Monday Mining Metrics: Mining Stocks vs Hosted Mining

Bitcoin Mining Update - 6/10/2024

Mining Stocks vs Hosted Mining

If you want exposure to Bitcoin mining, should you purchase publicly traded mining stocks or mine with a host? What are the trade-offs? Which is more profitable? Here is the high-level overview:

Buying Mining Stocks:

- Excess Overhead: Debt Servicing, C-Suite Compensation

- Cash-in, Cash-out

- Poor fleet efficiency

Hosted Mining:

- Only operating expense is electricity

- Bitcoin-in, Bitcoin-out

- Next-generation ASICs

Let’s discuss in detail…

Firstly, mining stocks have greatly underperformed spot Bitcoin year-to-date. BTC is up ~55% on the year while $WGMI, the mining stock ETF, is down approximately 5%.

The underperformance of mining stocks is not attributable to an underperformance of mining generally. In fact, mining economics are highly profitable, even with the block subsidy now at 3.125 BTC.

Why have mining stocks underperformed?

The spot Bitcoin ETFs

The ETFs launched in January of this year, providing a way of gaining direct access to Bitcoin exposure through a traditional financial vehicle. Mining stocks previously served as one of the few publicly traded vehicles, outside of $MSTR, that were directionally exposed to Bitcoin. That’s no longer the case with the ETFs.

Investor Speculation about the Halving

There was a strong sell-off of mining stocks during March and April prior to the halving. Investors were fearful of the post-halving environment for Bitcoin miners. Mining stocks have rallied since the halving; a call which we predicted days before the halving.

