Monday Mining Metrics: Hashrate Soars as Miners Deploy Capital in Anticipation of Bull Market

Bitcoin Mining Update - 11/4/2024

Hashrate is Ripping

Hashrate is up to 725 EH/s on the 14-day moving average – setting the stage for a ~6% increase in mining difficulty this afternoon. This is a positive sign for the health of the network and bitcoin miners as a whole, and likely a positive omen for price action in the medium term. The fact that miners, in the aggregate, are deploying capital into hardware upgrades means that the inefficient miners who became unprofitable after the halving, and constituted a large portion of sell pressure, are now

Rising difficulty will add to the stress of miners who are currently operating with a breakeven cost at or near the current BTC price; reinforcing the importance of mining with efficient hardware and low-cost power.

Hashprice ($/Th/Day)

On a year-over-year basis, hashprice (the primary measurement of Bitcoin miner revenue), is down ~33%. This is typical for the current stage in the Bitcoin cycle. The block subsidy is lower, miners are upgrading hardware, and the Bitcoin price has stagnated.

However, the table will flip entirely in the future as the BTC price begins to take off. The combination of positive difficulty catalysts have historically paled in comparison to the rate at which the BTC price rises during bull markets. This results in explosive growth in hashprice and BTC mining profit margins. Note the 300%+ year-over-year increase in each of the past two bull cycles.

Miners are deploying more hashrate right now in anticipation of this move.

CleanSpark Acquires GRIID Infrastructure ($GRDI)

Further highlighting the eagerness at which miners are attempting to expand, CleanSpark acquired GRIID Infrastructure this past week. This expands CleanSpark’s operations into the US State of Tennessee – providing them further geographic diversification following their expansion into Mississippi earlier this year.

Check out CleanSpark’s press release here.

Mining Economics Breakdown

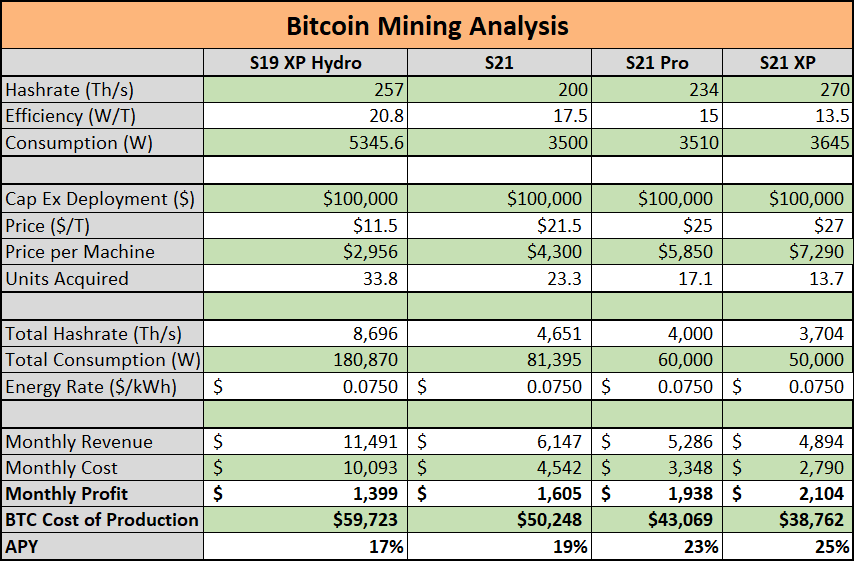

Here’s a chart showing the performance of new-generation Bitcoin miners (inclusive of the incoming difficulty increase). As you can see, the cost of production is well below the current BTC price for each of these miners. Miners using an S21 XP have the lowest cost of production, being able to mine 1 BTC for under $40,000 in electricity.

To learn more about Bitcoin mining with Blockware, fill out this form on our website.

The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

If you’re looking to purchase individual machines, you can use our self-service marketplace to pay with BTC and start mining immediately!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.