Monday Mining Metrics: Mining Stocks Outperforming BTC

Bitcoin Mining Update - 2/19/2024

“Bitcoin Miners Should Embrace the Halving, Not Fear it.”

In case you missed it, we launched our latest Blockware Intelligence research report. We provide a comprehensive case study into purchasing next-generation ASICs prior to the Bitcoin halving.

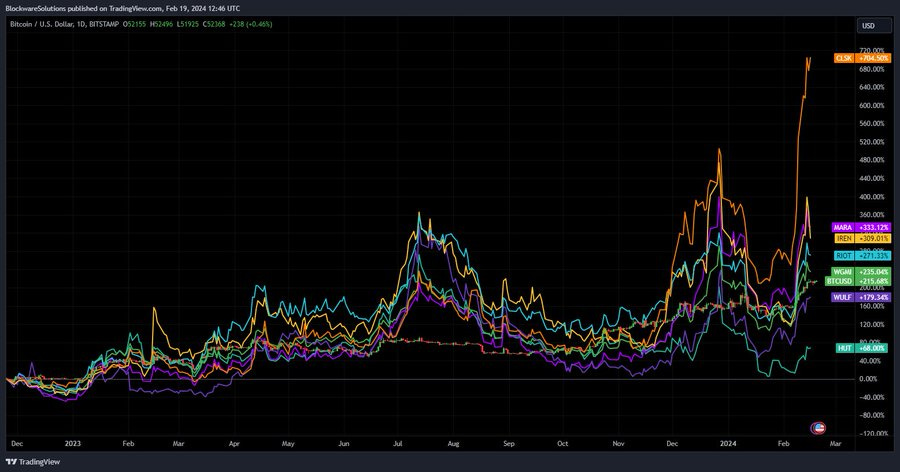

Bitcoin Mining Stocks vs BTC

Since the cycle bottom in November 2022, most of the publicly traded Bitcoin mining companies have outperformed spot BTC.

- $CLSK: +704%

- $MARA: +333%

- $IREN: +309%

- $RIOT: +271%

- $WGMI: +235%

- BTC: +215%

- $WULF: +179%

- $HUT: 68%

During bull markets, mining is the superior method of gaining exposure to Bitcoin’s price appreciation, as your electricity cost is fixed, allowing you to acquire BTC for the same price over time while spot buyers are forced to acquire BTC at higher prices.

Negative Projected Difficulty Adjustment

After one of the largest adjustments in months, mining difficulty is projected to decrease at the next adjustment, indicating that a handful of miners on the network likely became unprofitable after the latest adjustment and are now unplugging their machines.

The importance of mining with the most efficient machines possible cannot be overstated. Strong miners (efficient machines, low energy costs) will survive, and thrive, at the expense of the weakest miners.

2024 Halving

At block height 831,129, we are now ~95.7% of the way through the current halving epoch. The 2024 halving is projected to occur on April 20th, 2024. Until then, miners will continue to enjoy the 6.25 BTC block subsidy.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market; Antminer S21s, S19 XPs, and S19k Pros.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.