Monday Mining Metrics: Miner Bloodbath

Bitcoin Mining Update - 6/24/2024

Mining Disrupt 2024 - Miami, Florida

The Blockware team is in the 305 this week for Mining Disrupt. We’ll be meeting with other industry leaders to talk about Bitcoin mining. If you’re in the Miami area, make sure to swing by the event and say hello to our team!

We’ll have two Blockware representatives speaking at the event. Danny Condon, Chief Revenue Officer, and Mitch Askew, Head Analyst.

Danny will be delivering a keynote speech, “Bitcoin Mining Reimagined: ASICs as an Asset Class”, at 9:55 am on Wednesday. Mitch will be on a panel at 1:35 pm on Wednesday to discuss how Bitcoin miners can utilize hedges, yields, and treasury strategies to grow their balance sheets.

Bitcoin Dipping, Hashprice Dipping, Miners Battling

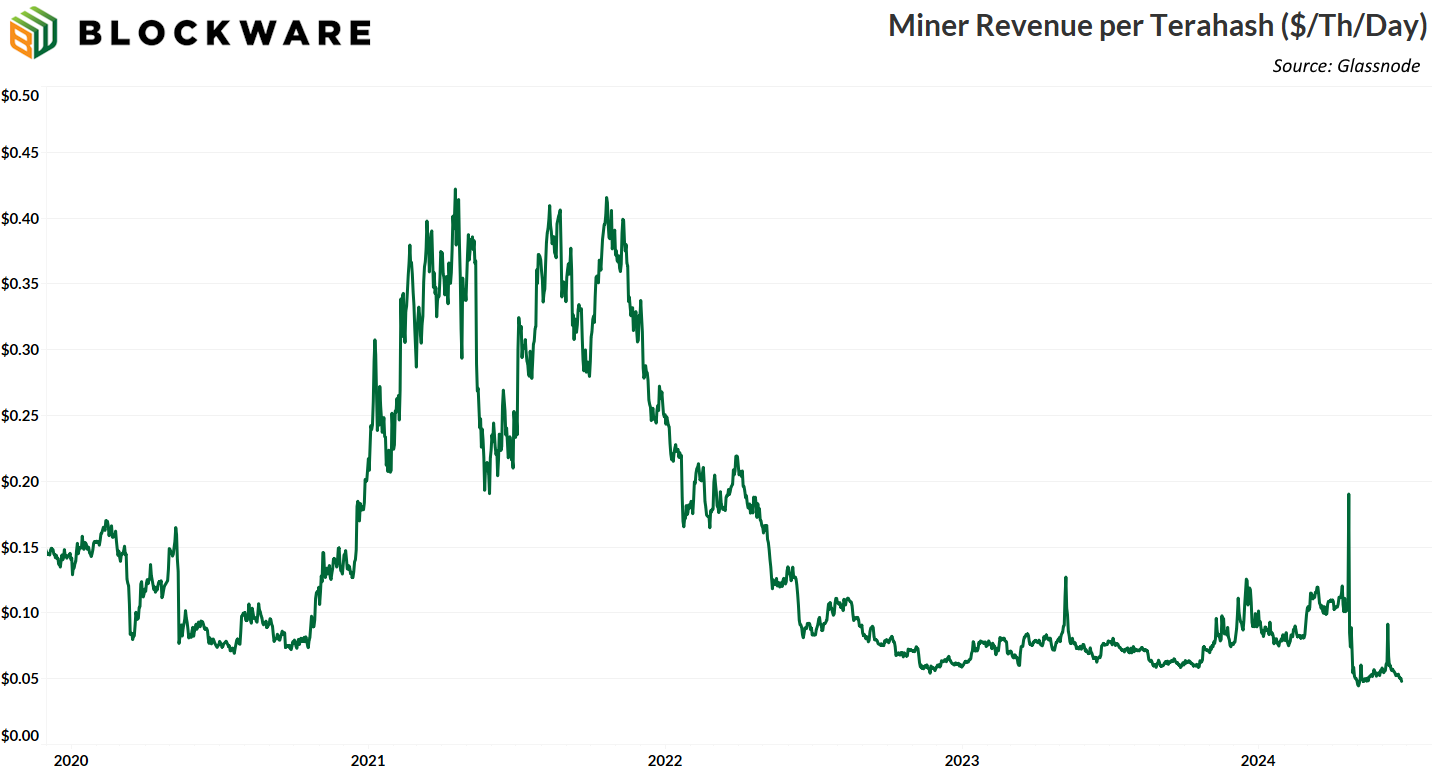

