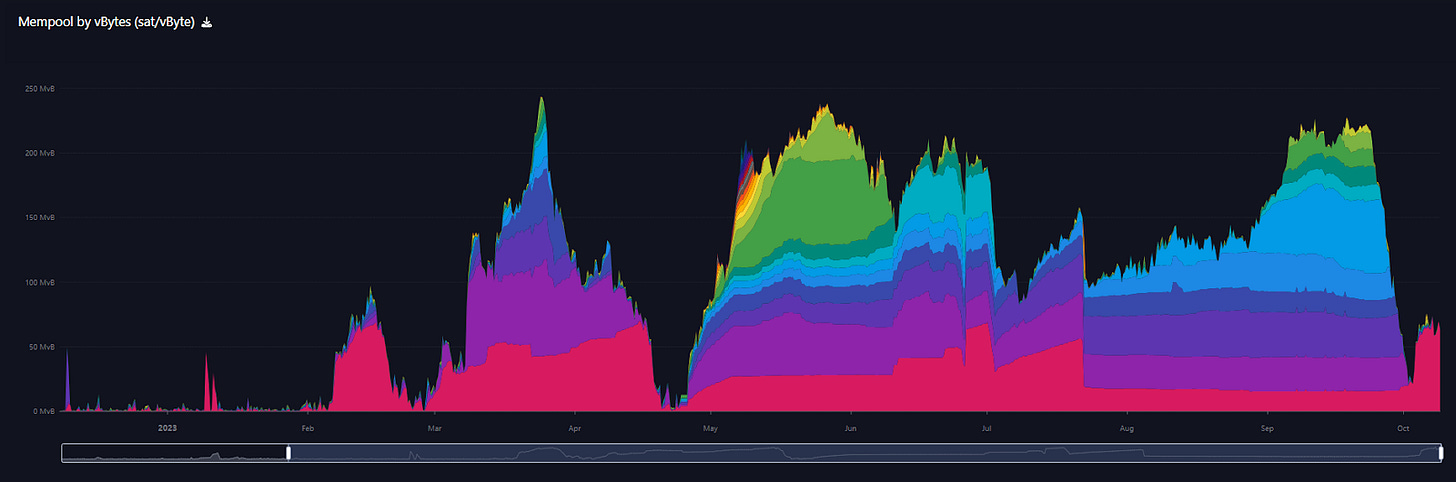

Monday Mining Metrics: Mempool remains full despite fees reaching 1 sat/vByte

Bitcoin Mining Update - 10/9/2023

Demand for On-Chain Transactions Rebounds After Mempool Almost Clears.

One of the most notable events to occur in Bitcoin this year was the rise in transaction fees due to the popularity of inscriptions/ordinals.

The mempool went from basically empty, to consistently full, within a matter of months. This surge in demand for on-chain settlement of course resulted in higher transaction fees as users attempted to out-bid each other for the limited block space.

Over the past few weeks, the mempool began to clear and ultimately reached 1 sat/vByte for zero priority transactions. Upon reaching this level, the amount of transactions in the mempool whose fee is set to 1 sat/vByte has bounced significantly.

There are two important signals here. First, there is still significant demand for on-chain settlement, despite the fact that we are presently in a bear market (although the tides are likely to shift within the next 12 months) Secondly, the Bitcoin network does a flawless job of reaching market equilibrium. Clearly, there was a cohort of users waiting for fees to drop to 1 sat/vByte before the submitted transactions. Although most of the transactions in the mempool have their fee set to that rate, some users are still choosing to bid a higher fee in order to achieve faster settlement.

With blockspace limited, and demand for Bitcoin as a means of counterparty-free final settlement increasing, it’s only reasonable to expect that transaction fees will reach a continuously elevated level during the coming cycle, especially as institutions enter the playing field.

