Monday Mining Metrics: Mining as a Call Option on Bitcoin

Bitcoin Mining Update - 5/19/2025

Monday Mining Metrics: Mining as a Call Option on Bitcoin

Call options are a popular tool in traditional finance for getting long on an asset – amplifying potential returns by adding a “time” component to a position. “If Equity Z reaches X price or higher before Y date, the option will yield a greater return than simply purchasing Equity Z outright.” Bitcoin Mining – from an investment perspective – can be viewed in a similar manner. Specifically, Bitcoin Mining has a similar investment profile to ‘LEAPS’ – options contracts with MultiYear expiration dates.

BTC Mining Average Cost of Production = “Strike Price”

Mining Hardware Price = “Options Premium”

Rising Mining Difficulty = “Theta Decay”

Bitcoin miners using specialized hardware and low-cost electricity are able to produce BTC at a discount to the market price. This is inherently “long Bitcoin” because the operating profit margins of Bitcoin Miners expand and contract with the Bitcoin price. Mining for multiple years allows a capital allocator to accumulate significant amounts of Bitcoin – often times more than what they would otherwise get from buying Bitcoin directly. However, Bitcoin Mining difficulty has historically increased by ~37% per year. This results in the “cost of production” for Bitcoin miners increasing accordingly. But if the price of Bitcoin increases at a faster rate, mining profitability will continue to rise regardless.

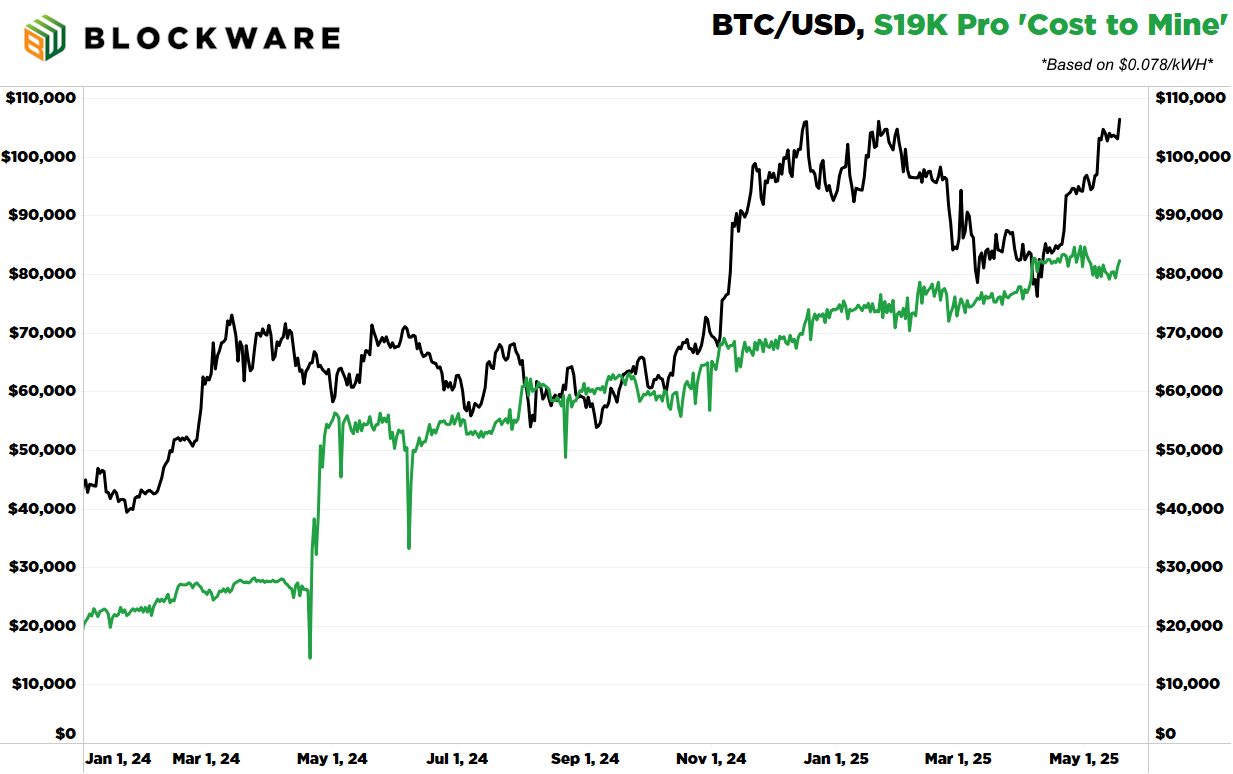

The chart below can help us understand this concept a bit more…

The difference between the ‘cost to mine’ and the price of Bitcoin is why mining is an inherently ‘long’ position (like a call option). When the BTC Price increases, profit margins expand. The gradual increase in the ‘cost to mine’ (and the sharp increase at the 2024 halving), is the ‘theta’ component (similar to a call option in which the passage of time = loss of value on the option, all else being equal).

Then, when you consider the upfront expense necessary to purchase a Bitcoin mining machine, that is similar to a “call option premium.” Inclusive of the premium, the true ‘breakeven’ price for an options contract is slightly higher than the strike price. However, changes in the price and/or volatility of the underlying asset can cause the premium for an option to increase. Many options traders don’t hold to expiration – rather, they simply sell their contracts if/when the premium increases. Bitcoin Mining is similar in this regard. Miners can purchase hardware and then re-sell the hardware later after a rise in the price. The Blockware Marketplace is a one-of-a-kind platform that enables Bitcoin miners to trade their machines in this manner.

