Monday Mining Metrics: Miners Thrive Post-Halving

Bitcoin Mining Update - 4/22/2024

Bitcoin Halving

Bitcoin flexed its guns of predictable, programmatic monetary policy. The 4th ever halving took place Friday night at block height 840,000. The BTC block subsidy dropped from 6.25 to 3.125.

In roughly four years, it will get cut in half again. And this will occur every four years until the year 2140 (block height 6,720,000) at which point all 21,000,000 BTC will be mined into circulation.

The halving block, 840,000, had a whopping 37.6 BTC worth of transaction fees (~$2,400,000).

Fee mania was the theme of the weekend on-chain and there was frenzy of users attempting to get their transactions (mostly new ordinal projects) into the early blocks of the epoch.

In total, on Saturday April 20th, 75% of total Bitcoin mining revenue was derived from transaction fees.

Transaction Fees Surging

The on-chain fee required to guarantee your transaction gets into the next Bitcoin block is north of 200 sat/vByte. Ordinal/inscription projects such as Runes are the primary culprit for the increase in transaction fees.

Fees will likely remain elevated for the next few weeks or months, especially if mining difficulty begins to drop after the halving. Dropping difficulty means blocks are getting mined slower than 10 minutes on average, high fees are the result of users wanting TX’s processed urgently, slower blocks increases that urgency. This is why the mempool tends to clear during epochs in which mining difficulty increases (faster blocks).

To quantify the absolute insanity of transaction fees this weekend, priority transactions were broadcasting a fee rate of more than 2,000 sats/vByte. Wild is an understatement.

On a relative basis, fee mania has subsided. However, 100+ sat/vByte is still a historically high fee rate. It is unlikely that fees become categorically “low” (less than 10 sat/vByte) anytime in the coming months. Especially if/when BTC resumes the bullish price action that dominated Q1 of this year.

Mining Difficulty

A marginal difficulty increase is projected for the next adjustment. The estimated difficulty adjustment was slightly higher before the halving, around 2-3%.

The adjustment after this one will be where we really get important insights into the profitability of incumbent miners. It is unlikely that the next adjustment is significantly negative, especially given the high fee environment.

ASIC Breakeven Prices

Most miners are operating well post-halving; which should come as no surprise if you are a frequent reader of Blockware Intelligence. All of the latest-generation ASICs, and even older models such as the S19, are still profitable at industry-standard electricity prices (the same can’t be said for home miners operating with retail electricity rates).

A machine operating at an electricity rate of $0.08/kWh needs an efficiency of 40 W/Th or greater to be profitable. This is a high threshold to cross; we’ll see how this changes over time as price, difficulty, and transaction fees fluctuate.

Mining Stocks Surge Post-Halving

Publicly traded Bitcoin mining stocks have responded well-post halving. $WGMI, the Bitcoin miner ETF, is up 18% over the past five trading days, and is up 5% on Monday as we near market-close.

The underwhelming performance of mining stocks year-to-date came on the back of unsubstantiated investors fears about post-halving profitability. Consequently, the halving became a “buy the news” event as the survivability of miners became apparent thereafter.

Blockware Head Analyst, MitchellHODL, predicted this last week. You can read more about that in this Cointelegraph article in which he was featured.

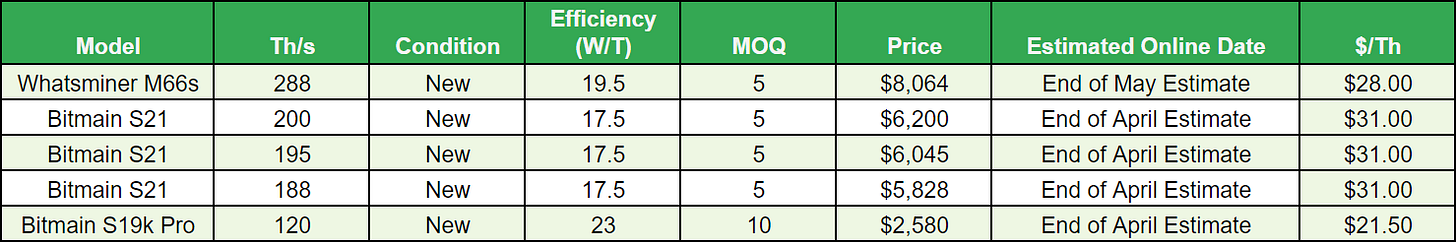

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.