Monday Mining Metrics: Profitability Spread Rises

Bitcoin Mining Update - 11/18/2024

Mining Profitability Spread

The green chart on this line measures the 90-day percent growth in Bitcoin miner revenue (in $ terms) subtracted by the 90-day percent growth in mining difficulty. In simple terms, this compares the growth rate in revenue for Bitcoin miners to the growth rate in costs.

When the Miner Profitability Spread is greater than zero, Bitcoin miners are becoming more profitable, when it’s less than zero Bitcoin miners are becoming less profitable. This metric includes additional miner revenue from transaction fees as well as a loss in revenue from the quadrennial Bitcoin halvings.

A crucial threshold has been reached – the mining profitability spread is now positive for the first time after the 2024 halving. Historically, the first instance of the spread flipping positive after a halving has signaled the start of a bull market. The weakest miners have capitulated, stronger miners are becoming more profitable, and fewer coins are being sold.

After this moment, the spread has historically gone parabolic as the BTC price gets bid higher faster than new competition is able to get additional miners plugged in and increase difficulty.

The next few months are going to be very kind to Bitcoin miners.

Here you can see how this dynamic – price/miner revenue growing faster than difficulty – creates an incredible arbitrage opportunity during bull markets. The price of Bitcoin and the cost to produce via mining (industry average) widens significantly.

Recent price action has put us in the early innings of this arbitrage for the current Bitcoin halving epoch.

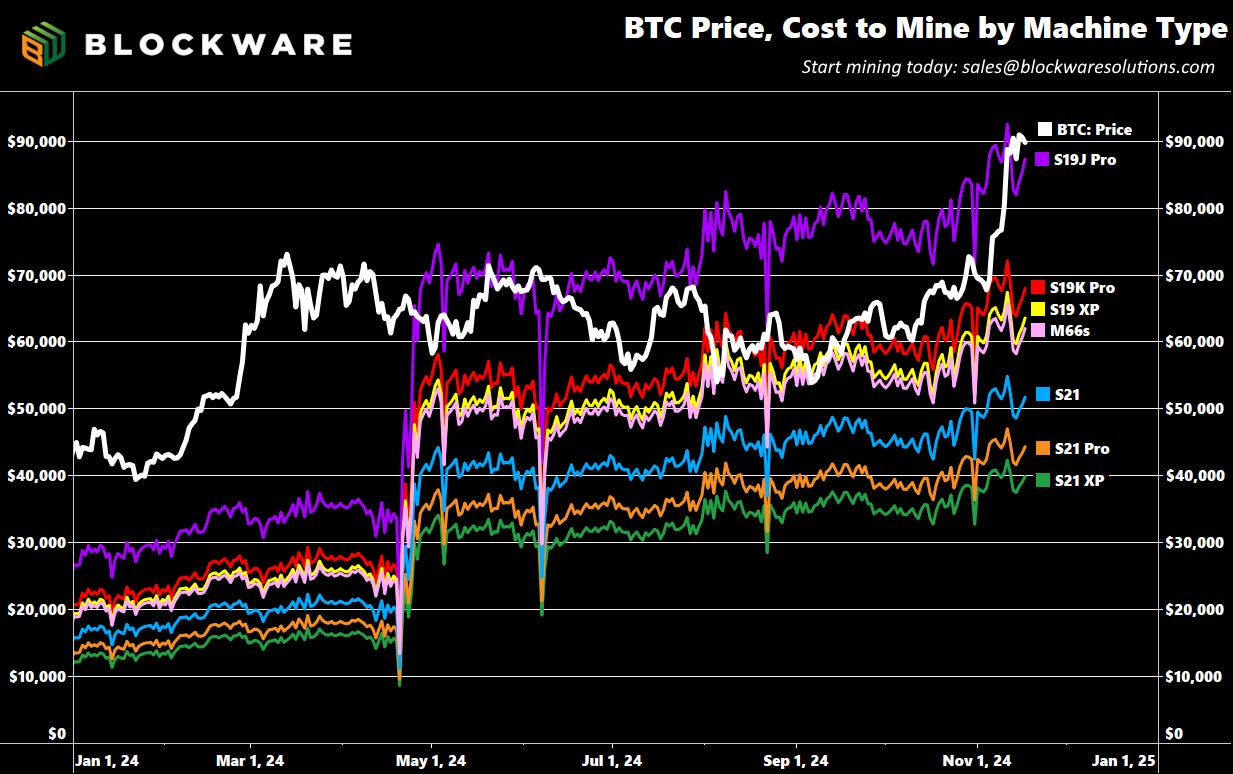

Looking beyond the industry average above, here’s a breakdown by mining hardware. The cost to mine 1 Bitcoin with the S21 line of machines ranges from $40k to $52k.

The cost to mine gradually increases over time as new miners plug into the network. However, the rate at which it increases is much lower than the rate at which the BTC price increases.

It will take months before the latest move in price is off-set by an equivalent increase in mining difficulty (and price will likely move even higher in the meantime since this is a bull market).

🚨Join Blockware for a Live Webinar to Learn About Bitcoin Mining🚨

If you want to learn more about Bitcoin mining, Blockware, and meet the authors of this newsletter…

…then join us Wednesday, November 20th, at 1pm EST!

We will be hosting a live webinar to discuss all things Bitcoin mining! We will dedicate the entire second half of the webinar for a Q&A, so bring your questions! We hope to see you there!

To learn more about Bitcoin mining with Blockware, fill out this form on our website.

The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

If you’re looking to purchase individual machines, you can use our self-service marketplace to pay with BTC and start mining immediately!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

I hope for $MARA to get on that bull train very soon. Most frustrating stock in my life.