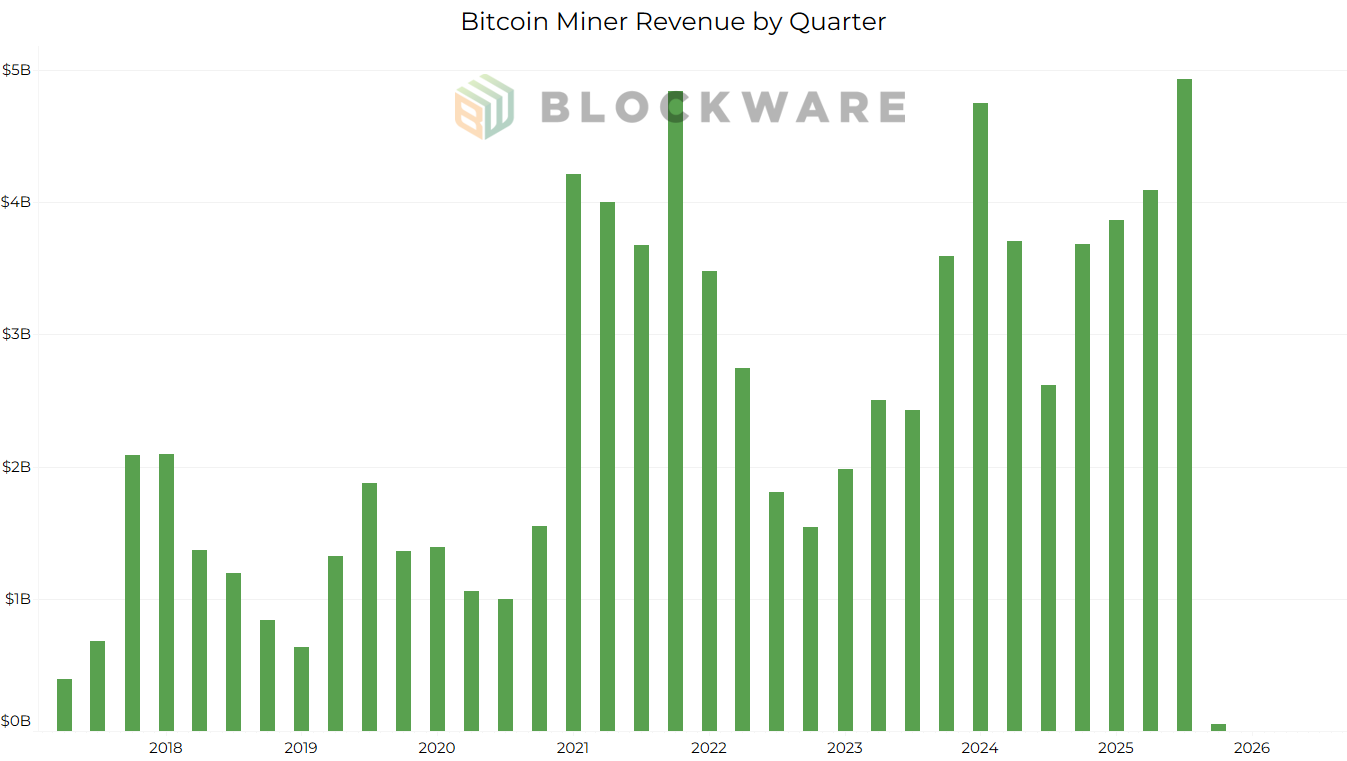

Q3 2025 — The Highest Grossing Quarter in Bitcoin Mining History

With BTC trading north of $100,000 for the entirety of Q3, Bitcoin miners earned nearly $5 Billion in revenue for the quarter — the highest earning quarter in Bitcoin mining history. This surpasses even the blow-off top of 2021, despite the BTC block subsidy now being half of what it was back then.

Miners using efficient hardware and low-cost power are enjoying the bull market more than anyone. Consistent acquisition of BTC at a discount, BTC-denominated cash flow, and 100% bonus depreciation of their hardware.

Schedule a consultation with Blockware to learn how to become a Bitcoin miner yourself. We service retail and institutional investors alike: https://mining.blockwaresolutions.com/consult

New Blockware Intelligence Content

The market is on a heater and so is the Blockware YouTube channel. Our goal is to keep you informed on all things Bitcoin and financial markets through real-time updates and analysis. Check out the most recent interviews on our channel where we chat with market experts Matt Crosby and Caleb Franzen to unpack their perspectives on Bitcoin’s new all-time high and where we go from here.

Matt Crosby, Bitcoin Magazine Pro:

Caleb Franzen, Cubic Analytics:

All content is for informational purposes only. This Blockware Intelligence Report is of general nature and does not consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.