Monday Mining Metrics: How Mining Profitability Changes During Bull Markets

Bitcoin Mining Update - 8/19/2024

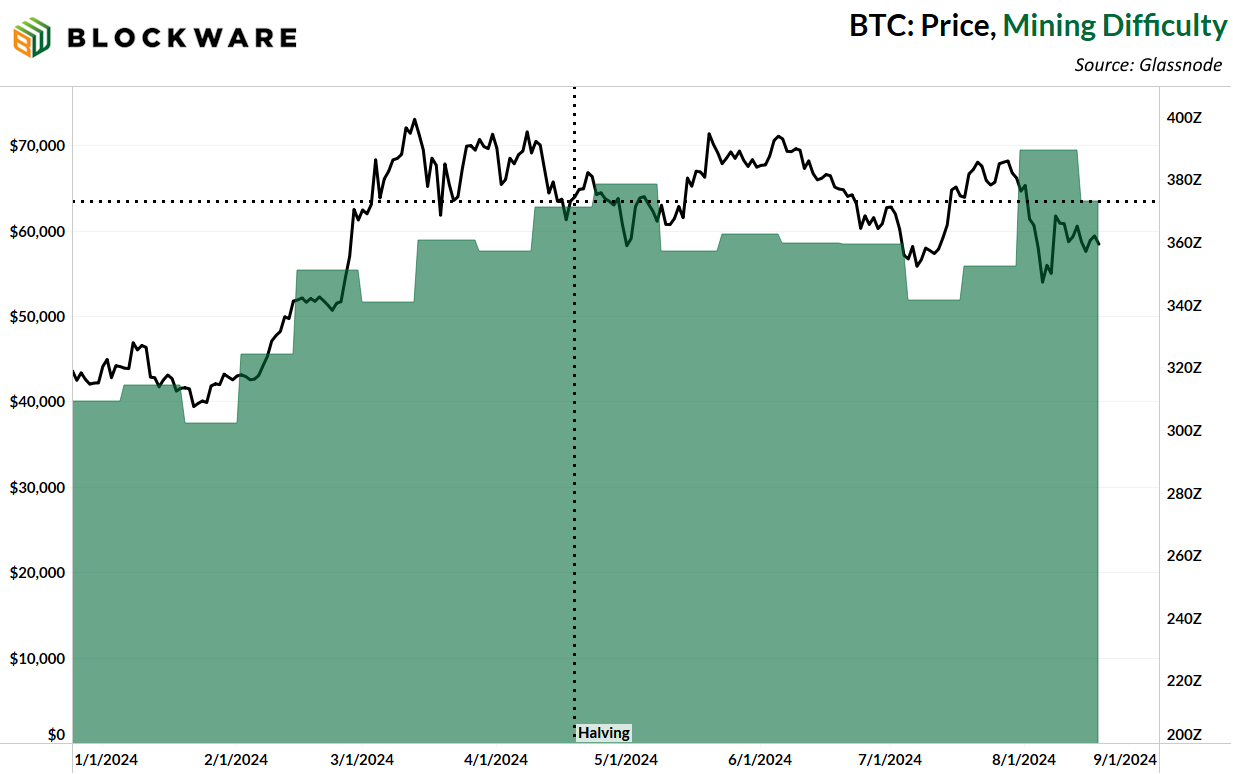

Mining Difficulty Adjusts Down

After the latest negative difficulty adjustment of -4.19%, difficulty is now more-or-less flat since the Bitcoin halving back in April. Four months of net-zero difficulty growth is exactly what we expected as the mining industry searches for equilibrium in the new era of 3.125 BTC block subsidies. Moreover, difficulty growth often stagnates during Northern Hemisphere summer months due to heat-induced curtailments. Lastly, sideways/downward BTC price action this summer has certainly played a role in dampening any potential growth in mining difficulty.

The signal here is that miners who have been upgrading their fleets to the latest-generation ASICs (S21, S21 Pro, etc.) are benefiting tremendously right now. Because while difficulty has stayed relatively flat they have grown the hashrate of their personal fleet, allowing them to accumulate more BTC than they otherwise would.

Hashprice (Miner Revenue per Terahash)

Hashprice has been able to hold its own at around ~$0.04/Th/Day. It is our belief at Blockware that it is highly unlikely to go any lower than this. Negative catalysts for hashprice would be:

Drop in BTC Price (already happened, was unsustained and BTC rebounded within 24 hours)

Significant Rise in Difficulty (unlikely to happen without BTC price moving first)

Miners that survive this period of a 4¢ hashprice will be the ones to profit the most during the bull market.

