Monday Mining Metrics: ETF False Alarm Foreshadows Price Pump to Come

Bitcoin Mining Update - 10/16/2023

ETF False Alarm Foreshadows What Approval Will Look Like

BTC pumped to 8% in very short order, touching $30,000, upon a now-confirmed-false announcement from Cointelegraph that the iShares/Blackrock spot Bitcoin ETF had been approved.

Seeing such significant price action in very short order, the rumor was only circulating for ~20 minutes, is a sign of what is to come once the ETF is approved for real.

The timeline for approval remains uncertain, but one thing that is not uncertain is that the BTC price will move up rapidly once approval happens. At this point, ETF approval is a “when”, not an “if.”

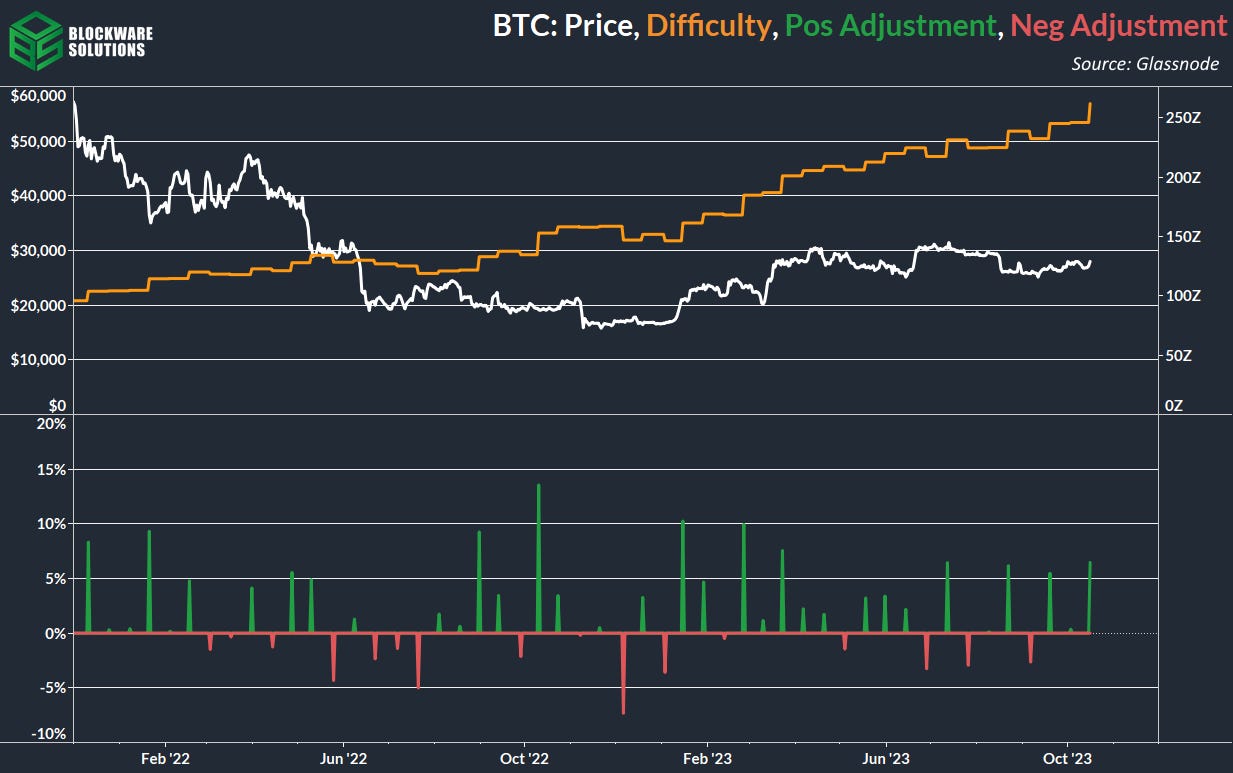

Miners increase hashrate in preparation of the 2024 halving.

Overshadowed by the ETF false alarm is the fact that difficulty surged 6.47% this morning. The largest miners in the industry are doubling down in the face of a soon-to-decrease block subsidy.

The importance of upgrading your fleet to the latest and greatest hardware has never been more apparent than it is right now. While macro circumstances and capital inflows via a spot ETF should bode well for Bitcoin price action, nothing is certain. Minimize your risk of mining unprofitably post-halving by buying the latest-generation ASICs.

“Hope is Not a Plan.”

The clip below is from a podcast we recorded recently with $CLSK CEO, Zach Bradford. Zach reinforces the importance of mining with the best ASICs available on the market.

Wise miners aren’t sitting around waiting for the price of Bitcoin to increase. They are increasing their fleet efficiency and total hashrate; gearing up to survive, and even thrive, when the block subsidy gets cut in half.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market; Antminer S19 XPs, S19k Pros, and Whatsminer M50s.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.