Monday Mining Metrics: $MARA Issues $700m in Convertible Notes

Bitcoin Mining Update - 12/02/2024

Marathon ($MARA) Doubles Down on Bitcoin Acquisition Strategy

Marathon issued another $700,000,000 worth of convertible notes (bond/option mix) with the expressed purpose of acquiring more Bitcoin.

In Friday’s newsletter we gave an in-depth breakdown into convertible notes and why they have been successful for MicroStrategy. There are tens of trillions of dollars in the corporate-debt market clamoring for Bitcoin exposure – “BTC Backed” convertible notes are the best (and only) way to get that.

Marathon remains the only publicly traded Bitcoin miner in the US Market to replicate this play and it’s unlikely they are showing no signs of slowing down as this is now their 3rd convertible note offering since August; and the previous offering was oversubscribed.

Read $MARA’s Press Release Here.

Slight Difficulty Adjustment

The difficulty adjustment we’ve been tracking came through at a very negligible increase of +1.59%. Difficulty adjustments occur every two weeks (on average), but this one was of particular importance as it was the first adjustment since BTC’s run into the upper $90,000’s range.

The adjustment here gives us insights into how much hashrate was sitting idle – previously unprofitable – waiting for BTC price appreciation before plugging in. The very nature of unprofitable rigs on the sideline implies that they are older, less efficient models. As such, these machines plugging back in only had a marginal increase on total network hashrate/mining difficulty.

Difficulty growth will continue to lag behind BTC price growth, resulting in massive profit margins for incumbent Bitcoin miners.

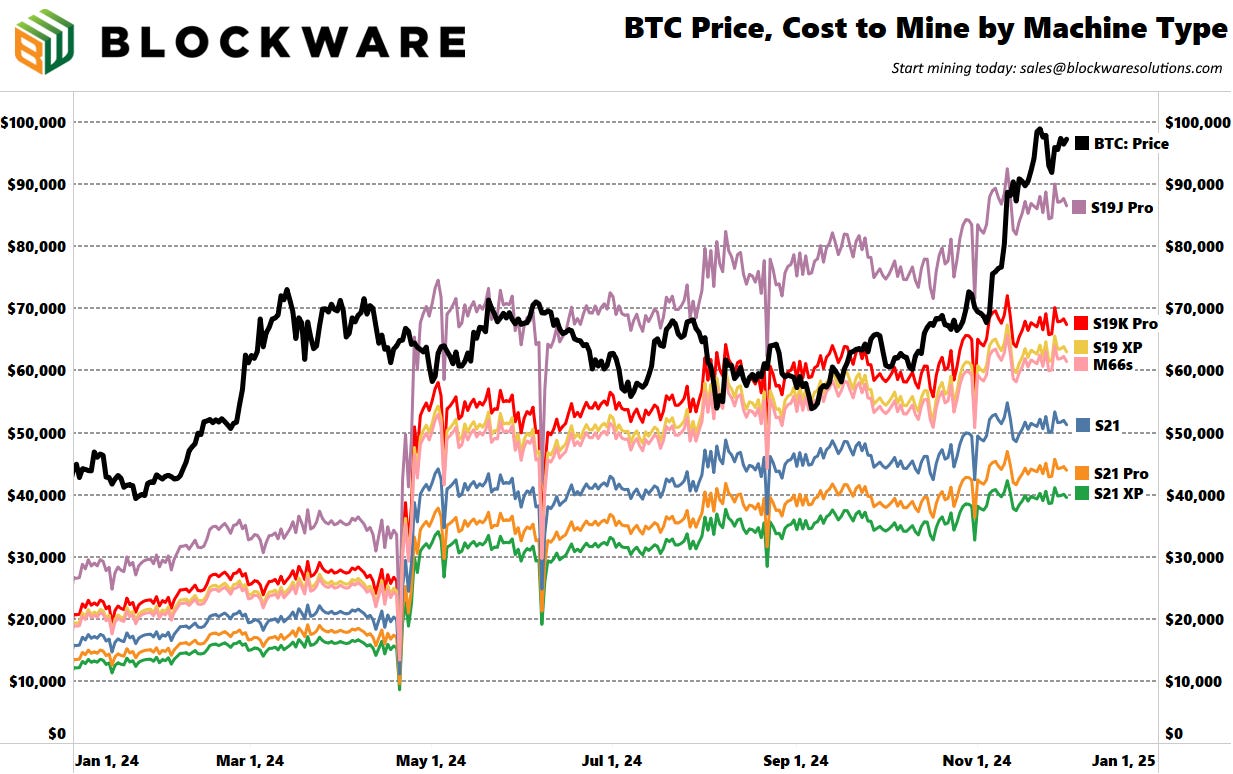

Cost to Mine 1 Bitcoin

Here’s an updated chart on the cost to mine 1 BTC based on machine type and an electricity rate of $0.078/kWh.

This calculation uses a moving average of daily miner revenue in order to account for short-term variations in the time it takes for Bitcoin blocks to get mined.

The cost to mine has gradually increased over the past few months (as mining difficulty gradually increases), but it has not moved with anywhere near as much velocity as the Bitcoin price.

Antminer S21 XP’s are mining 1 BTC for ~$40,000 in electricity. Another way to think about this is that they are “dollar cost averaging” at an effective price of $40,000 per BTC.