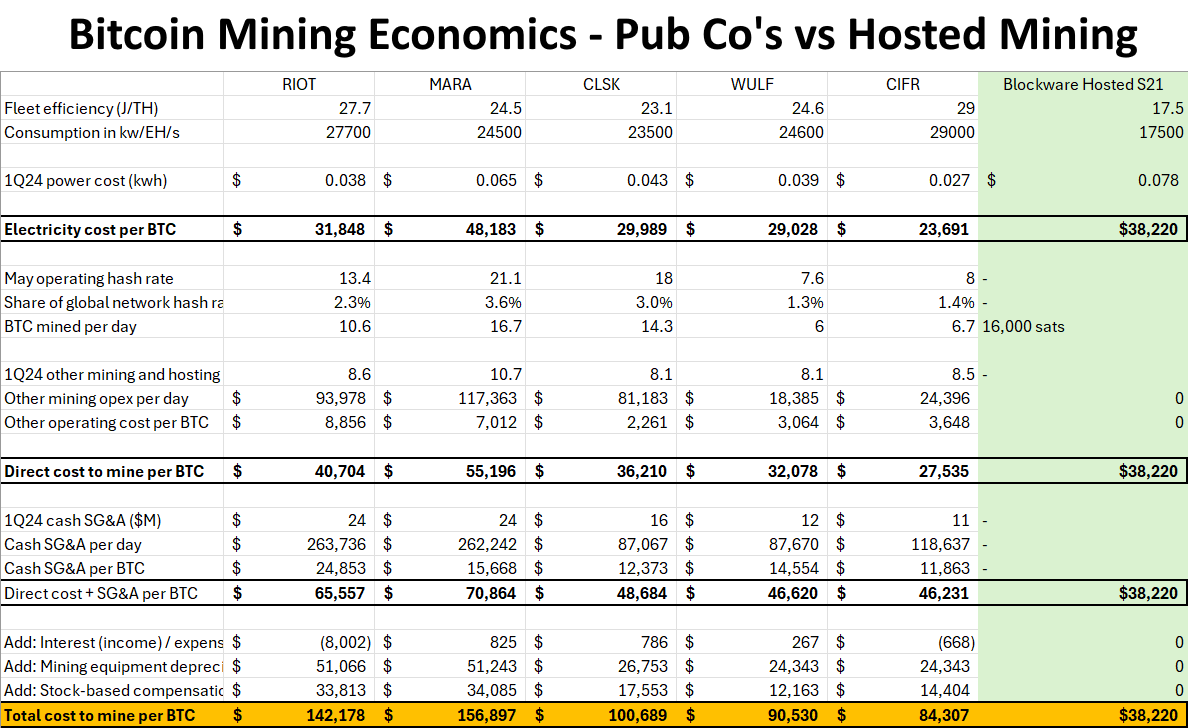

Mining Economics Comparison

The table below depicts the cost to mine 1 Bitcoin for five of the top publicly traded Bitcoin mining companies, compared to the cost to mine 1 Bitcoin using an S21 hosted with Blockware. Credit to the original post here. This data has been derived from public filings.

Public Mining Stocks - Excess Overhead Costs

The bottom line is that an individual Bitcoin miner has far less overhead than a publicly traded Bitcoin miner. The public companies, while they have extremely low electricity rates, carry an immense amount of operational costs beyond just electricity. Primarily executive compensation and debt servicing.

For each of the companies listed in this table, the cost to mine 1 Bitcoin, inclusive of all operating expenses, is north of $80,000 per Bitcoin. For three out of five, it is north of $100,000 per Bitcoin.

A miner with an S21 at Blockware’s facility can mine 1 Bitcoin for ~$38,000 in electricity.

Public Mining Stocks - Cash in, Cash out

Most people deploying capital into Bitcoin mining, whether via equities or via hosted mining, do so with the goal of accumulating more Bitcoin than they otherwise would from buying spot. The problem with executing this strategy through public mining stocks is that these are Cash in, Cash out vehicles. You cannot buy or sell mining stocks with Bitcoin, and they do not offer a Bitcoin dividend.

On the other hand, mining Bitcoin with a host like Blockware allows you to earn daily Bitcoin rewards and have them sent to your cold-storage wallet. Moreover, the Blockware Marketplace is a Bitcoin-native platform that allows you to sell your ASICs at any time, and receive payment in Bitcoin. This allows you to capitalize on volatility in the ASIC market as well as recoup your capital expense, in Bitcoin, at any time.

Public Mining Stocks - Poor Fleet Efficiency

Each of the five public mining companies evaluated in the table above has an average fleet efficiency greater than 23 W/Th. Blockware clients can mine with the latest-generation ASICs, allowing you to immediately surpass the public companies in terms of efficiency. The Antminer S21 has an efficiency of 17.5 W/Th. This is ~28% more efficient than the fleet average of CleanSpark; the most efficient of the pub co’s analyzed.

