Monday Mining Metrics: Hashprice Explained

Bitcoin Mining Update - 4/29/2024

How to Evaluate the Profitability of Bitcoin Mining (Part 1)

There’s been an influx of new readers the past week, and we want to make sure you are all caught up to speed on the lingo of the Bitcoin mining industry.

The two most important metrics in Bitcoin mining are hashprice and ASIC efficiency. The former allows you to forecast the expected revenue of Bitcoin miners, and the latter allows you to measure the cost of running a specific type of mining rig. Together, these two metrics will give you a good estimate of how profitable you will be with a specific mining rig at a specific electricity rate.

Today we are going to analyze the revenue side of the equation by looking at…

Hashprice

The revenue earned by Bitcoin miners is a function of four dynamic inputs: Bitcoin price, the total Bitcoin network hashrate, the BTC block subsidy, and on-chain transaction fees. Hashprice compiles all four of these inputs to quantify the expected revenue for Bitcoin miners.

Hashprice is a measure of how much $ a Bitcoin miner will earn per terahash per day. Or, written mathematically:

Hashprice = $/Th/Day

You may also see hashprice reference in terms of petahash ($/Ph/Day). Either way, it’s measuring the same thing: the amount of money Bitcoin miners earn daily per unit of computational power.

The four inputs of hashprice are:

BTC Price

Total Network Hashrate (mining difficulty)

Block Subsidy

Transaction Fees

Let’s break these down 1 by 1

BTC PRICE

The first and most important variable affecting Bitcoin miners is, of course, the market price of bitcoin.

If it costs $70,000 worth of electricity to mine 1 bitcoin, and the price of bitcoin is $60,000, then of course it doesn’t make any sense to mine bitcoin. But if it costs $50,000 to mine 1 bitcoin and the price of bitcoin is $60,000, then mining bitcoin is basically a no-brainer.

When Bitcoin goes on bull runs, mining profitability skyrockets. On the contrary, during bitcoin bear markets, miner profit margins are crunched. And ultimately the weakest, least efficient miners find themselves underwater and are left with no choice but to capitulate.

As Bitcoin becomes more widely adopted as store-of-value its price will continue to increase accordingly, creating a tremendous opportunity for Bitcoin miners.

HASHRATE/DIFFICULTY

The second factor affecting mining revenue is the total hashrate of the bitcoin network.

If you’ve studied Bitcoin before then you’ll know that an increase in computational power dedicated towards Bitcoin mining does not allow the 21,000,000 bitcoin to get mined any faster. Through a mechanism called the difficulty adjustment, blocks take an average of 10 minutes to get mined regardless of total network compute.

The term “Hashrate” can be used to refer to the total computing power of all Bitcoin miners on the network, and also the individual computing power of a single Bitcoin miner. In order to avoid confusion between the two, we can use ‘mining difficulty’ to reference the total Bitcoin network hashrate.

Bitcoin mining, being the highly lucrative business that it is, has attracted the attention of retail and institutional investors alike. And over time mining difficulty has increased as a result.

A helpful analogy is to think of Bitcoin as a pizza. With each block that gets mined, miners receive a slice of that pizza. More miners coming online doesn’t mean that the slices get bigger. Rather, each miner's share of the slice gets smaller. As mining difficulty rises, the amount of BTC earned by each miner decreases.

Bitcoin mining difficulty recalibrates every 2,100 blocks, or about every two weeks. Mempool and Braiins are two good resources for tracking Bitcoin mining difficulty.

HALVINGS

The next factor affecting mining profitability is Bitcoin halvings.

