Monday Mining Metrics: BTC to $72,000

Bitcoin Mining Update - 3/11/2024

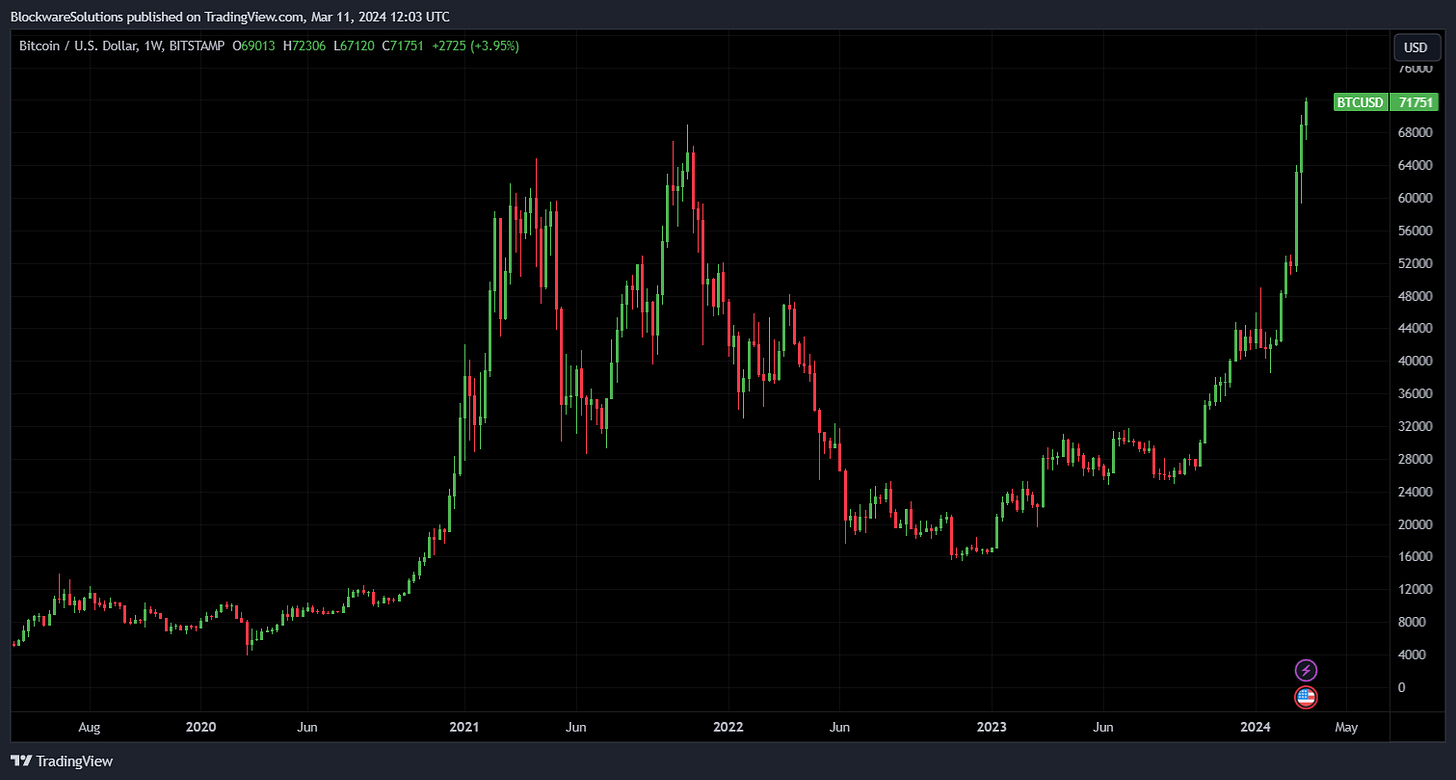

Bitcoin Blasts to $72,000

It seems like every week when we write this market update, we have to preface it with news about BTC price action. This magic internet money will not stop pumping; now solidly breaching the previous all-time high, and all associated resistance.