Bitcoin is slipping and sliding into the lower $60,000’s (a drawdown that percentage wise is very typical for bull markets). Consequently, hashprice is now at ~$0.04/Th/Day, pushing towards the all-time low it made in the aftermath of the halving.

Miner Capitulation Continues

With Hashprice dipping below $0.05, miners are once again finding themselves in a tight position. The summer miner capitulation that we noted in last week’s newsletter is persisting, with difficulty projected to drop another ~4.75% at the next adjustment.

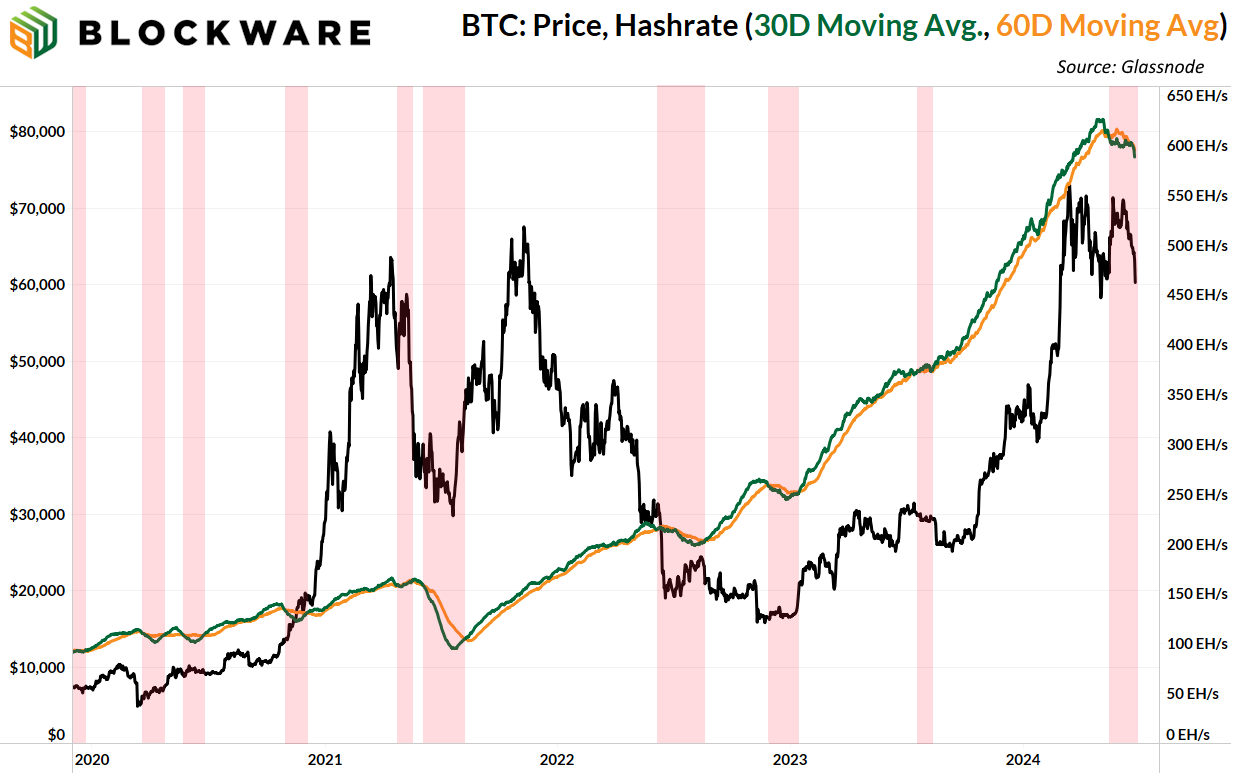

Hash Ribbons is an elite indicator for tracking miner capitulations When the 30-day moving average of hashrate (green line) is less than the 60-day (orange line) that means miners are unplugging machines, either due to unprofitability or energy curtailments. The current hash ribbon is prolonging as the 30-day continues to drop.

