Monday Mining Metrics: Hashprice Rebounding

Bitcoin Mining Update - 5/13/2024

Hashprice Bottoms at $0.05

It’s been almost a month since the halving, and it appears that hashprice has found solid support at ~$0.05/Th/Day.

If history is any indicator, hashprice will be back in a bull market in just a handful of months. When hashprice moves, it tends to do so exponentially. The most profitable miners will be plugged in before hashprice starts ripping. on the sidelines when this happens

"Time in the market" >>> "timing the market"

Mining Difficulty

After the largest negative difficulty adjustment in over a year, the next projected adjustment is a difficulty increase.

This is a testament to the strength and profitability of Bitcoin miners. Despite hashprice being at all-time lows, the latest-generation ASICs are comfortably profitable given the current Bitcoin price.

Difficulty will most likely continue to rise throughout the coming months as miners scramble to increase the size and efficiency of their mining fleets in preparation for the bull market.

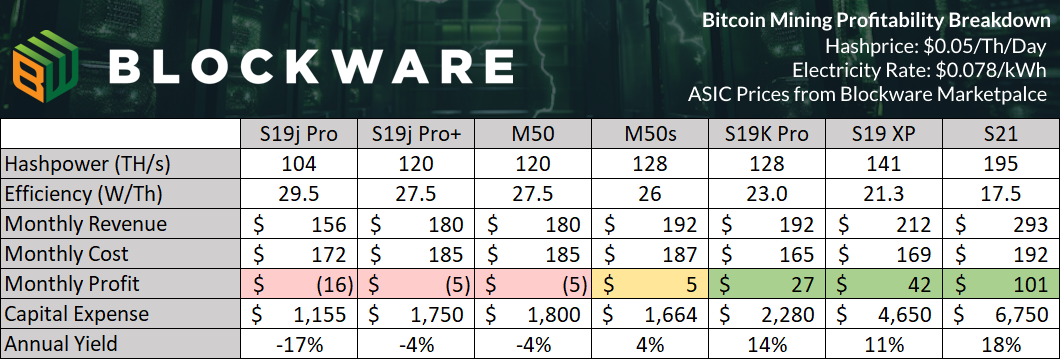

Profitability Breakdown by Machine Type

The table below shows the monthly profit for various ASICs based on the current hashprice at an electricity rate of $0.078/kWh.

Newer generation ASICs have plenty of breathing room at the moment, with a single S21 producing >$100 of profit per month.

Mid-generation ASICs such as the S19j Pro+ and Whatsminer M50 are essentially breaking even. Miners that are willing to hash at breakeven, or even a slight loss, may want to purchase these types of machines with the expectation that the BTC bull run resumes later this year. You can essentially think of this play as a call option.

On the other hand, buying new-generation ASICs will allow you to profit greatly during the bull market, while also giving you downside protection if BTC remains stagnant in the short to medium term. In exchange, these machines have a higher up-front cost.

Mining Stocks Consolidating

Just as BTC has consolidated, so have the publicly traded mining companies. $WGMI, the mining stock ETF, is forming a bull flag. The 13-14 point range seems to be a support level.

The market appears to be unsure how to price the mining stocks. They plummeted leading up to the halving, pumped immediately after, and now they’ve traded sideways since then.

There’s a handful of reasons to be bullish on the miners: heavy BTC exposure, ASICs on balance sheets, and the FASB rule change coming in December.

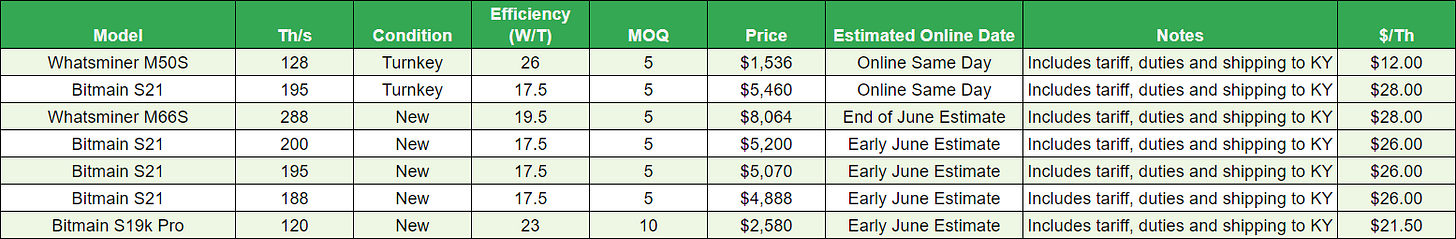

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Truly a great write up. With hashprice finding solid support and mining difficulty on the rise, it's clear that the most forward-thinking miners will reap substantial rewards in the upcoming bull market.