We’ve now entered the “price discovery” zone; prepare for this thing to move at a velocity you’ve never seen before.

Let’s discuss how this is affecting mining profitability👇

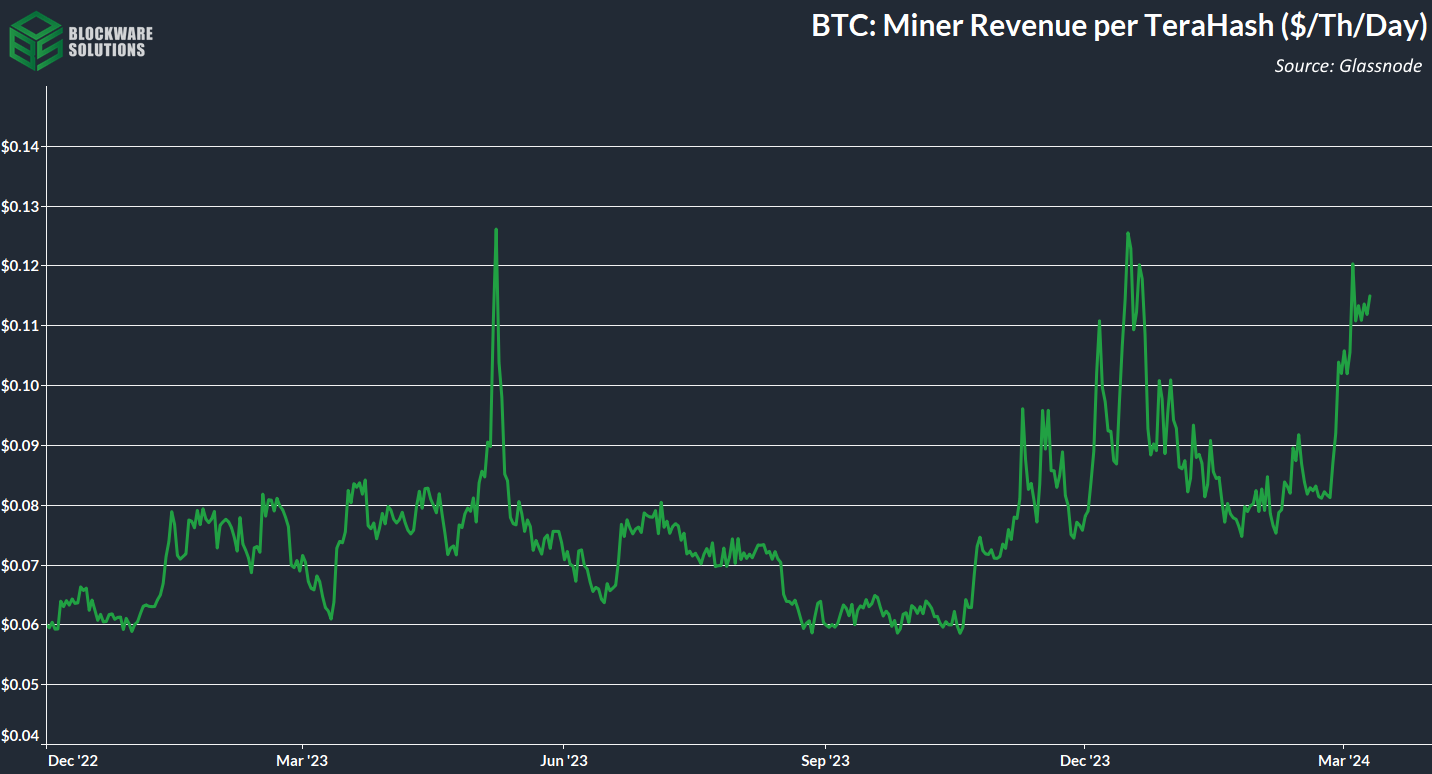

Hashprice to 11.8 cents

Hashprice is ripping alongside the price of BTC. Miners are now earning ~11.8 cent per terahash per day, and this is with on-chain fees at their lowest level in over a year.