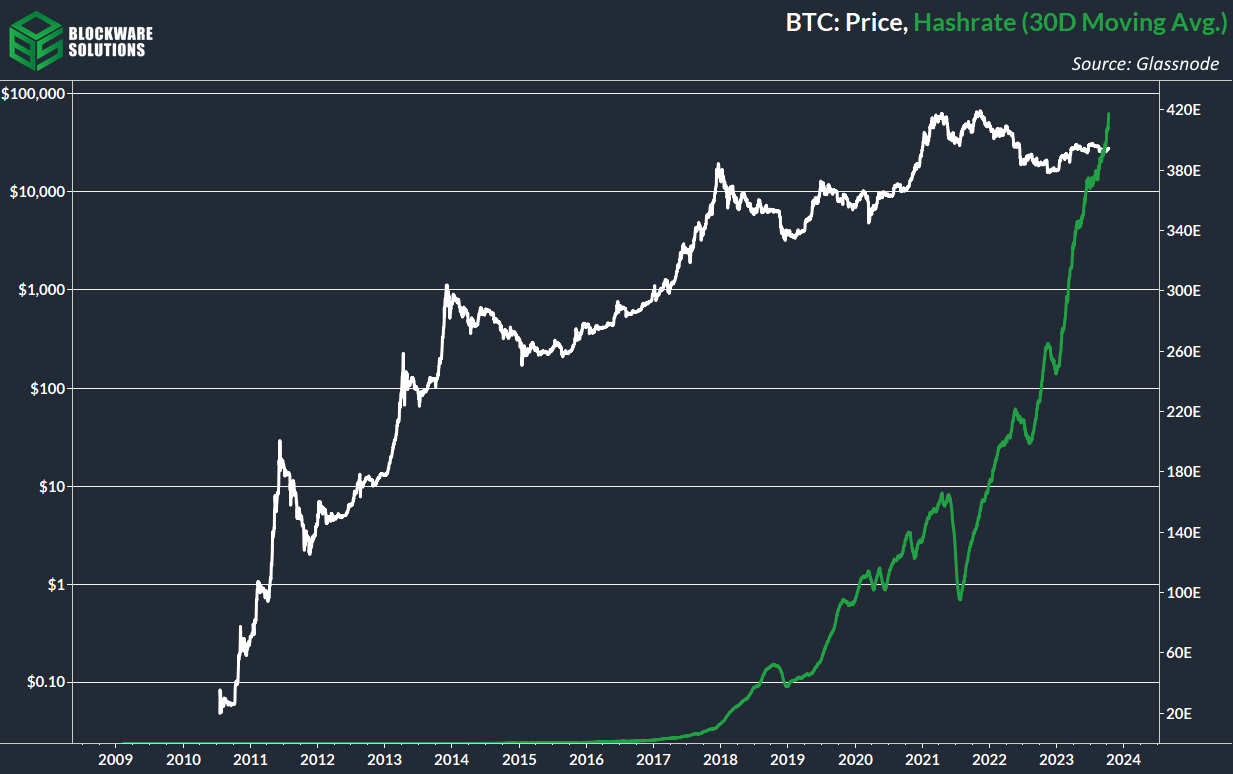

Hashrate All-Time High

Miners continue to make aggressive moves heading into the 2024 halving; upgrading their fleets and plugging in more machines to ensure they can endure a 3.125 BTC block subsidy.

The 30-day moving average of hashrate has reached 417 EH/s and the next difficulty adjustment is projected to be +4.2%.

If you haven’t already upgraded to S19k Pro’s, S19 XPs or S21s, now is the time to do so.

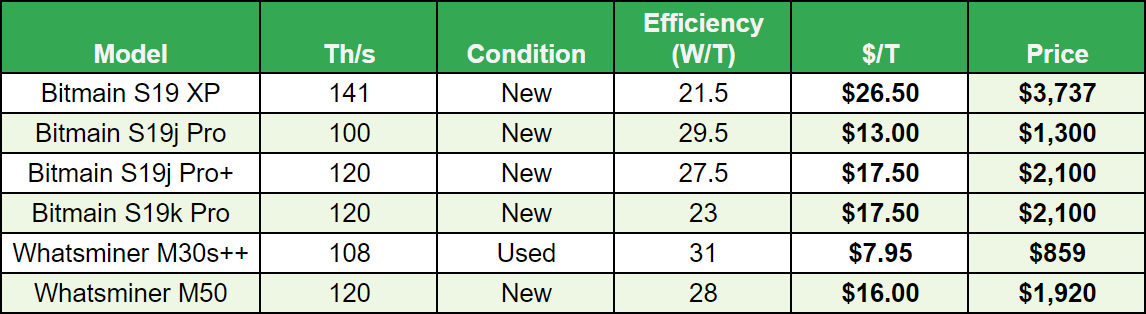

Spot ASIC Pricing

Below are the lowest current listing prices (asks) on the Blockware Marketplace for a variety of popular ASIC models, including the week-over-week change.

Antminer S19 XPs are incredibly well-priced at the moment. According to our 2024 halving research, these machines at the hosting rate provided by the marketplace will remain profitable after the block subsidy drops to 3.125 BTC!

Antminer S19j Pro (+14%)

$1,199 (0.0435 BTC)

$12.5 / T

Antminer S19j Pro+ (+0%)

$2,530 (0.0919 BTC)

$20.7 / T

Antminer S19 XP (-10%)

$4,100 (0.1489 BTC)

$29.1 / T

Whatsminer M30s++ (-20%)

$1,210 (0.0439 BTC)

$11.2 / T

Whatsminer M50 (+8%)

$2,700 (0.098 BTC)

$22.5 / T

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.