Hash Ribbons are also helpful for gauging potential local bottoms in the price of Bitcoin. An excess of unprofitable miners means heightened sell-pressure on BTC (these miners are selling most or all of the BTC they mine to cover operating expenses; and possibly even selling some of their treasury). The forced capitulation from these miners means a relief in sell-pressure, which has historically created local bottoms. It’s beautiful to watch a true free market in action; there are no bailouts for unprofitable Bitcoin miners.

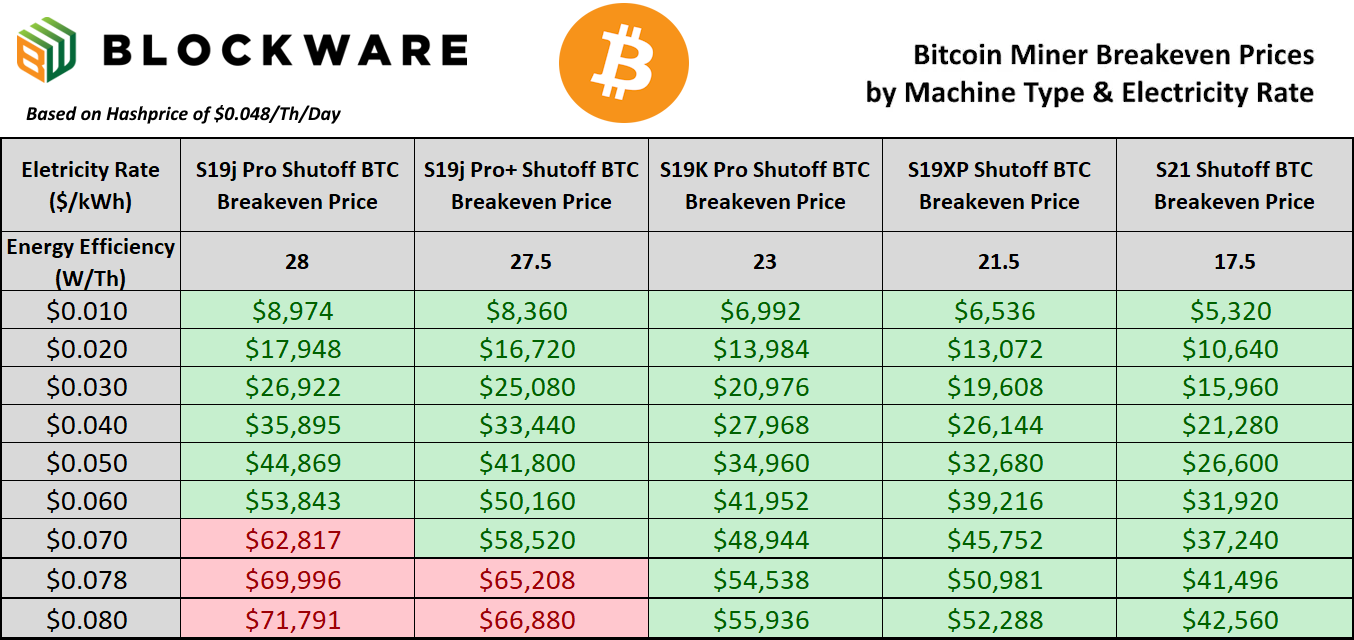

Profitability Breakdown by Machine Type

With hashprice now down to ~$0.048/Th/Day and BTC just under $61,000, S19j Pro’s at $0.07/kWh are underwater. jPro’s still comprise a solid portion of total global hashrate, so, unsurprisingly, difficulty is dropping as these machines go in the red at certain electricity rates.

“Buy when there's blood in the streets, even if the blood is your own." - Warren Buffet

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.