If you’re bullish on BTC price action for 2024, then you are inherently bullish on transaction fees. As demand for BTC the asset increases, so will the demand for settlement on the Bitcoin network.

BTC Price ⬆️ → TX Fees ⬆️ → Miner Profitability ⬆️

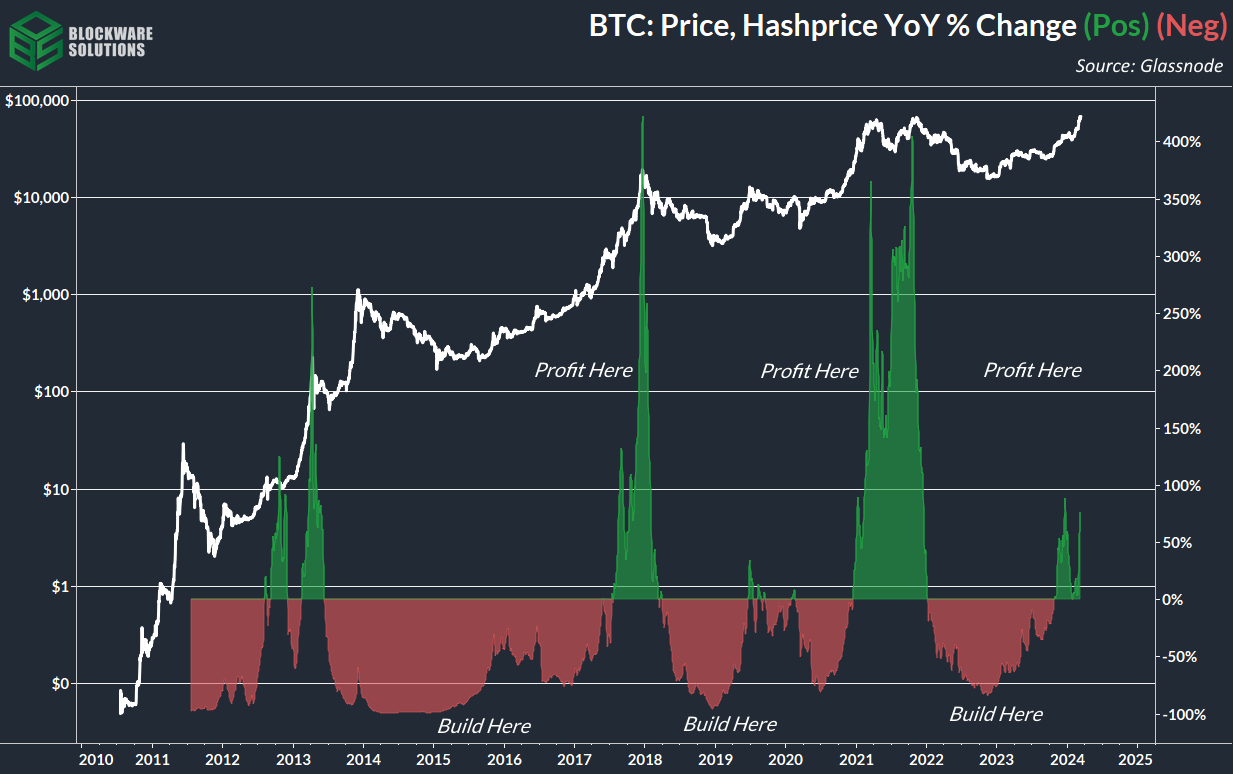

Hashprice Year-over-Year % Change

Hashprice is up 71% on a year-over-year basis. The cyclical nature of Bitcoin is even more impactful in Bitcoin mining; as mining profitability has historically been “double-whammyed” during bear markets: declining BTC price, and rising mining difficulty.

Timing your entry into the market is extremely important when it comes to Bitcoin mining. Build and stack ASICs during the bear markets, and feast on higher profits during bull markets.

The next wave of mining profitability is just getting started; it’s not too late to acquire ASICs.

The Blockware Marketplace offers turnkey hosting so you can capitalize on the hashprice bull market without being hampered by lead times.

