Monday Mining Metrics: Mempool Clears. Is Bitcoin Dead?

Bitcoin Mining Update - 2/3/2025

Bitcoin Mining x Ordinals

The Blockware team has been working on a project in stealth-mode for the past year: Hashrate Hackers. This project is bridging the gap between Bitcoin miners, ordinals, and institutional investors.

We’ll have more to share on this in the near future, but for now, check out this exclusive CoinTelegraph interview featuring Blockware CEO, Mason Jappa, and Founder of Eden Block VC, Lior Messika, discussing Hashrate hackers.

https://x.com/Cointelegraph/status/1885357432643477956

Mempool Clears, Transaction Fees Drop to Nearly Zero, is Bitcoin Dead?

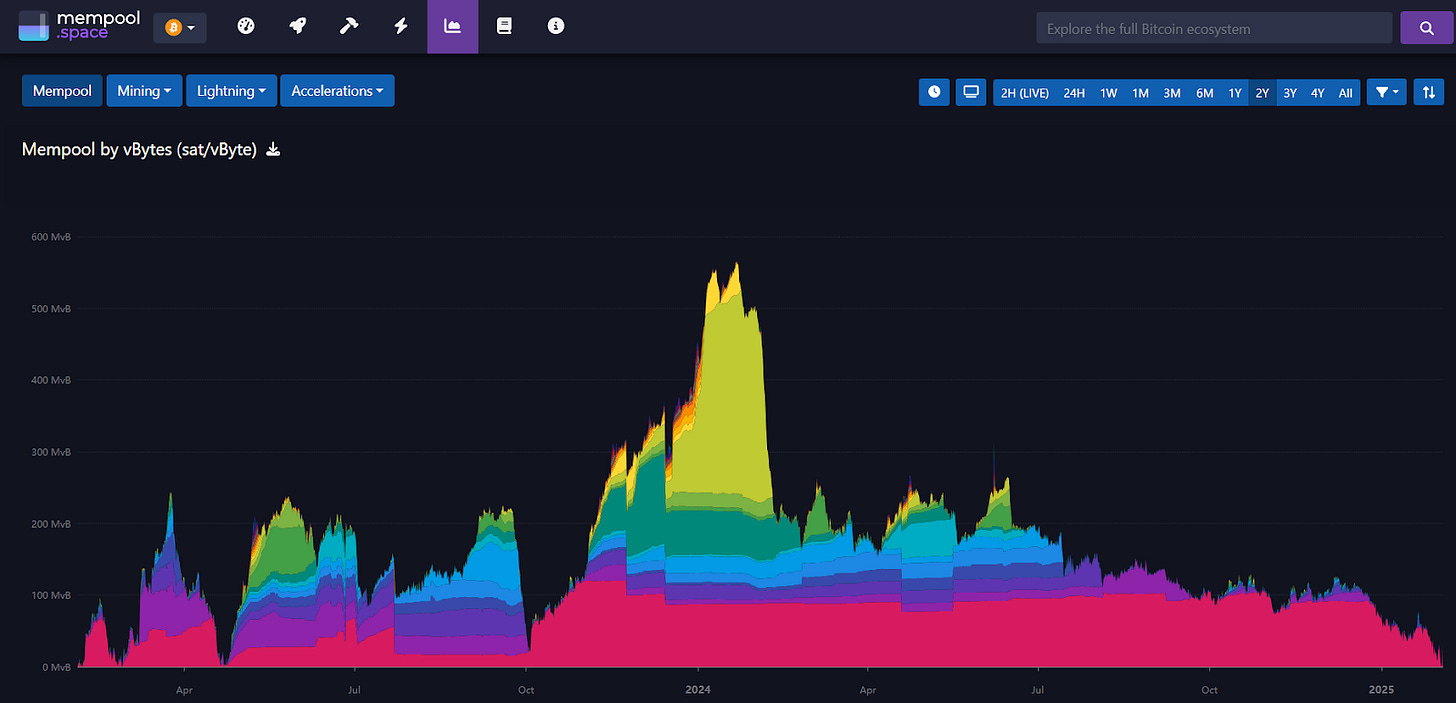

The ‘Mempool’ – short for “memory pool” – is a collection of Bitcoin transactions that are “in the queue”, so to speak.

Due to the limited amount of data that can be included in each Bitcoin block, miners tend to include the transactions that are paying the highest fee (measured in sat/vByte). Users who want to send Bitcoin on-chain, but aren’t necessarily in a hurry to have the transaction processed, will broadcast transactions with a low-fee rate. The transaction will then wait in the mempool until there’s less demand / competition for block space, at which point miners will begin including these lower-fee transactions.

Over the weekend, the mempool cleared for the first time in two years, and transactions paying the lowest possible fee rate, 1 sat/vByte, were included in blocks. Moreover, as the mempool cleared, multiple “half empty” blocks were mined – blocks that were not full data-wise because there weren’t enough outstanding Bitcoin transactions to include.

This resurfaced a debate about Bitcoin’s “security budget” – with the claim from naysayers being this: “If nobody is sending Bitcoin on-chain, miners will go bankrupt and the network will no longer be secure.”

This is an incorrect analysis for a variety of reasons:

Bitcoin miners earn revenue even if there are no transactions in a block.

Mining economics are a constantly adjusting equilibrium

Let’s attack these points one-by-one.

Bitcoin miners earn revenue even if there are no transactions in a block.

There is a “subsidy” awarded to Bitcoin miners for each block successfully mined – the subsidy is newly created Bitcoin and the amount that miners earn per block is cut in half every 210,000 blocks (roughly every four years).

Even if zero transactions are included in a block (and thus no fee revenue), miners will still receive the subsidy, which is ~3.125 BTC (~$300,000) right now. If your perception of Bitcoin’s “security” hinges on revenue for Bitcoin miners, then we are still quite a few decades out from a “transaction fees only” based revenue model for Bitcoin miners.

Mining Economics are a Constantly Adjusting Equilibrium

Unlike other commodities, the “difficulty” of producing (mining Bitcoin) is programmatically adjusted every 2,016 blocks. If Bitcoin miners are unprofitable they turn off their machines, then blocks start getting mined more slowly, and in response, the difficulty of mining automatically decreases. If for some reason miner revenue decreased significantly, difficulty would continue to adjust down until only the most efficient miners remain in operation.

Over time, mining difficulty has increased substantially, indicating health and profitability amongst Bitcoin miners.

Bitcoin Miner Revenue – $48 Million per Day

Despite the noise, Bitcoin miners are collectively earning roughly ~$48 million per day – this is the highest amount of revenue for miners since the halving in April of 2024. Moreover, miner revenue, while volatile, is in a long-term uptrend, in spite of the fact that the BTC block subsidy is cut in half every four years.

We are hosting our first ever live Q&A for Blockware Premium Subscribers on Thursday, February 6, 2025 – 5pm Eastern Standard Time.

Alongside the live Q&A, premium subscribers receive a comprehensive market update every Friday, access to our premium-only telegram channel, and more!

You can become a premium subscriber for just $15/month.

Blockware's Mining-as-a-Service enables you to start mining Bitcoin, without lifting a finger. Blockware handles everything, from securing the miners, to sourcing low-cost power, to configuring the mining pool - they do it all.

With multiple data centers across the US, Blockware is the most reliable mining partner in the industry.

Click here to check out our Marketplace where you can see real-time analytics on our miners, and make an immediate purchase using BTC or fiat.

If you’d like a more hands-on mining experience, fill out this form on our website. One of our Account Executives will be in touch and they can walk you through our entire product and service offerings! The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.