To learn more about Bitcoin mining with Blockware, fill out this form on our website.

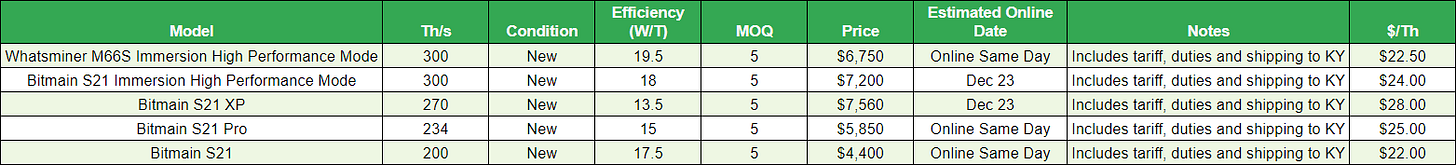

The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

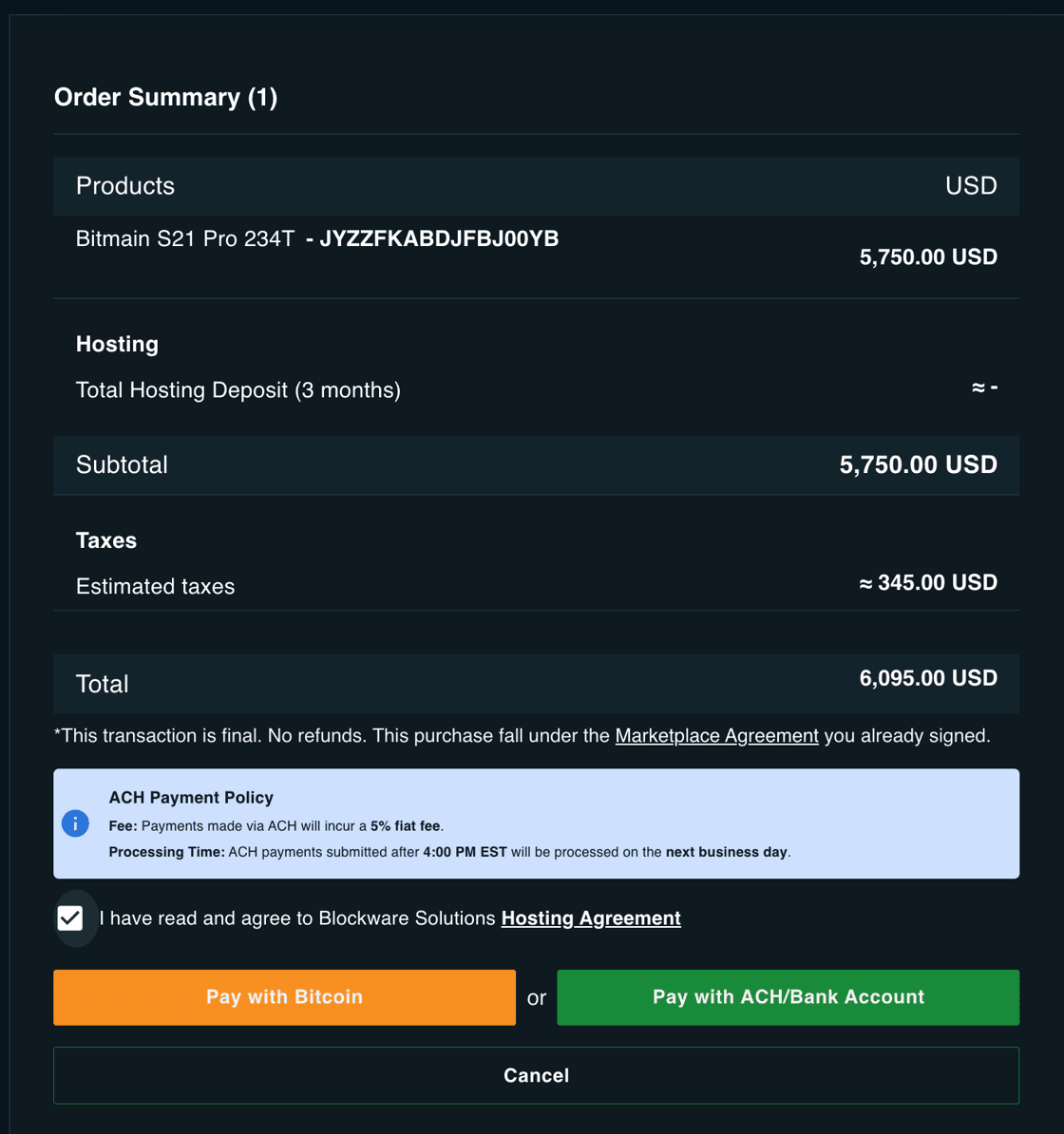

If you’re looking to purchase individual machines, you can use our self-service marketplace to pay with BTC and start mining immediately!

As a reminder, you can now use dollars to purchase hosted Bitcoin miners on our marketplace.

Simply click the green “Pay with ACH/Bank Account” button at check out.

HODL your Bitcoin while you exchange your dollars for Bitcoin-producing hard assets.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.