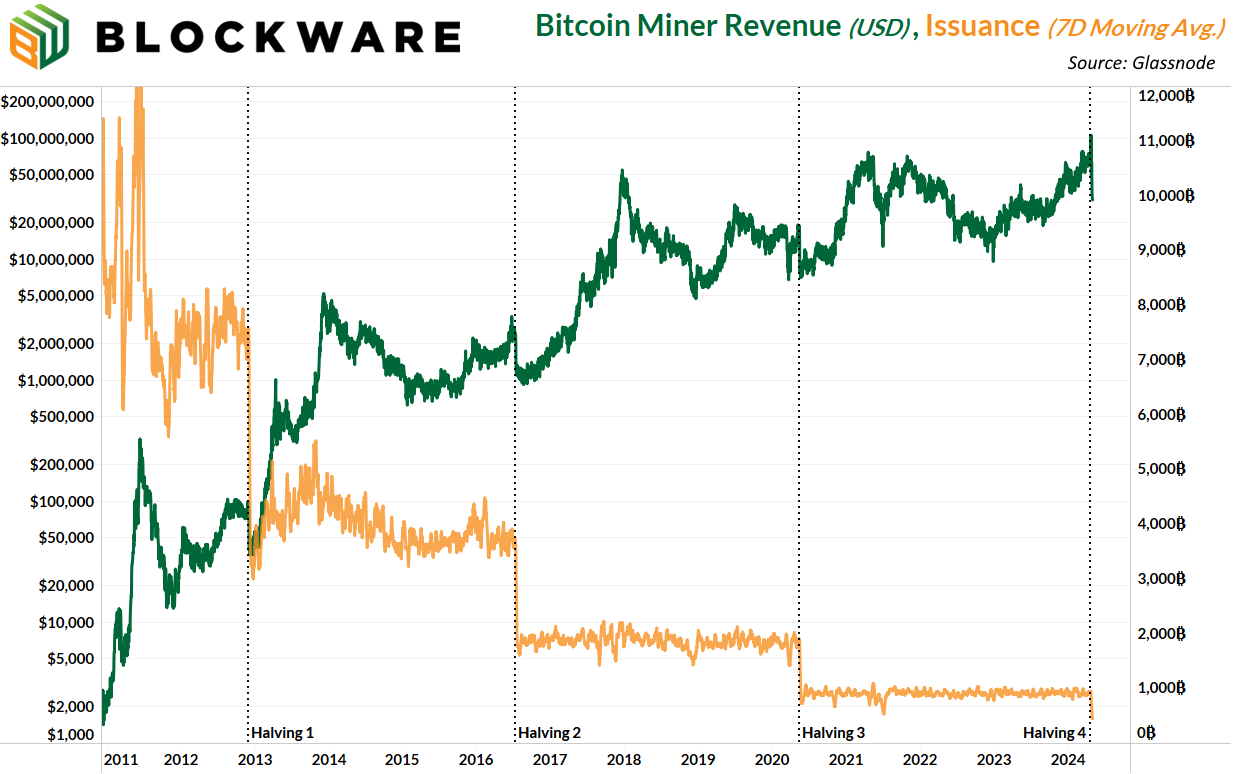

The revenue that miners earn consists of two parts: newly created BTC and transaction fees. The amount of newly created BTC gets cut in half every four years. And as you likely know, the latest halving event just took place ten days ago on April 19th, 2024.

Halvings, which are bad for Bitcoin miners in the short-term, are ultimately bullish as they are what allow Bitcoin to have an absolutely scarce supply of 21,000,000. Moreover, halvings decrease the amount of BTC miners are able to sell on a recurring basis, a positive catalyst for the Bitcoin price, which, as we mentioned, is the MOST important variable for mining profitability.

Halvings, being predictable and verifiable years in advance, are the least dynamic input affecting hashprice. Miners know for a fact that halving-induced drops in revenue are coming, and they’re able to prepare beforehand by acquiring more efficient mining hardware.

TRANSACTION FEES

Alongside the block subsidy, miners also earn revenue from transaction fees. Revenue from transactions varies depending on how much demand there is for use of the Bitcoin blockchain. There’s a limited amount of transactions that can fit in each block due to the ~4 megabyte block size limit, and as such the fee market functions like an auction. Miners are incentivized to include the highest-paying transactions inside the limited block space, and so users can place bids to get their transactions included in the next block. The highest bidding transactions will get mined first.

When more people want their transactions included in the blockchain, fees rise. Typically this happens during bull markets as waves of new users enter the network. Over the past year, due to the rise in popularity of inscriptions, we’ve been able to witness just how much a marginal increase in demand for block space can increase fees.

The future economics of mining revenue will be entirely fee-based as the block subsidy trends towards zero with each halving.

ASIC Breakeven Prices

Now that you have a solid understanding of hashprice, here’s a chart that shows what hashprice needs to be at in order for certain ASICs to be profitable, based on how much they are paying for electricity.

With hashprice currently at ~$0.05/Th/Day, only miners with the most efficient hardware and/or low electricity costs are turning a profit. Mining difficulty is expected to decrease at the next adjustment. This is the result of unprofitable miners turning off their machines. The miners that have remained profitable will benefit at the expense of those unplugging, as a decline in difficulty will increase hashprice. Bitcoin mining is a dog-eat-dog world.

Subscribe to the Newsletter!

If you’re not already subscribed, make sure you do so! Next Monday we’ll be covering the other most important metric in Bitcoin mining: ASIC Efficiency, which allows you to measure the cost, in terms of electricity, of Bitcoin mining.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.