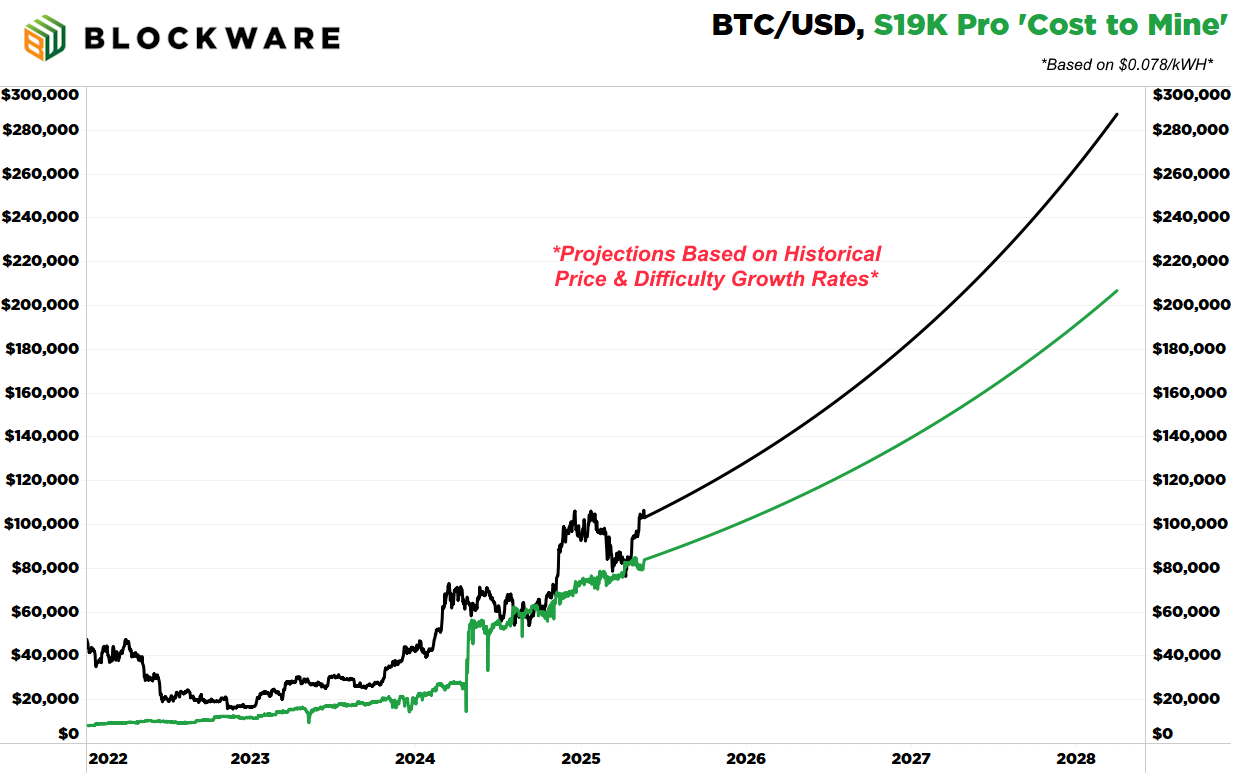

Future Mining Projection:

Historically mining difficulty has increased by ~37% per year. Here is the same chart showing the S19K Pro’s ‘cost to mine’, extrapolated from present day until 3/31/2028 (projected date of the next halving). Furthermore, the price of Bitcoin is up ~43% over the past year. A continuation of this growth rate will see the price of Bitcoin north of $280,000 by the end of the halving epoch.

Based on these historical growth rates, an S19K Pro will remain profitable through the remainder of this halving epoch (~3 years). The cost of production at the end of this period will be ~$206,000 but the average cost of production across the entire period will be ~$136,000 (think of this as the “strike price).

Using the historical growth rates for Bitcoin price & difficulty, we can project the future BTC acquisitions of a Mining strategy vs a “Buy Bitcoin Directly” strategy.

Mining with an S19K Pro:

Total BTC Acquired: 0.0424

Total Spend (Hardware Price + Electricity): $6,202

Average Price per BTC: $145,977

Buying Bitcoin Directly:

Total BTC Acquired: 0.0405

Total Spend (Upfront Purchase + DCA): $6,202

Average price per BTC: $153,071

If you think the average price of Bitcoin between now and the 2028 halving will be $145,977 or greater, you will perform better by mining Bitcoin than purchasing it directly. Just like a call option allows you to get amplified long exposure to an asset, Bitcoin mining allows you to get amplified long exposure to BTC, with the added benefit of the fact that with mining you are accumulating BTC in your self-custodied wallet every single day (great for building sovereign wealth).

There are other benefits to mining which we have not quantified in this analysis:

> Cap. Gains Tax Savings via Accelerated Depreciation

> Net Salvage Value of Mining Hardware at the end of the Term

> Additional Revenue from On-chain Transaction Fees

> Additional Mining Profits Beyond the Projected Period

If you’d like to learn more about Bitcoin Mining, you can schedule a free 30–minute consultation with a member of the Blockware team by filling out our form at mining.blockwaresolutions.com/consult

Now is a great time to get started. Blockware is running a limited-time promotion to celebrate Bitcoin 2025 in Las Vegas. Each miner purchased on the Blockware Marketplace (including the S19K Pro’s analyzed today) gives you an entry into our miner giveaway.

One lucky Marketplace user will receive a free Antminer S21+. Use code ‘VEGAS25’ for $50 off each miner you purchase. Good luck!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does not consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.