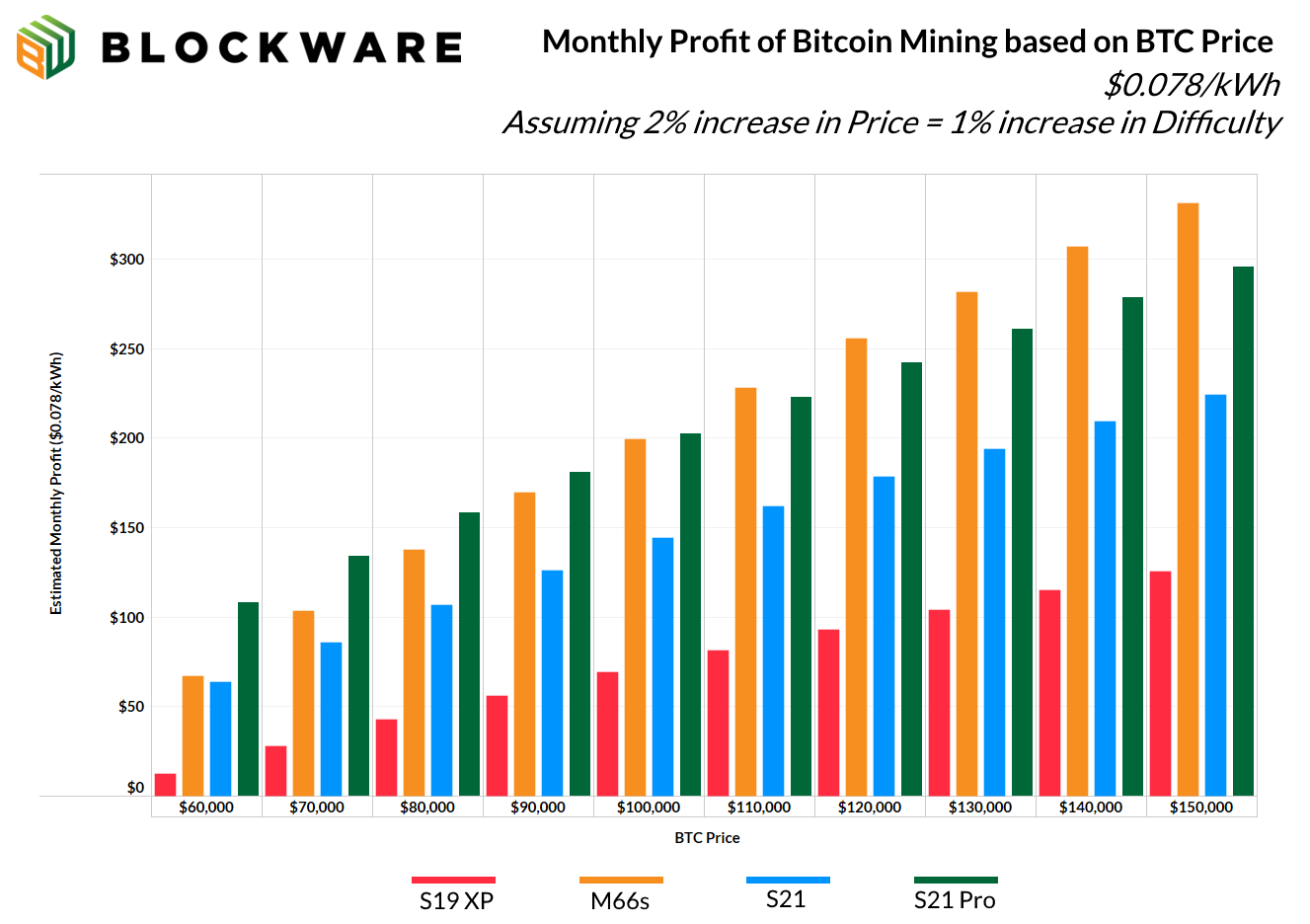

Projected Future Profitability

The chart below shows the estimated monthly profit of four different Bitcoin mining rigs:

S19 XP

M66s

S21

S21 Pro

…based on major Bitcoin price milestones that may be reached over the next 12 months.

The key takeaway here is this:

***Growth in the price of Bitcoin results in even higher growth of Bitcoin mining profit margins***

Bitcoin going from $60,000 (present value) to $150,000 is a 150% increase. In this scenario, here’s how much profitability for each ASIC would increase:

S19 XP: $12 → $125 (939%)

M66s: $66 → $331 (398%)

S21: $63 → $224 (252%)

S21 Pro: $108 → $296 (173%)

The profitability of each ASIC (on a % basis) not only increases by more than the price of Bitcoin, but it does so by many multiples depending on the machine.

With these insights, you should be able to make a more informed decision on what type of ASIC is best for you based on your level of bullishness. If you expect BTC to soar past the numbers outlined here, you may want to consider something like an S19 XP or S19K Pro. This positions you to benefit tremendously on the upside, while also spending less upfront because these machines are trading at a discount to newer-generation ASICs. The tradeoff is that these machines are right around breakeven in the current environment.

If you want to play things a bit safer, but still position yourself as “long Bitcoin”, then acquiring an S21, S21 Pro, or M66s, is the right play for you. Higher capital expense, but you’re highly profitable even at the current hashprice.

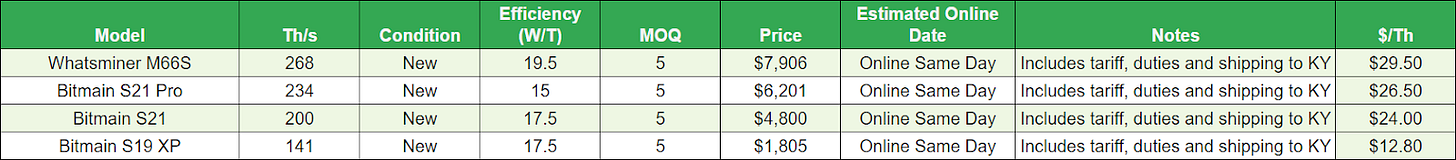

Blockware Direct ASIC Pricing with Hosting

We have 100s of ASICs available for purchase right now on the Blockware Marketplace! Machines are sold turnkey which means you’ll be hashing as soon as your BTC payment is confirmed on-chain! Click here to start mining today.

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here. Buying machines in bulk gives you access to better per-unit pricing than buying individual machines!

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.