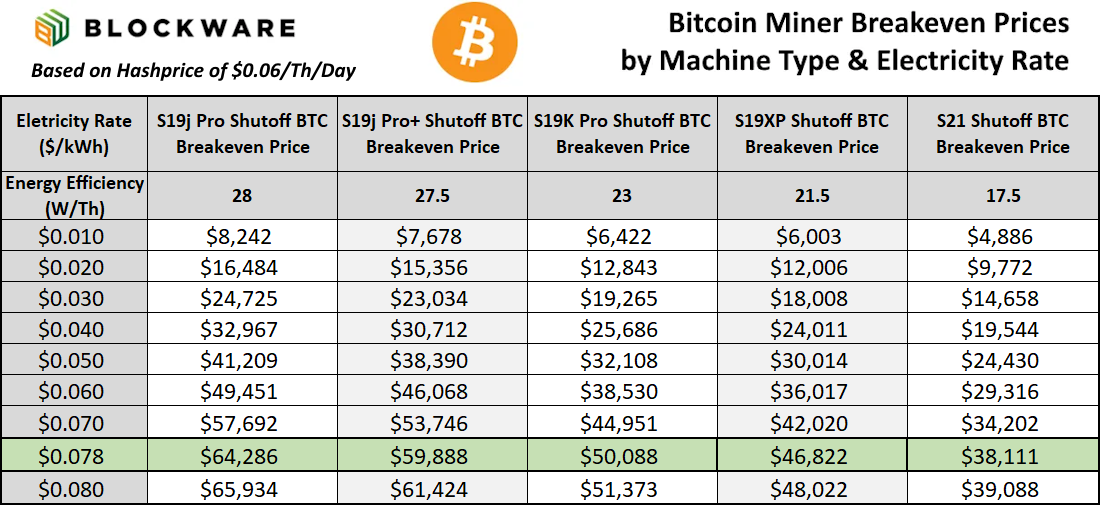

The table below shows the average breakeven cost for various ASICs at various electricity rates. The $0.078 row that is highlighted represents the standard Blockware rate. Notice the vast advantage that energy-efficient ASICs have when it comes to breakeven costs.

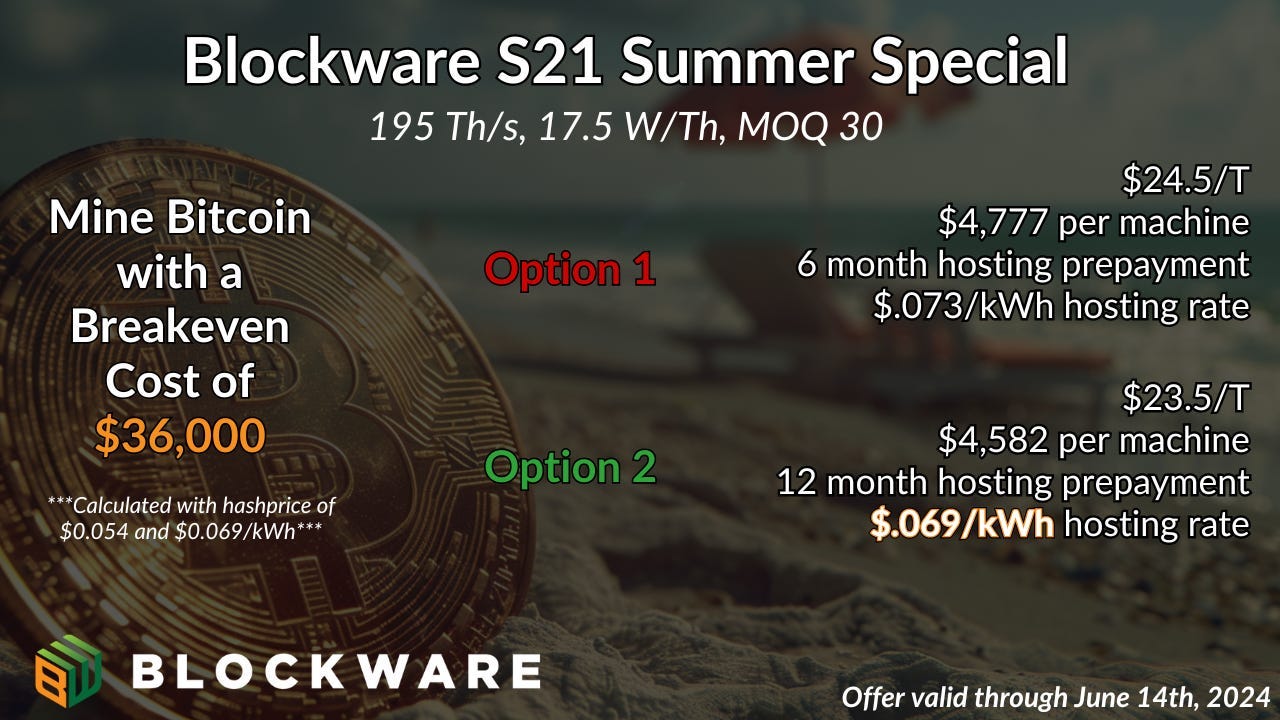

Blockware Summer Special - Discounted Hosting

Blockware is excited to provide a limited-time opportunity to mine Bitcoin with heavily discounted electricity rates. This opportunity requires a minimum order quantity of 30 Antminer S21s.