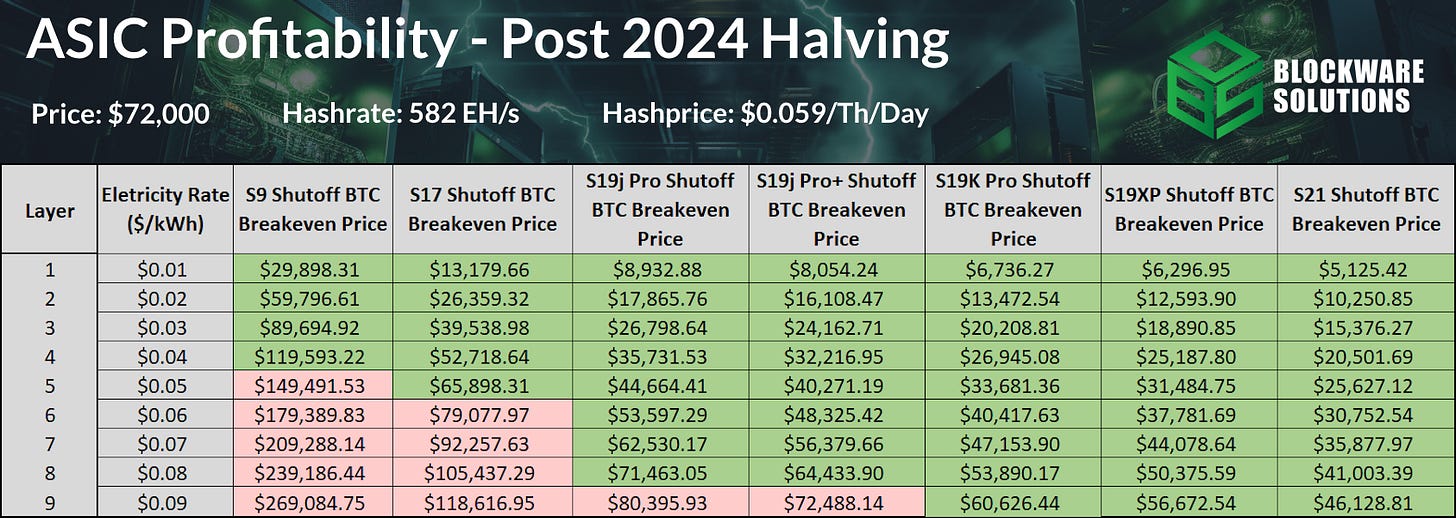

Post-Halving Mining Profitability

The post-halving landscape is shaping up favorably for Bitcoin miners; much more so than it appeared this time last year.

BTC Breakeven prices are subject to change with mining difficulty & TX fees. Still, at current mining dynamics, S19j Pros at an 8cent rate will (barely) remain profitable in the immediate aftermath of the halving.

This will have major implications for Bitcoin miners, as most miners have positioned themselves under the assumption that these machines will be unprofitable at a 3.125 BTC block subsidy. That’s certainly not out of the realm of possibility, BTC needs to sustain its recent run up to $72,000, but not all hope is lost for older-generation ASICs. Given their lower cost on a $/Th basis, they possess the potential for major Cap. Ex appreciation. If BTC continues to rip and older-gen machines become even more profitable, their market price will likely begin to reflect that fact.

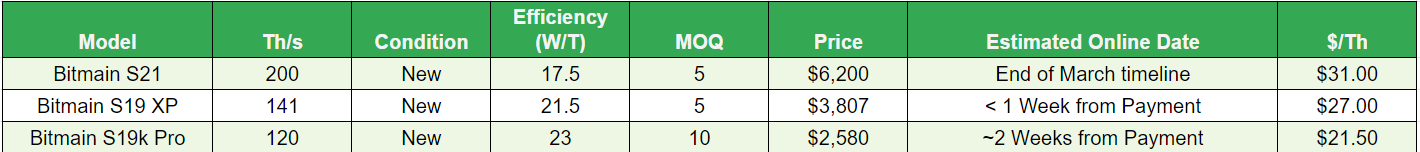

That said, the latest-generation ASICs are still the optimal play for prospective Bitcoin miners. Here’s the breakeven BTC price for latest-generation models based on an $0.08¢ per kWh electricity rate:

