Monday Mining Metrics: Christmas Comes Early for Bitcoin Miners

Bitcoin Mining Update - 12/18/2023

Transaction Fees Unrelenting

Christmas has come early for Bitcoin miners. Transaction fees went parabolic over the weekend, with numerous blocks being mined in which revenue earned from TX fees was greater than the 6.25 BTC block subsidy. In total, roughly 37% of miner revenue on Sunday was from TX fees, equating to an extra ~3.67 BTC per block.

There is much debate in the Bitcoin community about the normative economics of transaction fees: “should on-chain fees be high?”

A better use of time and energy would be spent answering this question: “How can I prepare for a future in which on-chain fees are consistently high?”

The future economics of Bitcoin mining is a 100% fee-based revenue model; this we know. The best way to benefit from this inevitable future is by managing your UTXOs in a way that prevents you from paying higher fees as a user. And also to stack Bitcoin mining rigs so that you can profit from the high-fee environment.

4.5% Projected Difficulty Increase

The increase in miner revenue is likely the catalyst for the projected rise in mining difficulty.

Hashrate and difficulty will continue to trickle up in the months before the halving as miners seek to increase their fleet size and efficiency to prepare for the drop in the block subsidy.

Moreover, new-generation ASICs hitting the market in Q1 will further increase mining difficulty. While it’s likely that bullish Bitcoin price action makes up for rising difficulty as it pertains to mining profitability, the immediate aftermath of the halving will of course be a squeeze on miner profit margins. Miners with the most efficient machines will be best positioned to remain profitable post-halving, especially if the BTC price does not immediately increase.

Hashprice (Miner Revenue per Terahash)

Miners are now earning a year-to-date high of ~$0.13 per terahash per day.

Hashprice is poised to soar in 2024 due to bullish BTC price action and higher transaction fees; in spite of the halving and rising mining difficulty.

Hashprice bull markets tend to correspond with an increase in ASIC prices. Acquiring machines now means you likely see appreciation on your capital expense. The Blockware Marketplace was built with this idea in mind. By providing an easy platform for buying and selling ASICs, our clients can list their machines for sale at any time to realize the Cap. Ex. appreciation.

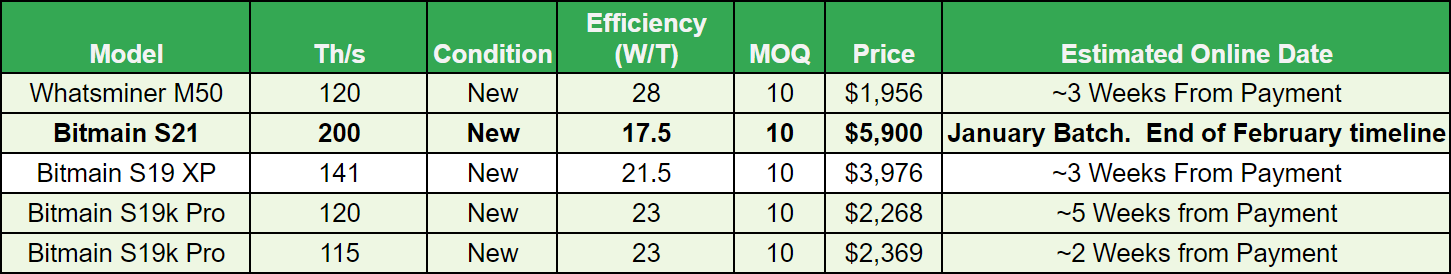

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market; Antminer S19 XPs, S19k Pros, and Whatsminer M50s.

Moreover, we are now accepting pre-orders for the newest Bitmain ASIC: The Antminer S21.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.