Pre-pay six months hosting → $0.073/kWh, $4,777 per Machine

Pre-pay twelve months hosting → $0.069/kWh, $4,582 per Machine

Over the course of one year, option 2 will result in a projected annual return of ~62.3%. Without the discounted hardware and hosting, the projected annual return is ~55.7%.

Projections are calculated with the following assumptions:

4% month-over-month BTC price growth (Avg. of past 3 years)

3% month-over-month BTC difficulty growth (Avg. of past 3 years)

6% additional miner revenue from transaction fees

This special will allow you to benefit immediately by leveraging the highly liquid Blockware ASIC Marketplace Purchase in bulk at a discounted rate → resell on the Marketplace.

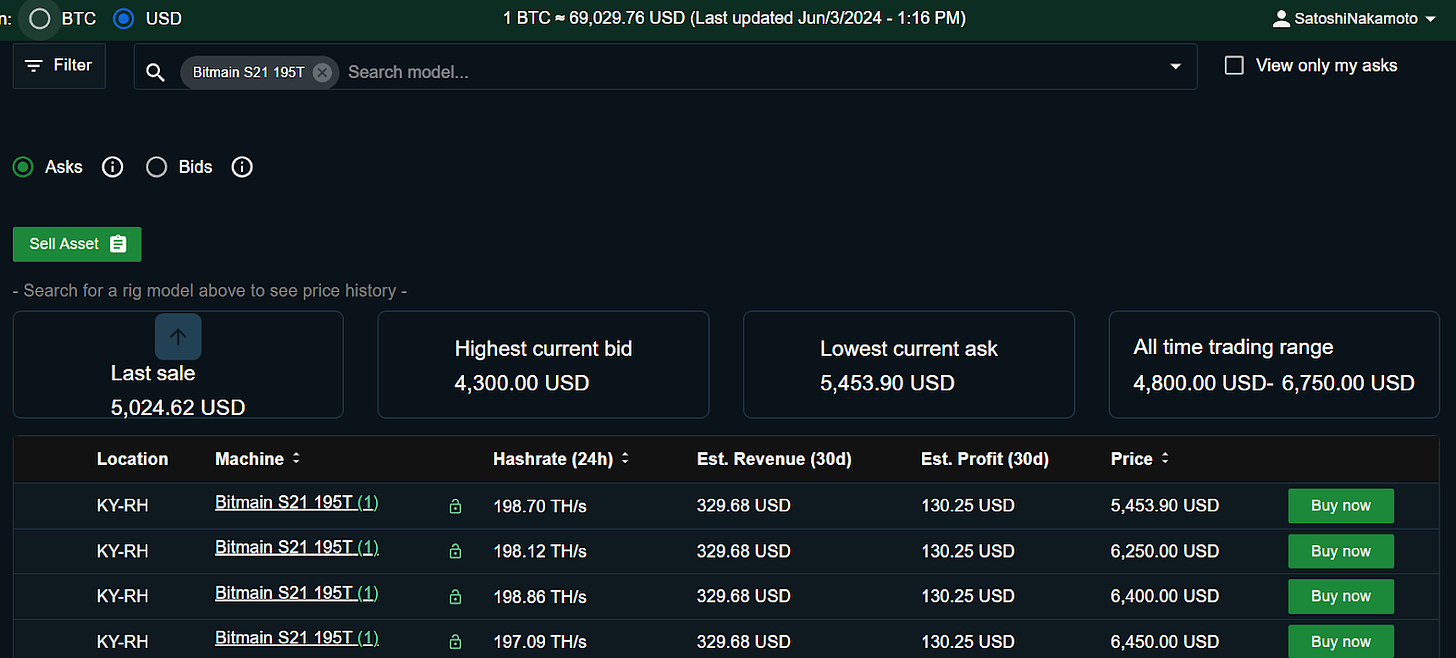

ASIC prices are volatile; often moving directionally with the price of Bitcoin. Right now S21 (195 Th/s) are trading around ~$5,000 per machine on the Marketplace.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.