S19j Pro+: $64,500

S19K Pro: $53,900

S19 XP: $50,400

S21: $41,000

The most energy-efficient Bitcoin mining rigs carry the least risk and the highest profit margins. This is reflected in their price. However, if past bull markets are any indication, the price of these rigs is poised to rise alongside BTC.

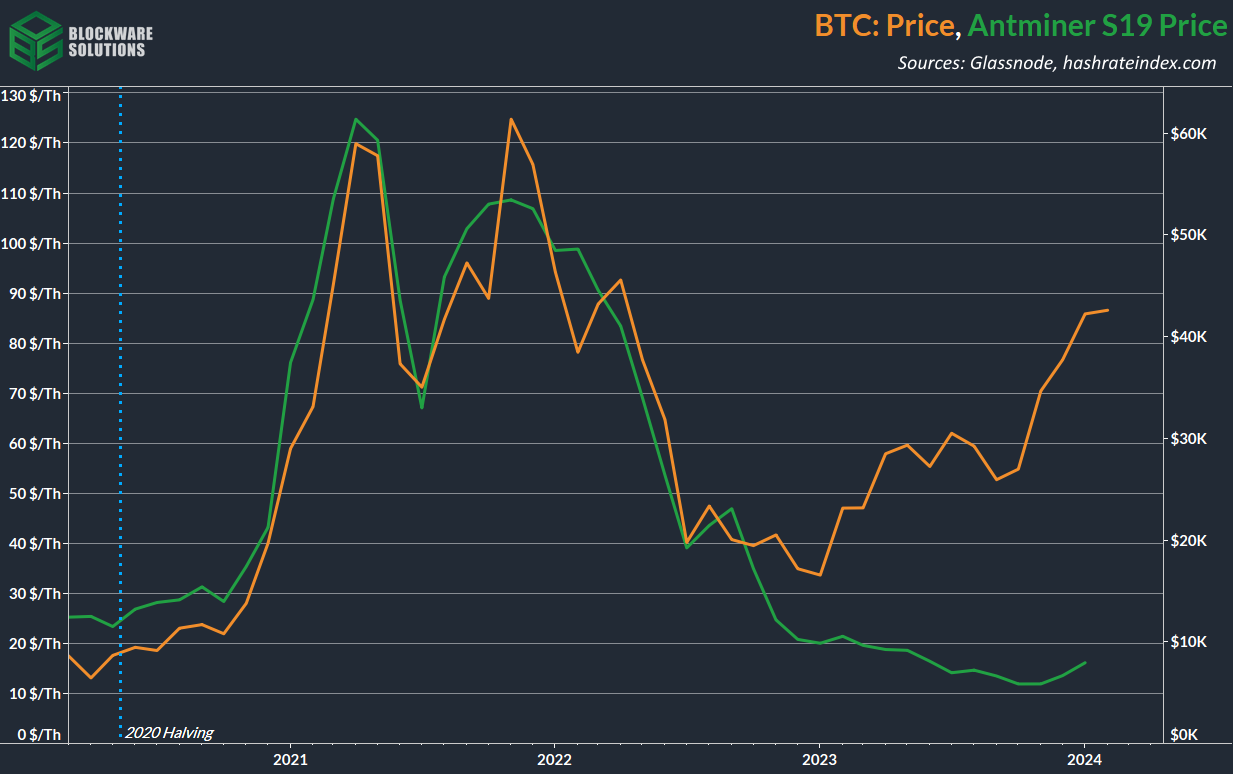

Here’s a chart showing the price of S19s during the last Bitcoin bull market. Click here to read our in-depth analysis of next-generation ASICs.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market; Antminer S21s, S19 XPs, S19k Pros, and Whatsminer M50s.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.